Author: Brad Ripps | Posted On: 07 Dec 2023

Huge numbers in the November VFACTS data, with 112,141 new vehicle sales, making it the second highest month of the year behind the EOFY-backed June. This places the 1.2m yearly sales mark squarely in sight, with just over 80,000 required in December. As context, 2021 (78,402 sales) is the only year in the past decade to fall below that mark, making it appear likely!

top takeaways

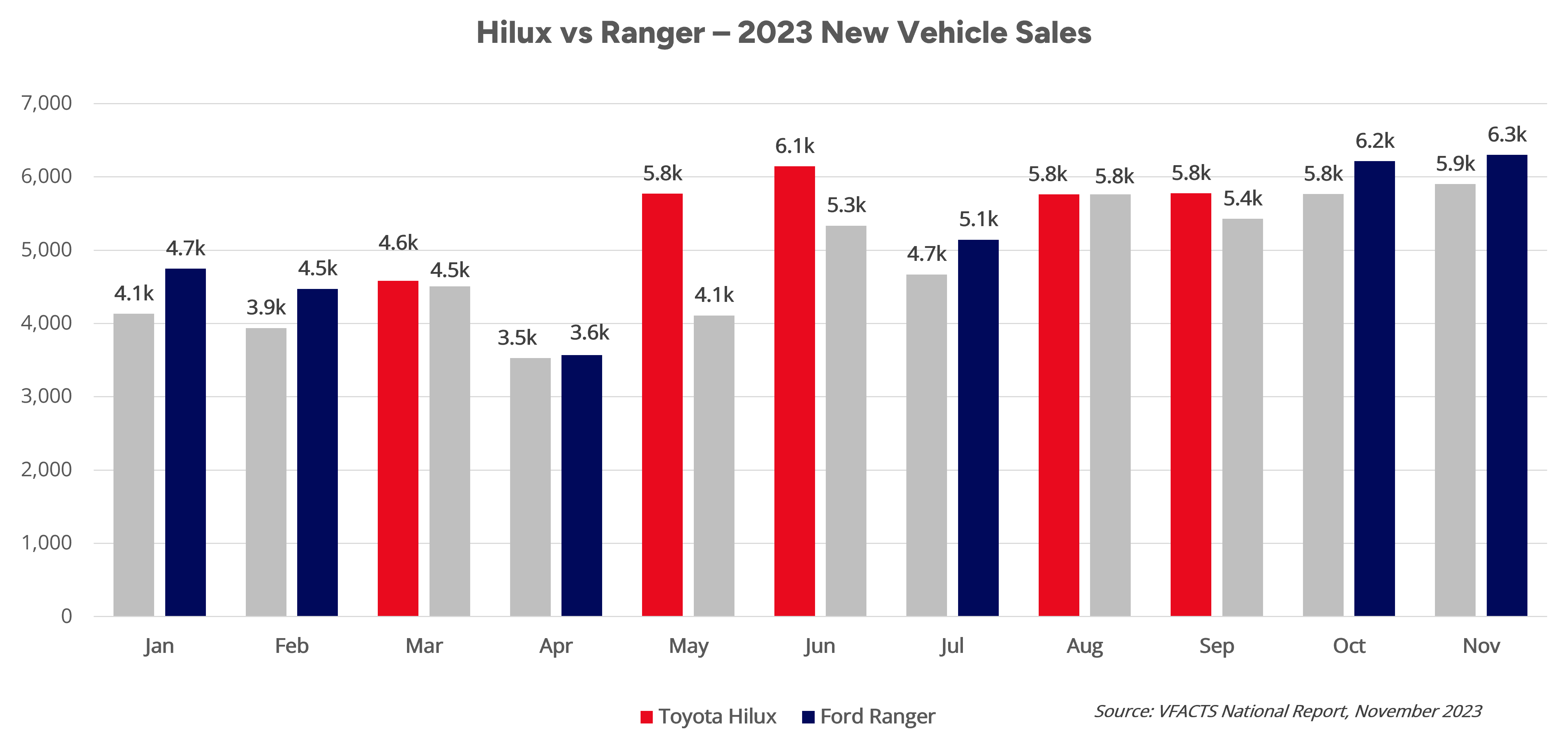

- Ranger goes back-to-back: Ford Ranger was again the top selling vehicle, recording 6,301 units for the month. That puts it 400 sales ahead of the Hilux (5,901 units), while the Tesla Model Y (3,151) rounds out the top 3

- Pickups, picking up: 4x4s saw huge growth, up 32% YoY (from 15,962 in 2022 to 21,096 in 2023)

- Tundra Down Under: The ‘Tundra Insider Program’ has begun as Toyota’s latest US export has reached Australian shores for real world testing. The initial roll-out of 50 units included 6 hybrids, which are the first production model Hybrid utes in the country

- EV strong: 8,646 units were sold through November. Telsa took the top 2 spots with the Model Y (3,151) and Model 3 (788), ahead of BYD Atto 3 (668 units)

- Plug in hybrids trending: PHEV sales have reached four digits for the fourth month in a row with 1,429 units in November

race to the top

The race for the top model in Australia is the closest it has been for some time. While the Toyota Hilux has comfortably held the crown of best-selling vehicle since 2015, 2023 could be the year for change, with the Hilux just 379 units ahead as we move into the final month of the year. To add to the tension, the Ranger is finishing with a wet sail, going back-to-back in October and November as it recorded two of the highest single-month volumes this calendar year.

just a hiccup

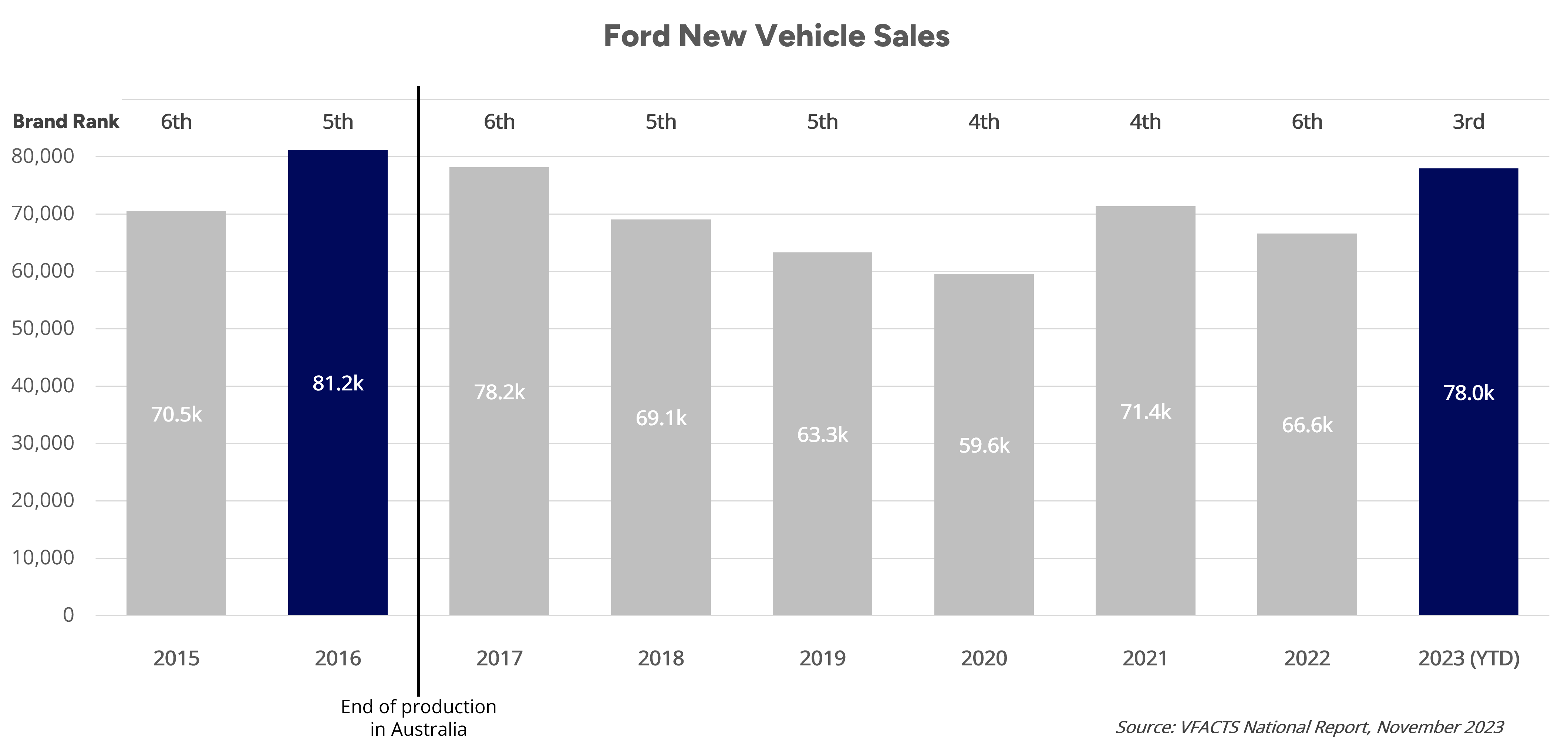

The top performing brands in the Australian market have been stable for quite some time, with Kia’s rise into the mix at the expense of Holden the most recent change. Toyota and Mazda have consistently held the top two spots, with a combination of Hyundai, Mitsubishi, Ford and Holden/ Kia rounding out the top 5.

While 2023 isn’t going to see a new entrant on this list, we will see change within it. The Ranger’s strong performance is likely to result in a first time, top 3 finish for the American Multinational. This is an impressive result after experiencing a downturn after moving production out of Australia and dropping out of the top 5 last year. In terms of total sales, this could be Ford’s best result. Needing just over 3,000 units in December to surpass their previous record which came in 2016.

Another one to watch is the race for fourth. Kia is currently ahead of its Korean stablemate by just 185 units, with Hyundai topping them by 951 units in November. Who can finish the year strongest, and claim supremacy?

what’s next

A few great storylines to follow as we approach the end of the calendar year. Regardless of the internal battles, breaking the 1.2m barrier will demonstrate the sector’s resilience, and be a huge achievement off the back of significant local and global disruption. We look forward to the December results!

With that said, question marks still exist as we look to the future, with this year’s volume largely fulfilling existing orders, and consumer confidence rocked by interest rate hikes and rising cost-of-living pressure. All indications are for a more challenging year ahead as we move into 2024.

For more information about our automotive research, you can browse our insights page, reach out to our experts, or access our latest automotive research reports.

Posted in Auto & Mobility, B2B, QN, TL, Transport & Industrial, Uncategorized