Author: Ben Selwyn | Posted On: 10 Sep 2024

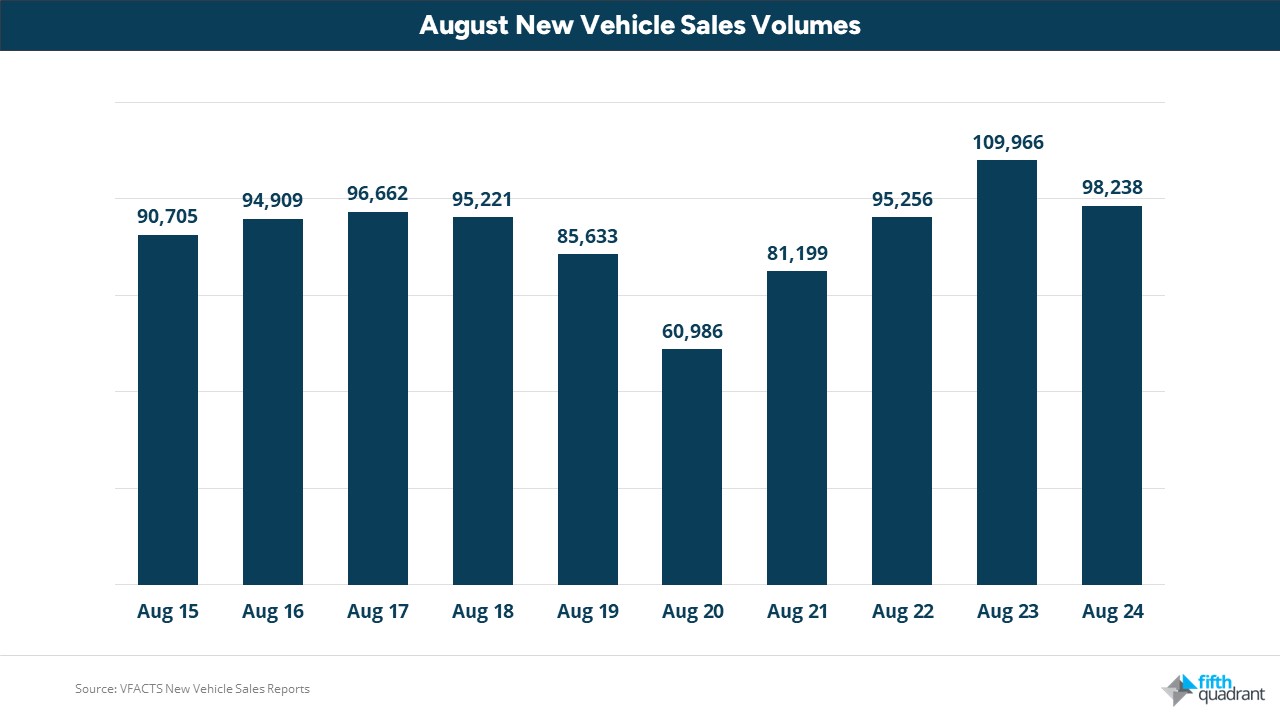

August 2024 VFACTs marked a significant moment in the Australian automotive industry, with 98,238 units sold, for a 10.6% decline on last year’s 109,966 vehicles. While this initially suggest a cooling market, it is still a strong result for August, and could simply represent a reversion to long-term trends, rather than a downturn in consumer demand. In this blog, we dive into the factors influencing this shift, exploring whether August’s dip represents an outlier or signals a return to market normalisation as broader economic pressures begin to take hold.

key insights from august’s auto market

- Toyota at the top… Again: The Japanese market leader might have dropped 4% year-on-year, but its year-to-date sales are up by almost a quarter on 2023. This gave it 21,490 sales in August (with Ford the closest competitor at 8,890), and 165,496 so far this year (up from 133,747 by August 2023).

- Hybrid Takes Over: Weak electric vehicle sales in August as hybrids continued their strong performance (hybrid up 45% year-on-year, PHEV up 120% year-on-year). While hybrid has mainly been cannibalising petrol so far, we are also starting to see a downturn in diesel sales, which will be exacerbated as more ZLEV light commercial options come to market.

- Small SUVs Hold Steady: Despite being the second smallest group within the broader SUV category, Light SUVs captured 5,166 sales (up from 3,728 in Aug ’23) for a 39% year-over-year increase

- Weakness from East to West: Monthly new vehicle sales volumes are down year-on-year across the country, with ACT (-22%), NSW (-14%), TAS (-13%) and VIC (-11%) all recording double-digit drops (while WA just snuck inside this threshold at -9.9%).

- Fleet Buyers Driving The Market: Private buyers deserted the market in August, with almost 10,000 less sales than in August 2023. While fleets also declined, this was by just 3%, with their more structured replacement cycles helping give the market a greater level of certainty around their behaviours.

august dip an outlier, or a reversion to the mean?

Looking at the trend over time, the August new vehicle sales results show a shift towards normalisation following the spike in 2023. With 98,238 units sold, the market recorded a 10.6% drop from last year’s 109,966, but this appears to be more of a reversion to the longer-term mean. In essence, August 2023 was the outlier, driven by unique post-pandemic factors, including pent-up demand and supply chain recovery.

While August aligns with historical averages seen from 2015-2019, where sales ranged from 85,000 to 96,000 units (and represents one of the best Augusts on record), we do however also need to consider that these volumes were previously based on a total market of 1.05-1.1m, while all indications are that this year will again exceed 1.2m.

putting the handbrake on new vehicle sales

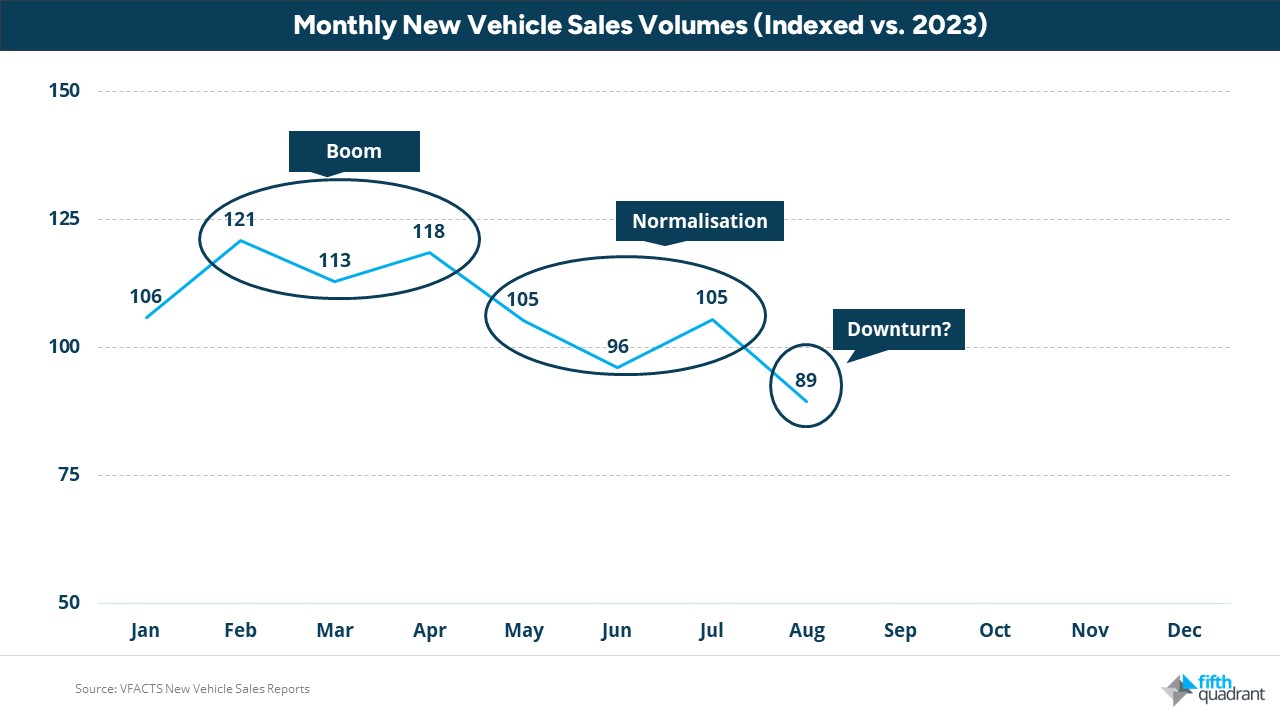

Digging deeper into 2024’s new vehicle sales, we can see the clear shift in market dynamics as we move through 2024. Early in the year, from February to April, we were in a “Boom” phase, with sales performing well above 2023 levels, peaking at an indexed score of 121 in February. This likely reflects pent-up demand from supply chain improvements and continued strong consumer confidence.

However, as we moved into the second quarter, the market shifted into a “Normalisation” phase, with sales settling down to a more sustainable (and largely comparable with 2023) level. This period marks a return to more typical market behaviour, as the initial rush subsides and economic factors like rising interest rates started to weigh more significantly on consumer sentiment.

In August, the index dropped sharply however to 89, signaling a potential “Downturn.” Importantly, dealership incentives have increased as inventory has started moving more slowly, indicating that the slowdown could persist into the final quarter of the year.

looking ahead

Looking ahead, the trajectory of the Australian vehicle market remains uncertain. On the one hand, if interest rates and inflation continue to rise, we could see an extended period of lower sales volumes, particularly for non-essential vehicle purchases. On the other, if economic conditions stabilise, the market may recover more quickly than expected. Ultimately, the coming months will be crucial in determining whether 2024 ends on a strong note or further sales declines loom.

As it stands, we feel that the market is still on track to exceed 1.2m sales, but not reach the heights of 2023. Regardless, the trends we observe now will offer valuable insights into the evolving dynamics of Australia’s new vehicle market.

Want more of this content? Sign up for our newsletter here to ensure you stay up to date with our monthly updates.

Also remember that our b2b and consumer tracking research runs monthly. Click here to find out more, and feel free to get in touch if you’ve got questions you’d like to ask.

VFACTS

Posted in Auto & Mobility, B2B, QN, TL, Transport & Industrial, Uncategorized