Author: James Organ | Posted On: 05 Dec 2024

Updates to this research are published monthly. View previous wave.

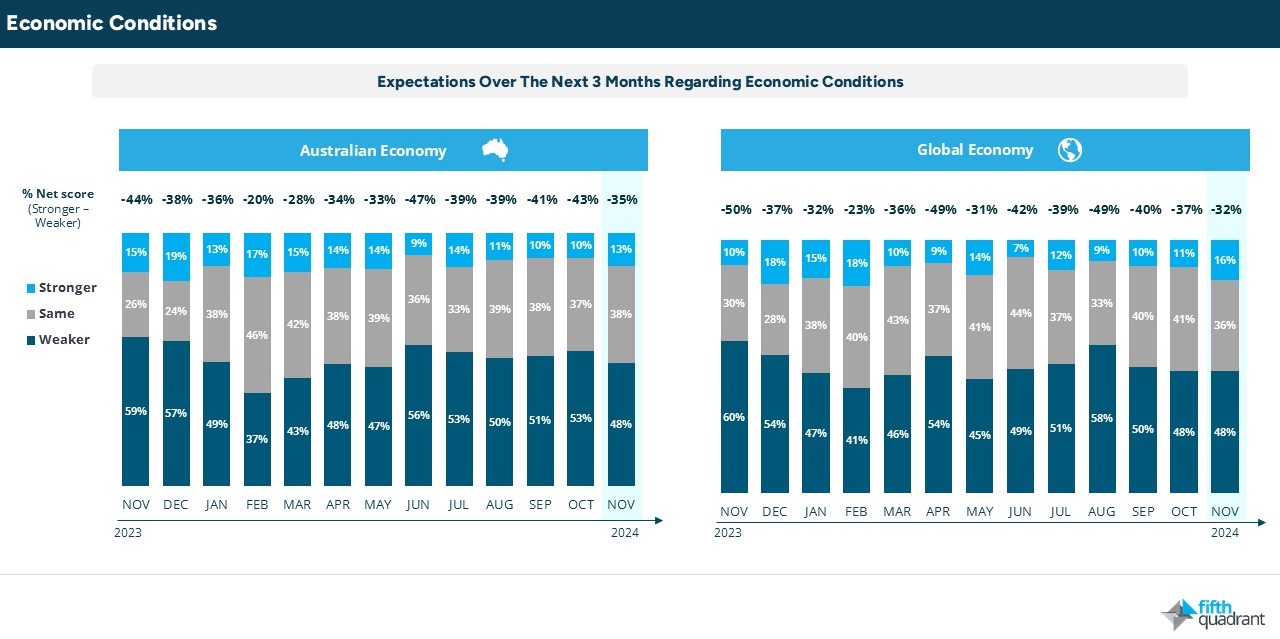

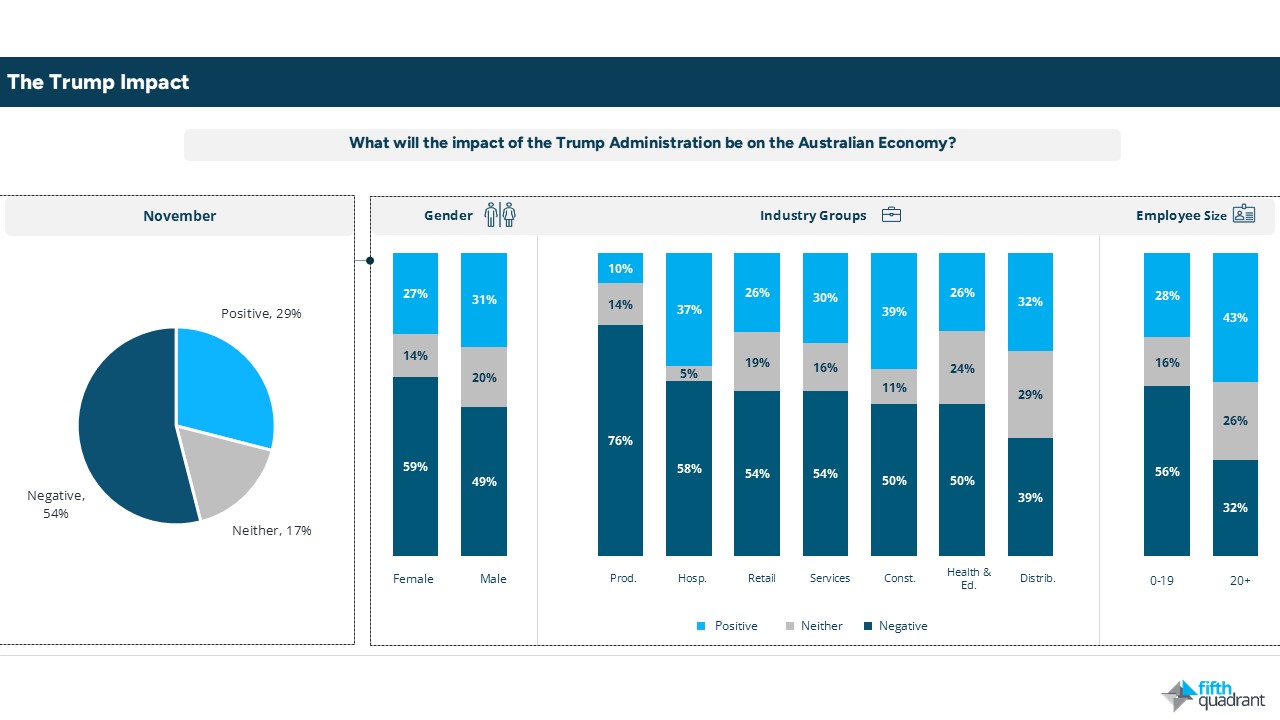

SME optimism regarding global and local economic conditions has increased since the re-election of the Trump administration.

However, this optimism is tempered by concerns about the long-term implications of Trump’s presidency, particularly among those in the production sector who may be directly impacted by increased tariffs and changes to trade policies.

A majority (54%) of SME decision-makers believe the Trump administration will have a negative impact on the Australian economy, with this sentiment rising to 76% among those in the production sector. Notably, 59% of female respondents also anticipate adverse outcomes for Australia.

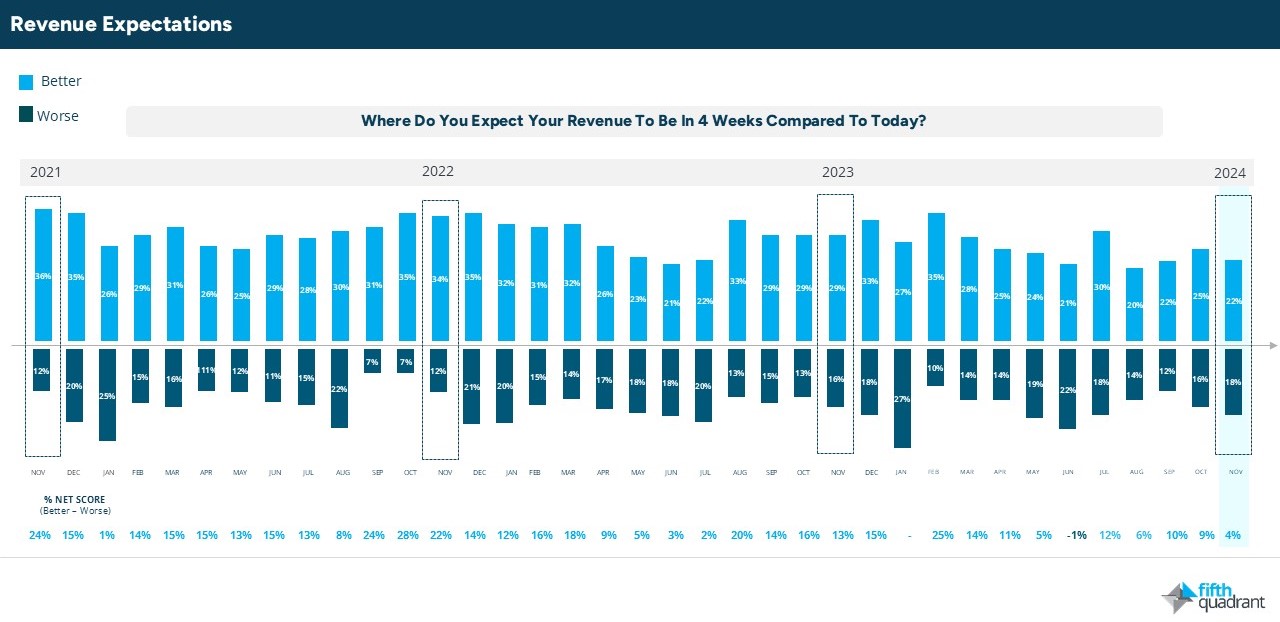

revenue & growth expectations

Supporting these concerns, SMEs are reporting weaker short-term revenue expectations and subdued 12-month growth projections. In fact, short-term revenue expectations for November are the lowest in three years, signalling a tough December ahead and potential cashflow problems in the first quarter of 2025.

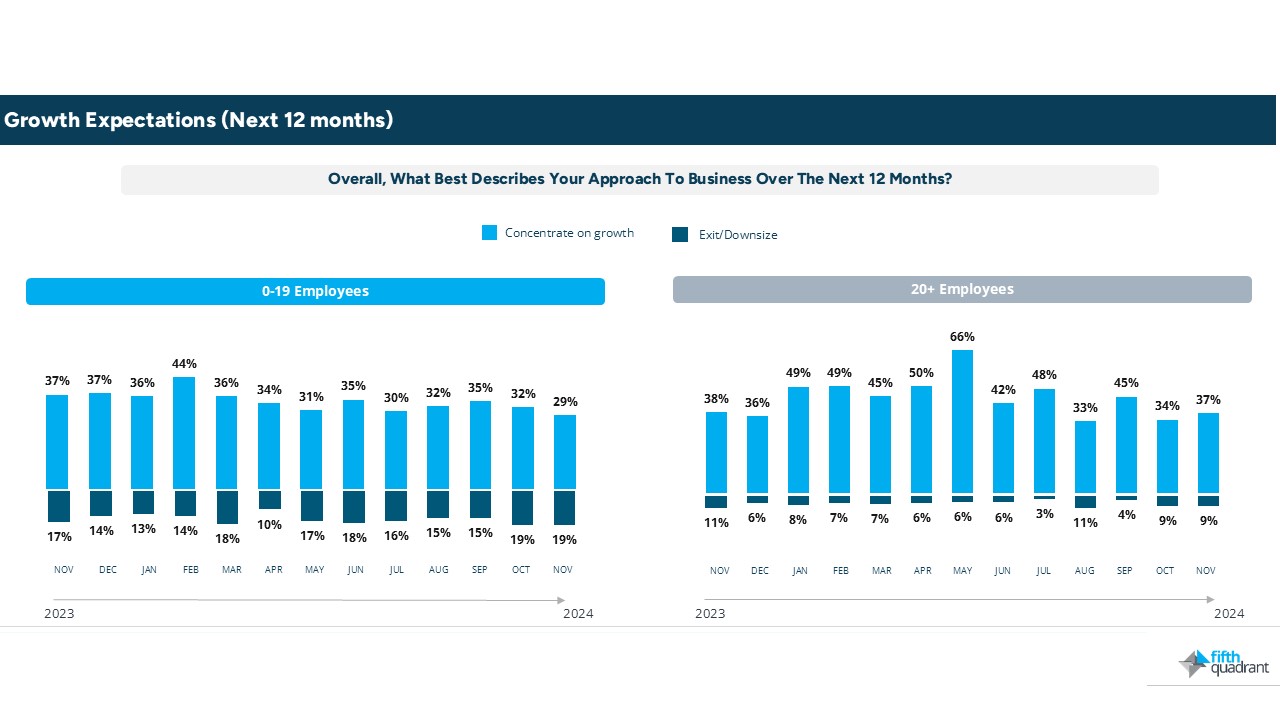

Additionally, only 30% of SMEs are focusing on growth over the next 12 months, down from 38% in November 2023, with 19% of smaller SMEs anticipating downsizing or exiting during this period.

profitability

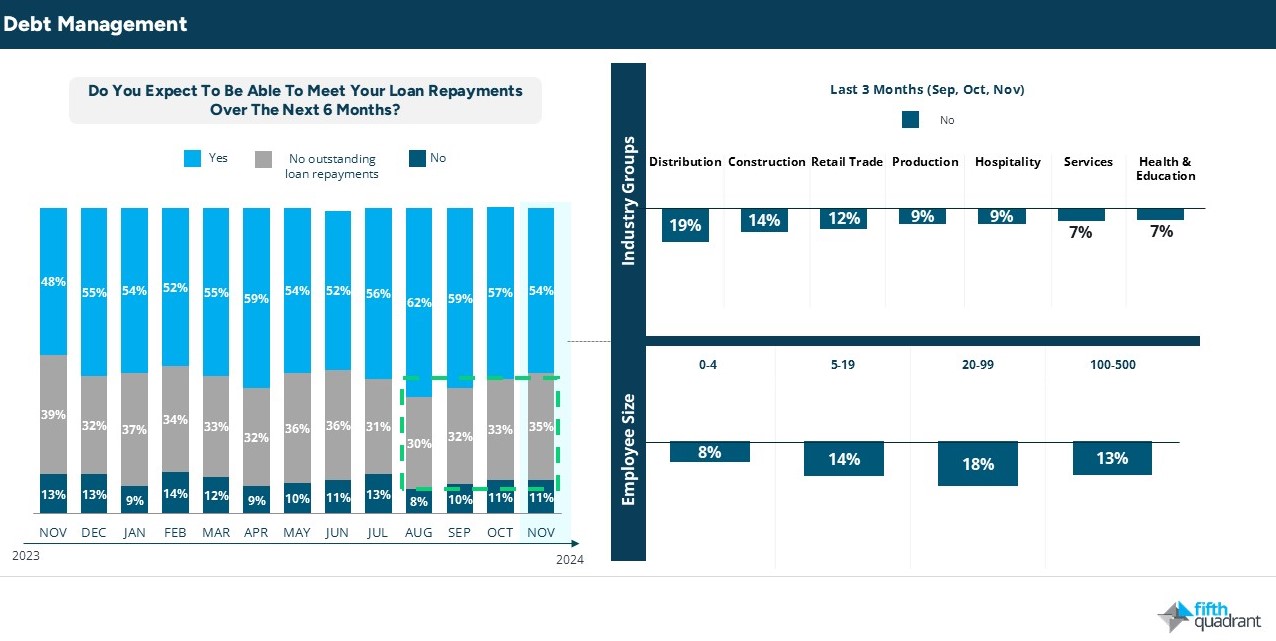

Despite these headwinds, there are positive signs regarding profitability. SMEs have shown resilience by focusing on optimising their product and service offerings. Many have discontinued unprofitable lines or expanded their range to drive new revenue streams, contributing to improved profit margins. Additionally, fewer SMEs are carrying debt, with the proportion of debt-free businesses rising from 30% in August to 35% in November. This shift underscores an increased focus on cost and debt management, helping to strengthen financial stability across the sector.

The re-election of the Trump administration has created a mix of optimism and uncertainty for Australian SMEs. While global confidence is boosting local sentiment, concerns about the longer-term implications could hinder growth. This presents both opportunities and challenges for SMEs heading into 2025, including weaker revenues, rising financial losses, and increasing loan stress, have negatively impacted growth expectations, capital investment, and hiring intentions. In this environment, SMEs are likely to remain highly cautious as we move through the holiday period.

Please click on this link to access the full report including subgroup analysis by industry sector, size of business and state. Fifth Quadrant and Ovation Research publish monthly updates of this research here. For any questions or inquiries, feel free to contact us here.

SMEs remain resilient

Posted in Uncategorized