Author: Mel Borg | Posted On: 12 Nov 2024

In today’s world, personal safety, financial stability, and the rising cost of living are concerns shared by all Australians, but there is a growing disparity in the gender divide and how these issues impact women compared to men. Our latest Consumer Insights Tracker results reveal the challenges faced by Australian women, how these issues can intersect, and what this means for their future.

Financial insecurity and cost of living concerns

A substantial proportion of Australian women are feeling financially insecure. 65% report being dissatisfied with their financial situation, compared to 55% of men. Similarly, 43% of women indicate they struggle to make ends meet, meaning they don’t have enough money or only just enough to cover their household expenses, which is above the 33% of men who report experiencing comparable financial strain.

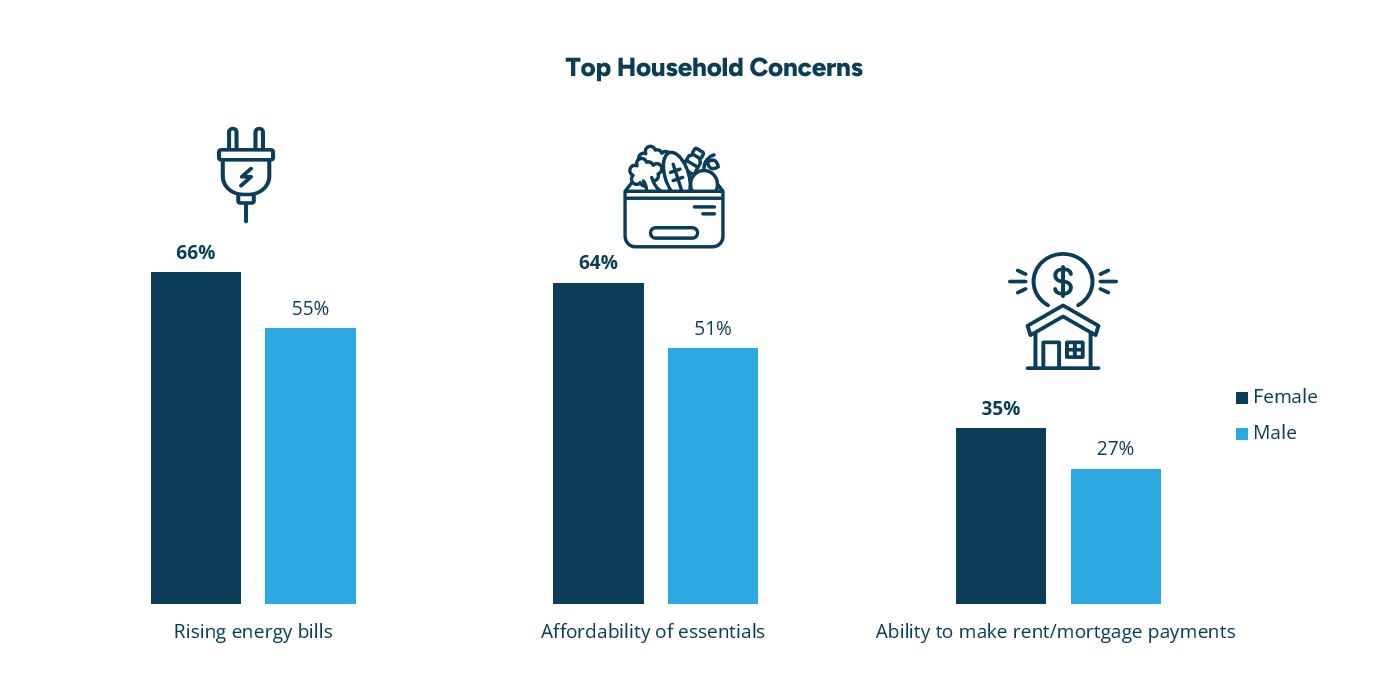

The rising cost of living is one of the primary contributors to increased financial instability. Women are more concerned than men about rising energy bills (66%), affordability of essential products (64%) and the ability to make rent/mortgage payments (40%). Additionally, 66% of women expect the cost of living to worsen in the coming year, compared to 55% of men.

These numbers reflect a reality where Australian women face an increasingly uncertain financial future, and many women agree. Thirty-six percent are expecting their financial position to worsen over the next 12 months, compared to 27% of men who feel the same.

The intersection of financial security and personal safety

The challenges women face extends beyond finances and into matters of personal safety, with the two often intersecting. In our survey, 63% of women express concern about domestic violence in Australia, compared to 50% of men. For many women, the choice to leave or stay in an abusive relationship can come down to their financial position, and many also experience economic abuse.

Further to this, those who experience abuse often feel its economic affects throughout their lifetime. This could be due to lower levels of education, lower incomes and/or having to leave property and/or assets behind during separation. Data from the Australian Longitudinal Study on Women’s Health suggests that women were 30–45% more likely to experience high financial stress if they had experienced sexual violence, compared with those had not.

Addressing the gender divide

The data reveals a clear and complex picture of a growing gender divide and the challenges faced by Australian women. There is no one size fits all answer to addressing this disparity, but we all have a role to play. The Australian government’s commitment to making gender equality a national priority is a start, and personally, I volunteer my time with a charity focused on empowering vulnerable women. However, we could all be doing more to address challenges that more than half the population experience to ensure everyone has a secure and equitable future.

Contact us if you would like to explore this or further data from our Consumer Insights Tracker. If you would like to speak to someone about the content presented in this article, please reach out to 1800 RESPECT.

Posted in Financial Services, Social & Government