Author: James Organ | Posted On: 08 Apr 2025

Updates to this research are published monthly. View previous wave.

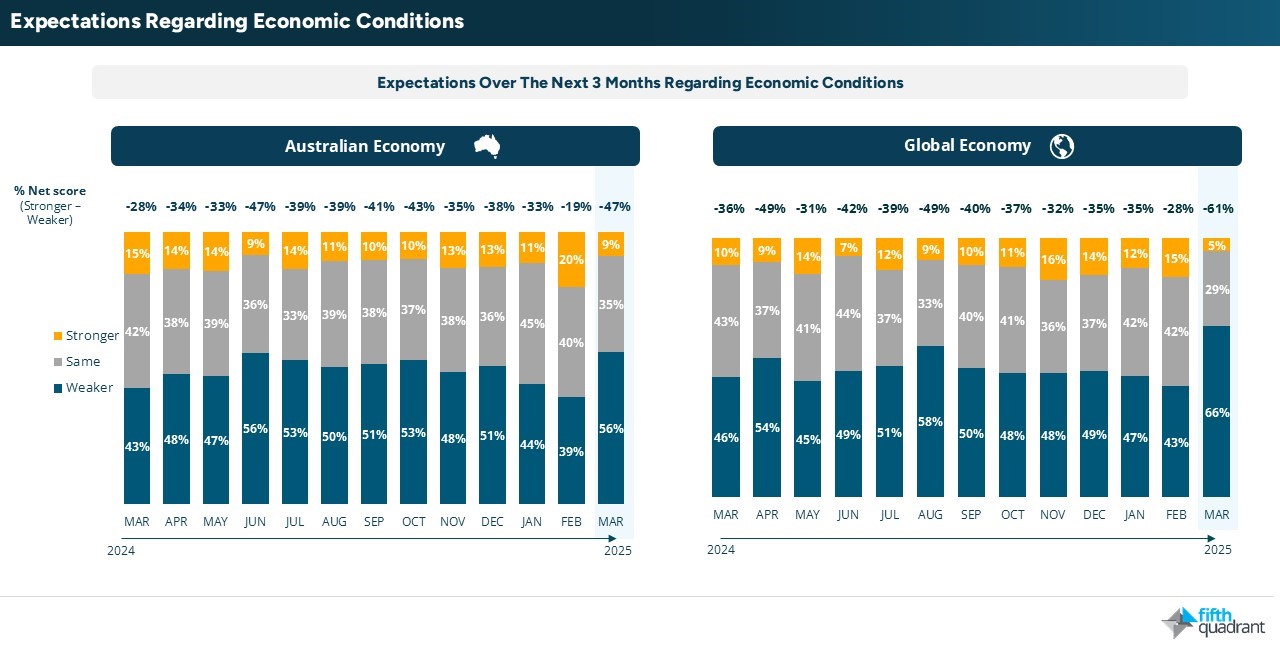

Confidence in both domestic and global economies has plummeted as tariff wars shift from threat to reality. Now, 66% of SMEs expect a weaker global economy (up from 43% in February) and 56% anticipate a weaker domestic outlook (up from 39%).

Geopolitical tensions

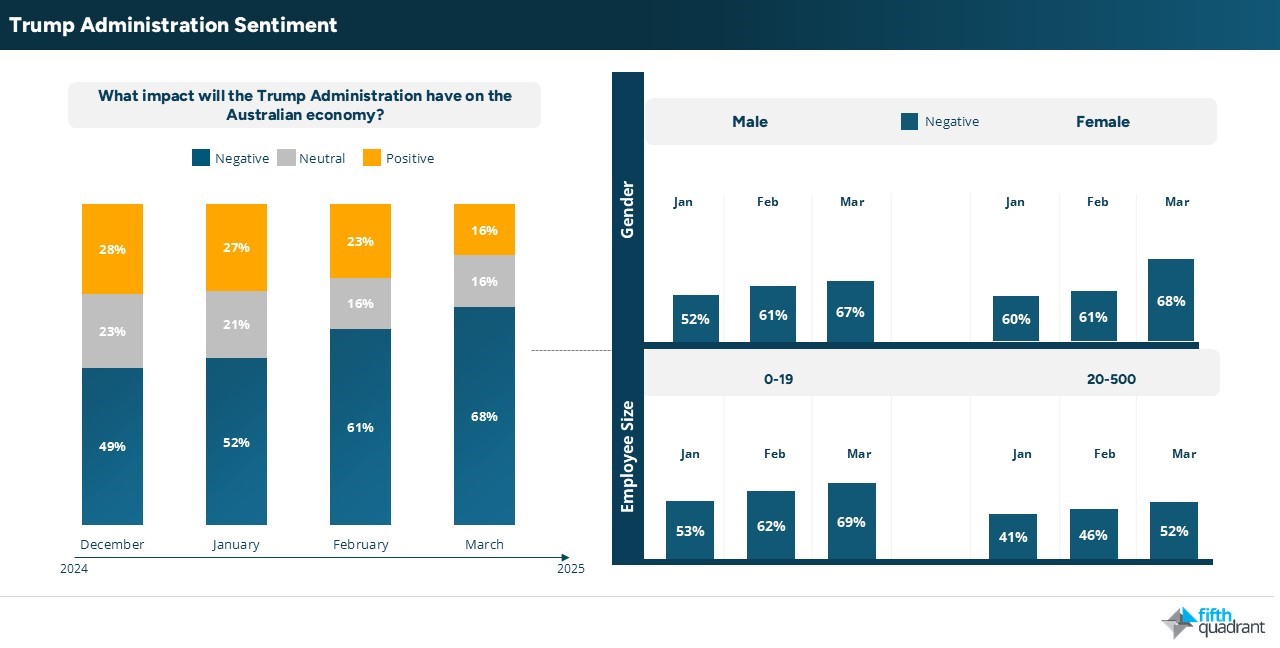

Accordingly, 68% of SMEs now believe the Trump Administration will have a negative impact on the Australian economy.

Heightened concern around these geopolitical tensions and associated supply chain challenges is adding to the economic unease, putting pressure on business planning and investment.

Softened revenues

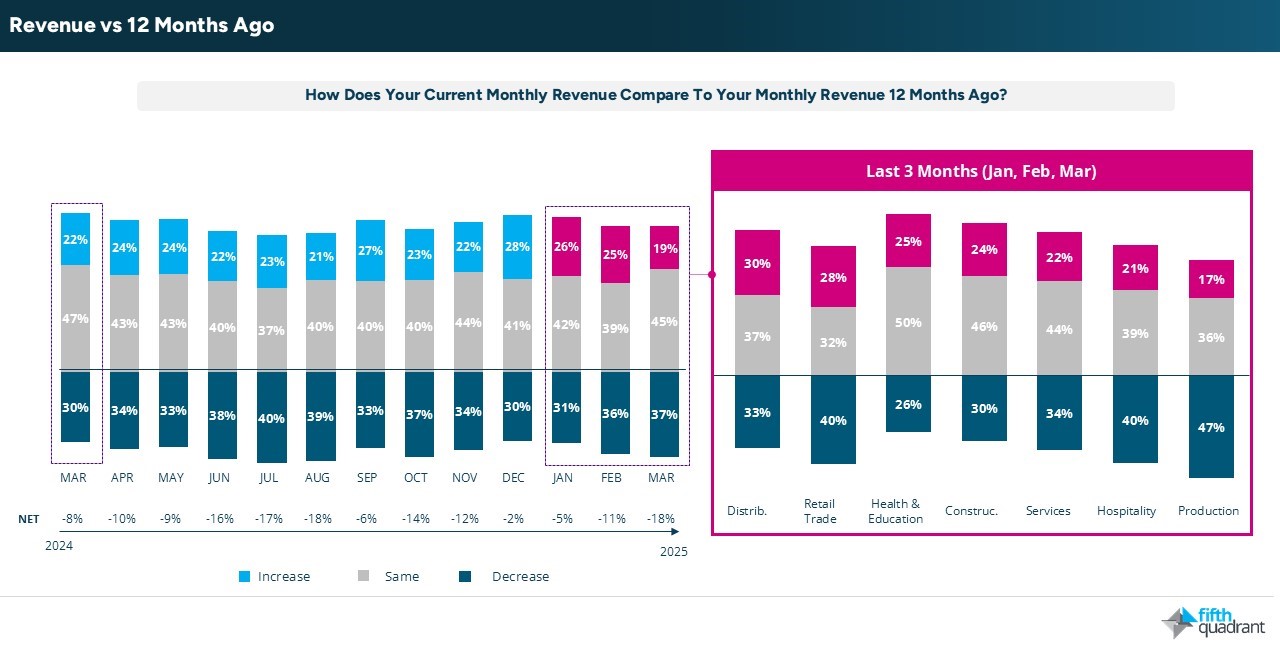

SME revenue softened over the past month, with only 19% reporting higher turnover compared to the same period last year. More concerning, 37% are now reporting lower revenue — up from 31% in January. The weakest performance in Q1 2025 came from businesses in production, retail, and hospitality.

Growth focus

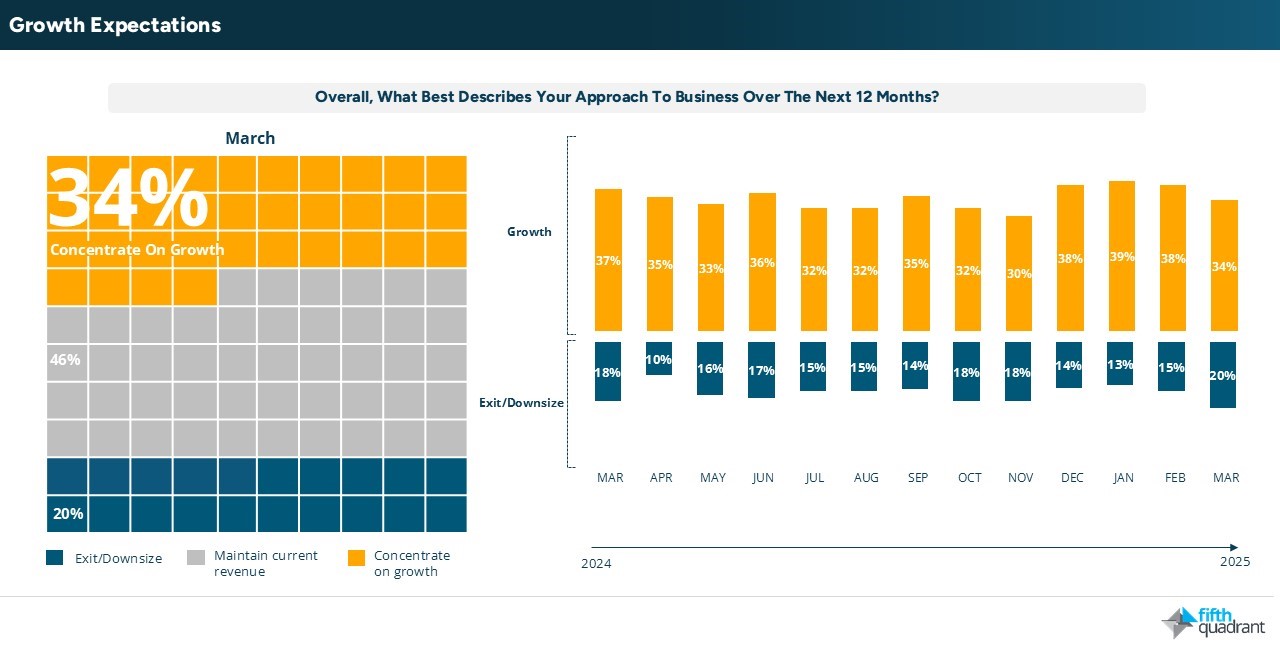

Consequently, the proportion of SMEs focused on growth declined to 34% (down from 39% in January), while 20% now report plans to downsize or exit—the highest level recorded in the past 12 months. Accordingly, investment intentions for capital equipment and marketing spend also retraced from February levels.

Hiring intentions

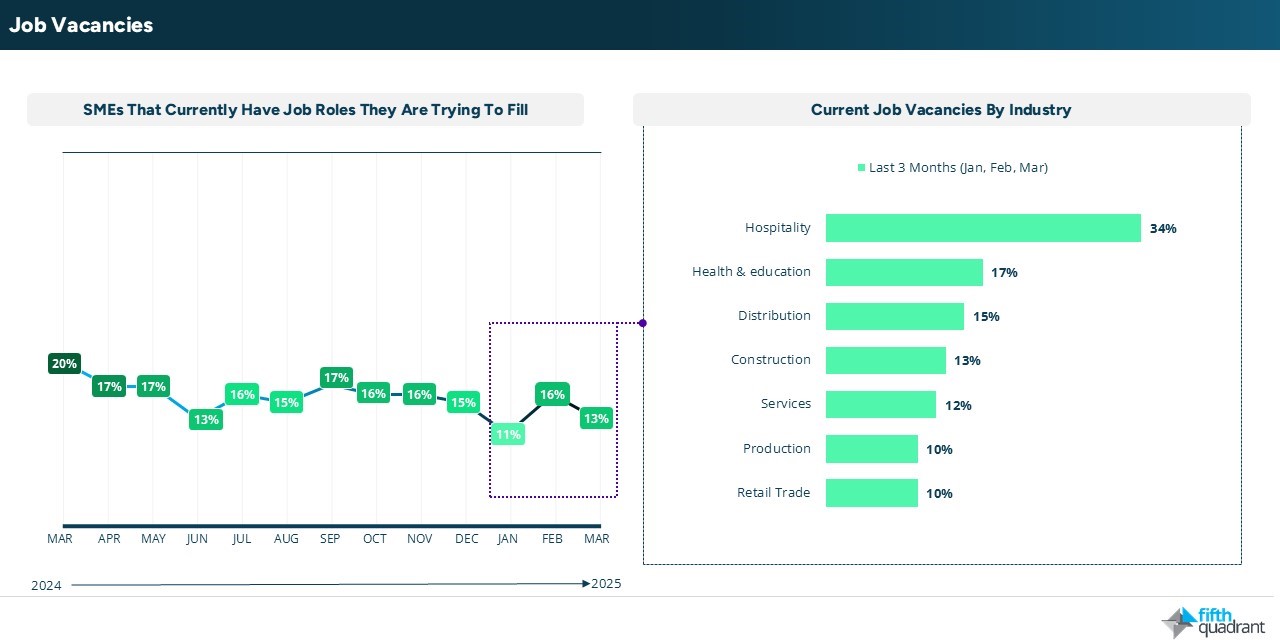

Hiring intentions also continue to decline, with only 10% of SMEs planning to increase staff over the next three months, down from 15% in December. Notably, the retail sector has been the least active in hiring over the past quarter. In line with limited workforce growth expectations, job vacancies have also dropped to 13%, following a temporary uptick in February.

Demand for finance

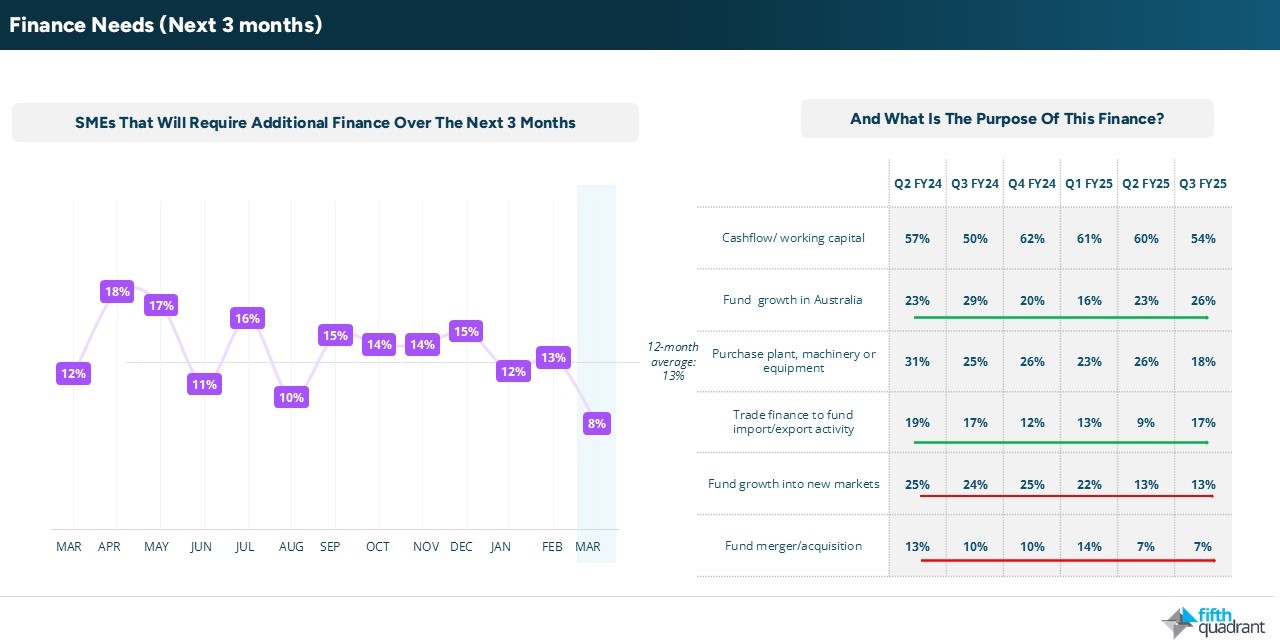

Financing trends reflect a similar caution. Demand for additional financing has fallen to its lowest point in a year (8%), particularly among smaller SMEs. On a positive note, loan stress has eased—from 12% in December to 8%, supported by falling interest rates, although this improvement could be short lived in the current environment.

conclusion

This is clearly a time of heightened risk for SMEs, with sentiment weakening across all key indicators. The direction of SME confidence and activity in the coming months will largely depend on how tariff negotiations play out and whether businesses see a path to greater stability.

Please click on this link to access the full report including subgroup analysis by industry sector, size of business and state. Fifth Quadrant and Ovation Research publish monthly updates of this SME market research here. For any questions or inquiries, feel free to contact us here.

SMEs remain resilient

Posted in Uncategorized, B2B, Consumer & Retail, Financial Services