Author: James Organ | Posted On: 09 Sep 2024

Updates to this research are published monthly. View previous wave.

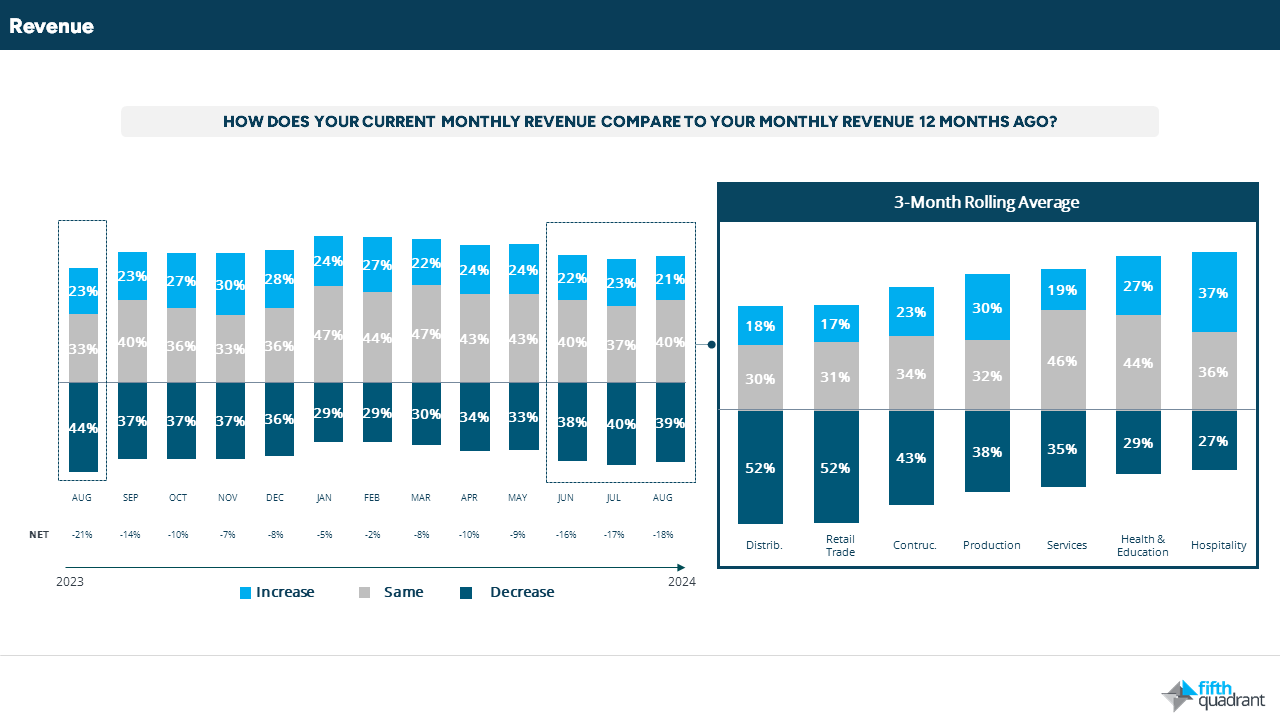

SMEs have continued to face a downward trend in revenues, with 39% reporting declines in August and only 21% seeing growth, marking the weakest performance in 12 months. Despite these challenges, many businesses have shown resilience by managing costs effectively, with only 17% reporting losses, down from 29% a year ago. However, concerns about operational and production costs have increased slightly, despite the decline in inflation.

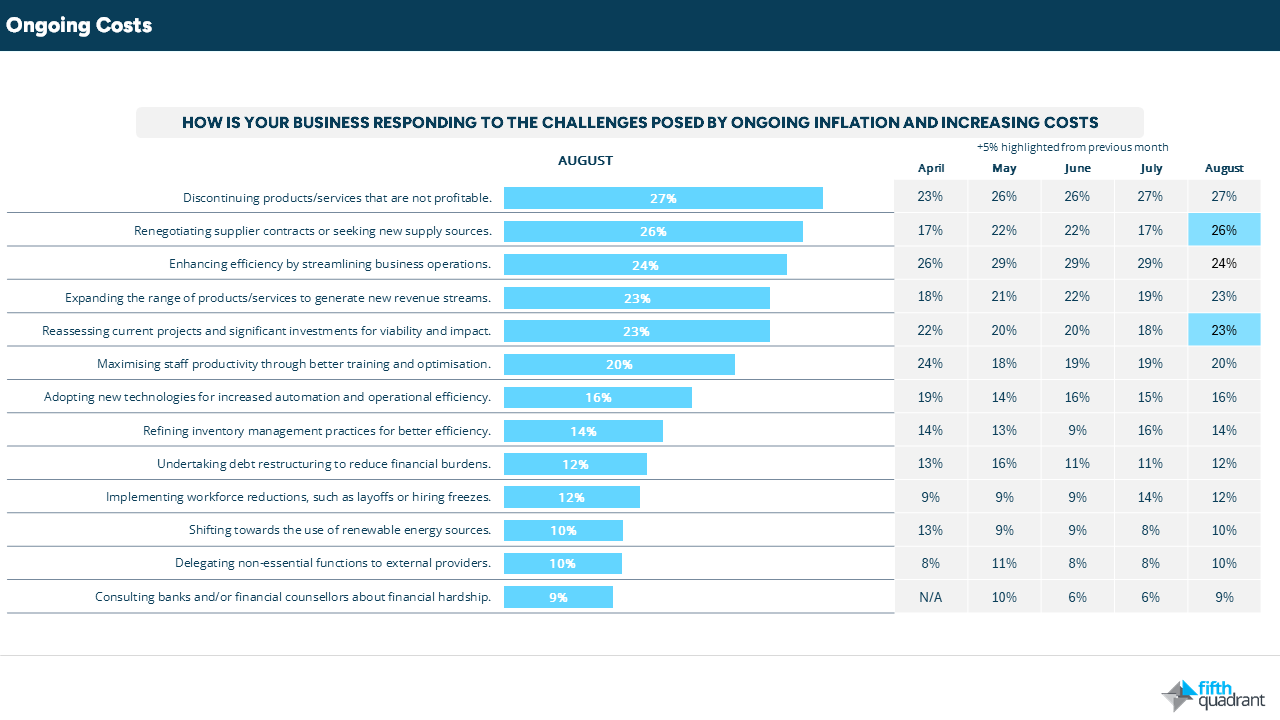

ongoing costs

As customers become more price-sensitive, the ability to pass on higher input costs has steadily decreased since April. In response, SMEs are focusing on reviewing supplier contracts and reassessing major projects. Positively, fewer businesses are facing severe financial difficulties, with the figure dropping from 30% in June to 25%, reflecting improved cost management in a competitive market.

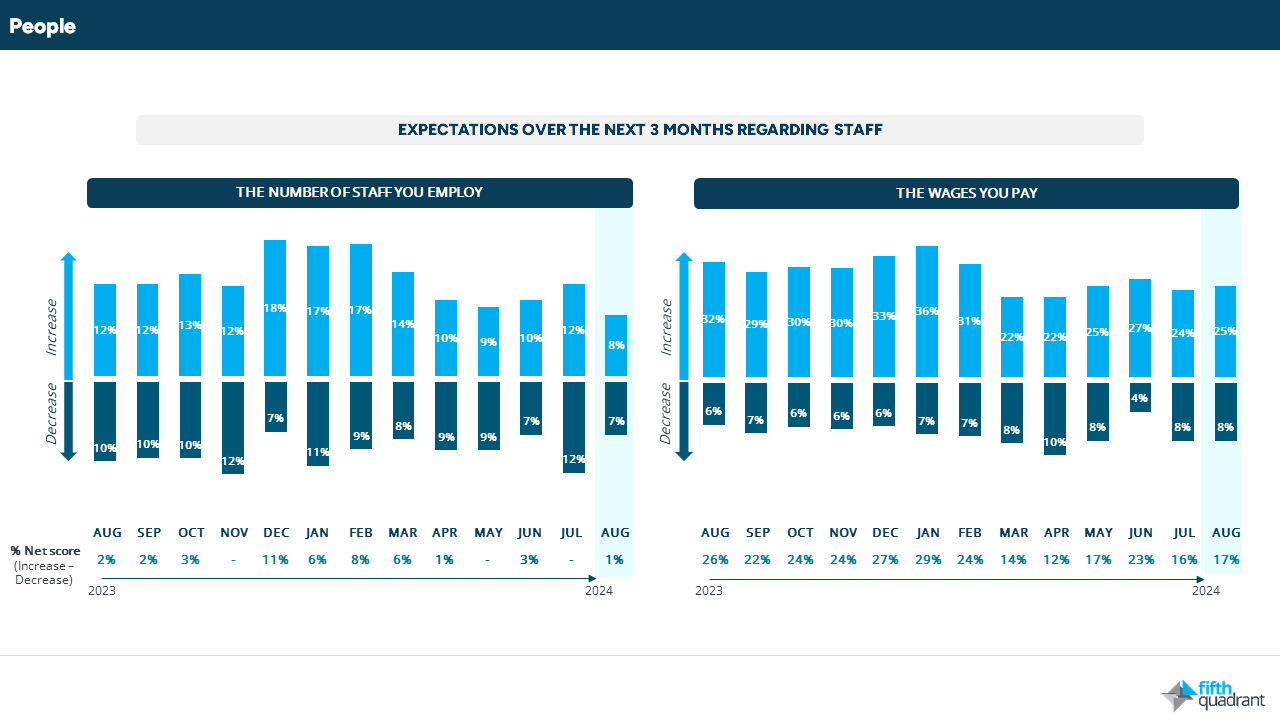

people

Hiring trends are not optimistic, with only 8% of SMEs planning to increase staffing in the next three months, the lowest level in a year. As a result, recruitment activity remains stagnant, with just 15% of businesses trying to fill positions.

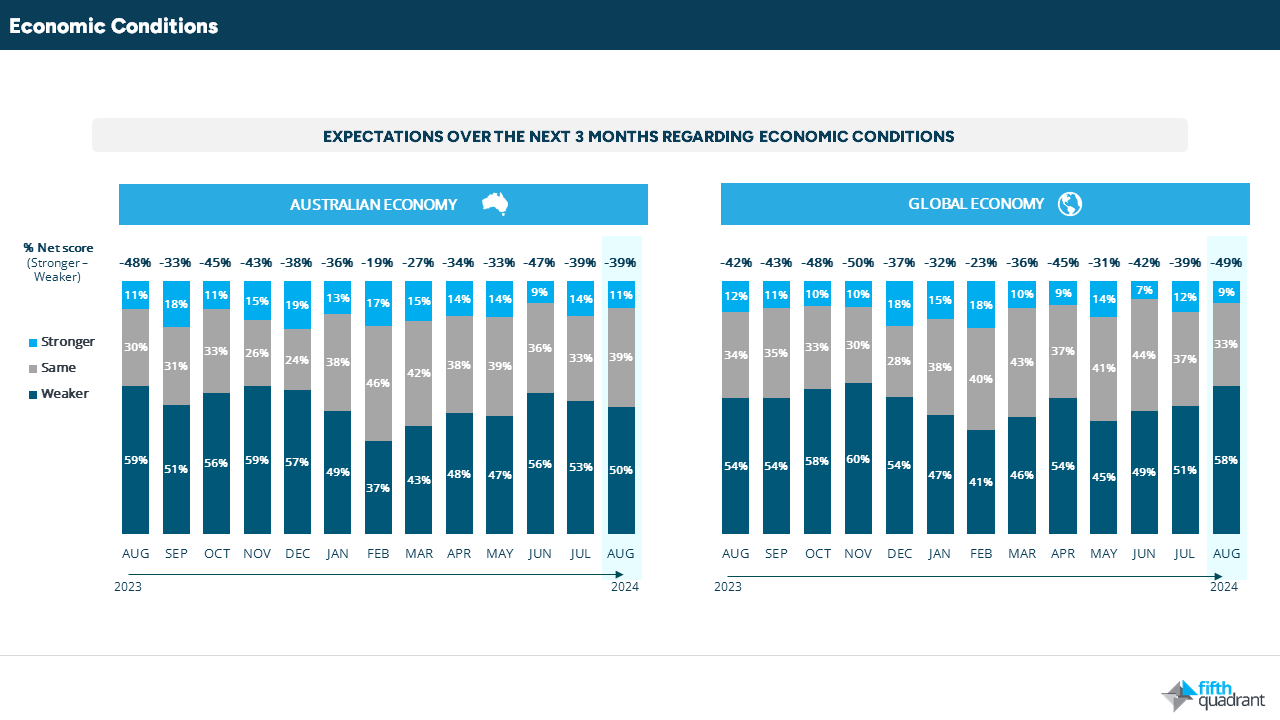

economic conditions

Meanwhile, confidence in the global economy continues to decline, with 58% of businesses expecting further weakening over the next three months. While sentiment around the Australian economy is more optimistic, it remains lower than earlier in the year.

business investment & marketing spend

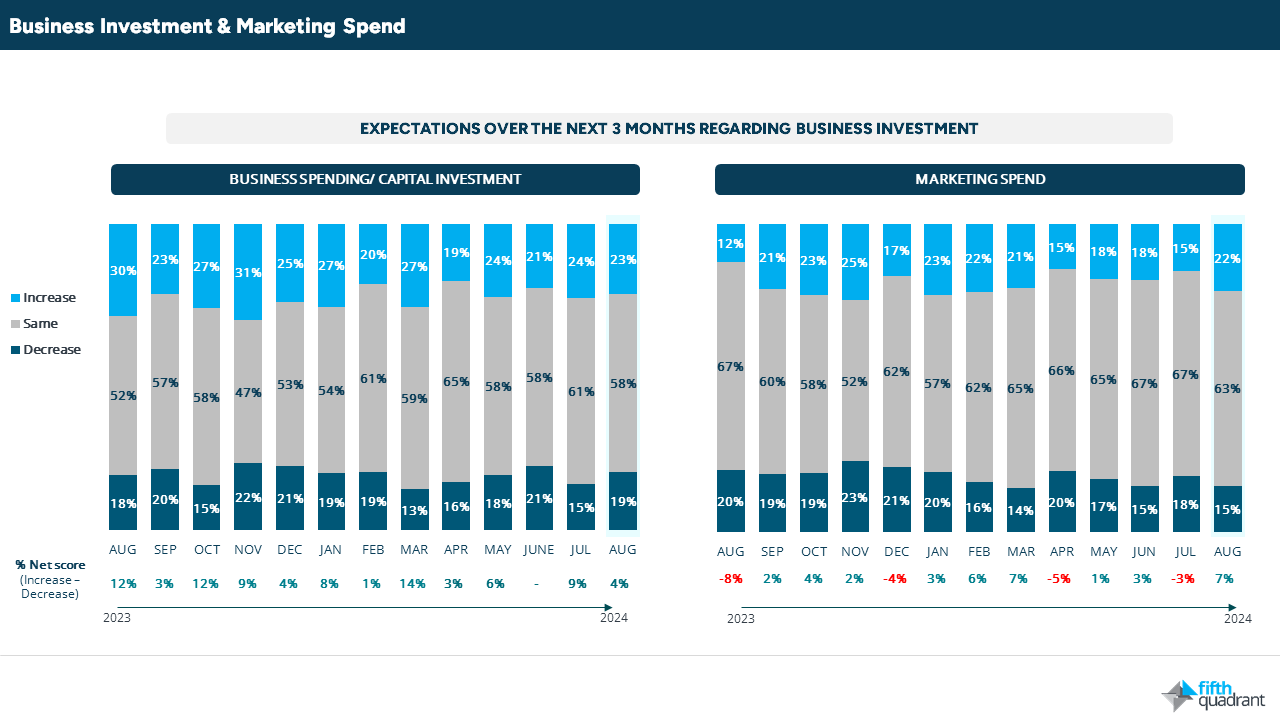

It is positive that ahead of the crucial pre-Christmas trading period, SMEs are planning to increase marketing spend, with 22% signaling heightened activity. However, business investment across most equipment categories has steadily declined throughout 2024. This reduction in investment has resulted in weaker demand for financing, as businesses adopt a cautious approach in navigating the ongoing economic uncertainty.

In summary, sentiment has declined across all key indicators, but SMEs have implemented initiatives to reduce costs and future-proof their businesses. Recruitment and capital investment activity remain very low, but there is a positive outlook for an uplift in marketing activity as the pre-Christmas period approaches. This reflects a cautious yet proactive approach as businesses prepare for a critical trading period.

Please click on this link to access the full report including subgroup analysis by industry sector, size of business and state. Fifth Quadrant and Ovation Research publish monthly updates of this research here. For any questions or inquiries, feel free to contact us here.

SMEs remain resilient

Posted in Uncategorized