Author: James Organ | Posted On: 12 Jun 2024

Updates to this research are published monthly. View previous wave

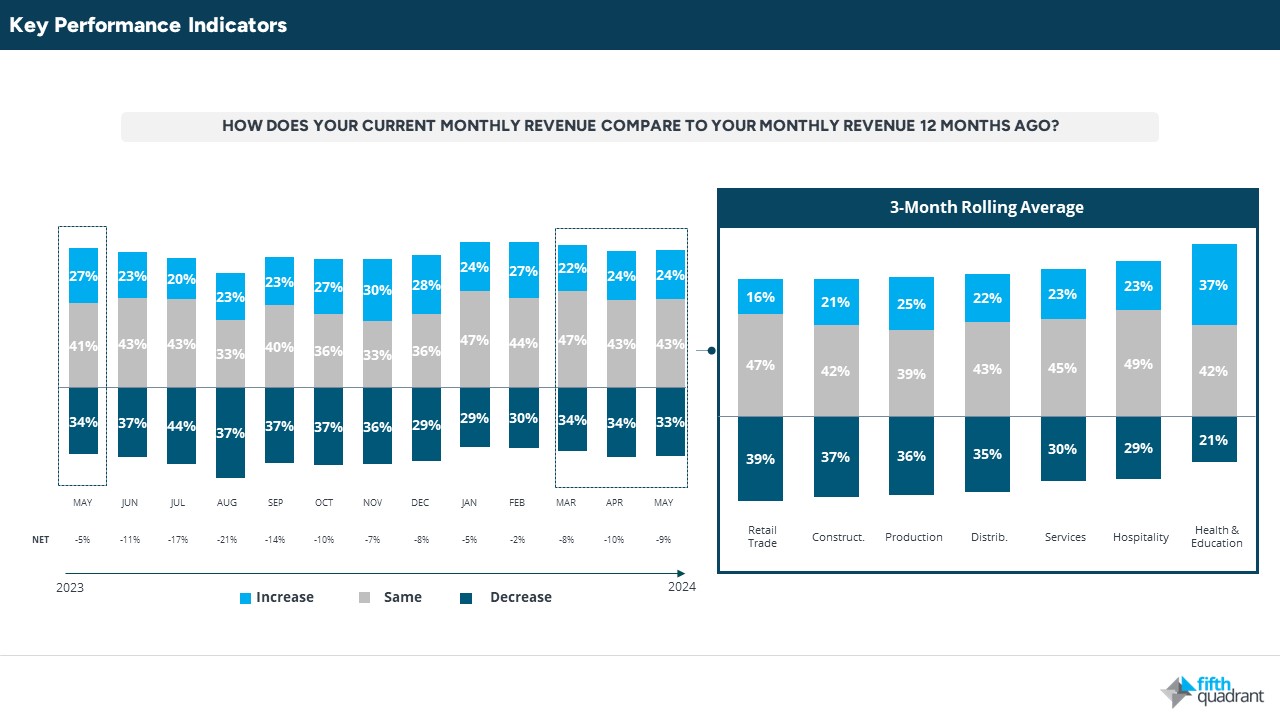

The latest Fifth Quadrant SME Sentiment Tracker continues to report soft revenues in line with weak economic conditions. 33% report lower revenues than 12 months earlier. The Health & Education is the only sector showing significant growth, while Retailers are doing it tough with 39% reporting lower revenues over the past 3 months.

Business concerns

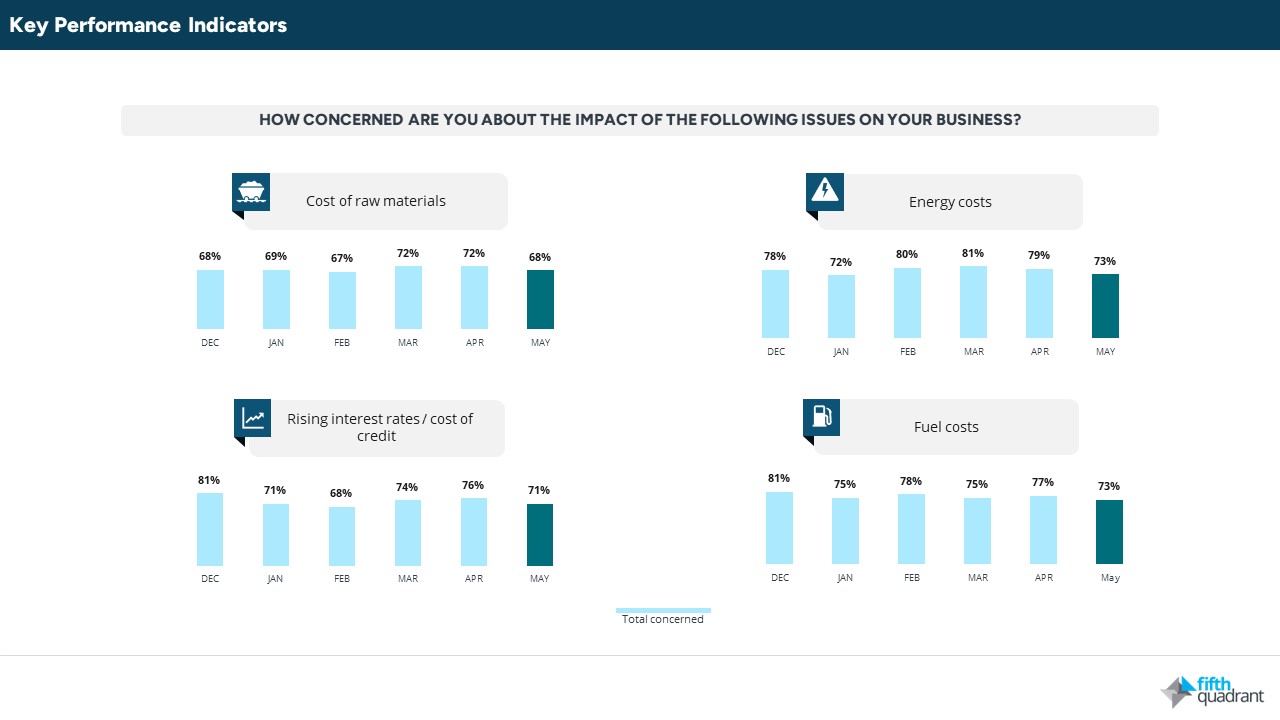

Profitability remains volatile. In May, only 50% of SMEs reported making a profit, a decrease from 59% in April. More than one-fifth of SMEs reported losses, underscoring their vulnerability. Despite these challenges, there has been a slight easing of inflationary pressures, as concerns about key inputs, including energy and fuel costs, have declined.

growth expectations

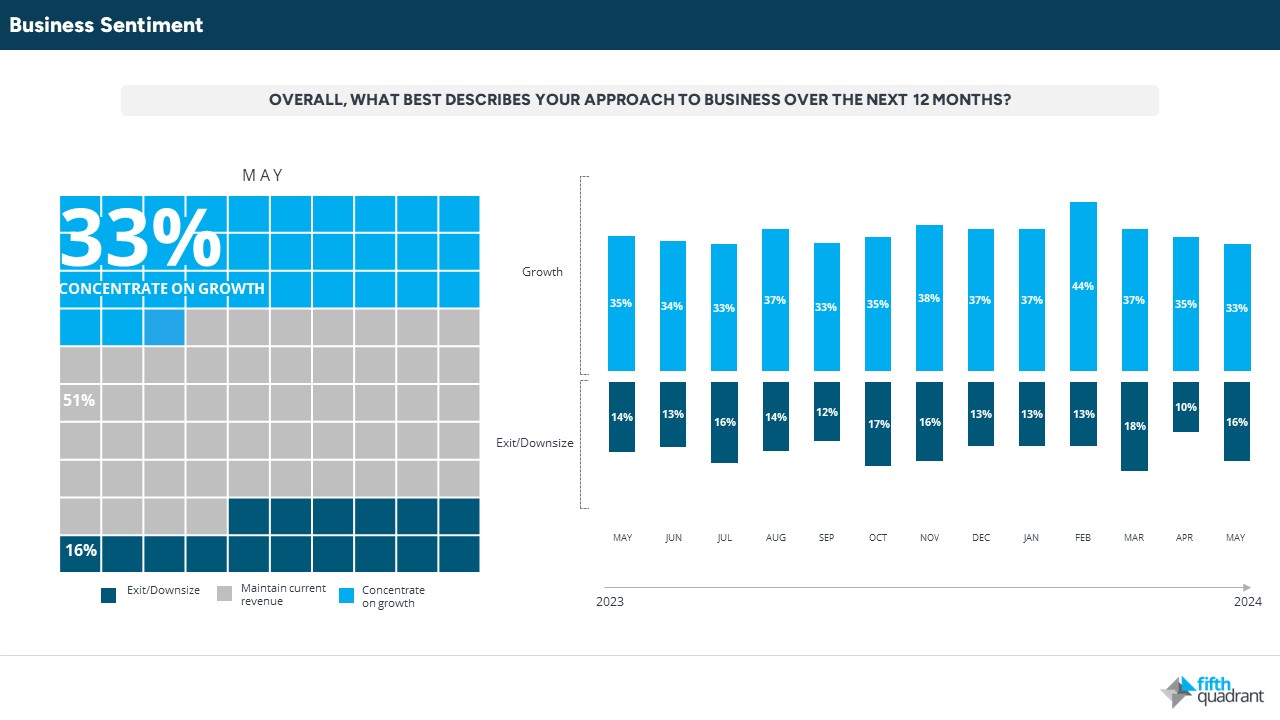

Growth expectations for the next 12 months have decreased for the fourth consecutive month, suggesting that stronger economic conditions are not anticipated soon. Similarly, revenue expectations for the next four weeks are low, mirroring the levels reported in May 2023.

people

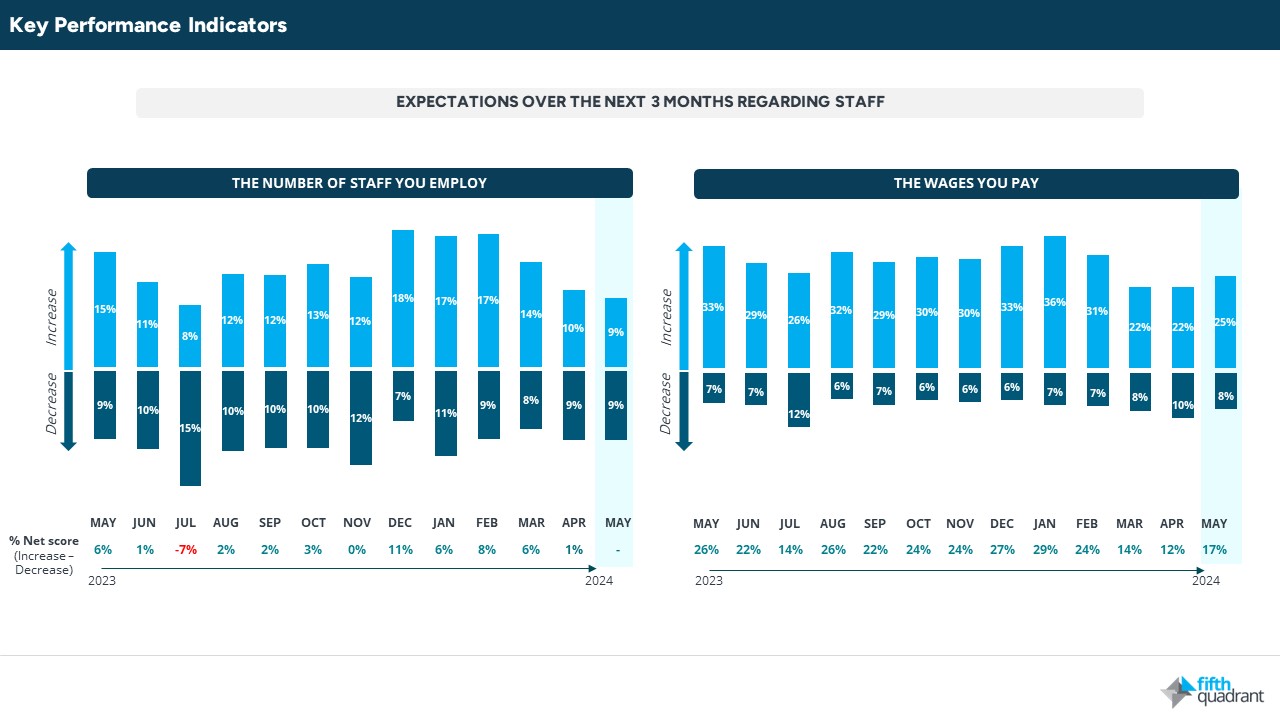

Employment data indicates a downward trend, with only 9% of businesses planning to increase staff in the next three months, and an equal percentage expecting a decrease. The upcoming rise in the minimum wage in July is expected to put upward pressure on payroll costs, likely contributing to a rise in unemployment. Consequently, recruitment activity remains low, at 17%.

Economic Conditions

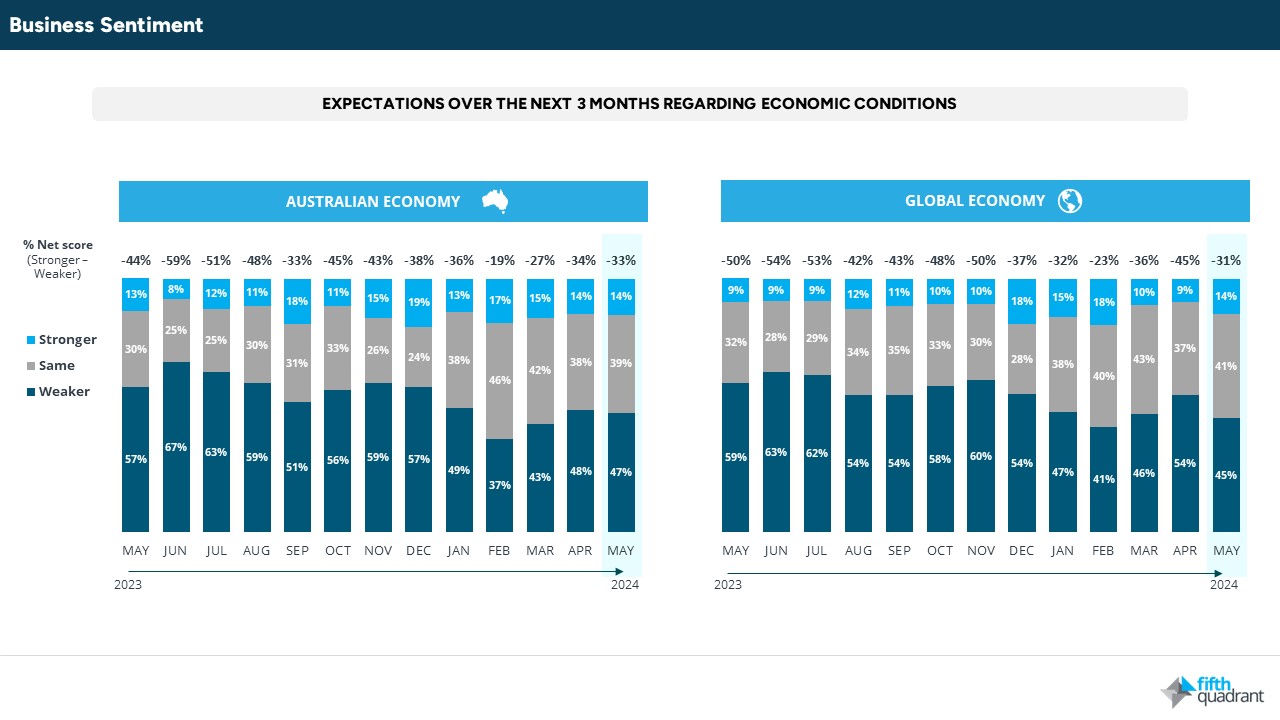

Despite these ongoing challenges, there are signs of improving business sentiment towards the global economy. The percentage of businesses expecting stronger conditions has risen to 14% in May 2024, and the net sentiment score has improved from -45% to -31%, reflecting growing optimism about economic prospects in the global economy.

In summary, revenue, profit and employment data are all on the decline with little expectation that the economic conditions in Australia will improve any time soon. The data indicates unemployment will rise again next month and hence the ongoing commentary regarding the direction of interest rates will again point lower. Hopefully, this will stimulate greater consumer confidence and spending activity.

Please click on this link to access the full report including subgroup analysis by industry sector, size of business and State. Fifth Quadrant and Ovation Research publish monthly updates of this research here. For any questions or inquiries, feel free to contact us here.

Posted in TL, Consumer & Retail, Financial Services, QN, Social & Government