Author: James Organ | Posted On: 11 Nov 2024

Updates to this research are published monthly. View previous wave.

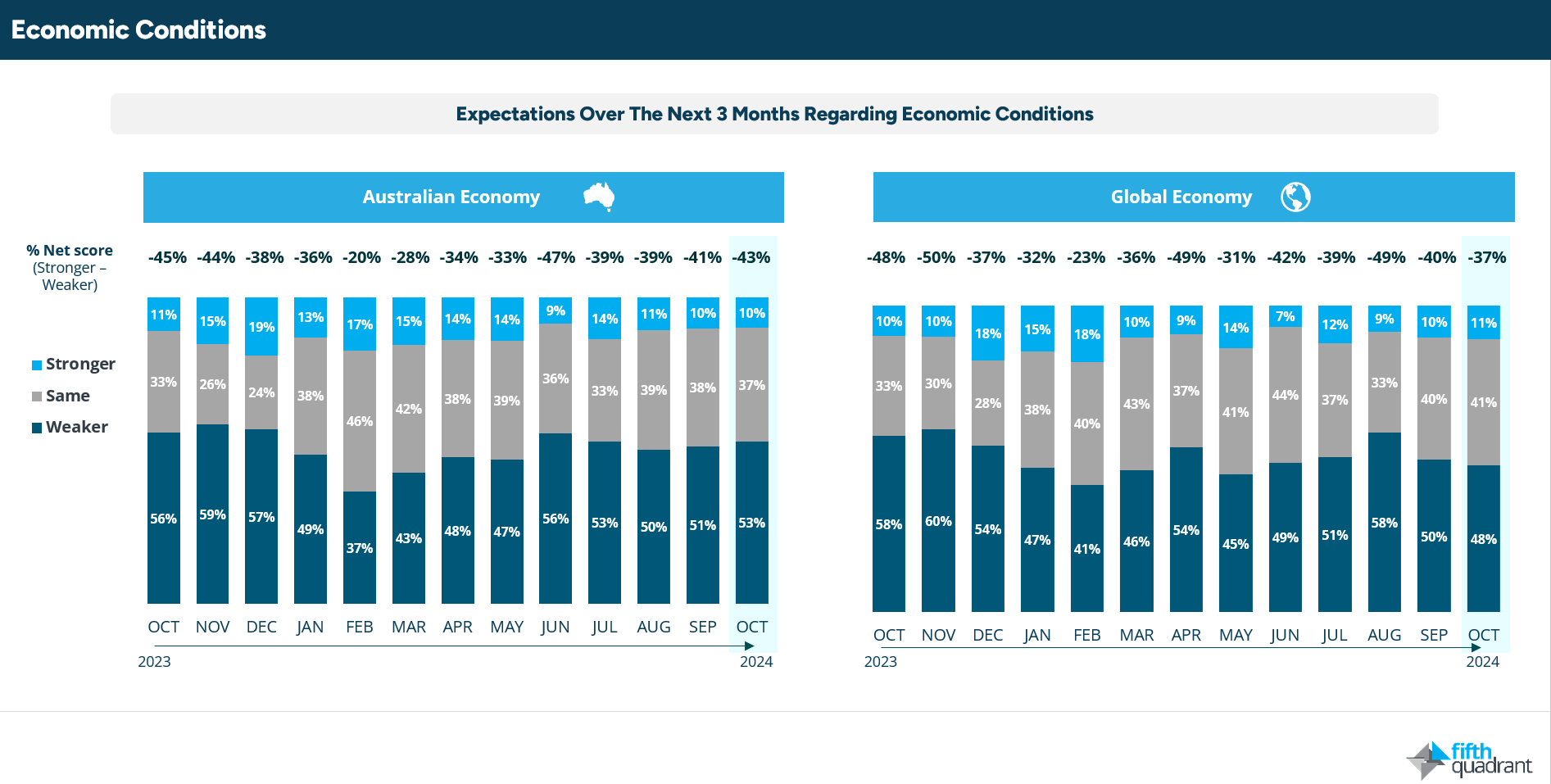

After showing signs of recovery over the past two months, the latest Fifth Quadrant data reveals another dip in sentiment as SMEs lack confidence in the Australian economy. Only 10% of SMEs expect the local economy to improve over the next three months, while 53% anticipate weaker conditions.

In contrast, sentiment regarding global economic conditions continues to strengthen, driven by declining interest rates in many countries. Consequently, support for the Australian government dipped in October, with only 30% of respondents expressing satisfaction with government policy.

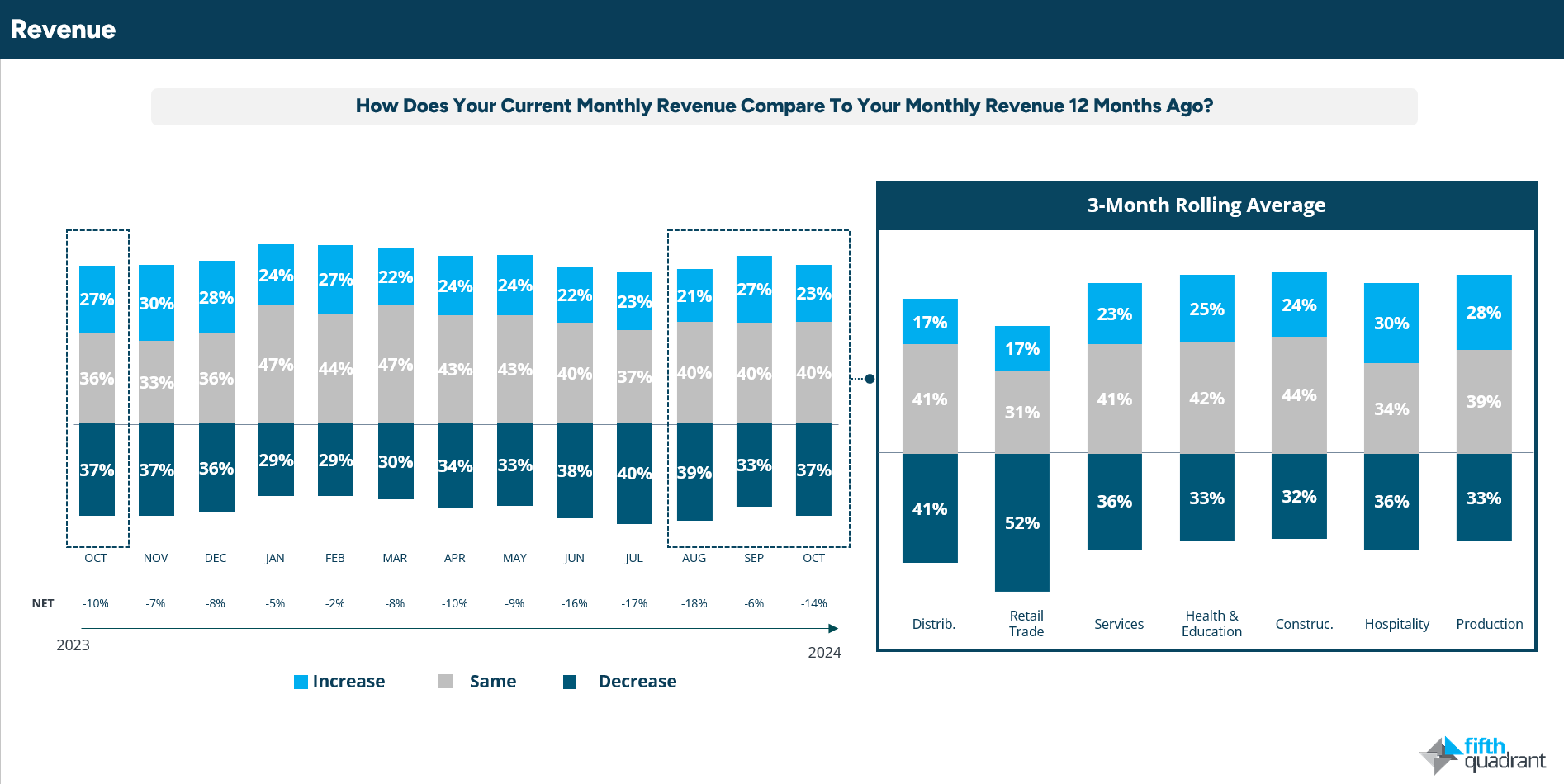

Revenue

All key financial indicators weakened, with 37% of SMEs reporting lower revenues compared to 12 months ago, and 22% reporting a financial loss in October. Additionally, 23% of SMEs have faced significant financial challenges over the past year, with increased competition (58%) and poor strategic decisions (36%) emerging as more prominent drivers of these difficulties. As a result, 11% of SMEs expect to struggle with loan repayments over the next six months, up from 8% in August.

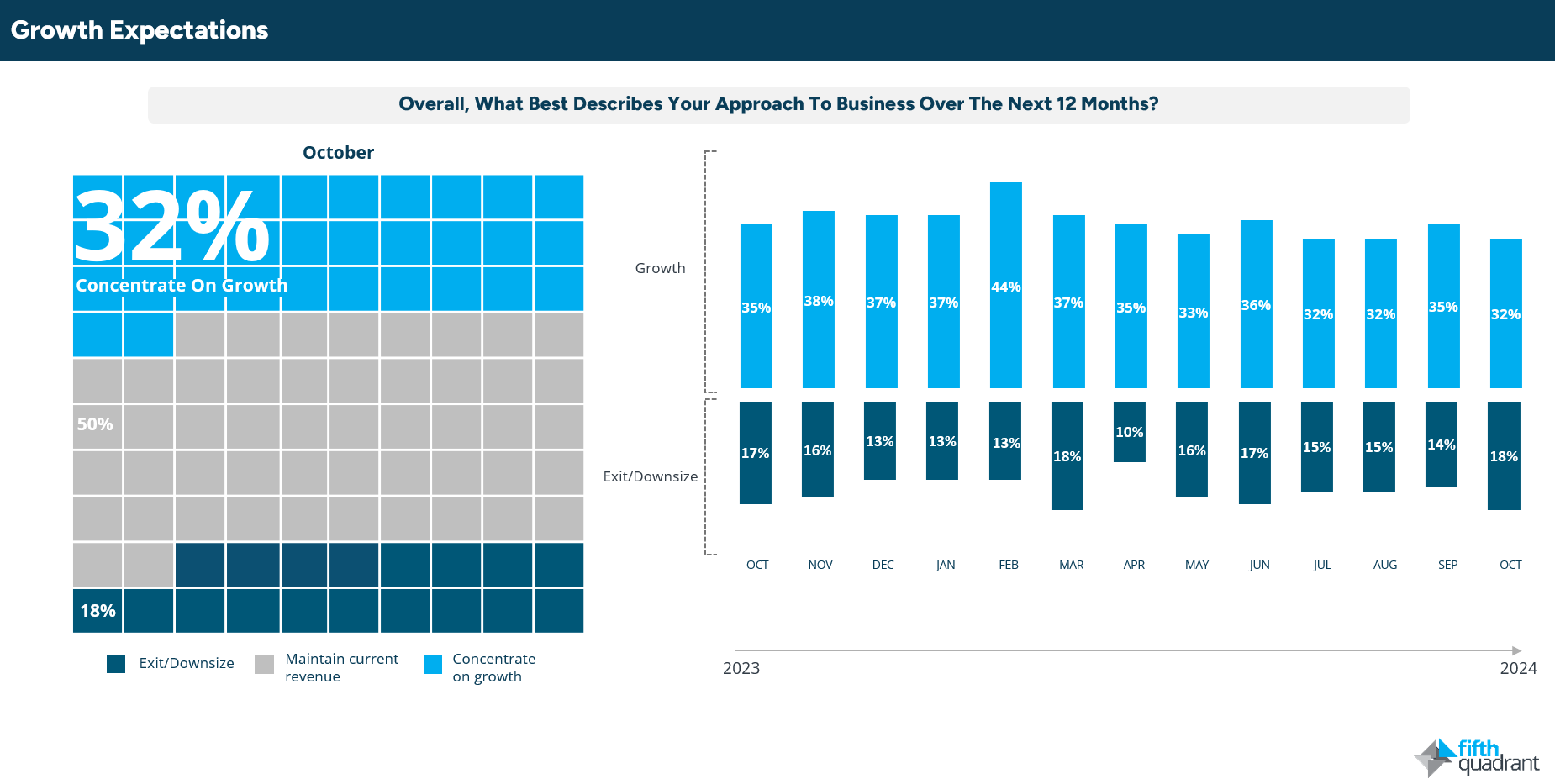

growth expectations

Furthermore, growth expectations for the next 12 months have dipped, with only 32% of SMEs focusing on expansion, down from 35% the previous month. Consequently, capital investment and marketing spend intentions for the next three months have also declined.

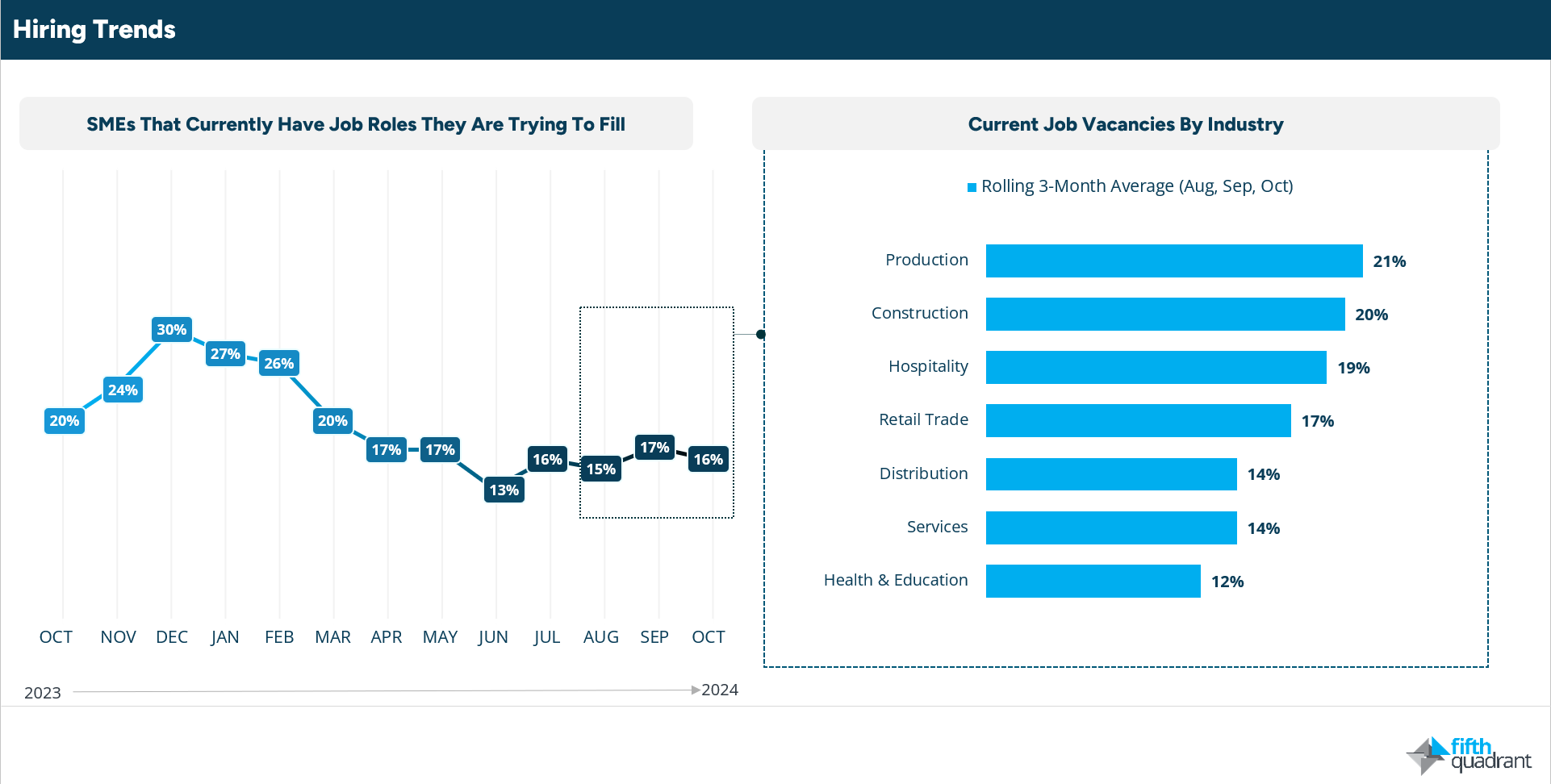

hiring

Currently, 16% of SMEs are hiring for new or existing roles, a figure significantly lower than 12 months ago but consistent with the 17% reported last month.

SME sentiment has weakened once again, with declining confidence in the Australian economy. Key financial indicators, including weaker revenues, rising financial losses, and increasing loan stress, have negatively impacted growth expectations, capital investment, and hiring intentions. In this environment, SMEs are likely to remain highly cautious as we move through the holiday period.

Please click on this link to access the full report including subgroup analysis by industry sector, size of business and state. Fifth Quadrant and Ovation Research publish monthly updates of this research here. For any questions or inquiries, feel free to contact us here.

SMEs remain resilient

Posted in Uncategorized