Author: James Organ | Posted On: 10 Nov 2023

Updates to this research are published monthly. View previous wave.

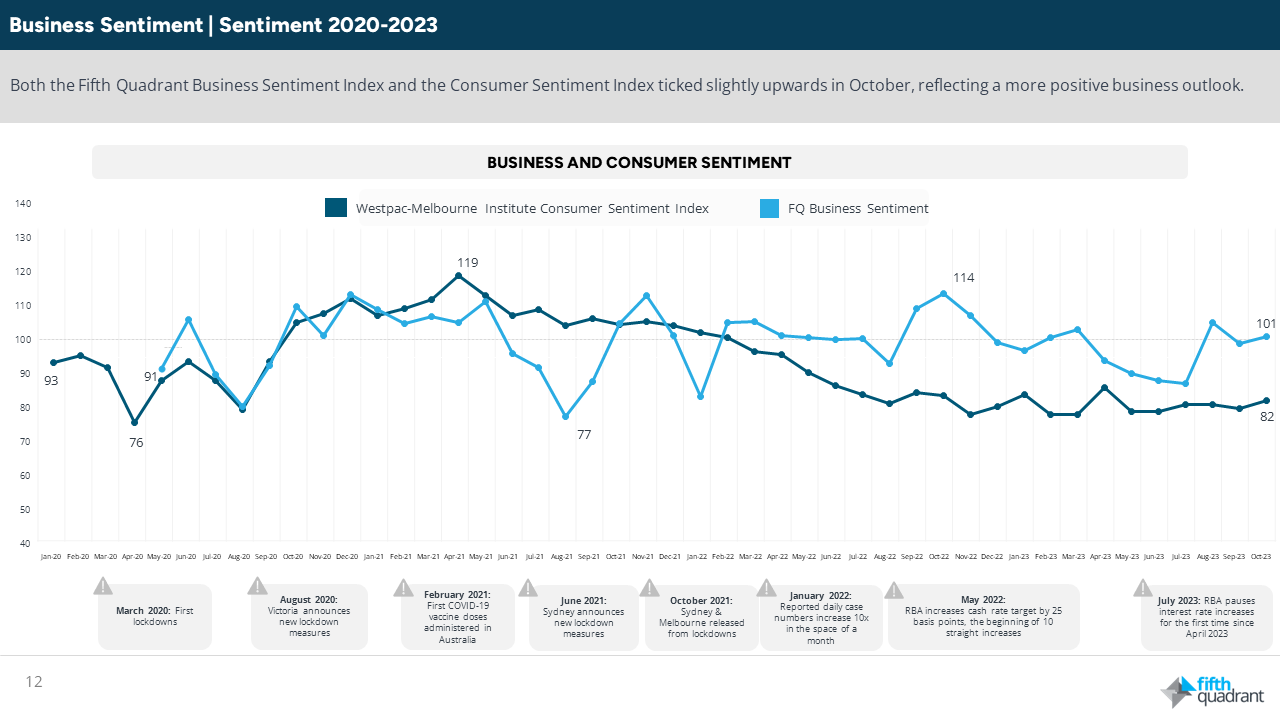

The latest wave of the Fifth Quadrant SME Sentiment Tracker presents a positive picture for SMEs, with profitability and expected revenue continuing to grow. Winter blues have been left behind and 27% now report a higher monthly revenue compared to 12 months ago. The Fifth Quadrant Business Confidence Index also remains high at 101.

table 1: business confidence index

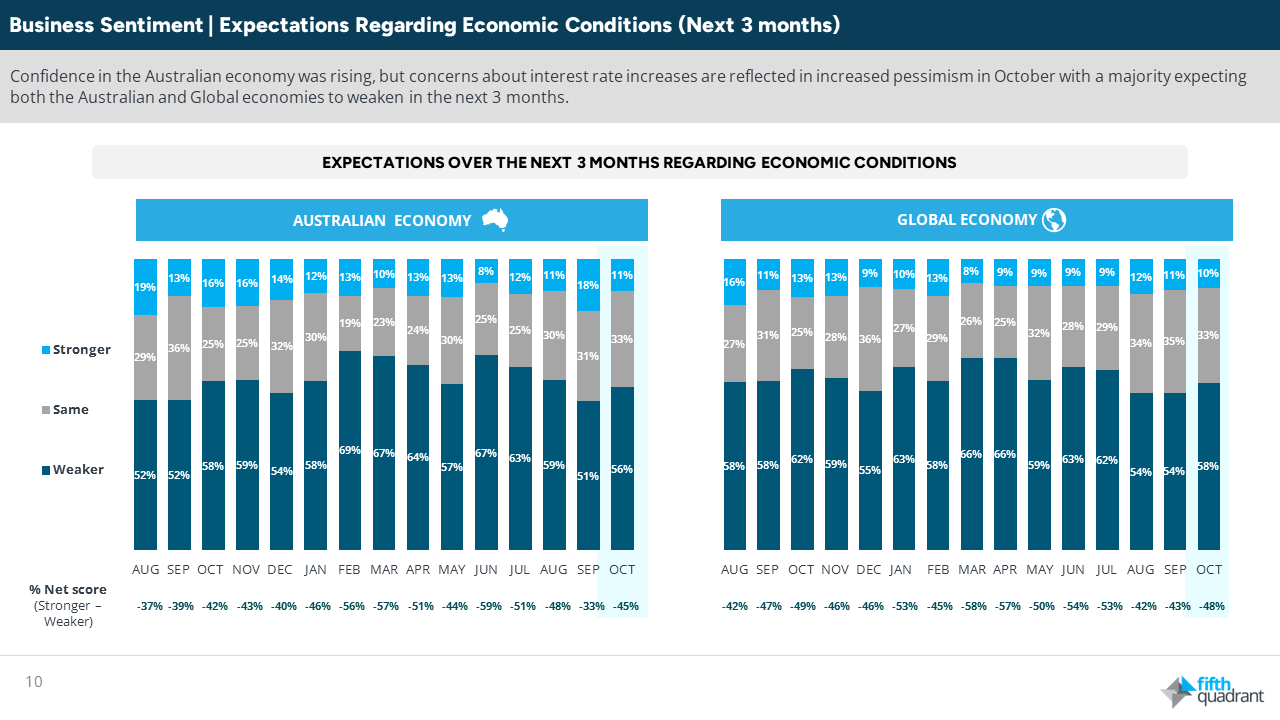

However, in October SMEs were braced for rising interest rates and the RBA decision in early November to lift rates has cooled their optimism. Almost 9 in 10 SMEs are concerned about rising interest rates and concern over fuel and energy costs has increased accordingly. This is reflected in dampened expectations for both the Australian and Global economies. 56% now expect the Australian economy to weaken over the next three months.

Table 2: expectations regarding economic conditions (next 3 months)

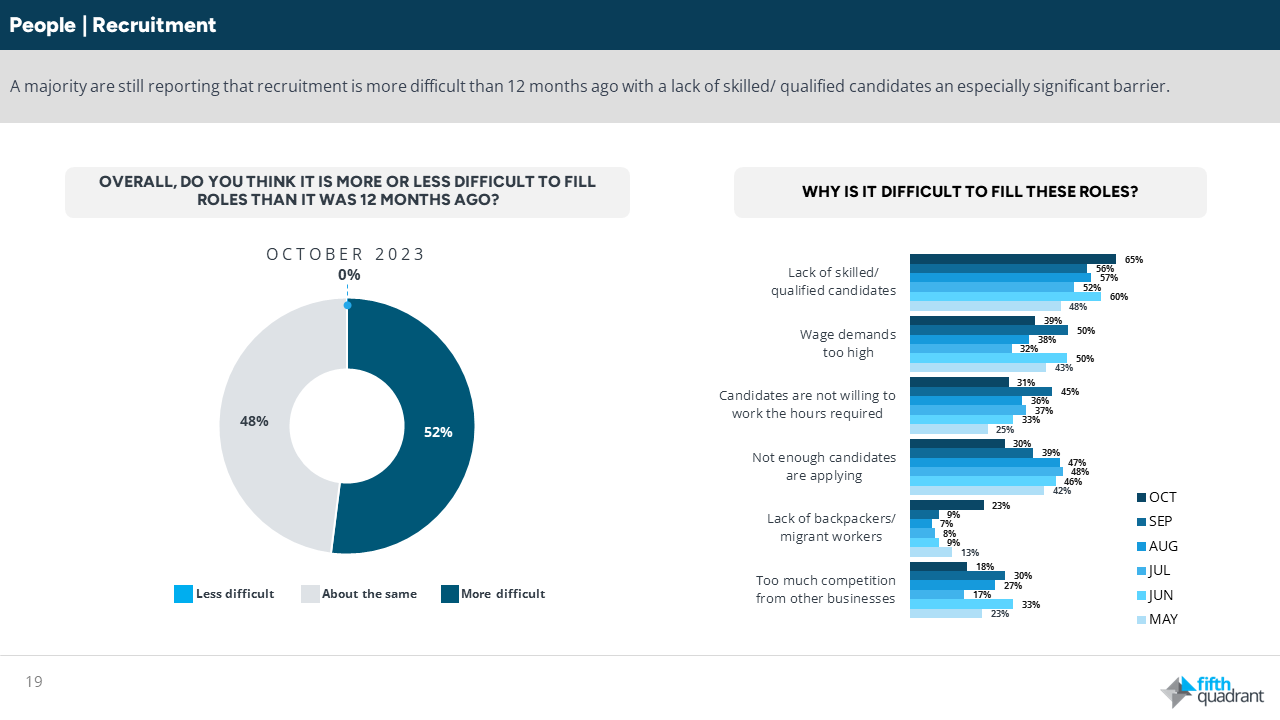

This caution has resulted in a slowdown in recruitment with only 20% now advertising vacancies. Even so, filling roles is still proving difficult for SMEs that choose to do so.

Table 3: recruitment

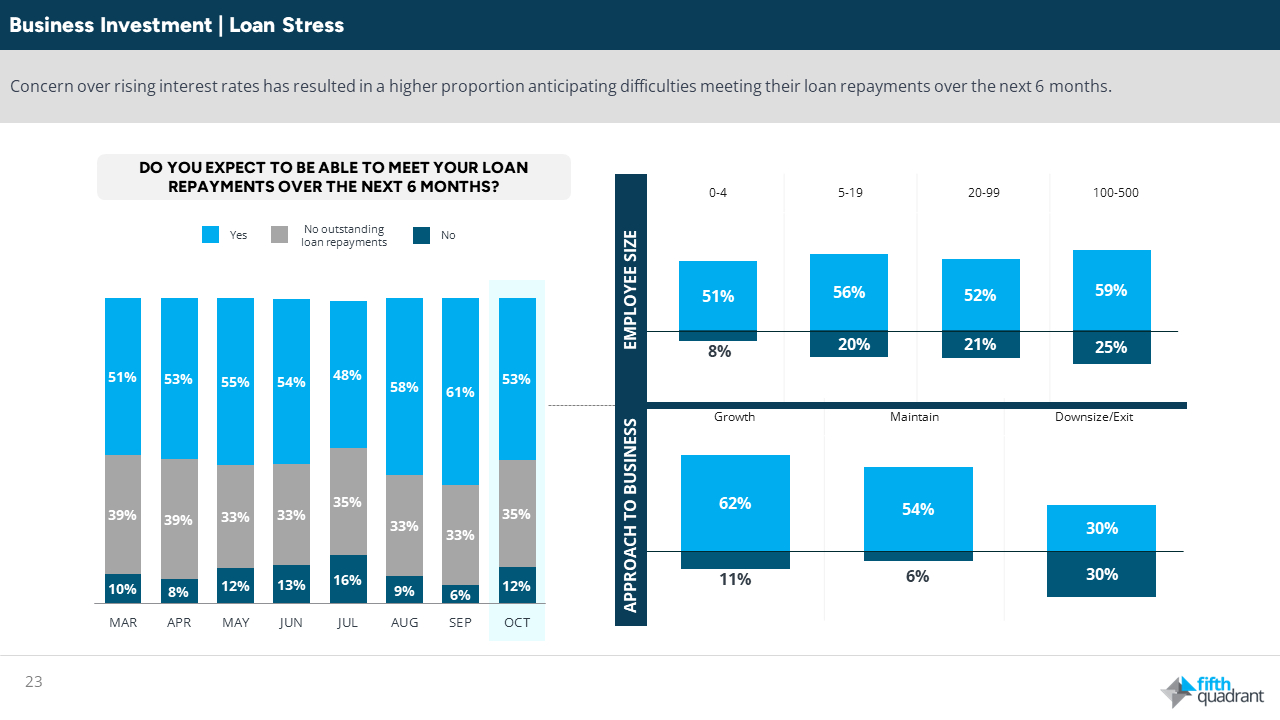

Concerns over rising costs has resulted in fewer SMEs feeling prepared to withstand a possible recession over the next 12 months, with those in the retail and hospitality especially worried. The proportion who feel unable to meet their loan repayments has also increased.

Table 4: loan stress

In summary, the October results continue the positive trend in SME confidence with growing revenues and profitability. SMEs have been more positive since August, but rising interest rates and high fuel and energy costs remain significant areas for concern. As we enter the Christmas trading period it will be interesting to see if sentiment holds up as many consumers adjust their budgets to accommodate the latest interest rate rise.

Please click on this link to access the full report including subgroup analysis by industry sector, size of business and State. Fifth Quadrant and Ovation Research will publish monthly updates of this research.

Posted in Financial Services, B2B, QN, TL