Author: James Organ | Posted On: 09 Jul 2024

Updates to this research are published monthly. View previous wave

The latest edition of Fifth Quadrant’s SME Sentiment Tracker shows that the current economic climate for SMEs remains challenging, with 38% reporting a decline in revenue in June. The construction sector remains weak, with 48% of companies experiencing reduced revenues.

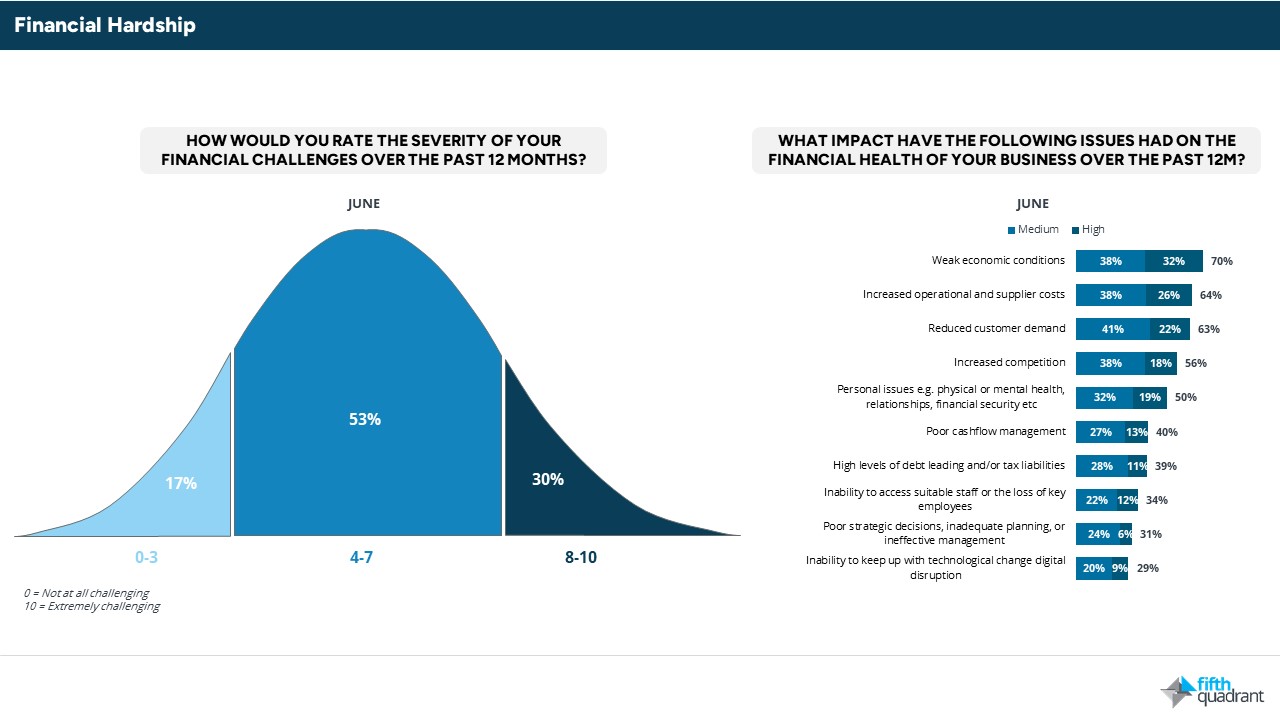

financial hardship

30% of SMEs have faced severe financial challenges over the past year, with challenging economic conditions, high operational costs and weak consumer demand having a significant impact. Accordingly, 50% of respondents report issues relating to physical and mental health, relationships and personal financial security.

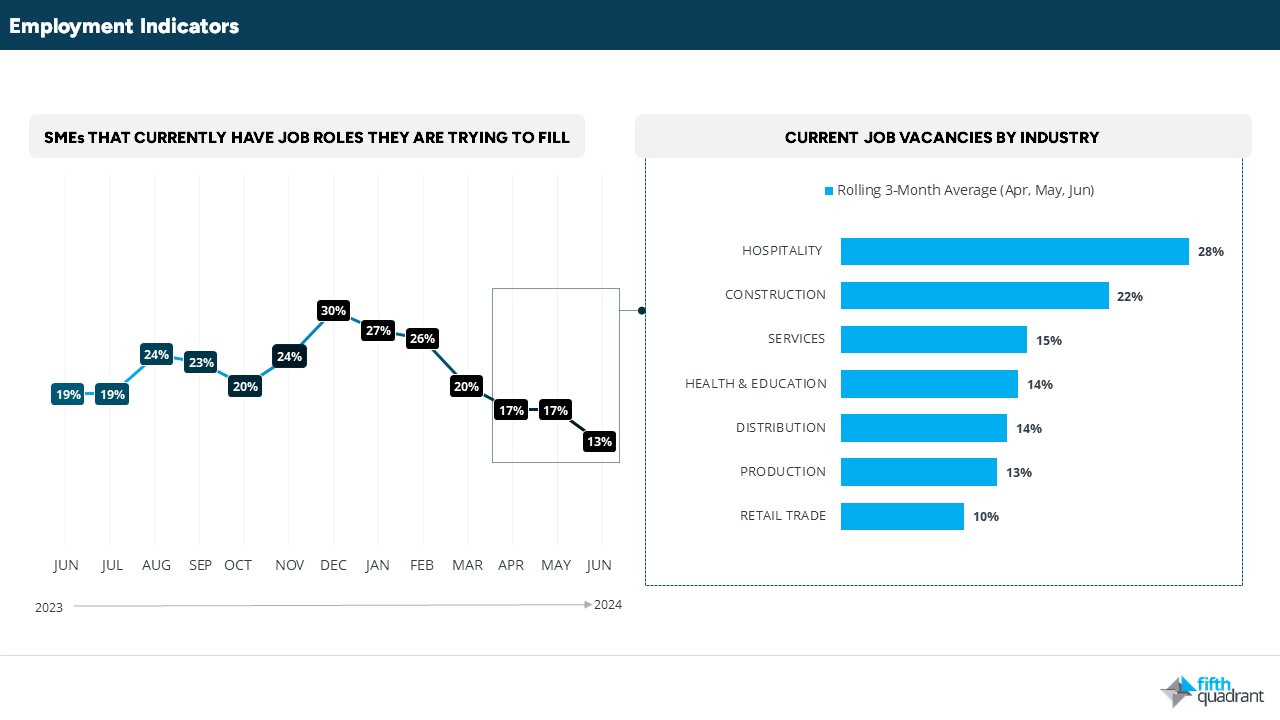

people

Employment data continues to nosedive with only 13% of SMEs actively trying to fill job roles, the lowest level seen over the past year. With weak conditions and the increase in the minimum wage on July 1, only 10% now expect to increase staff numbers over the next 3 months.

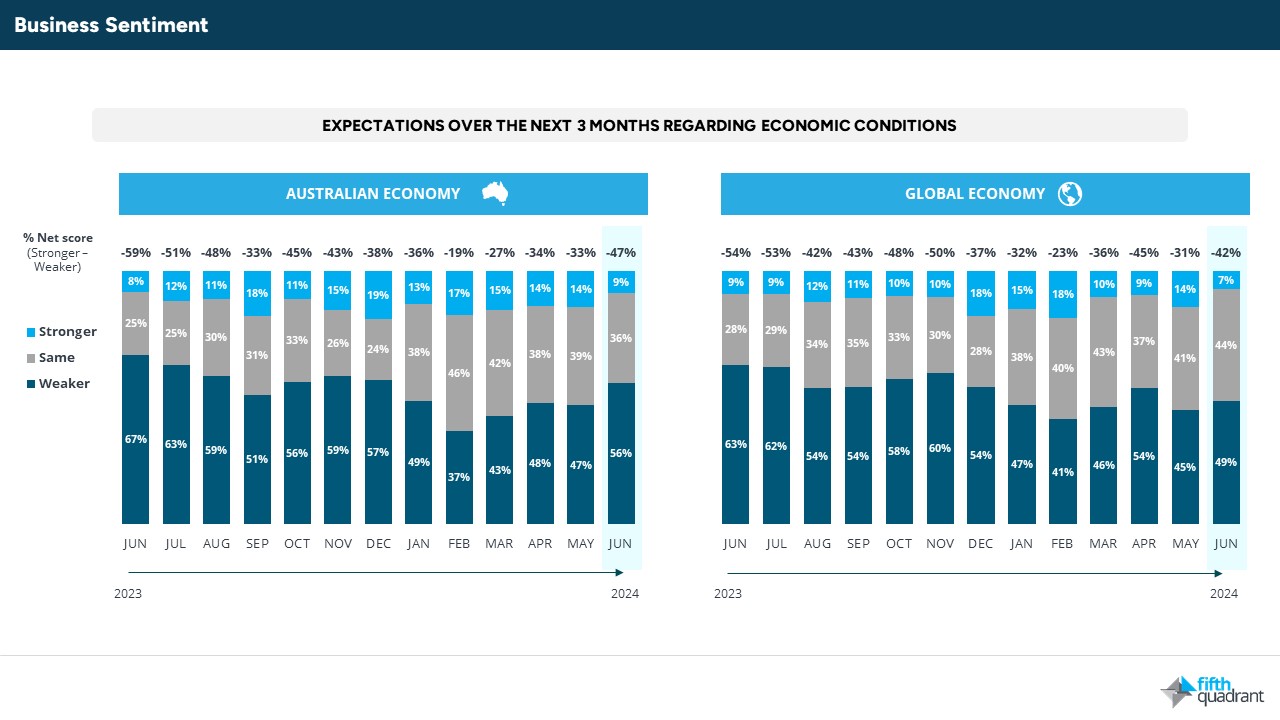

economic sentiment

Moving forward the outlook remains negative, as sentiment regarding economic conditions globally and in Australia continue to slide as sticky inflation and geo-political issues persist. 56% of respondents expect conditions in Australia to worsen and 49% are expecting a decline globally. Accordingly, expectations regarding short term revenue growth continue to drop sharply with only 21% expecting an increase over the next 4 weeks, compared to 35% in February.

In summary, revenue and sentiment continue the ongoing decline that commenced in early 2024. Accordingly, many SMEs are facing significant challenges, that not only impact their financial wellbeing but also their health and personal relationships. As reported last month recruitment data is at the lowest levels recorded over the past 12 months and hence, we continue to expect unemployment to rise soon.

Please click on this link to access the full report including subgroup analysis by industry sector, size of business and State. Fifth Quadrant and Ovation Research publish monthly updates of this research here. For any questions or inquiries, feel free to contact us here.

Posted in Financial Services, B2B, QN, TL