Author: James Organ | Posted On: 09 Oct 2024

Updates to this research are published monthly. View previous wave.

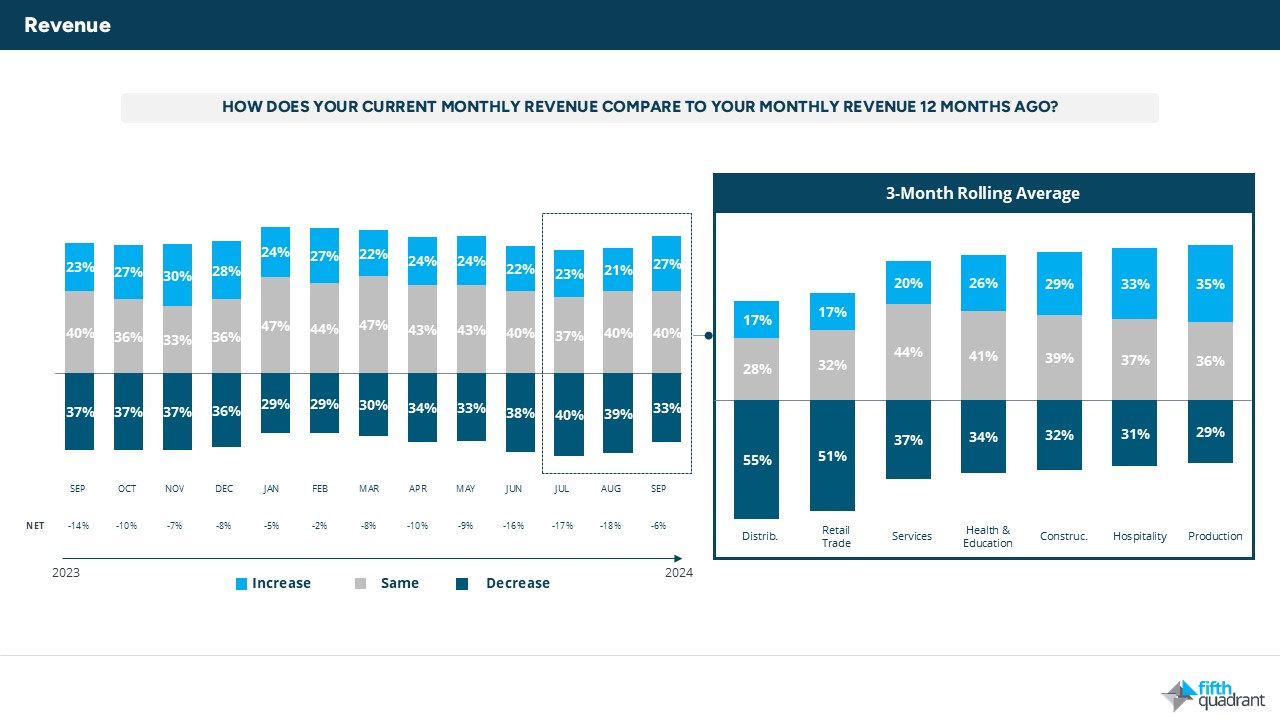

After reaching significant lows in August, the latest Fifth Quadrant data indicates an improving outlook for SMEs, with 27% experiencing higher revenue compared to 12 months ago, marking the highest level since February. Short-term revenue expectations have also improved, with only 12% expecting declines in the next four weeks, down from 22% in June. Furthermore, growth expectations for the next 12 months have rebounded, with 35% of SMEs focused on expansion, compared to 32% over the past two months.

recruitment

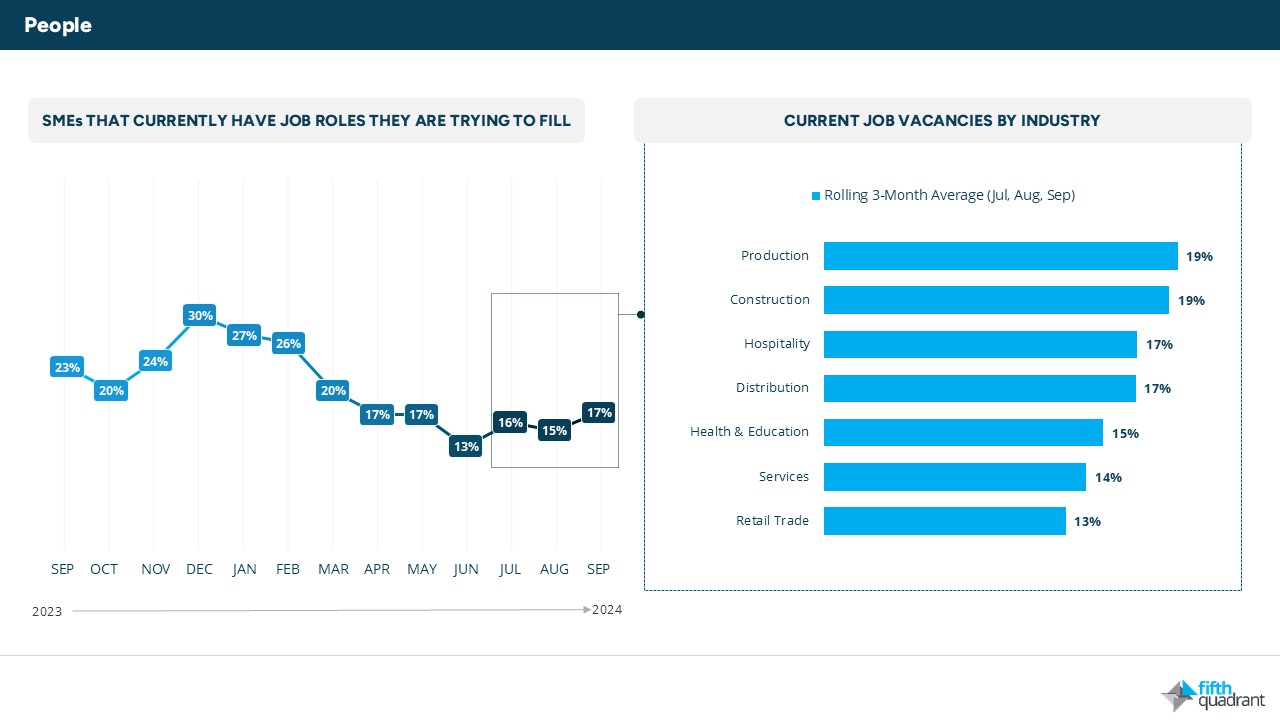

Recruitment activity has also ticked up, with 17% of SMEs hiring for new or existing roles, up from 13% in June. However, competition for talent has intensified, with a shortage of candidates and rising wage demands increasing. Moreover, the retail sector remains particularly weak.

business investment

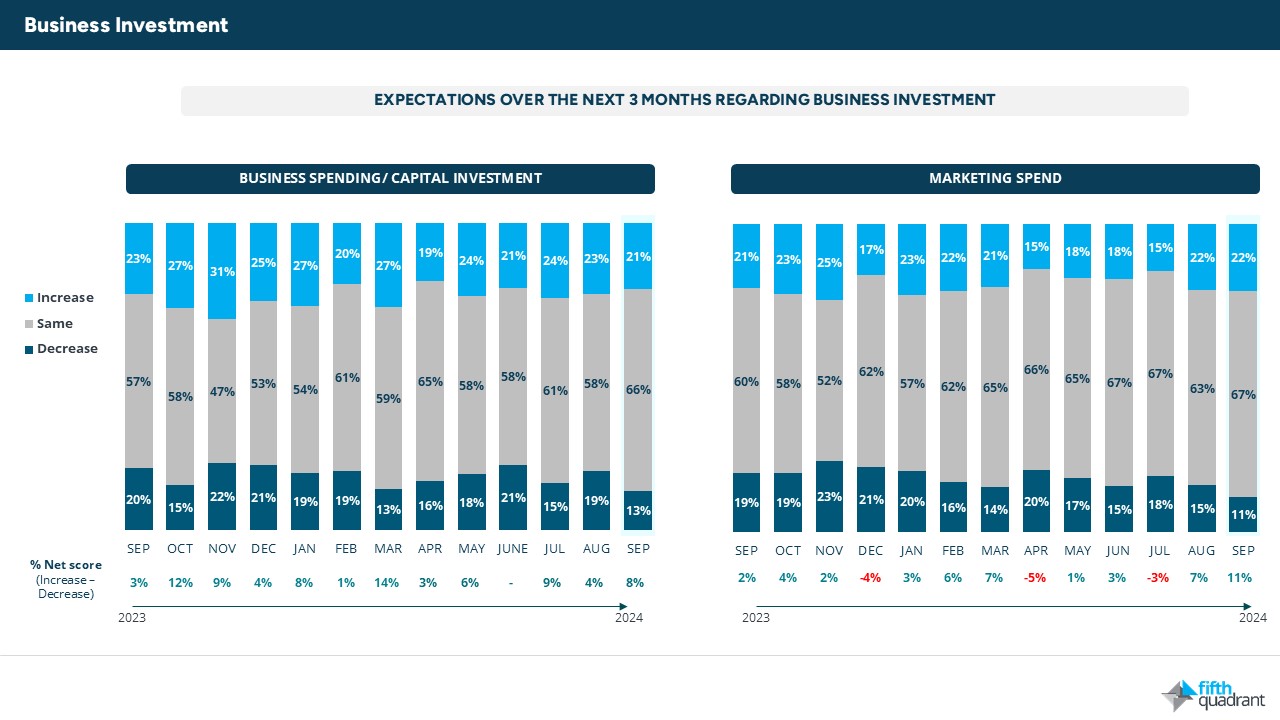

In terms of business investment, SMEs are maintaining a cautious stance, but marketing spend is trending upwards. Capital investment remains flat, underlining a focus on cost control, though there has been some uplift in spending on technology and machinery.

additional finance

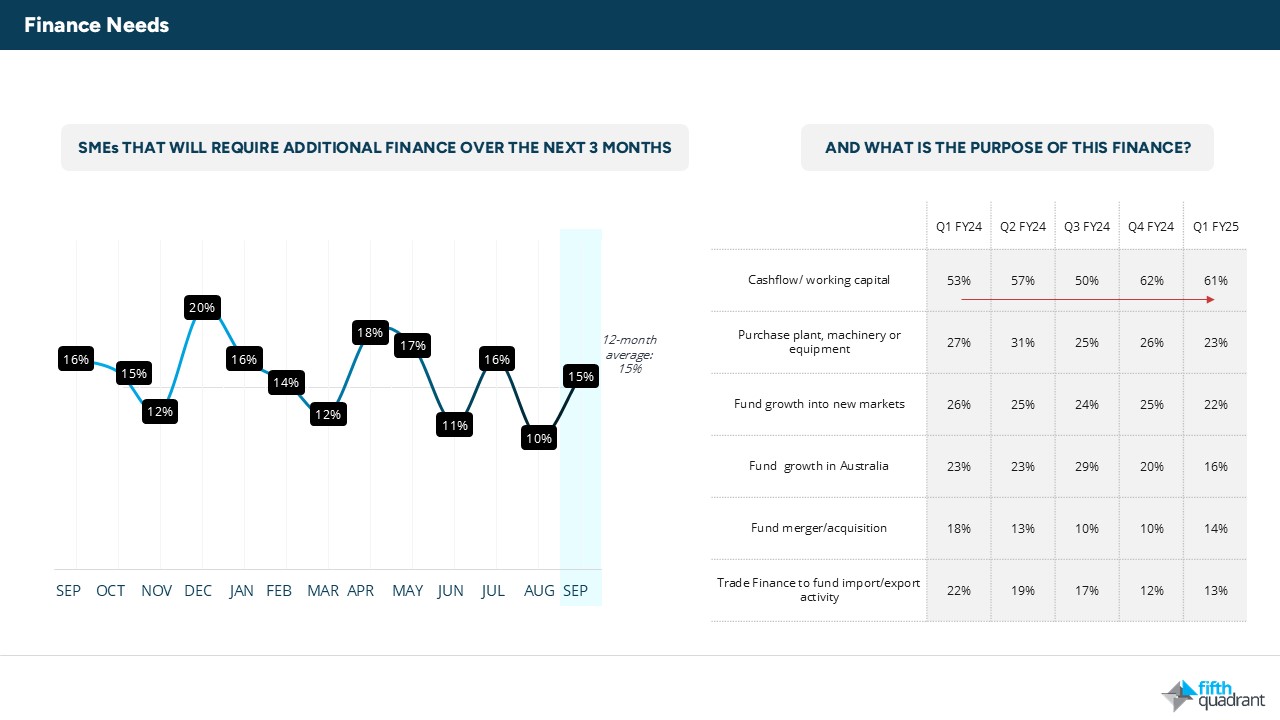

The demand for working capital continues to rise, though the appetite for additional finance fluctuates. Additionally, satisfaction with the Federal Government has held steady despite ongoing challenges such as geopolitical tensions, business costs, and the absence of interest rate reductions.

Despite challenging economic conditions, SMEs have bounced back from recent lows. Inflation has dropped, leading to more positive expectations regarding interest rates, which is likely contributing to increased business activity. This is reflected in higher revenue and growth expectations. Overall, the economic outlook appears to be improving and hence businesses are more optimistic.

Please click on this link to access the full report including subgroup analysis by industry sector, size of business and state. Fifth Quadrant and Ovation Research publish monthly updates of this research here. For any questions or inquiries, feel free to contact us here.

SMEs remain resilient

Posted in Uncategorized