Author: James Organ | Posted On: 10 Mar 2025

Updates to this research are published monthly. View previous wave.

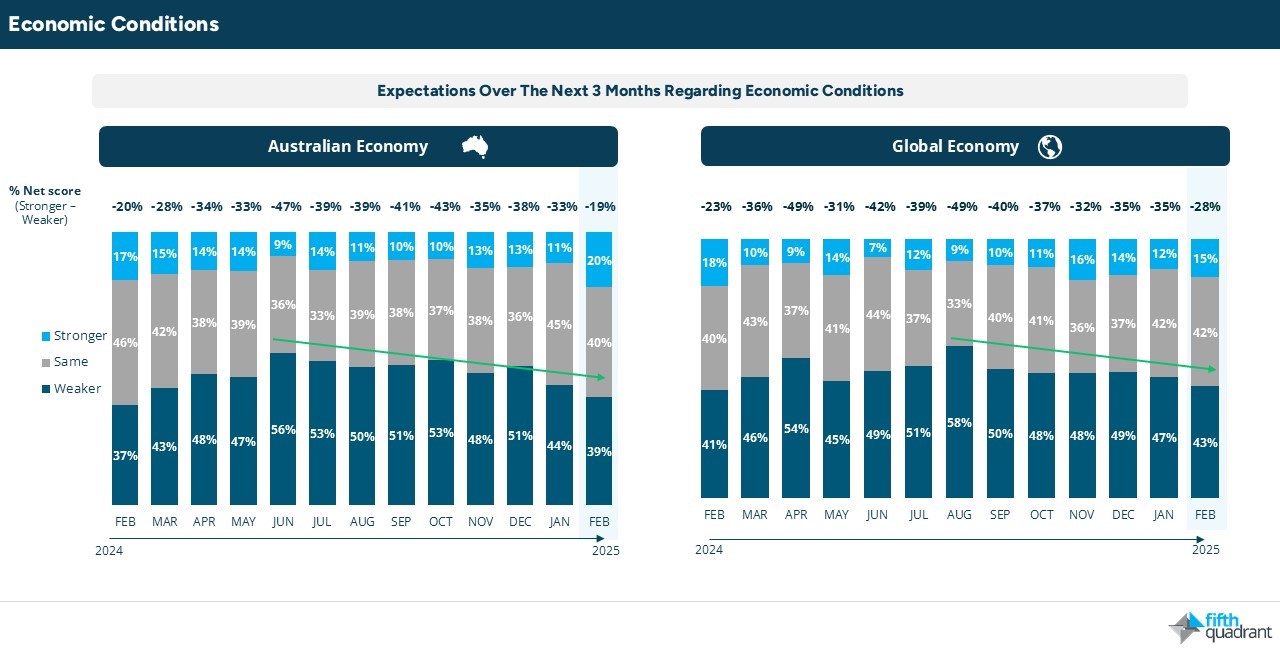

Despite a slowdown in revenue and profitability in February, SME confidence in Australian economic conditions has surged, driven by falling interest rates. Accordingly, 38% of SMEs are expecting growth over the next 12 months.

Short-Term Revenue and Investment

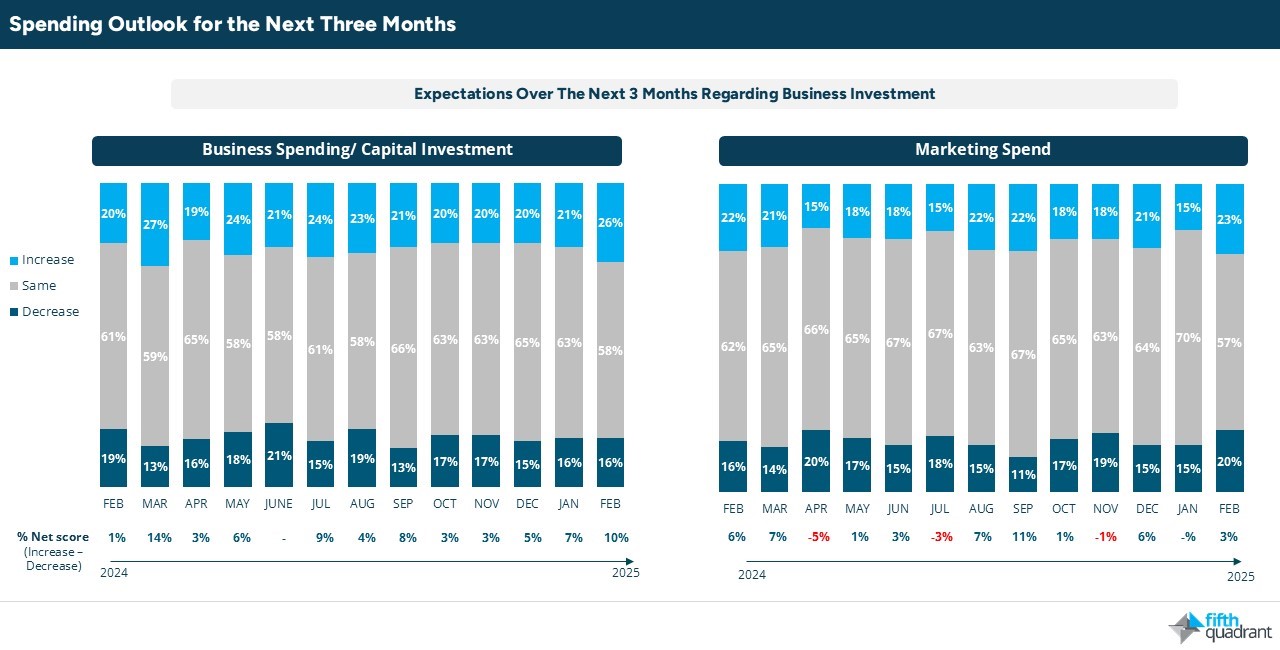

Short-term revenue expectations are also improving, with nearly one-third of SMEs anticipating month-on-month growth. Capital investment and marketing spend is also set to rise over the next three months.

Hiring Intentions

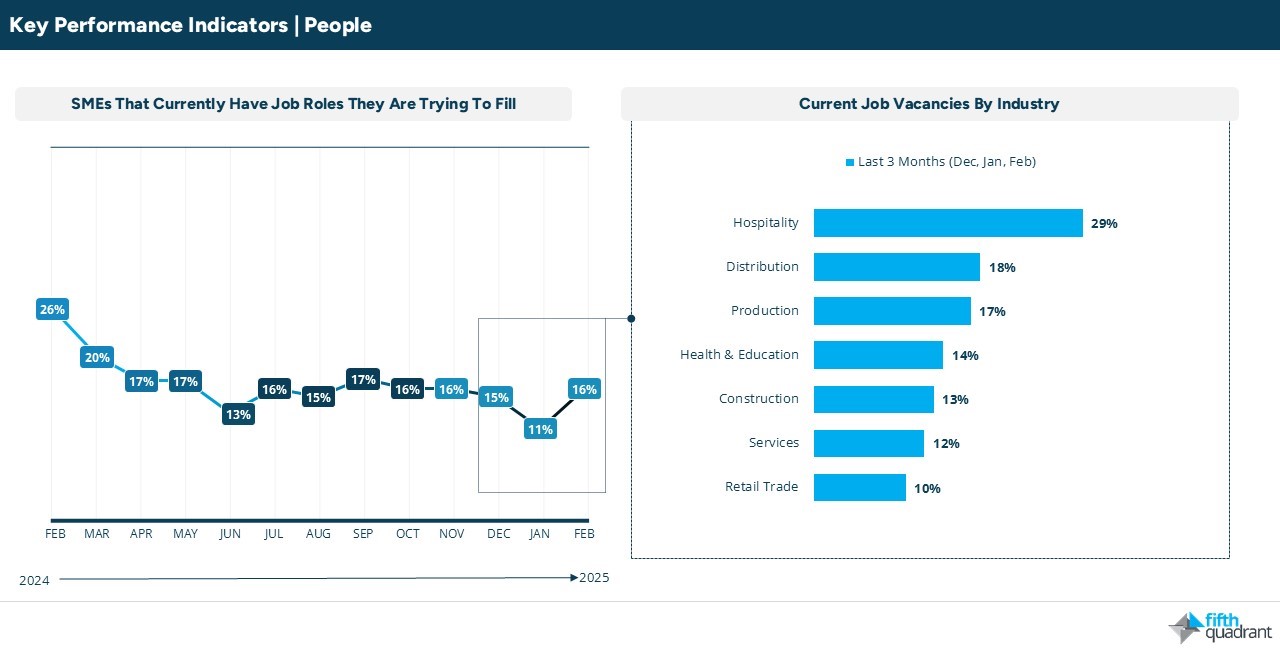

Despite this positive outlook hiring intentions remain weak, with only 12% of SMEs planning to increase staff in the next quarter—down from 17% last year and 15% in December. While recruitment has picked up slightly to 16% after a quiet January, this is largely due to seasonal hiring in the Hospitality sector.

Political Outlook

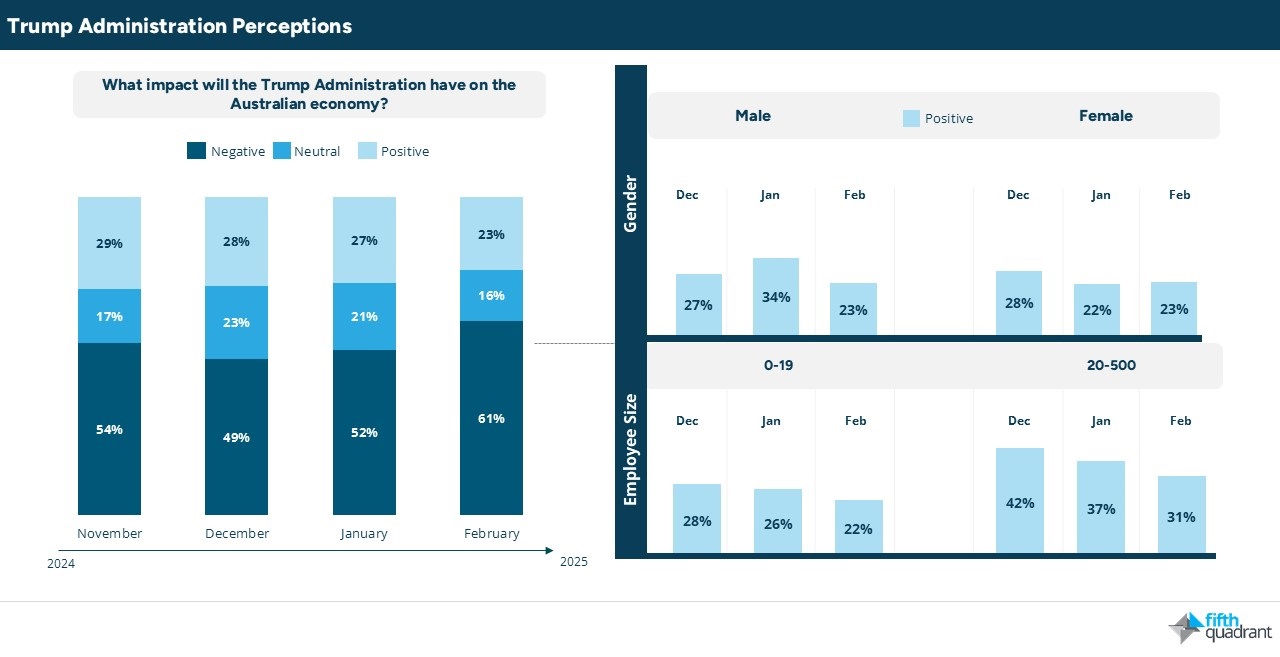

Looking ahead, the political landscape in both Australia and the US is likely to weigh on SME confidence. With the Australian election approaching, satisfaction with the Federal Government has dropped to 28%. Meanwhile, concerns over the Trump Administration’s trade policies and unpredictable approach to global relations are growing. This month, 61% of SMEs believe Trump will have a negative impact on the Australian economy, a sharp increase from 49% in December before his inauguration.

Conclusion

While falling interest rates have strengthened SME confidence and growth expectations, hiring intentions remain subdued, reflecting ongoing caution in the labour market. Despite an improving revenue outlook and increased investment plans, political uncertainty – both domestically and internationally, poses a risk to business confidence in the months ahead.

Please click on this link to access the full report including subgroup analysis by industry sector, size of business and state. Fifth Quadrant and Ovation Research publish monthly updates of this research here. For any questions or inquiries, feel free to contact us here.

SMEs remain resilient

Posted in Uncategorized, B2B, Consumer & Retail, Financial Services