Author: Ben Selwyn | Posted On: 16 Oct 2024

As we close out the third quarter of 2024, the Australian new vehicle market has posted another 10% year-on-year decline, continuing the downward trend seen over recent months. Despite the drop, when sales from electric vehicle (EV) manufacturers such as Tesla and Polestar are included, the final tally for the month reached 99,881 units. This brings the year-to-date total to 935,946 vehicles, keeping the industry on track to break the 1.2 million sales mark for the second consecutive year.

It’s not all smooth sailing, however. Discounting is becoming more common across a range of OEMs, raising concerns that the market might limp rather than sprint toward the 1.2m threshold. As brands work to clear surplus stock and manage shifting consumer preferences—especially toward hybrids and affordable models—there’s a growing sense that the momentum seen earlier in the year won’t carry into the final quarter.

key insights from July’s auto market:

- RAV4 reigns supreme: The Japanese market leader’s top-selling model captured more than 5,000 sales for the month, more than all but five other brands recorded across their entire range. At this rate, it’s well on track to exceed 50,000 sales for the year (currently 43,232)

- Ford riding high: Despite not being able to capture top spot, the blue oval brand again performed strongly, with the second placed Ranger (4,485 sales) and fourth placed Everest (2,902 sales), giving it two of the top five models as it ticked up 8,303 sales for the month.

- BYD has a hit on its hands: The first plug-in hybrid model from BYD is building a strong position, with the Sealion 6 again capturing more than 1,000 sales for the month (1,111) to sit just outside the top 20 models

a slowing shift to zlev

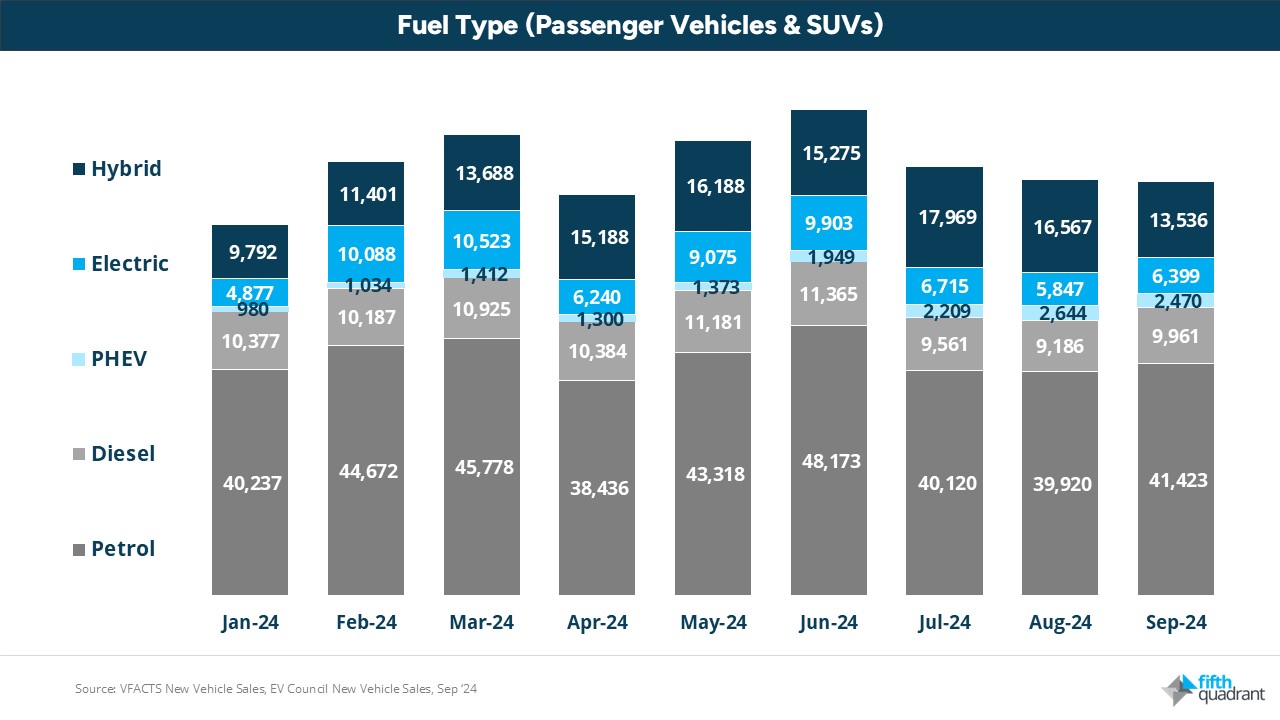

While we know that EV sales growth has slowed, the data still clearly shows a continuing shift toward hybrid and battery electric vehicles (BEVs). Hybrids are the primary driver of this trend, consistently outselling their other zero- and low-emission vehicle (ZLEV) counterparts by more than double. In fact, hybrid sales peaked in July at nearly 18,000 units, while BEVs trailed, maintaining around 6,000 units by September.

Interestingly, plug-in hybrids (PHEVs) are slowly gaining traction as a legitimate alternative, achieving approximately 2,500 sales in both August and September. This indicates that the growing range of options available in this space are doing a better job of capturing consumer interest.

While petrol and diesel vehicles continue to dominate the market, they are gradually declining. While this shift has previously been evident for petrol models, the rise of hybrids is now also driving cannibalisation of diesel sales, particularly in the SUV segment.

going deeper – tesla vs. the market

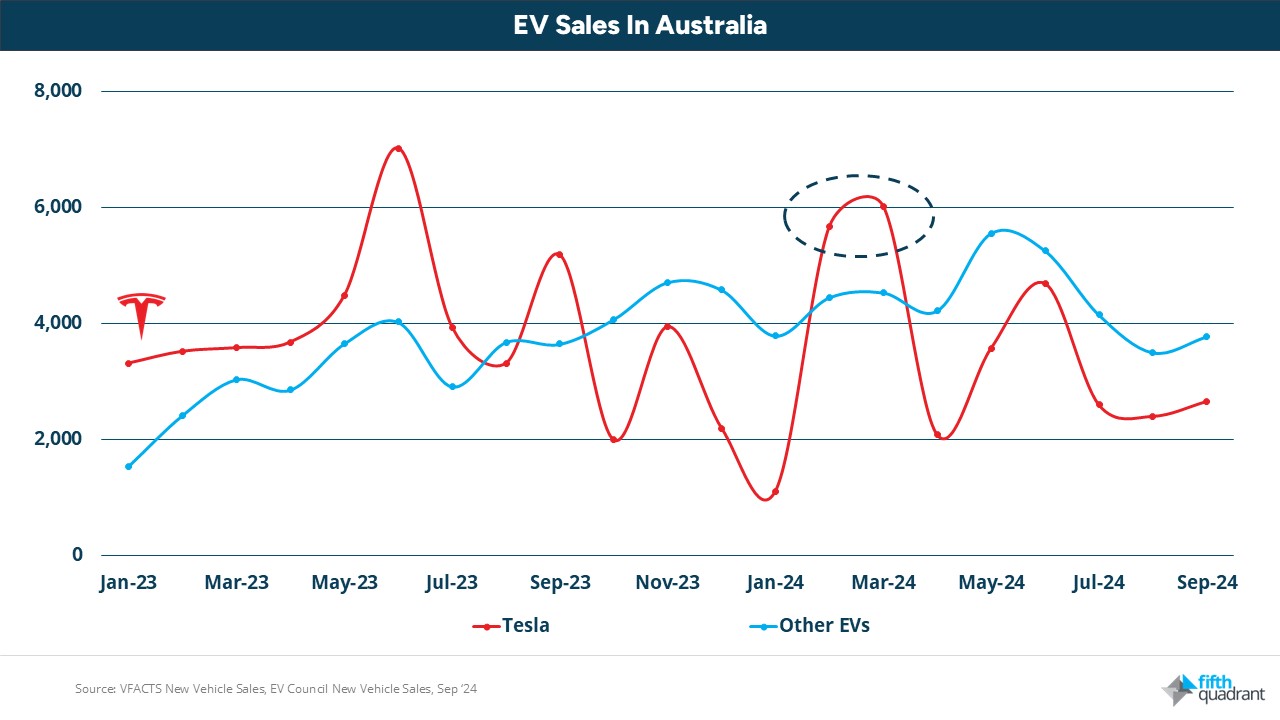

Digging deeper into EV sales in Australia, we can however see that the overall decline isn’t as clear cut as we might think. As can be seen below, there is a clear disconnect between Tesla (red line) and other EV manufacturers (blue line).

In 2023, Tesla comfortably outperformed the market, selling more vehicles than all other brands combined in eight out of 12 months. The trend has shifted though in 2024, with Tesla struggling for consistency. Despite recording strong results in February and March, Tesla witnessed a sharp decline over the following months. In contrast, other EV brands have shown more stability, maintaining sales of around 3,000 to 5,000 units over the same period.

The steady performance of these other EV brands indicates growing consumer confidence in alternative manufacturers as the market diversifies. Overall, the data reflects a maturing Australian EV market, with Tesla’s former dominance being tested by increased competition and shifting consumer preferences.

looking ahead

With economic uncertainties still in play, the true test for the industry will come in the final months of the year. Whether consumer demand can hold up or whether deeper discounts will be needed to push sales across the finish line remains to be seen.

Want more of this content? Sign up for our newsletter here to ensure you stay up to date with our monthly updates.

Also remember that our b2b and consumer tracking research runs monthly, click here for more information. Keep an eye out for our upcoming vehicle reliability reporting. Feel free to get in touch if you’ve got questions you’d like to ask.

VFACTS

Posted in Auto & Mobility, B2B, QN, TL, Transport & Industrial, Uncategorized