Author: Jessica Phan | Posted On: 13 Nov 2024

October 2024 VFACTs saw steady performance in Australia’s new vehicle market, closing the month with 99,969 units sold – nearly matching September’s 99,881 units. This stability is noteworthy, as October sales typically dip below September’s numbers. However, when measured month-on-month, sales are still down by 6.4% from October 2023, continuing the trend seen in recent months.

Despite this, the market remains 1.9% higher year-to-date (YTD), with sales inching past one million units by the end of October. This keeps the industry on track to again hit 1.2 million sales by year-end. The slowing pace is however putting more pressure on OEMs and dealerships to actively drive volumes, with increasing sales and discounting activity reflecting this.

key insights from october’s auto market

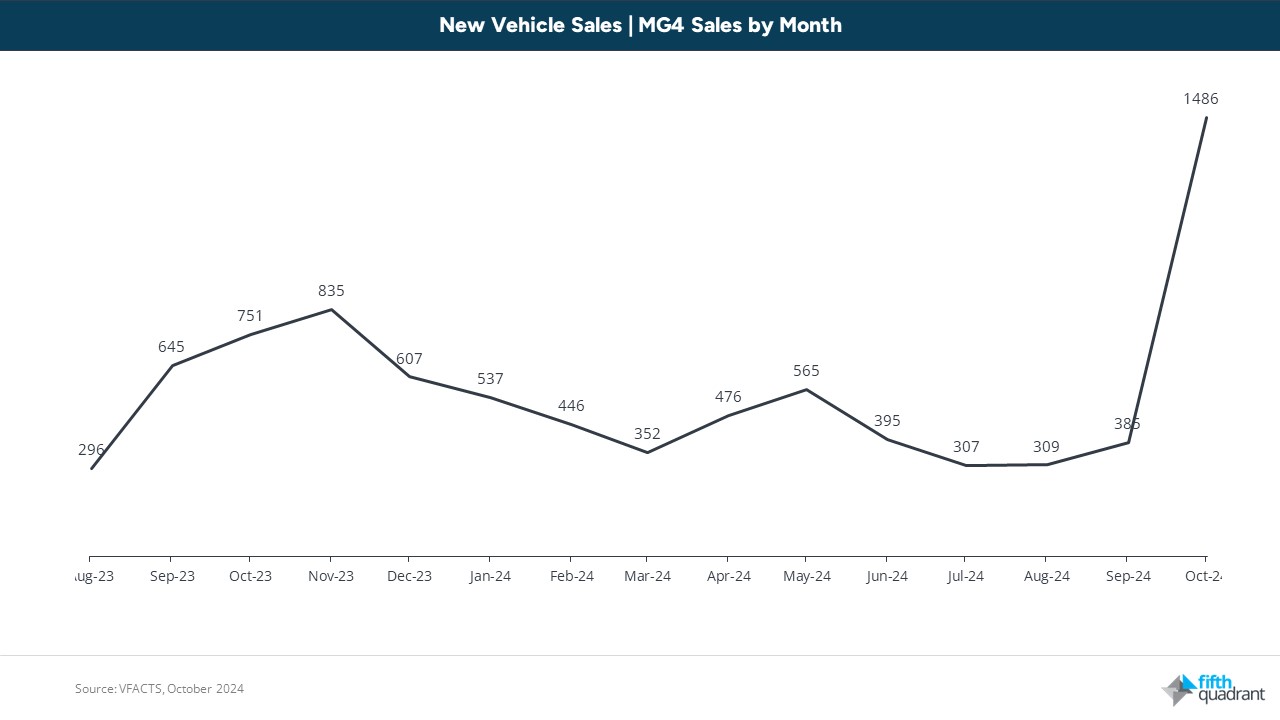

- The MG4 climbed the ranks in October, moving 1,486 units — a massive 286% jump from September, boosted by hefty factory discounts.

- While EV sales rose 6% YTD compared to 2023, Tesla’s sales continued their downward trend for the seventh consecutive month, signalling a shakeup in the Australian EV market.

- Mazda’s October sales fell nearly 20% year-on-year, with 7,656 units sold compared to 9,316 in October 2023, marking another monthly decline.

- Hyundai recorded a strong month, with sales soaring from 5,638 units in September to 7,090 in October, thanks to rising demand for the Kona and the refreshed i30.

- Chery saw impressive growth, achieving a 106.6% increase year-over-year and 110.5% month-on-month, largely due to the launch the new Tiggo 4 Pro model.

A New Era of Competition in the Medium SUV Market

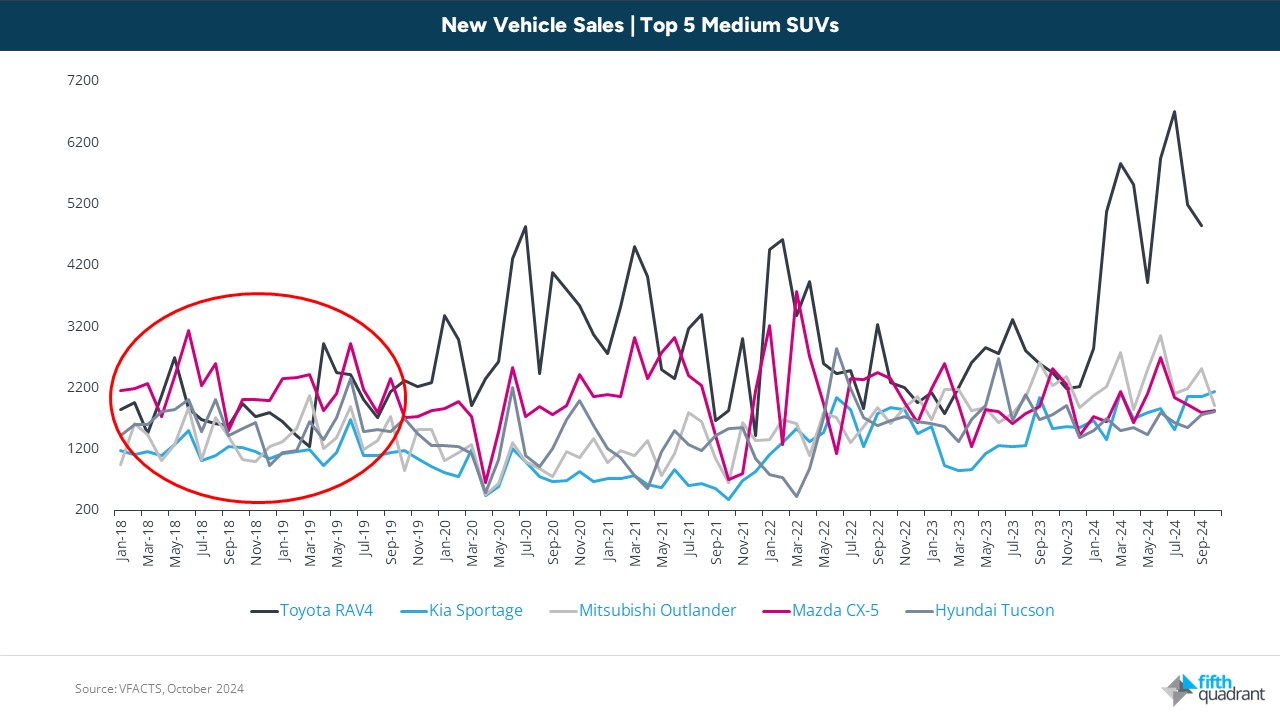

Medium SUVs have captured Australian drivers’ attention, becoming the most popular sub-segment in the market. Of the top 10 models sold in the country, half fall within this category, highlighting strong consumer demand for versatile, family-friendly vehicles. Leading the way (and well ahead of the trailing pack as the best-selling car in Australia) is the Toyota RAV4, with its reputation for quality, dependability, and value. This is a significant a shift from previous years, when the medium SUV landscape was more competitive, with a range of models vying for market share (as seen in the red circle).

The Mazda CX-5, once a top choice, has lost momentum in recent years, with its sales declining as competitors like the Hyundai Tucson and Kia Sportage gained traction. Although CX-5 sales are holding steady (19,510 units by October 2024, vs 19,404 by October 2023), it is well behind 2022, where it was over 23,000 total sales by this point in the year. Looking at its competitors, the Kia Sportage (2,136 units) has beaten the Mazda CX-5 (1799 units) for the third month in a row, with its massive 44% YoY increase setting it up to outperform its 2022 result.

Changing low-emissions vehicle landscape

Electric vehicles have experienced significant growth in Australia in recent years, from 5,149 units sold in 2021 to 33,410 in 2022, and a record 87,217 in 2023. While we’ve again seen further growth in 2024, there’s no question that this is slowing, with YTD sales of 76,376 up just 6.4% on last year.

Alongside this, the rise of hybrids highlights that the initial excitement around EVs has slightly plateaued, with this alternate technology gaining popularity among consumers who are not yet ready to embrace fully electric vehicles. While Australia recorded 98,437 sales through the whole of 2023, YTD sales are already at 145,681 units, a 48% increase with two months still left to go.

This doesn’t however mean the end for EVs. In October, MG slashed prices on its MG4, offering the base model for just $30,990 drive-away, and significantly discounting other grades. The result was a 286% surge in sales, from 385 units in September to 1,486 units in October. This significant jump emphasises the importance of price as a motivator of consumer interest, and should be carefully monitored by new entrants working out their pricing and broader go-to-market strategies.

Looking Forward

As we approach the final months of 2024, there is still a clear path to again reaching 1.2 million annual sales, though this does come with challenges. While steady demand in key segments is encouraging, dealerships will need to ramp up incentives to sustain momentum. This leaves November and December as a test how well the market can navigate shifting consumer preferences and economic pressures ahead of further significant changes in 2025 (e.g. likely interest rate cuts, new make/model launches, NVES regime implementation, etc.).

Want more of this content? Sign up for our newsletter here to ensure you stay up to date with our monthly updates.

Also remember that our b2b and consumer tracking research runs monthly, click here for more information. Keep an eye out for our upcoming vehicle reliability reporting. Feel free to get in touch if you’ve got questions you’d like to ask.

Posted in Auto & Mobility, QN, Uncategorized