Author: Madelyn Stafford | Posted On: 16 Dec 2024

The Australian automotive market in November 2024 showcased a mix of challenges and opportunities as the industry nears its projected annual sales target of 1.2 million units. Current estimates place year-end sales between 1.23 and 1.24 million vehicles, reflecting resilience in the face of economic pressures and shifting consumer preferences.

key insights from november’s auto market

- Emerging Brand Success: Chery achieved an impressive 108% year-on-year growth, driven by the Tiggo 7 Pro and Omoda 5. Upcoming launches of the Tiggo 9 and Tiggo 9 PHEV signal continued momentum in 2025.

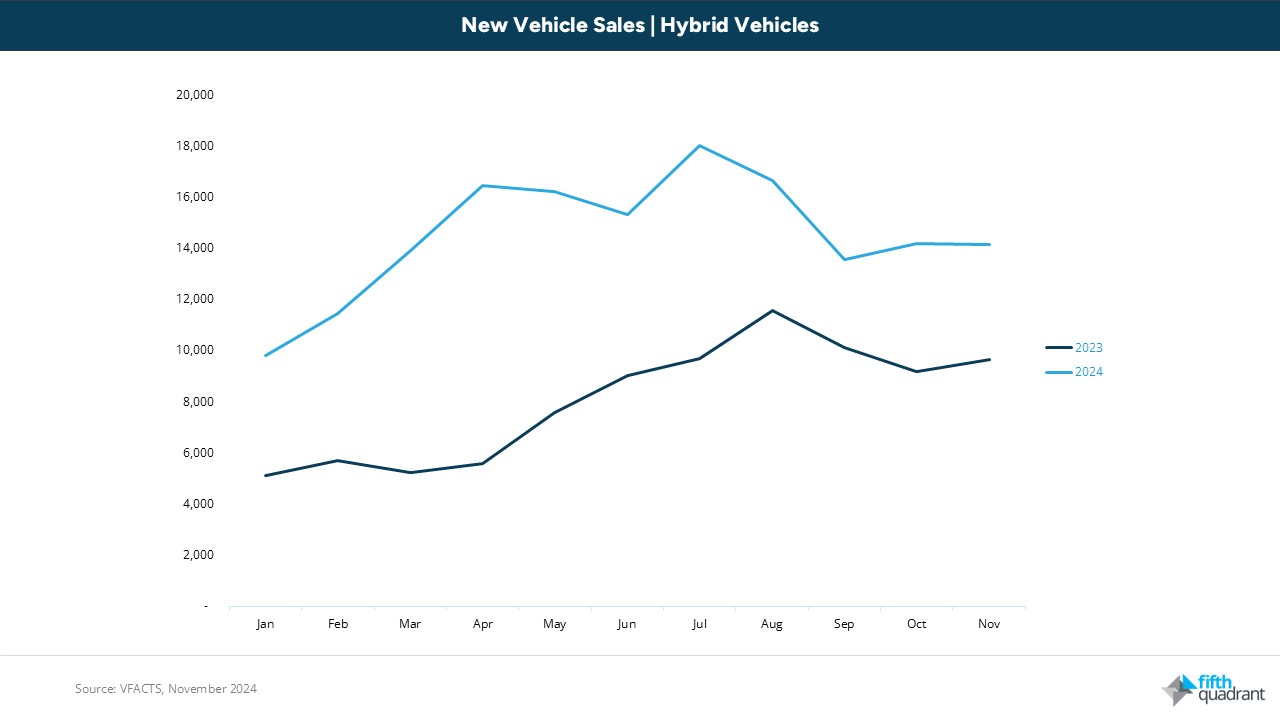

- Hybrid Surge: Hybrid vehicle sales surged 79% year-on-year, with plug-in hybrids showing 100% growth. SUVs led this trend, achieving significant increases in both hybrid (91%) and plug-in hybrid (103%) categories.

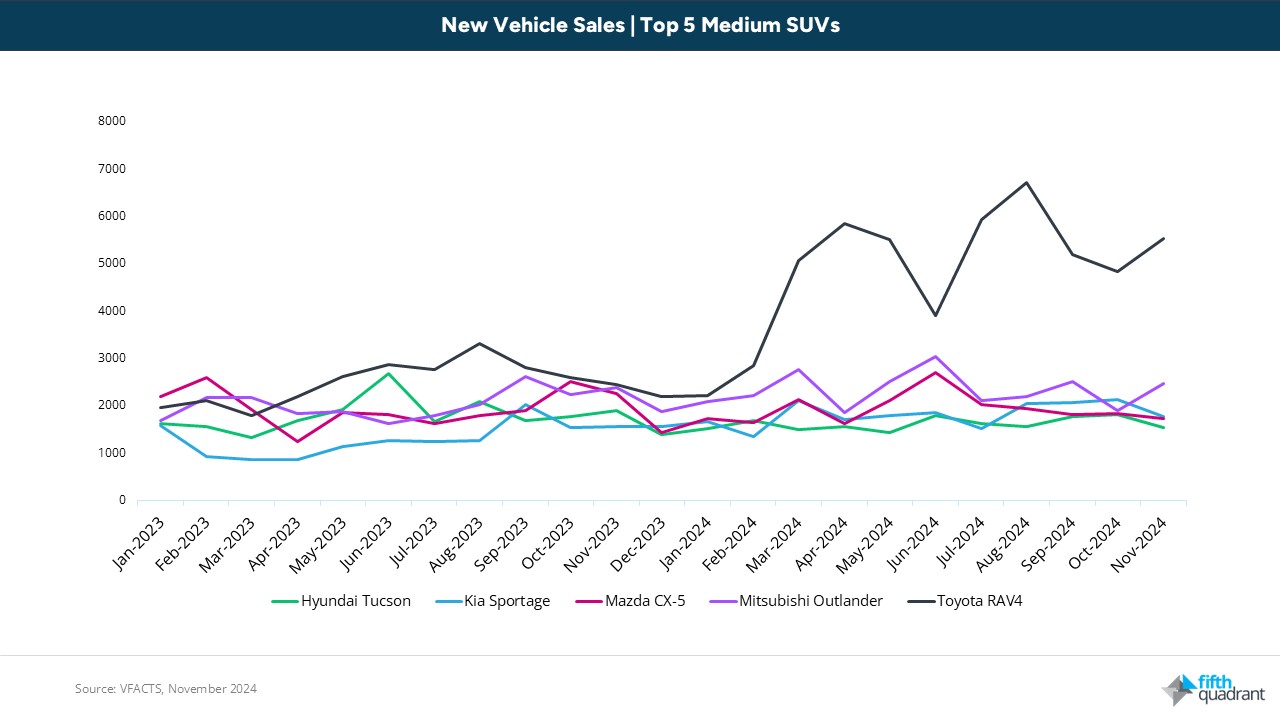

- Segment Leadership: SUVs remained dominant, particularly medium SUVs, with the Toyota RAV4 standing out as Australia’s best-selling SUV, boasting a 95% year-on-year sales increase (following supply issues in 2023).

- Mixed Brand Performances: While Ford excelled with an 18% year-on-year growth based on strong Ranger and Everest sales, established brands like Volkswagen, MG, and Mazda faced declines, reflecting the competitive pressures in the market.

- Market Resilience and Growth: The Australian automotive market is on track to set a new record as it against exceeds 1.2 million units; current projections suggest a final result of 1.23 – 1.24 million.

Brand Performance

Emerging brands continue to disrupt the market, with Chery achieving a remarkable 108% year-on-year growth. The Tiggo 7 Pro led the charge for newly released models, recording 2,546 sales this year. Chery’s Omoda 5 (released in March 2023) also contributed to its success, delivering 5,571 units and posting a 15% year-on-year growth. Chery’s release of the Tiggo 9 and Tiggo 9 PHEV next year could further solidify their growth and position in the Australian market for 2025.BYD strengthened its position in the electric vehicle segment, with a 68% year-on-year and 24% increase compared to November 2023.

There are established brands among the success stories too, as Ford continued to excel, with the Everest SUV seeing a 77% year-on-year increase, 97% increase to November 2023, and 24,018 sales this year. The Ranger also contributed Ford’s success, achieving a 5% year-on-year sales growth and 58,100 year-to-date sales. Suzuki also performed well, with sales up 26% year-on-year and a 59% increase between November of 2023 and this year. This was driven by the Vitara (2,726 sales, up 57% year-on-year) and the Jimny (9,096 sales, up 95% year-on-year).

Some established players did however faced challenges. Volkswagen recorded a 16% year-on-year decline, while MG experienced a 15% year-on-year drop, with declining sales of models such as the MG3 (11,135 sales, down 24% year-on-year) and the ZS (21,462 sales, down 23% year-on-year). Mazda also reported a 5% year-on-year sales drop, reflecting the difficulties faced by traditional brands in a competitive market.

Segment Trends

The SUV segment maintained its dominance, with medium SUVs leading the way and recording 263,360 sales this year so far (23% share of total market). This further underscores consumer preferences for versatile and family-friendly vehicles. The Toyota RAV4 is at the top of the list for medium SUVs, cementing its position as Australia’s best-selling SUV for 2024 with a 95% year-on-year increase in sales.

Looking at passenger vehicles, we saw more mixed results but can still find some notable successes. The Kia Cerato emerged as a standout performer, recording an impressive 188% year-on-year growth with 14,807 sales to date in 2024, a significant increase from 5,150 year-to-date sales in November 2023. This highlights that while SUVs dominate, well-priced and reliable sedans still hold appeal to the right buyers.

Fuel-Types: Hybrids Lead the Way

Hybrid vehicles emerged as clear winners in November, with total sales rising 80% year-on-year and 47% compared to last November. Plug-in hybrids (PHEVs) also performed well, achieving 100% year-on-year growth, led by SUVs in this segment, which posted a 103% increase. SUVs also led with traditional hybrids, seeing a 91% year-on-year increase. This contrasts with electric vehicle (EV) sales, where brand performance varied. Chery and BYD both posted strong gains, while Tesla continued its downward trend, with sales dropping 36% compared to November last year and 21% overall for 2024.

Market Outlook

As the year draws to a close, the Australian automotive market is set to again exceed 1.2 million units. Ultimately projected to fall between approximately 1.23 and 1.24 million units sold for 2024, setting another annual record. It’s close at the top of the market too, with this year’s top-selling model looking like it will come down to either the Ford Ranger leading with 58,100 units sold and a 5% month-on-month increase for November, or the Toyota RAV4 with 53,599 models sold, which saw a stronger 14% month-on-month growth.

While economic pressures remain a challenge, November’s results demonstrate that dealers can deliver sales outcomes with the right incentives. This is likely to remain important into the start of 2025, as we wait to see whether there is any reduction in consumer cost-of-living pressures as we move into the new year.

Want more of this content? Sign up for our newsletter here to ensure you stay up to date with our monthly updates.

Also remember that our b2b and consumer tracking research runs monthly, click here for more information. Keep an eye out for our upcoming vehicle reliability reporting. Feel free to get in touch if you’ve got questions you’d like to ask.

Posted in Auto & Mobility, QN, Uncategorized