Author: Amelia McVeigh | Posted On: 14 Apr 2025

Updates to New Vehicle Sales are published monthly. View previous wave.

March brought some welcome momentum to the Australian new vehicle market, with new vehicle sales data (from the FCAI’s VFACTS report and EVC’s Vehicle Sales Report) recording 111,617 units sold. While the year-on-year increase was minimal, March 2025 still delivered the highest month in Q1 for the past decade.

Top 5 Takeaways

- SUVs dominate as passenger cars decline: The market continues to shift toward SUVs (179,296 units sold in Q1 2025), while passenger vehicle sales dropped 22% year-on-year (41,902 vs 53,739).

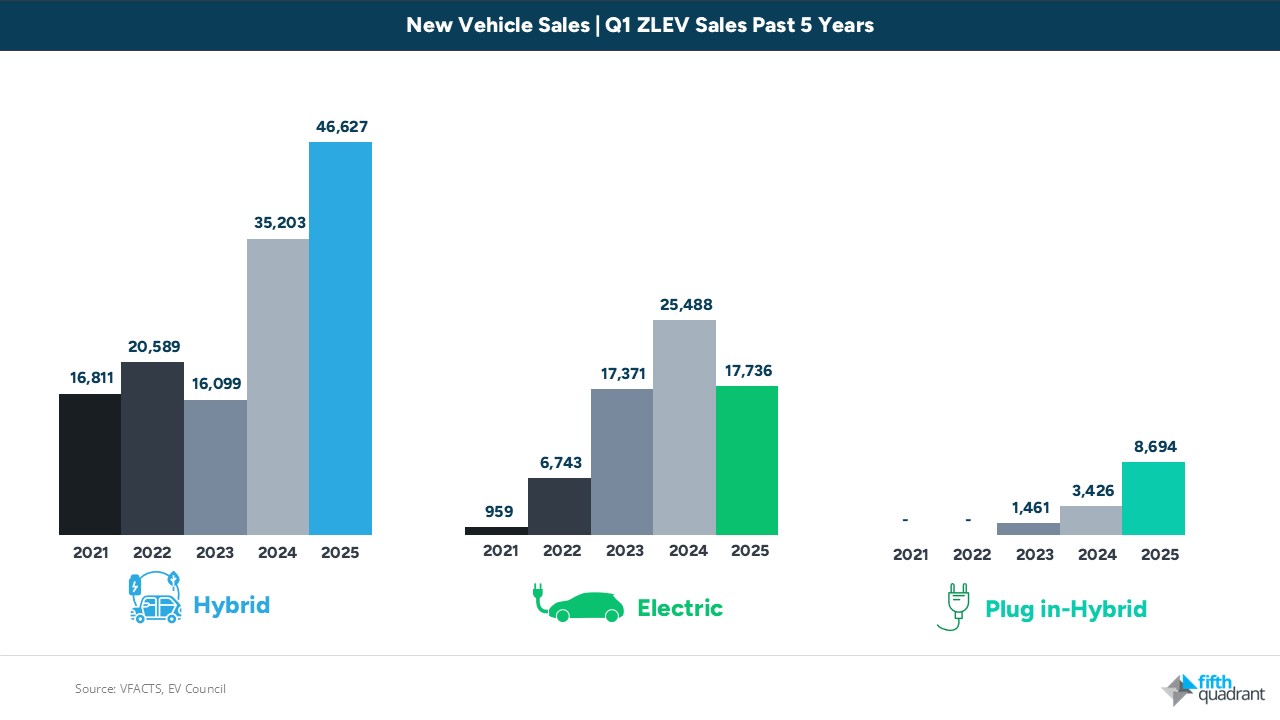

- PHEVs surge ahead of FBT exemption deadline: Plug-in hybrid sales more than doubled YoY (8,694 vs 3,426), as buyers moved to beat the end of FBT exemptions in April.

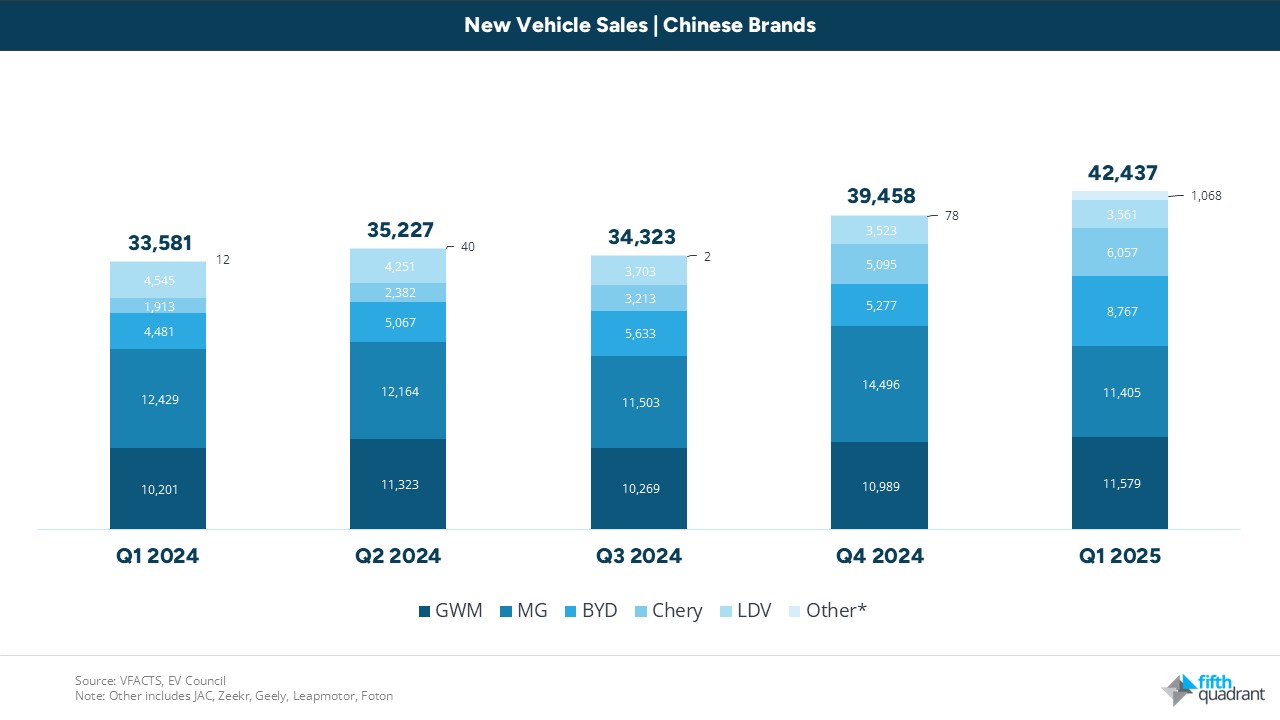

- Chinese brands strengthen their foothold: GWM, MG, BYD, Chery, and LDV now hold five of the top 20 positions, a clear sign of the changing face of the market.

- Battery giants battle for market share: Tesla remains on its downward trajectory, while BYD has now reached 7th place, up from 17th a year ago.

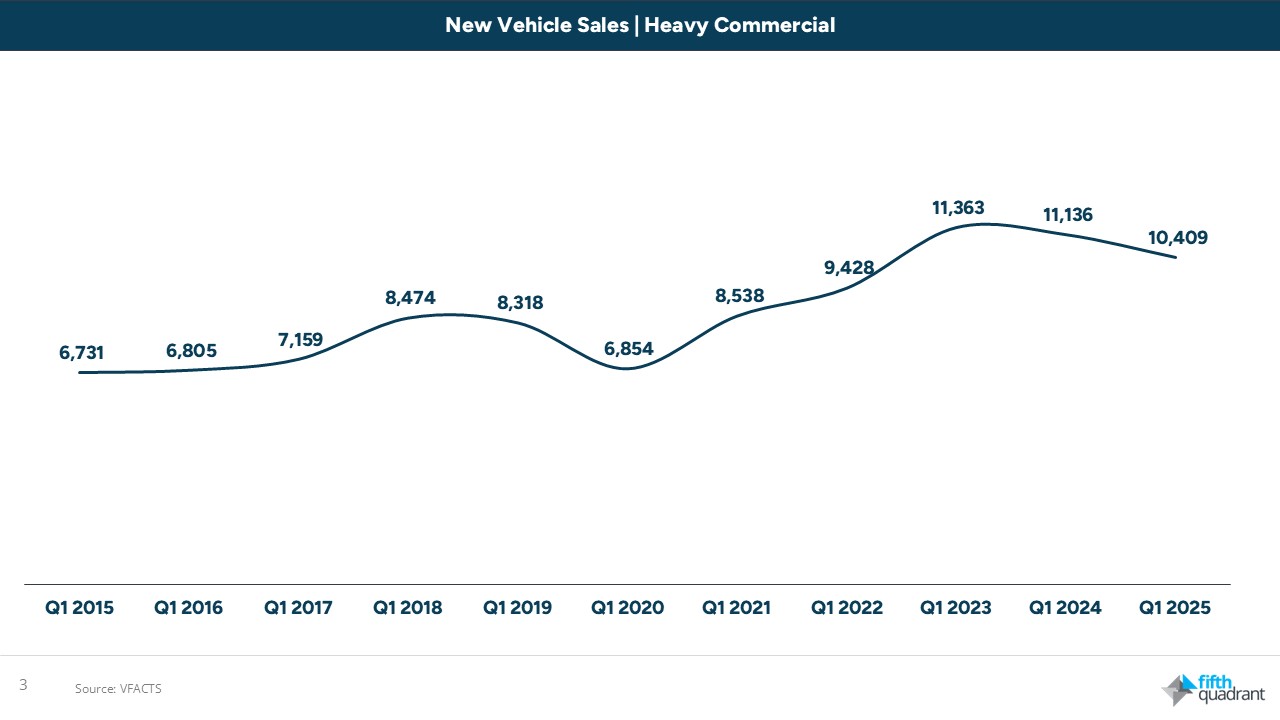

- Heavy commercial loses momentum: Q1 sales in heavy commercial vehicles dropped 6.5% YoY, although still the third strongest Q1 performance in a decade (10,409)

fuel watch: PHEVs keep climbing, hybrids hold steady and EVs lose momentum

While much of the spotlight has been on EVs, their growth has plateaued. In contrast, hybrids continue to deliver consistent, sustainable growth, rising 32% year-on-year in Q1. Meanwhile, PHEV sales have surged 154%, driven by buyers taking advantage of the final months of FBT exemptions. Although detailed model-level PHEV data is limited, we can see the impact of these incentives on sales across some key models. The Mitsubishi Outlander recorded its strongest quarterly result in over a decade, largely off the back of demand for its plug-in hybrid variant.

With the FBT incentive now concluded, the question remains: will the market shift back toward EVs, or could we see a renewed focus on ICE vehicles as affordability and flexibility take priority?

market movers: Chinese brands keep climbing

The rise of Chinese marques is no longer a trend, it’s a market shift. Five Chinese brands now sit inside the top 20, with Chinese brands selling 26% more vehicles in Q1 2025 than in the same period last year.

While continued demand for existing models like the GWM Haval H6 (+998 YTD) and GWM Haval Jolion (+700 YTD) has helped drive growth, the real momentum has come from new model launches:

- BYD’s Shark 6 has made a strong debut, with 4,836 units sold YTD, placing it 4th in the ute segment, ahead of the Mitsubishi Triton (4,597) and Mazda BT-50 (3,868).

- The Chery Tiggo 4 Pro is also performing well, with sales up 74% on the previous quarter (Q4 2024: 1,918 vs Q1 2025: 3,338).

- New entrants Geely, Zeekr and Xpeng are starting small, but could add to this trend in the coming months.

has the heavy vehicle boom hit the brakes?

Heavy commercial vehicle sales totalled 10,410 units in Q1 2025, down 6.5% compared to the same quarter last year. While the decline continues a softening trend from the strong start seen in 2023, Q1 2025 still ranks as the third-highest first quarter in the past decade.

The downturn hasn’t however been uniform across all brands. Fiat Professional more than doubled its Q1 sales (+226 units YoY), followed by solid growth from Ford (+146), Mercedes-Benz Vans (+68) and Kenworth (+66). The overall segment decline is largely driven by higher-volume brands that posted significant losses, including Volvo Commercial (-231), LDV (-202) and Hino (-182).

looking ahead

Following a slow start to 2025, the March result shows there’s still a level of demand in the Australian market, particularly in high-growth segments like hybrids and value-driven SUV brands.

With that said, interest rate pressures are still present, and policy changes are beginning to bite, meaning the second quarter will be critical in determining whether 2025 continues the post-COVID growth trend or settles into a flatter pattern. Much will depend on how consumers and businesses respond to tightening conditions, and whether emerging brands can maintain their momentum in a more challenging environment.

Looking for more auto insights? Click here to view of our automotive market research reports. Fifth Quadrant publish monthly new vehicle sales updates here. For any questions or inquiries, feel free to contact us here.

Posted in Auto & Mobility