Author: Ben Selwyn | Posted On: 21 Aug 2023

The latest report from our consumer tracking study focuses on the automotive sector, unpacking purchasing intentions, the vehicles Australians aspire to, and the key factors impacting these choices. In the context of growing electric vehicle sales, it also looks at consumer intentions around zero and low emission vehicles, providing some surprising insights into the groups in the community who are most (and least) likely to purchase an EV in the next 12 months.

top takeaways

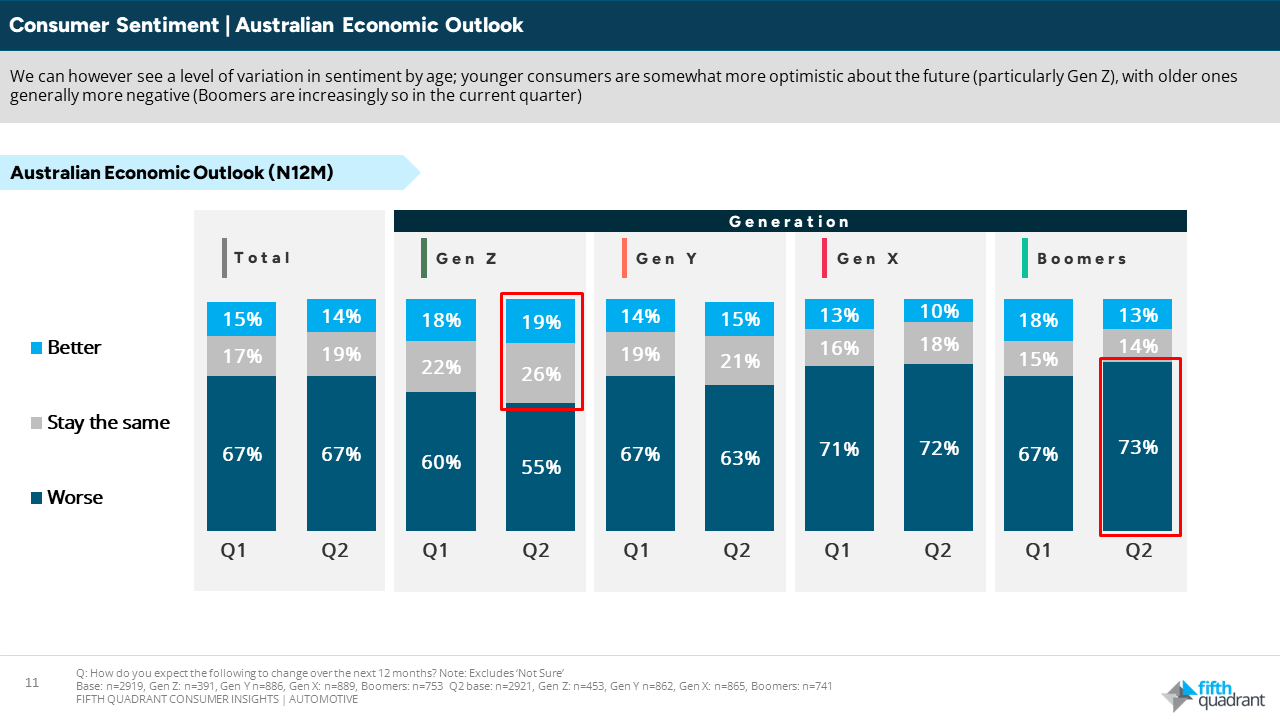

- Negative times ahead, with 71% expecting Australian economic conditions to worsen over the next 12 months

- Despite this, 22% still intend to purchase a vehicle in the year ahead

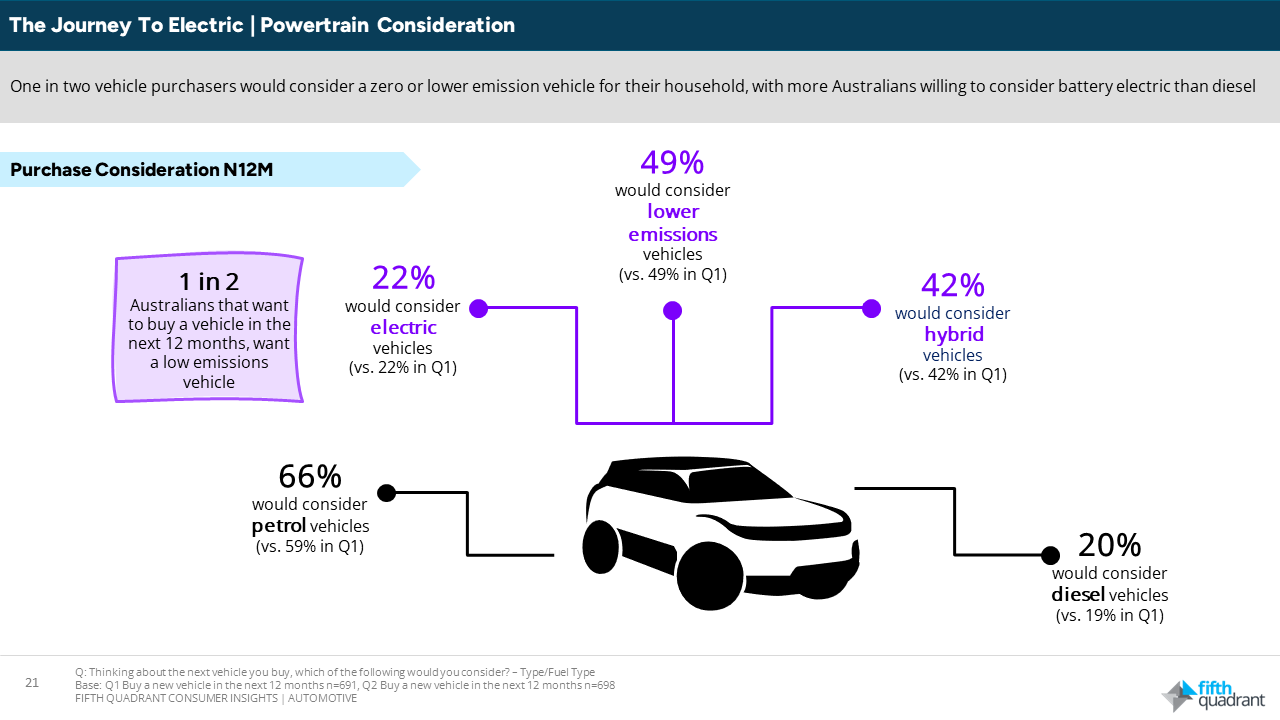

- Almost one in two (49%) would consider a zero or low emission vehicle (rising to 66% of Boomers)

- Despite expressing progressive mindsets, affordability issues mean Gen Z (35%) are the least likely to consider low emission vehicles

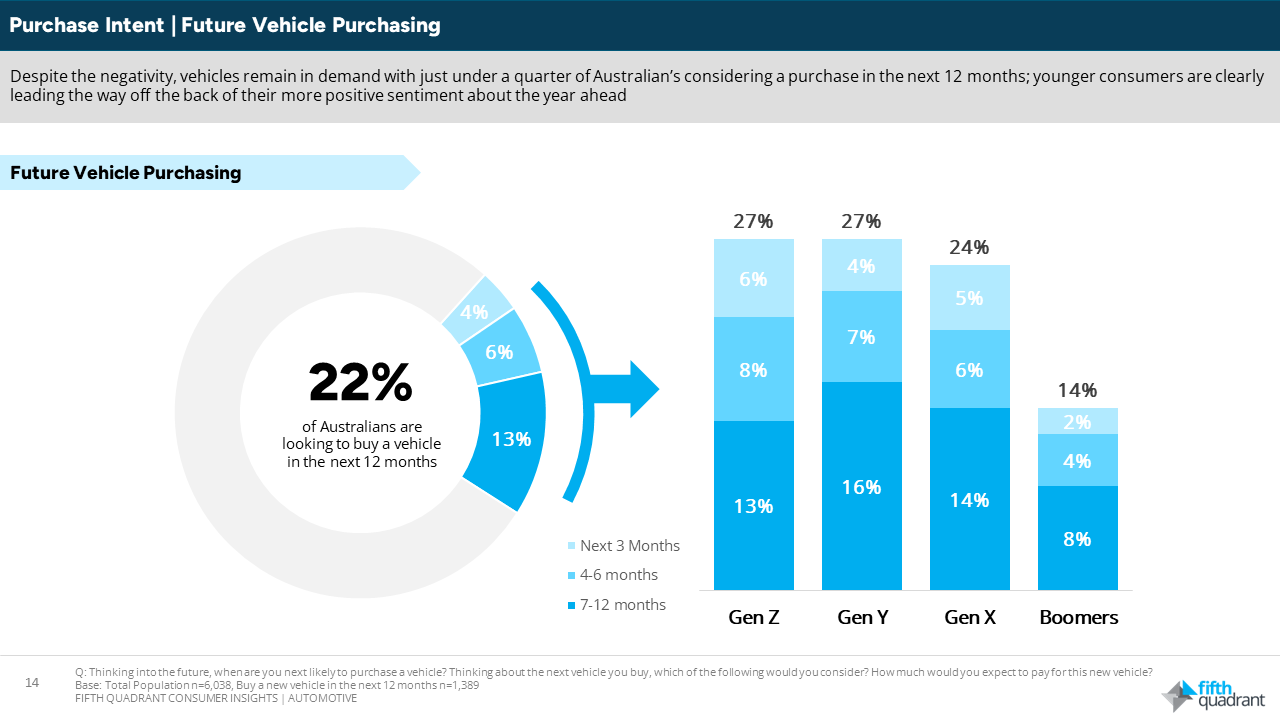

Against the backdrop of ongoing economic uncertainty, almost one in four (22%) Australians intend to purchase a vehicle in the upcoming year. This intention unravels along generational lines, with Gen Z (27%) and Gen Y (27%) leading the charge, followed closely by Gen X (24%), and a slightly lesser 14% among Boomers.

This divide is underpinned by consumer sentiment. Despite a staggering 71% foreseeing a challenging economic terrain ahead for Australia over the next 12 months, 45% of our resilient Gen Zs project optimism, anticipating that economic conditions will either stabilize or improve. This sits in stark contrast to the 27% of their Boomer counterparts who share this outlook off the back of concerns about the burden of rising energy bills (77%), the constant pressure of affordability for essential products (63%), and the accessibility of affordable healthcare (52%)

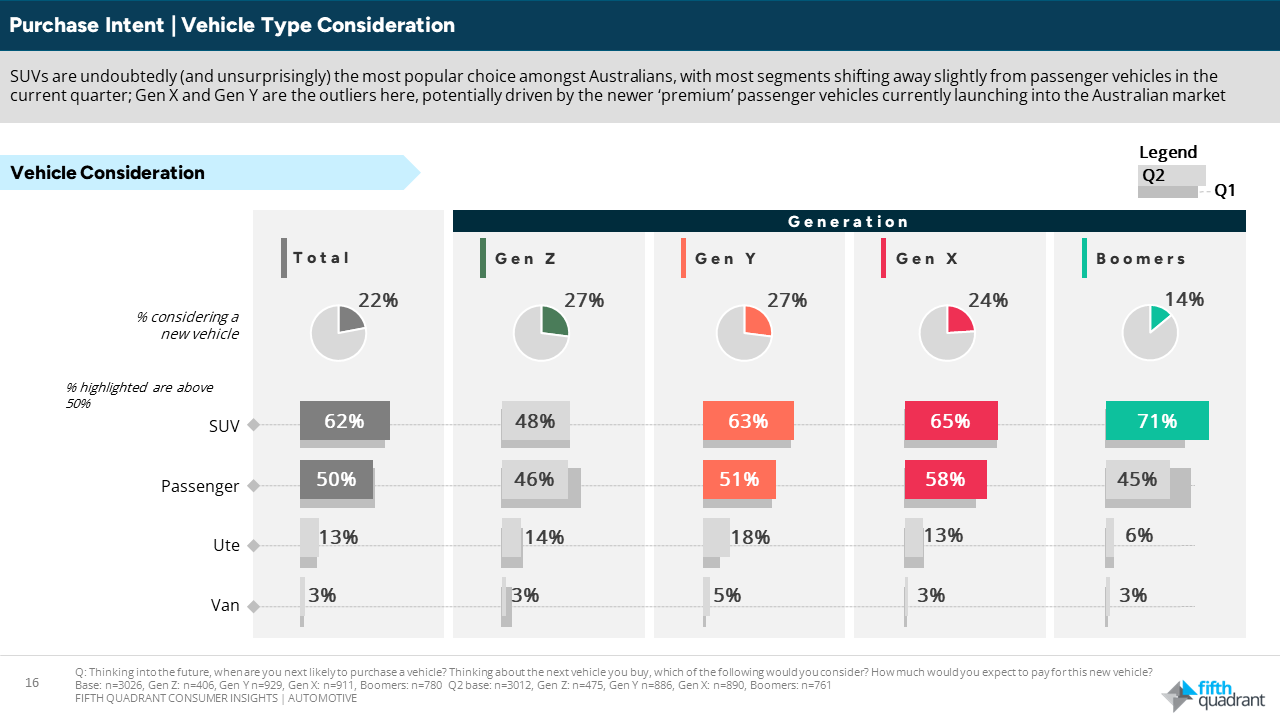

In line with recent automotive trends, SUVs command the spotlight, with 62% of consumers drawn towards this category for their next vehicle, overshadowing the 50% considering passenger vehicles. This trend notably gains momentum among Boomers (71%), underscoring the timeless appeal of these vehicles across generations. Brand loyalty also takes centre stage with Toyota (75%), Mazda (58%), and Hyundai (54%) emerging as the most favoured options for prospective purchasers. In a captivating twist though, Gen Z also displays a propensity for Volkswagen (49%), illustrating their willingness to explore newer avenues while still considering the established players.

Reflecting the continuing transition towards a sustainable future, almost half (49%) of potential vehicle purchasers are open to the idea of low or zero emission vehicles, with 42% considering hybrids and 22% contemplating electric vehicles. Intriguingly, Gen Z (34%) appear less likely to purchase a low emission vehicle within the next 12 months, with affordability a key factor in this decision.

In summary, this study unpacks shifting consumer sentiments and priorities, revealing distinct generational economic outlooks that are reshaping market dynamics. Purchasing intentions hold up despite a range of concerns, with Gen Z’s more optimistic outlook shining through despite the concerns they hold (e.g. rising energy bills and mental health) and contrasting with Boomers focus on rising cost of living pressure. These generational trends extend to vehicular preferences, with a notable emphasis on sustainability, led by Boomers who have the financial capability to invest in lower emission vehicles.

Please click on the button below to access the full report including subgroup analysis by generation and maturity segments, and keep an eye out for future updates of this research.

For more information about our automotive research, you can browse our insights page, reach out to our experts, or access our latest automotive research reports.

Posted in Auto & Mobility, B2B, QN, TL