Author: Brad Ripps | Posted On: 15 Apr 2024

In March there were 109,647 new vehicles delivered, continuing the strong start to the calendar year. This marks a significant 12.7% growth on last year’s March number, which just failed to crack 6 digits (97,251). Toyota (18,961 units) continues to lead the way from a brand perspective, with Ford (8,776 units) and Mazda (8,243 units) rounding out the top 3.

top takeaways:

- Ford Ranger was again the top vehicle in March (maintaining its 2024 position) with 5,661 total sales (vs. 5,070 for the strongly performing Toyota RAV4 in 2nd).

- Tesla Model Y has surged to be the 3rd most delivered vehicle, doubling February deliveries from 2,072 to 4,379 units.

- The previously dominant Toyota Hilux finds itself in 4th position, with 3,995 sales, down from last March’s 4,583 sales.

- Hybrids remain more popular than Electric vehicles, with 13,935 sales compared to 10,464.

- However, if we combine all ZLEVs (Electric, Hybrid & PHEV), the total comes to 25,811 units (24% market share), more than double where it sat 12 months ago (12,428 units).

booming first quarter sets the tone for the year ahead

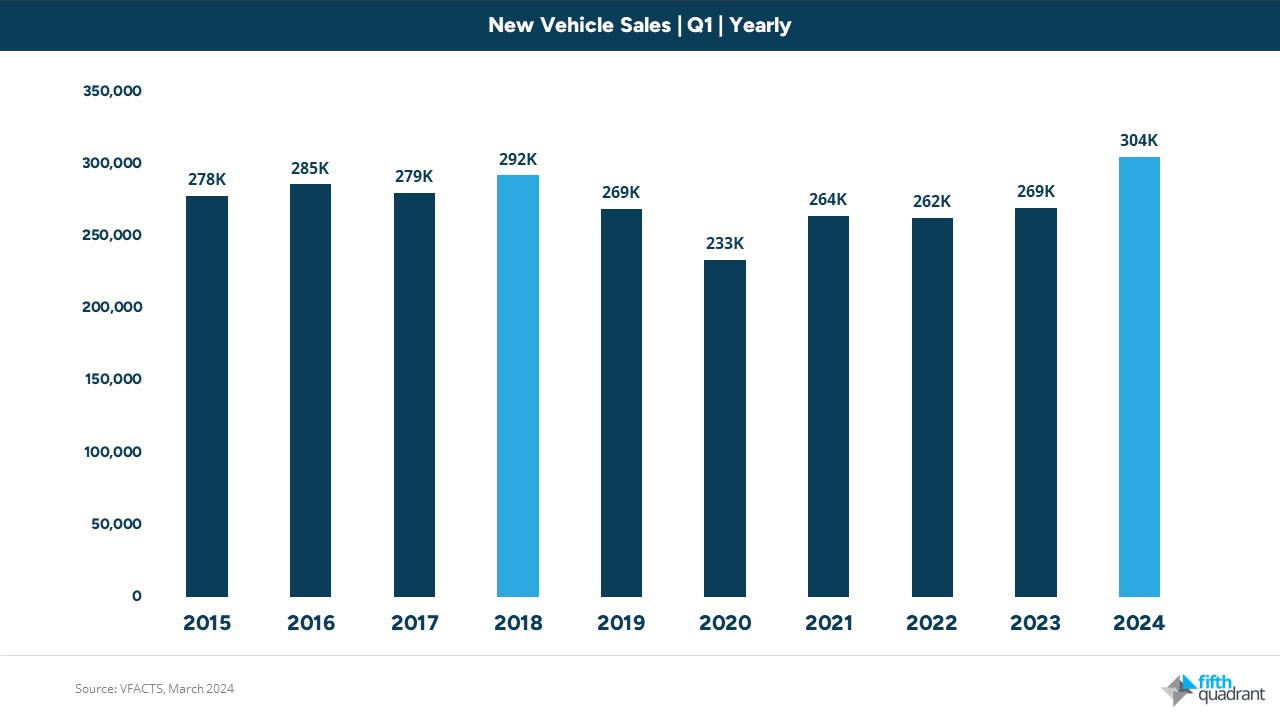

A total of 304,452 new vehicles have been delivered to Australian consumers in the first quarter of 2024,. This surpasses all previous Q1 results, with the next closest being 2018 where 291,538 units were delivered. While the new vehicle market has experienced significant change since them in terms of consumer preferences and technological advances, this impressive performance sets a positive tone for the remainder of the year, suggesting that we are again on track to crack the 1.2m barrier for total sales volumes.

suvs continue to surge ahead

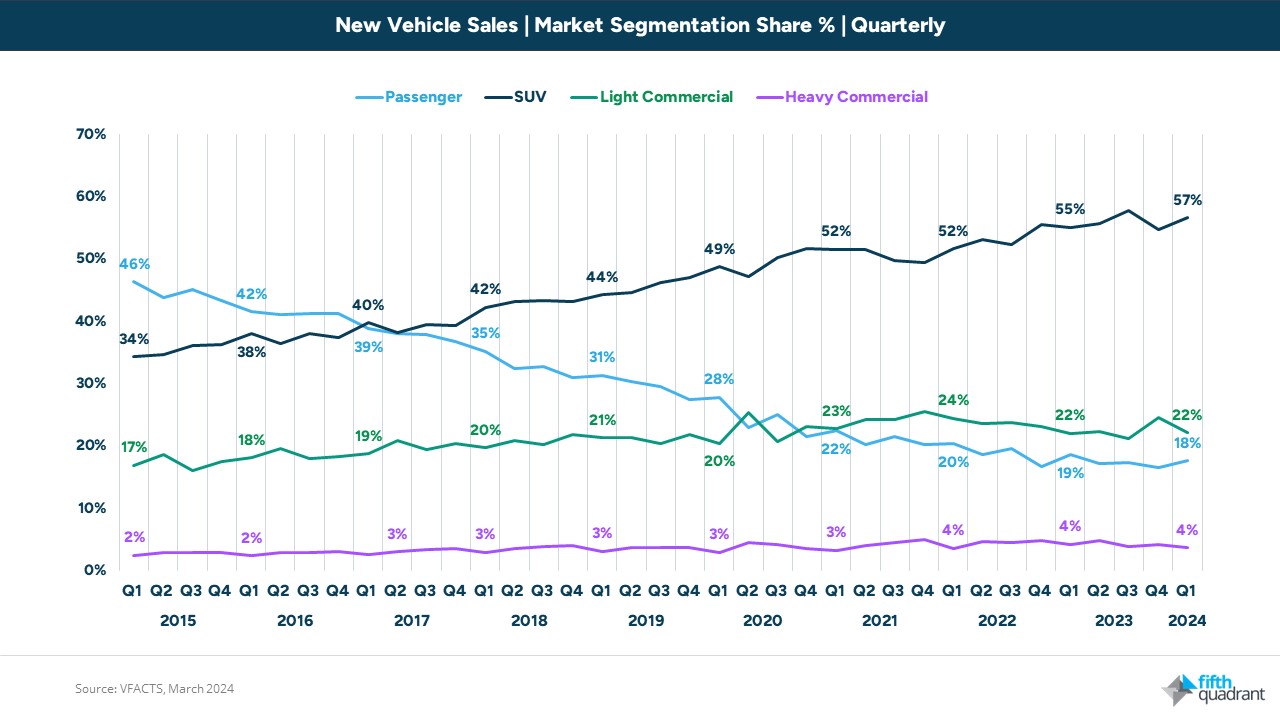

One of the standout trends over the years has been the continued growth and now dominance of the Sports Utility Vehicle (SUVs) market segment. Passenger vehicles were the preferred option until Q1 of 2017, when the SUV segment first surpassed them (40% SUV & 39% Passenger). Since then, SUV sales have soared, currently owning a majority of the market. As can be seen below, the gap continues to widen, with Passenger declining to just 18%. The key unknown going forward is the impact of vehicle emissions standards on this trend, with the new legislation creating a more compelling market opportunity for smaller passenger cars, and suggesting that we could see a corresponding reversal in the trend as manufacturers shift their efforts back into this segment.

fuel segment shift within suv

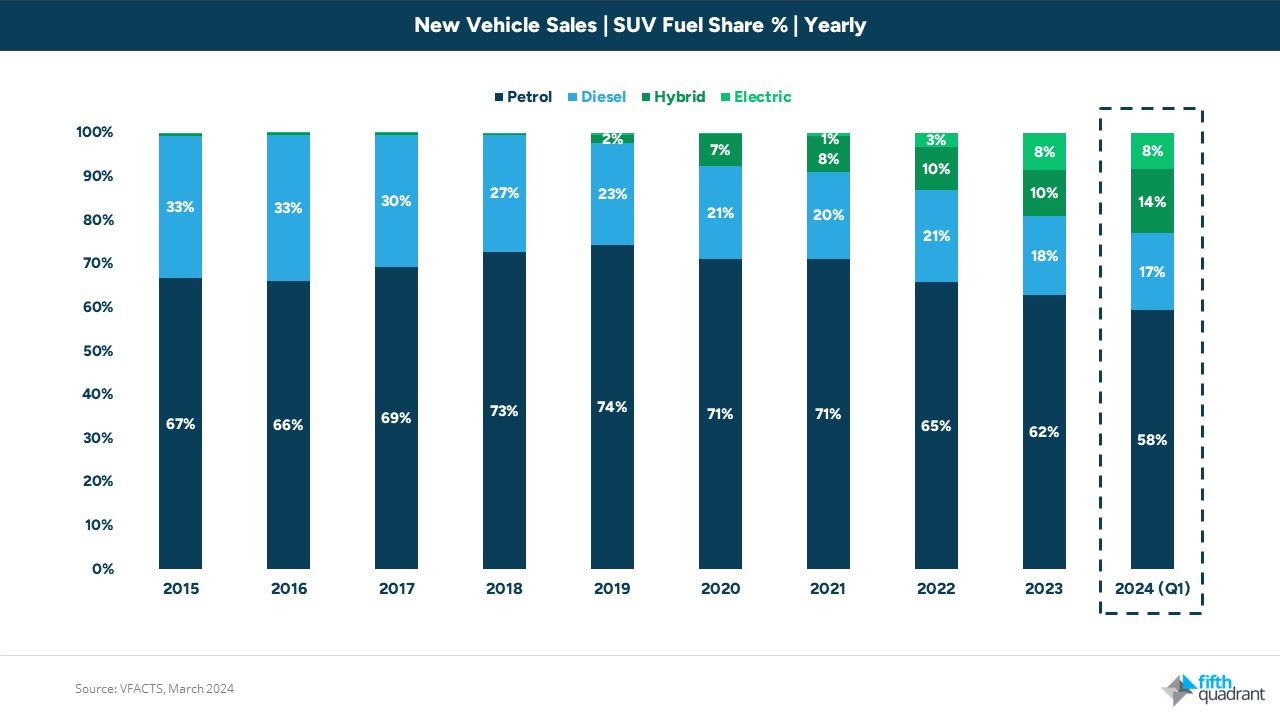

Notably, alongside the rise in SUV sales, there has also been a discernible shift in the fuel types being selected by SUV buyers. While petrol remains the predominant choice, accounting for 58% of SUV sales in Q1 2024, there has been a noticeable surge in the adoption of alternative fuel technologies. This is a relative new phenomenon, with Petrol and Diesel holding a combined share over 90% as recently as 2021. We can see these lower emission alternatives experiencing substantial growth since then, collectively representing 23% of SUV sales in Q1 2024, comprising 14% Hybrid (24,732 units) and 8% Electric (14,156 units).

looking ahead

As we move forward into the rest of the year, it’s evident that the Australian automotive market is continuing to evolve. While SUVs continue to reign supreme, the increasing popularity of electric and hybrid variants underscores a changing landscape driven by technological advancements and shifting consumer preferences. It will be crucial for industry stakeholders to closely monitor these trends and adapt their strategies accordingly to capitalise on emerging opportunities.

If you’ve enjoyed this piece, keep an eye out for our regular updates on the Australian automotive industry. You can also find our 2023 year in review summary slides here.

Also remember that our b2b and consumer tracking research runs monthly. Click here to find out more, and feel free to get in touch if you’ve got questions that you’d like to answer.

Posted in Auto & Mobility, B2B, QN, TL, Transport & Industrial, Uncategorized