Author: James Organ | Posted On: 07 Feb 2024

Updates to this research are published monthly. View previous wave.

The latest wave of the Fifth Quadrant SME Sentiment Tracker reveals a slowdown in the annual inflation rate to 4.1% which is alleviating concerns about escalating costs and interest rates, leading to a more optimistic outlook on economic conditions both globally and in Australia among the 2.5 million Australian SMEs.

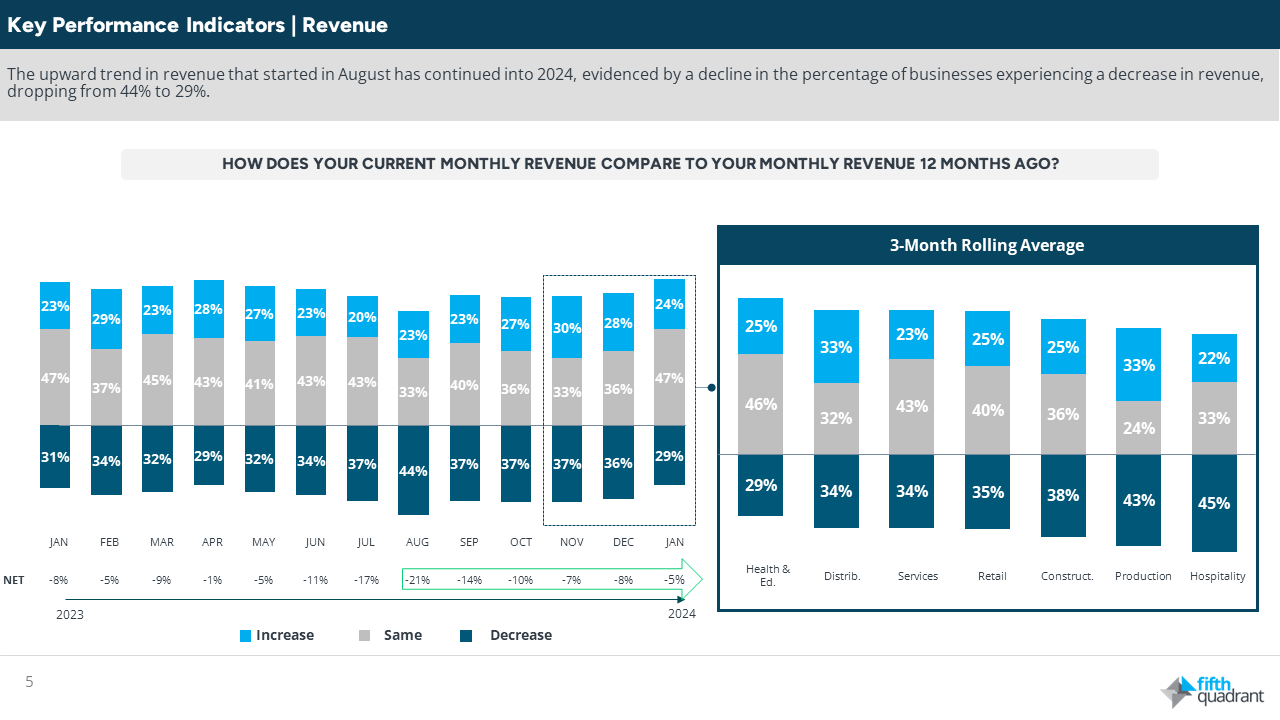

Despite ongoing fluctuations in profitability, revenue trends have maintained an upward trajectory since the last interest rate hike in July 2023, with 71% of businesses reporting revenues that are either improved or comparable to those in the same period last year.

table 1: revenue

While 40% of SMEs recognise that the economic outlook and cost pressures will pose a major challenge in 2024, concerns regarding energy prices (72%), fuel (75%), and the cost of credit (71%) have decreased to their lowest levels in the past 12 months.

Table 2: business concerns

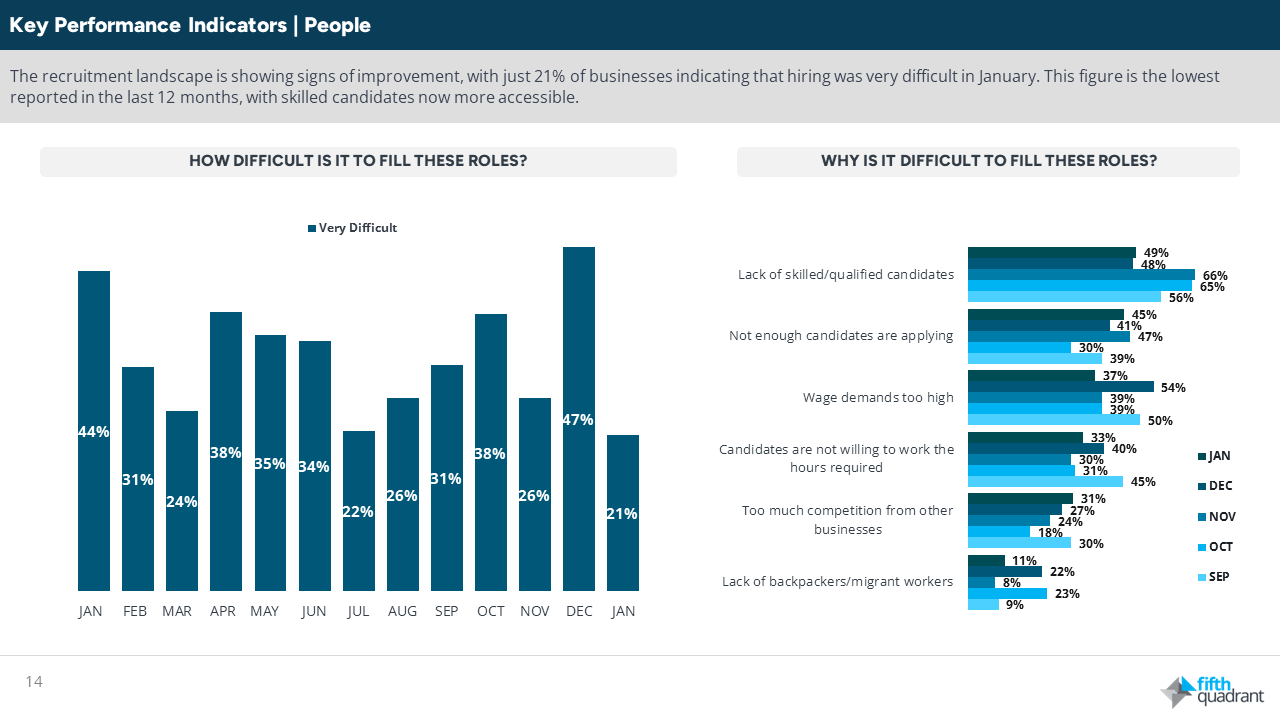

Even though 25% of SMEs are streamlining their business operations, employment figures continue to be strong. With 17% of SMEs planning to expand their workforce in the next three months and 27% actively seeking to fill vacancies, the job market remains dynamic. Furthermore, finding qualified talent is becoming less challenging, as only 21% of SMEs in the process of hiring report significant difficulties in recruitment. This percentage is the lowest observed in the past 12 months, with skilled candidates now more accessible.

Table 3: people

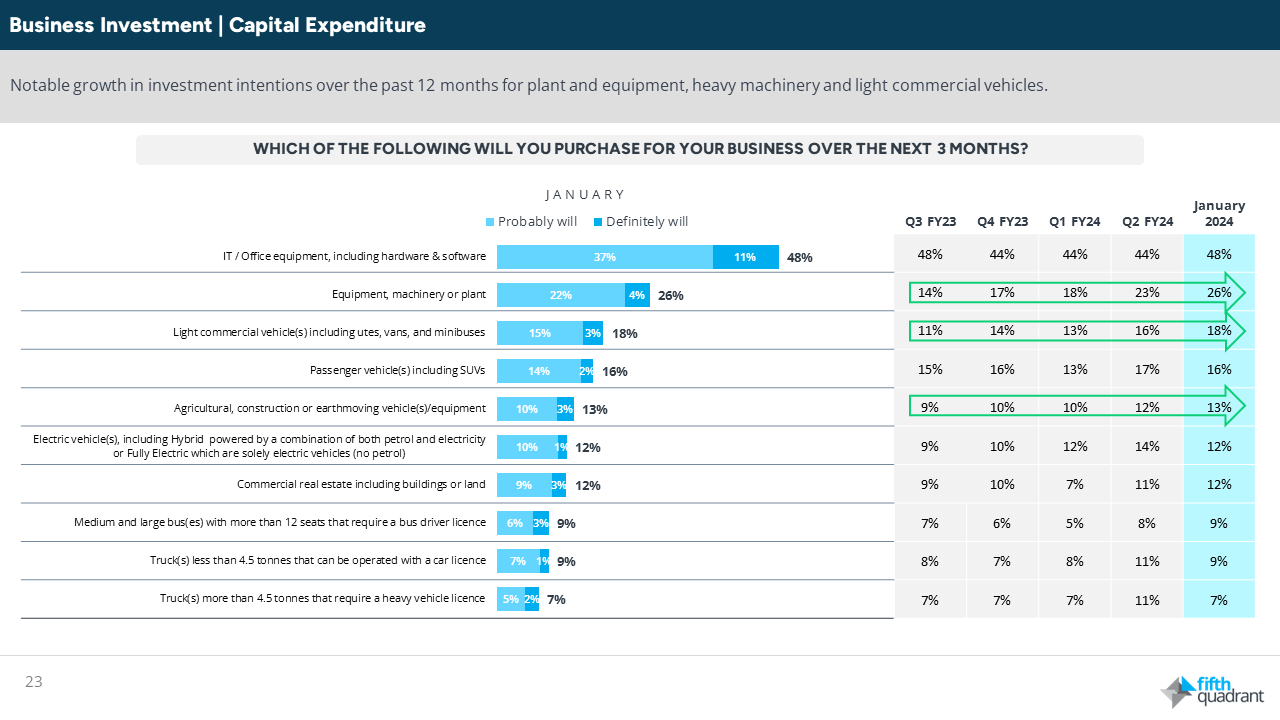

With 37% of SMEs forecasting revenue growth in 2024, there’s a noticeable uptick in their investment intentions, particularly in areas like plant and equipment (26%), light commercial vehicles (18%), and agricultural, construction, and earthmoving equipment (13%). This trend underscores a growing confidence among SMEs to make investments now that inflation appears to be under control.

Table 4: capital expenditure

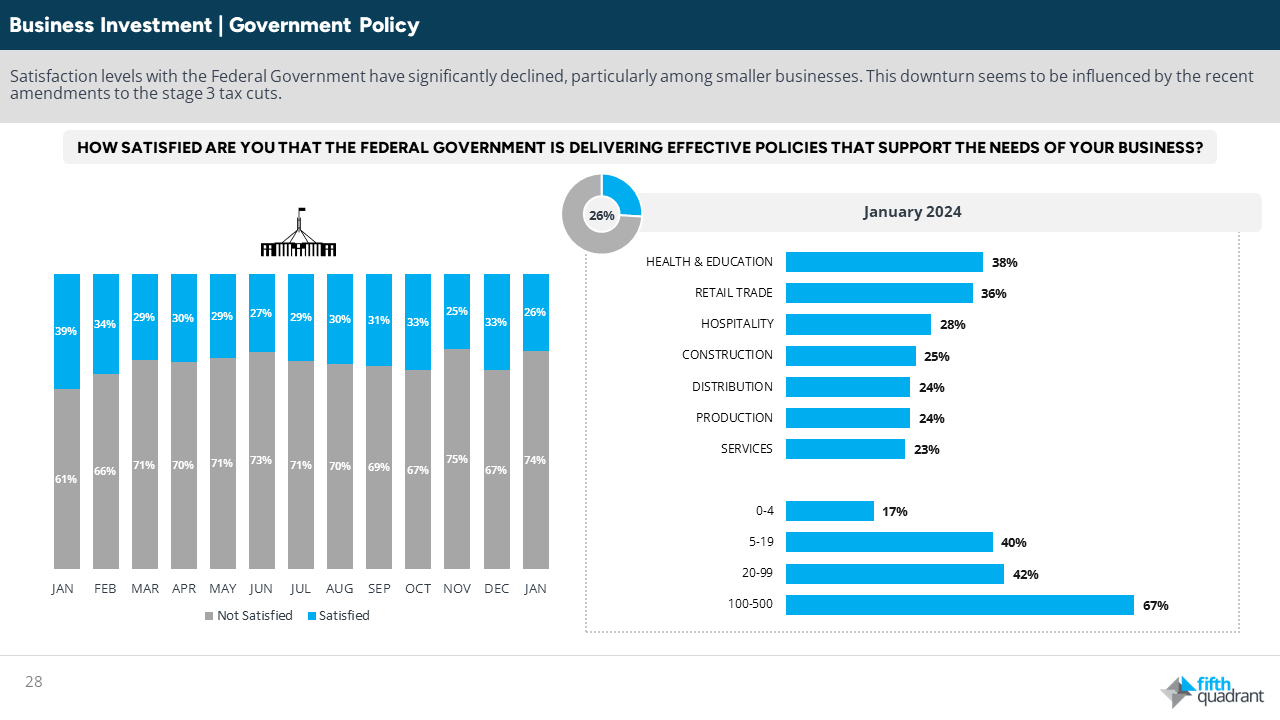

Despite the fall in inflation, there has been a notable decline in satisfaction levels with the Federal Government over the past month. This downturn in sentiment appears to be largely influenced by recent amendments to the stage 3 tax cuts. Interestingly, the government seems to be receiving little recognition or credit for the role it may have played in reducing inflation.

Table 5: government policy

Despite the backdrop of geopolitical tensions, new supply chain challenges and ongoing economic issues the sentiment amongst SMEs continues to trend higher now that inflation and interest rate pressures appear to be under control. Accordingly, investment intentions are growing with many SMEs increasing their capex, marketing and team numbers over the next 3 months.

Please click on this link to access the full report including subgroup analysis by industry sector, size of business and State. Fifth Quadrant and Ovation Research publish monthly updates of this research.

Posted in Financial Services, B2B, QN, TL