Author: Amelia McVeigh | Posted On: 16 Jul 2024

Australia has reached the midpoint of the year, and has recorded another strong sales figure, with 119,659 new vehicles delivered in June. We are however seeing conflicting trends across the market, with June sales well down on 2023’s record result (124,926 sales) despite many vehicle segments still tracking strongly.

top takeaways:

- Hybrids (including plug-in hybrids) remain strong (with Toyota at the forefront), with 17,285 units sold in June (vs. 9,762 in June 2023)

- Looking down the top 10, Nissan (+56%), Mitsubishi (+49%), Isuzu Ute (+23%) and Ford (+22%) all had positive months, mainly thanks to strong SUV sales

- The once-declining small passenger vehicle segment is showing some life, up 13% YoY (8,643 vs. 7,677)

- Small SUVs (+3%) are on the rise (with strong input from the premium end of the market), as vehicles over $45k saw 18% YoY growth (3,488 vs. 2,955)

Brand Performance Underpinned By SUVs

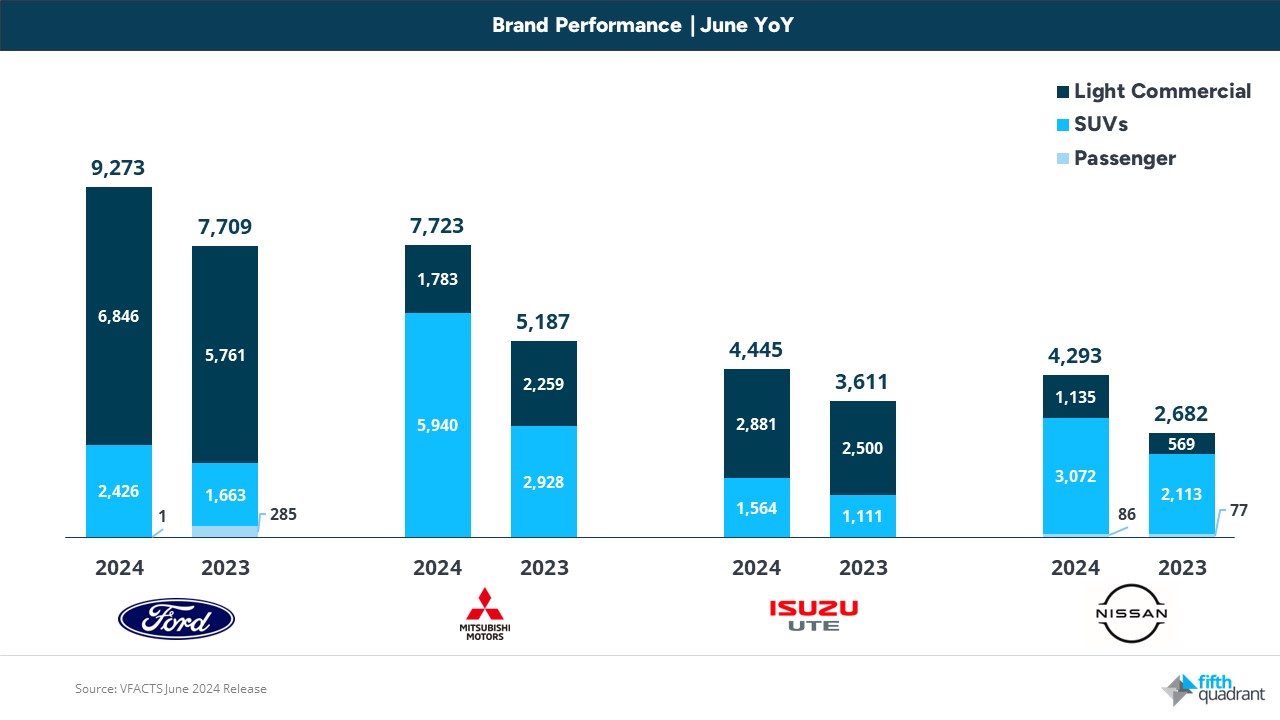

Looking at June’s top ten rankings, just four brands recorded double-digit growth vs. June 2023, with Nissan, Mitsubishi, Isuzu Ute and Ford combining to sell 25,954 vehicles (up from 19,310 in June 2023). This gives them a 22% market share for the month (up from 15% in June 2023).

While SUVs and light commercial vehicles are the core segments for each of these brands, we can see clear differences in the distribution, with utes playing a more significant role for Isuzu and Ford, whereas Mitsubishi and Nissan are more reliant on SUVs for their sales volumes (and growth).

Small Is The New Big

We’re also seeing a resurgence in smaller vehicles, with consumers appearing ready to push back (to a certain extent at least) on the ever-increasing size of the cars on our roads.

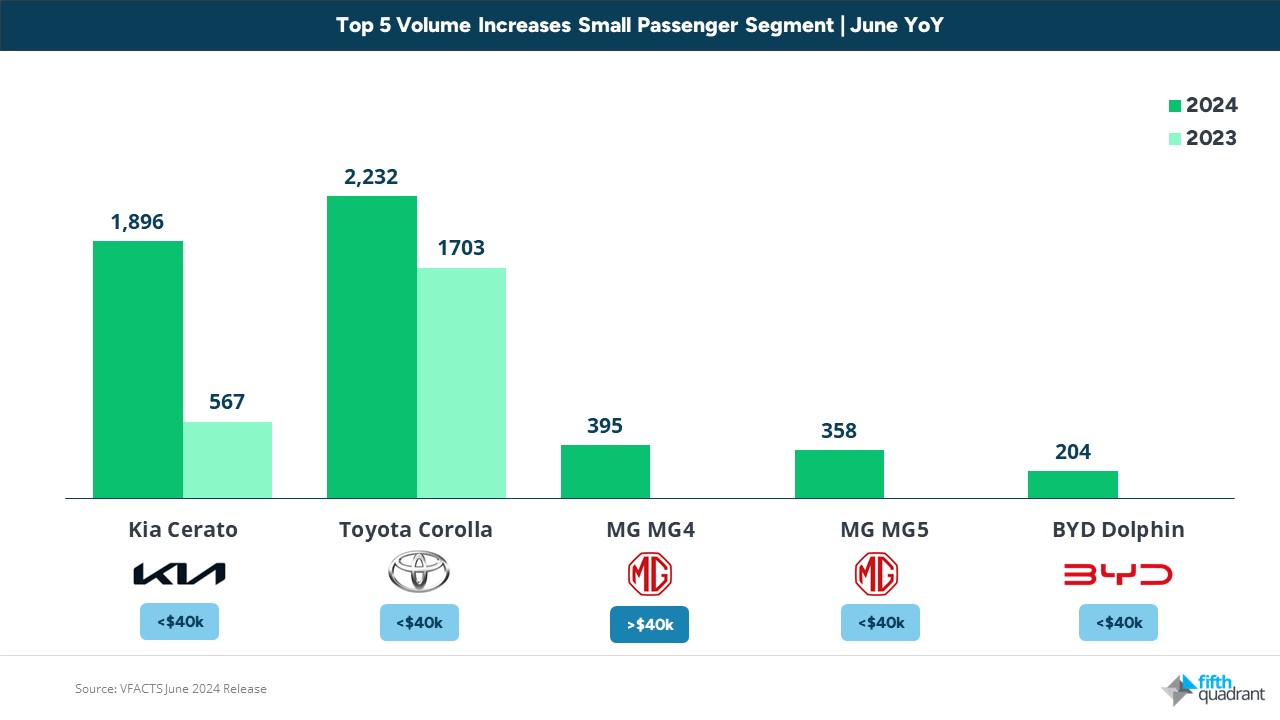

While the small passenger vehicle segment has been on the decline for the last 5 years, there may be some hope in sight thanks to increased interest in staples such as the Kia Cerato (up +234% YoY), and the Toyota Corolla (up +31% YoY). Newer electric models are also breathing life back into the segment, with an additional 957 vehicles on the road due to the introduction of the MG4 (395), MG5 (358) and BYD Dolphin (204). Given current cost-of-living pressures, it’s somewhat unsurprising that this increase is largely among more affordable (under $40k) small passenger vehicles.

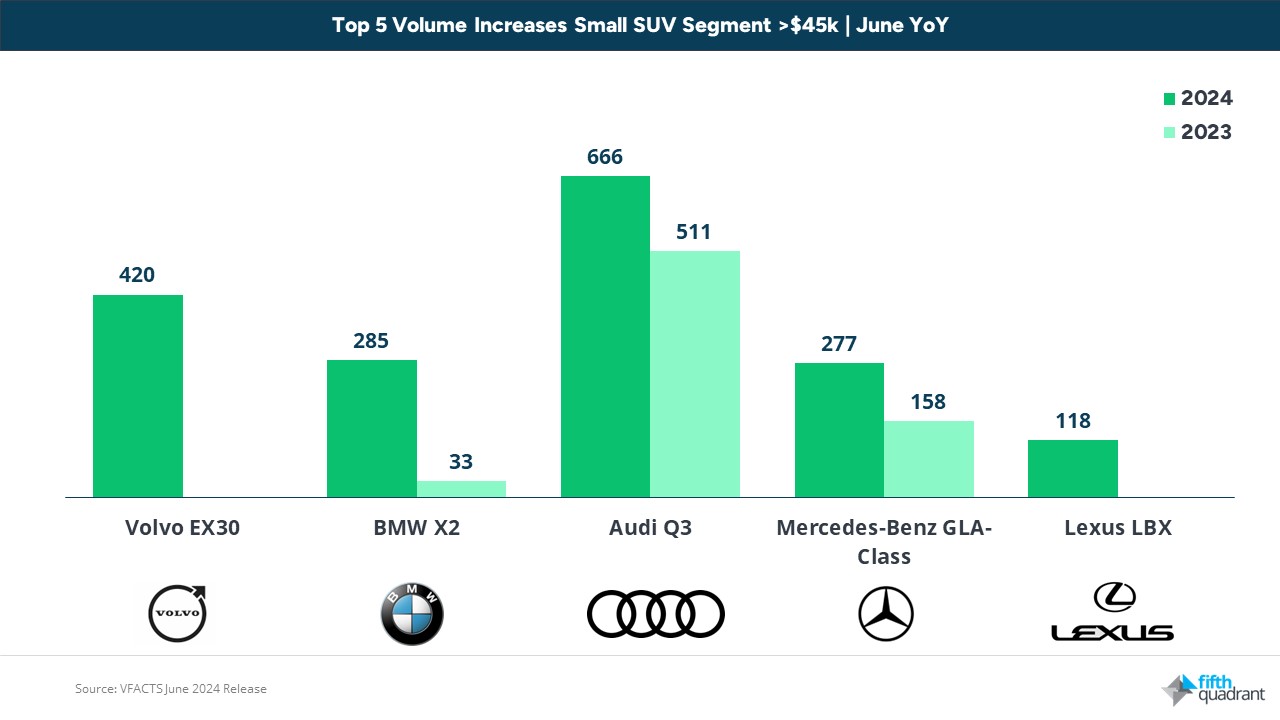

The same cannot however be said for the Small SUV segment in June, where more premium models (over $45k) are driving double-digit YoY growth within the sub-segment (up 18%). Specific new releases that have increased consumer interest include the Volvo EX30 (+420), BMW X2 (285 vs. 33 YoY), and Lexus LBX (+118), while the Audi Q3 is up 155 units (666 vs. 511 YoY) and the Mercedes-Benz GLA-Class has almost doubled its sales (277 vs. 158).

Looking ahead

With half the year gone, we are currently up 50,563 vehicles compared to last year. All market indicators suggest however that the second half of the year could be weaker than the first, with OEMs and dealers forced to resort to incentives to shift excess stock as consumer demand wanes. While this could still lead to a strong end of year sales figure, it will likely be at the expense of profitability, creating a more challenging environment for new vehicle dealerships.

Check back for our half-year review on Australian new vehicle sales, and keep an eye out for our half-year car parc and vehicle sales forecasting updates in the weeks to come. Subscribe below to ensure you’re among the first to hear about these.

Posted in Auto & Mobility, B2B, QN, TL, Transport & Industrial, Uncategorized