Author: Ben Selwyn | Posted On: 19 Aug 2024

July 2024 marked another pivotal month for the Australian automotive industry, with the latest VFACTS sales data revealing significant shifts in consumer preferences and market dynamics. The market again cracked six digits, with 102,181 new vehicles sold as it displays continued resilience in the face of ongoing economic pressure. This month, the spotlight is on hybrid vehicles, which have seen a substantial increase in sales, as electric vehicle (EV) sales have stalled.

Toyota continues to lead the pack, with the RAV4 once again topping the sales charts and multiple other models ranking in the top ten. However, the broader market tells a more nuanced story, with fluctuations in different segments, regional variations, and the ongoing tug-of-war between traditional and emerging vehicle types. As we delve into the July 2024 VFACTS data, we’ll uncover key trends shaping the Australian automotive landscape and what these could mean for the months ahead.

key insights from July’s auto market

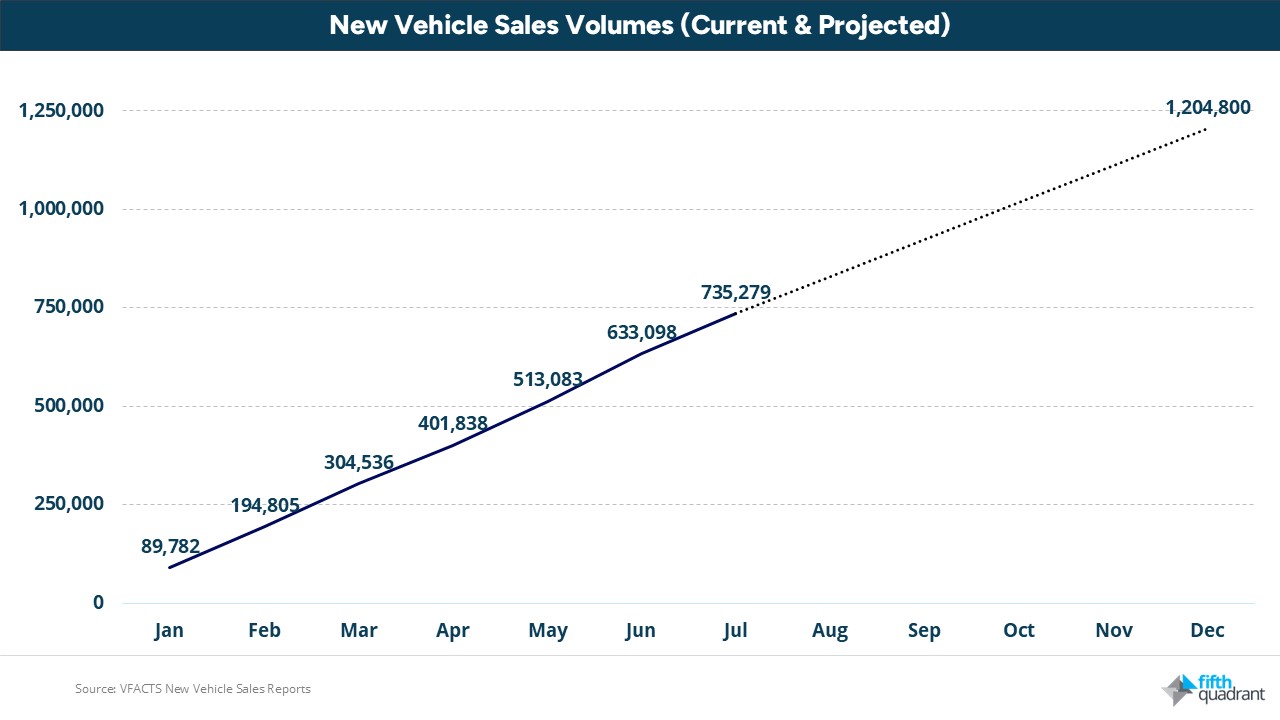

- Record Sales Volumes Amid Economic Pressure: Despite rising cost-of-living pressure, the Australian automotive market is on track to exceed 1.2 million vehicle sales in 2024, reaffirming its resilience. This robust performance indicates a level of continued demand across various vehicle segments.

- Hybrids Leading the Charge Among ZLEVs: Hybrid vehicles dominated the Zero and Low Emission Vehicle (ZLEV) segment, with over 20,000 units sold in July 2024 (92% YoY increase). Traditional hybrids accounted for 18,039 sales, while plug-in hybrids contributed 2,209 units.

- Toyota’s Unshakable Market Leadership: Toyota continues to assert its dominance, leading the charts with the RAV4, which sold 5,933 units in July 2024. This is supported by high sales figures for Hilux, Corolla, and LandCruiser.

- Consumer Preferences Reflected in Top 20 Models: The top 20 models showcase diverse consumer preferences, with SUVs, Utes, and compact cars all present. The continued presence of key players such as Toyota, Ford, and Mazda indicates their continued alignment with the evolving needs of Australian consumers.

- Emerging Brands Making Their Mark: Brands like MG and Isuzu have also gained significant traction, with the MG ZS and Isuzu D-Max well established in the top 20. MG’s focus on affordable quality and Isuzu’s reputation for rugged reliability are resonating with budget-conscious and utility-focused buyers.

on track for 1.2m… just…

Looking at monthly sales, we can see continued strong performance, with 735,279 vehicles sold YTD. Historic data tells us that the August to December period typically accounts for approximately 40% of annual sales volumes, putting us on track for 1.204m sales this year. Despite lagging marginally behind 2023 (1.216m), this would still be an incredibly strong result given cost-of-living pressures, and only the second time that the market breaks 1.2m vehicles.

This is also largely in line with the latest Fifth Quadrant new vehicle sales forecasts, published in early July, which predicted total sales of 1.202m vehicles for the year.

toyota triumphs and mitsubishi surges: key brand shifts in July 2024

In July 2024, Toyota solidified its position as the dominant force in the Australian automotive market, achieving an impressive 18% year-on-year (YoY) growth. It ended the month with 22,705 units sold, and six models in the top 20. Mazda and Ford followed, each securing two spots in the top 20, with moderate YoY gains of 2% and 9%, respectively. The biggest gain in the top 10 saw Mitsubishi achieve a 38% YoY increase based on strong Outlander and Triton sales. Conversely, MG experienced a 23% decline, with the ZS SUV in run-out and the all-new MG3 not yet available. Meanwhile, GWM continued its upward trajectory with a 29% YoY increase, despite not having any models in the monthly top 20.

| Rank | Brand | Jul ’24 sales | Jul ’23 sales | YoY Change | Top 20 Models (Jul ’24) |

| 1 | Toyota | 22,705 | 19,191 | 18% | 6 |

| 2 | Mazda | 8,476 | 8,307 | 2% | 2 |

| 3 | Ford | 7,749 | 7,109 | 9% | 2 |

| 4 | Kia | 6,620 | 6,150 | 8% | 2 |

| 5 | Hyundai | 6,028 | 6,526 | -8% | 2 |

| 6 | Mitsubishi | 5,718 | 4,143 | 38% | 2 |

| 7 | MG | 4,101 | 5,347 | -23% | 2 |

| 8 | Isuzu Ute | 3,821 | 3,340 | 14% | 2 |

| 9 | Subaru | 3,601 | 3,553 | 1% | 0 |

| 10 | GWM | 3,319 | 2,564 | 29% | 0 |

declining wait times boost market dynamics for top brands

A major contributor to the strong market performance throughout 2023 and 2024 has been the ability of leading automotive brands to significantly reduce their vehicle order backlogs, which had accumulated due to global supply chain disruptions. This progress is particularly evident in the notable reductions in vehicle delivery times.

Over the past year, Toyota has successfully cut its average wait time by 62 days, reducing it to 137 days. Similarly, Isuzu Ute, Ford and Subaru have achieved substantial improvements, with wait times decreasing by 119, 44 and 42 days, respectively.

Despite these advances, new vehicle wait times for three of the top five brands still experience wait times still exceed 100 days, suggesting that despite increasing consumer cost-of-living pressure they are well-positioned to maintain sales volumes over the short to medium term.

| Rank | Brand | Jul ’24 sales | Wait Time (Jul ’24) | Wait Time (Jul ’23) | YoY Change |

| 1 | Toyota | 22,705 | 137 days | 199 days | -62 days |

| 2 | Mazda | 8,476 | 30 days | 55 days | -25 days |

| 3 | Ford | 7,749 | 120 days | 166 days | -44 days |

| 4 | Kia | 6,620 | 94 days | 103 days | -9 days |

| 5 | Hyundai | 6,028 | 82 days | 76 days | +6 days |

| 6 | Mitsubishi | 5,718 | 74 days | 91 days | -17 days |

| 7 | MG | 4,101 | n/a | n/a | n/a |

| 8 | Isuzu Ute | 3,821 | 55 days | 174 days | -119 days |

| 9 | Subaru | 3,601 | 22 days | 64 days | -42 days |

| 10 | GWM | 3,319 | 14 days | 30 days | -16 days |

looking ahead

As we move through 2024, the Australian automotive market continues to defy economic headwinds, with sales on track to exceed 1.2 million vehicles. Anecdotal feedback tells us however that some brands are moving from shortage to excess supply, suggesting we’re entering a two-speed market. Given this, we expect to see increased discounting strategies by brands facing high inventory levels, while others may capitalise on reduced wait times to maintain premium pricing. This will be challenging for dealers, who will need to seek out alternative revenue streams to offset reduced new vehicle profitability.

We’ll be tracking market performance closely through the rest of the year, seeing how this split plays out, and how accurate our market forecasts estimates end up being. Sign up for our newsletter here to ensure you stay up to date with our monthly updates.

Also remember that our b2b and consumer tracking research runs monthly. Click here to find out more, and feel free to get in touch if you’ve got questions you’d like to ask.

Posted in Auto & Mobility, B2B, QN, TL, Transport & Industrial, Uncategorized