Author: Amelia McVeigh | Posted On: 27 Feb 2025

The Australian automotive market has started 2025 strongly, with new vehicle sales data sourced from the FCAI’s VFACTS report and EVC’s Vehicle Sales Report recording 87,625 vehicles sold for the third-highest January sales result in the past decade. While this is a slight year-on-year decline (down 2% on January 2024), SUVs continue to grow sales volumes, supported by fleet buyers. The important light commercial segment has however seen a notable dip, potentially reflecting the early impact of emissions standards on ute sales.

Key Takeaways:

- Strong start to the year: Despite a slight year-on-year dip, January 2025 recorded the third-highest January sales since in the past decade (87,625 vs 89,782 YoY)

- SUVs lead the market: Highest ever January sales for SUVs (53,276 units), as the segment maintains its dominance of the Australian automotive landscape

- Light Commercial decline: Sales down 10% YoY, with only 18,448 (vs 20,601 YoY) driving out of dealerships in Jan 2025

- Fleet sales remain strong: 2025 saw the second-highest January fleet sales over the past decade (36,770 vs 35,226 in Jan ‘24), driven by fleets investing in SUVs (17,521 vs 15,153 in Jan ‘24)

- Toyota RAV4 reigns supreme: The best-selling vehicle for the seventh consecutive month. Not much else to say. (5,076 sales)

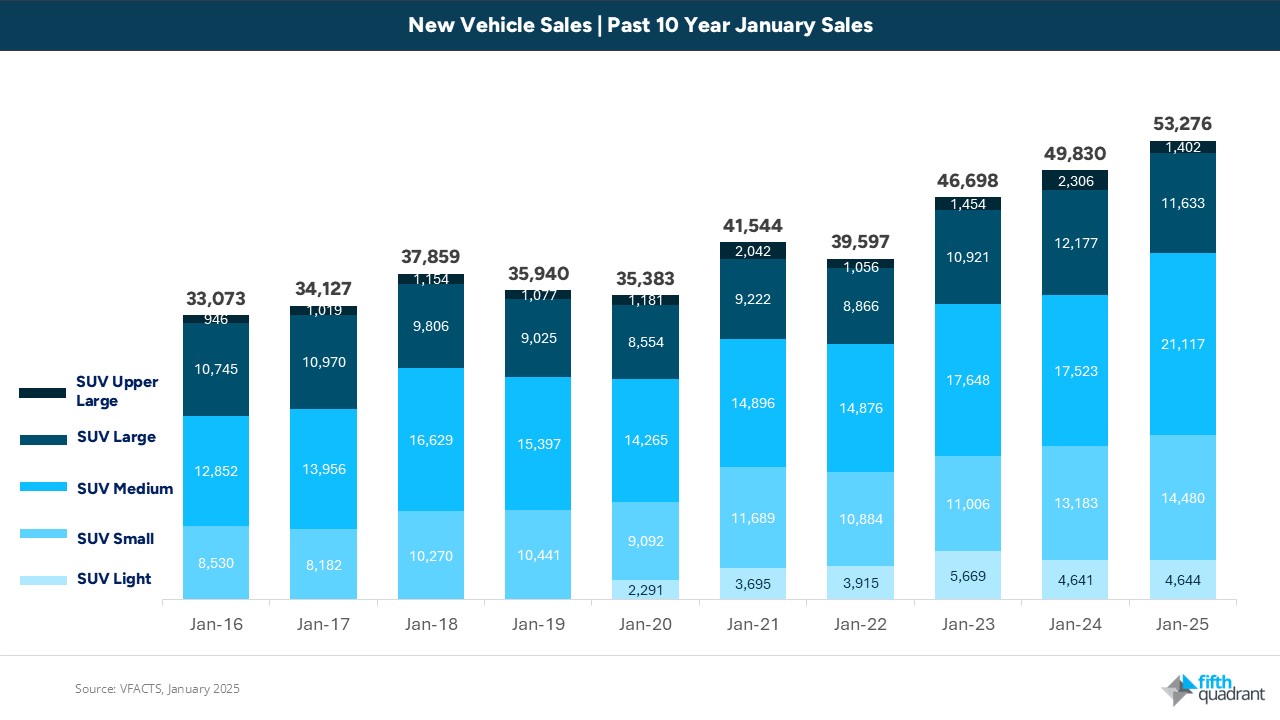

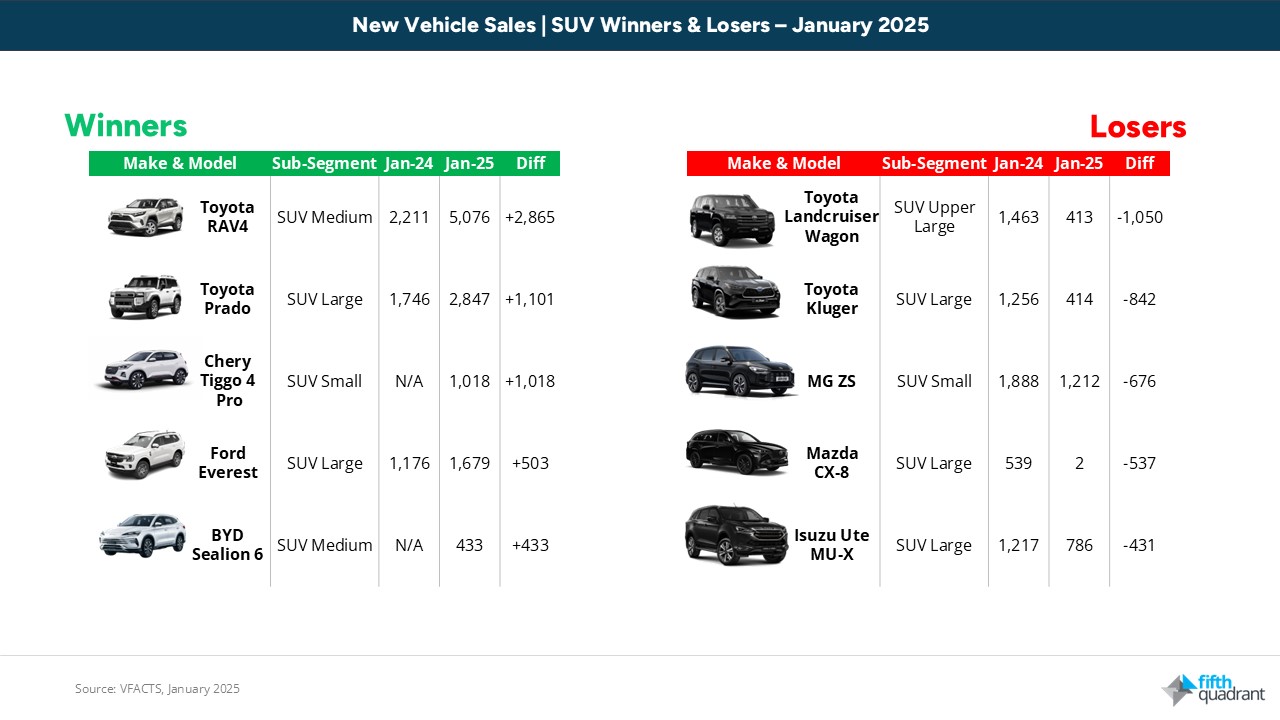

SUV Market Growth Continues

In January 2025, SUVs solidified their position in the Australian automotive market, with small and medium segments driving a combined year-on-year increase of approximately 5,000 units. In contrast, large and upper-large SUV segments witnessed a downturn, suggesting a shift in consumer preference towards smaller, more versatile vehicles. While this result did include notable declines for the Toyota LandCruiser Wagon (-1,050 units) and Kluger (-842 units), we also need to recognise that the segment was impacted by the discontinuation of the Mazda CX-8 (-537 units) and anticipation for the upcoming release of the updated Isuzu MU-X in March.

At a model level, the top selling Toyota RAV4 led the surge, contributing over half of the growth with an increase of 2,865 units compared to January 2024 (which was down due to Toyota facing significant supply chain issues). Emerging models also made significant inroads:

- Chery Tiggo 4 Pro: +1,018 units

- BYD Sealion 6: +433 units

- Kia EV5: +289 units

- Chery Tiggo 8 Pro: +203 units

It wasn’t however only new entrants performing well, with established models like the Mitsubishi ASX (+359 units) and GWM Haval Jolion (+231 units) also contributing to the upward trend. In contrast, the aging MG ZS experienced a decline, dropping from the third top-selling SUV in January 2024 to twelfth in January 2025 (-646 units).

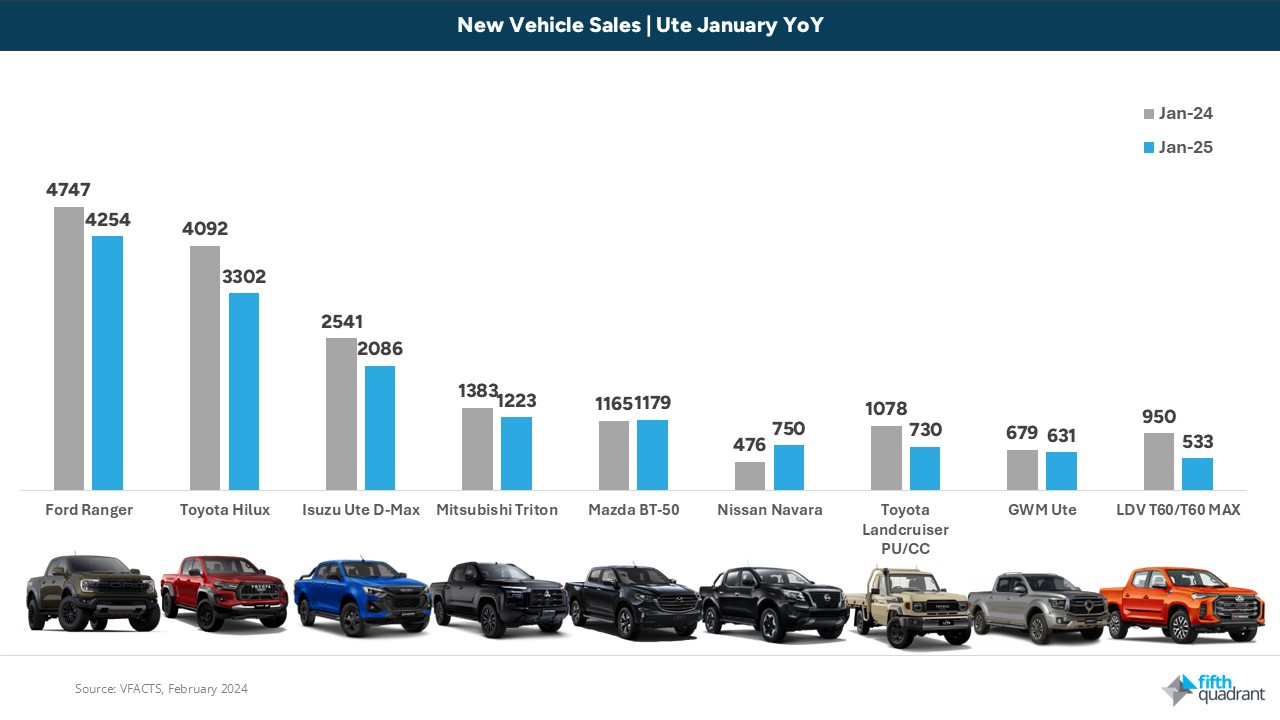

Emissions Standards and the Ute Market

Ute sales experienced a 12% year-on-year decline (-2,316 units), leading to a drop in YoY light commercial vehicle sales. This includes significant losses for key segment leaders, with the Toyota Hilux (-790 units), Ford Ranger (-493 units), and Isuzu D-Max (-455 units) all down compared to January 2024. Despite the downward trend, some models have defied the market shift, with the Nissan Navara (+274 units) and GWM Cannon (+177 units) both recording year-on-year growth.

Stricter emissions regulations are likely contributing to this downturn, as buyers potentially delay purchases to assess the impact of new standards or await further incentives before committing to a new vehicle. Looking ahead, interest rates are easing and fleet buyers adapting to evolving emissions standards, so the next few months will be crucial in determining whether sales can rebound in the lead-up to the end of the financial year.

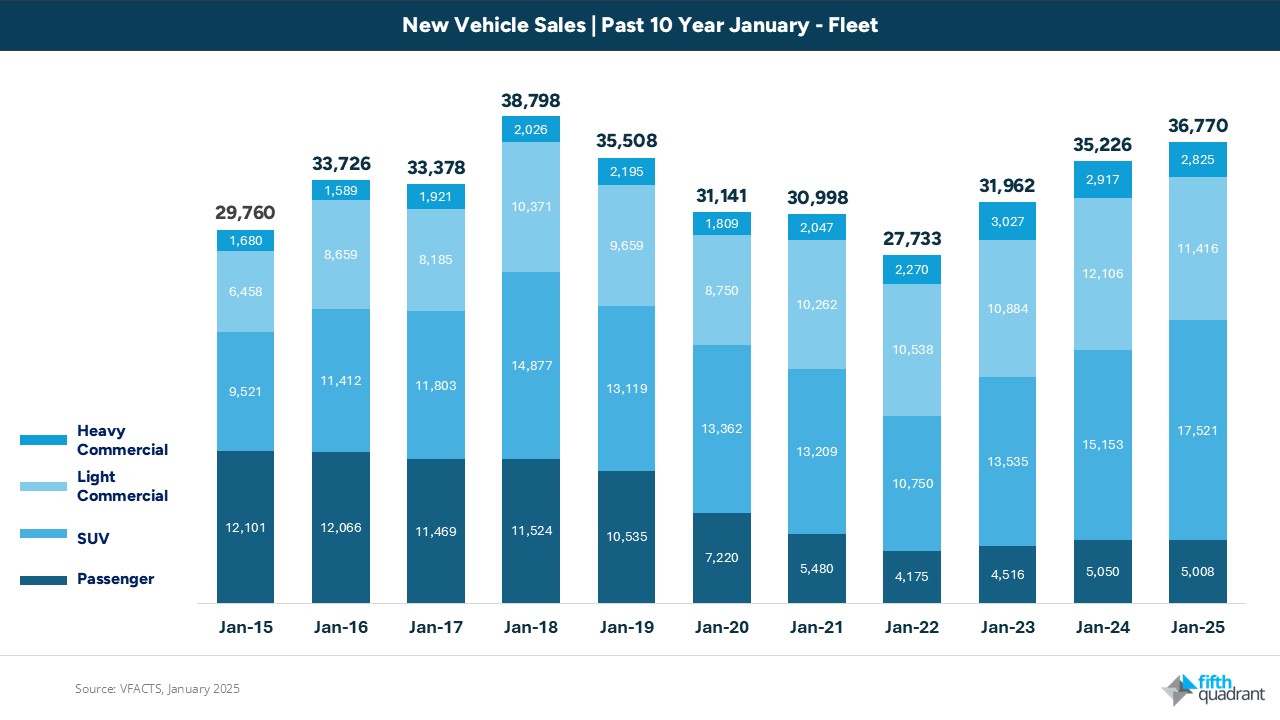

Fleet Sales Remain Strong

Fleets stood out as the only buyer category to record growth in January 2025, helping to counterbalance declines in other segments. Total fleet sales reached 36,770 units, marking the second-highest January in the past decade.

SUVs remain the preferred vehicle type, with fleet purchases jumping 16% year-on-year to 17,521 units, reinforcing their appeal for business and government buyers. Passenger vehicle fleet sales remained stable at 5,008 units, while light commercial fleet sales, despite a year-on-year drop, still recorded 11,416 units, the second-highest January result in the past decade.

Looking Ahead

As we move further into 2025, the Australian automotive market finds itself at a pivotal moment. SUVs are holding strong, with strong fleet demand underpinning record sales. However, challenges remain, particularly in the light commercial segment, where emissions standards are already influencing buyer behaviour.

The key questions for the months ahead will be how manufacturers respond to shifting consumer preferences and regulatory pressures. Will the light commercial segment rebound as businesses adjust to new emissions rules? Can the industry sustain SUV growth, particularly in smaller and more fuel-efficient models? And how will easing interest rates and potential government incentives shape buying decisions in the lead-up to the end of the financial year?

With a strong start and evolving market dynamics, 2025 is shaping up to be a defining year for the Australian automotive sector. Adaptability will be crucial, for manufacturers, dealers, and buyers alike.

Looking for more auto insights? Click here to view of our automotive market research reports. Fifth Quadrant publishes monthly new vehicle sales updates here. For any questions or inquiries, feel free to contact us here.

Posted in Auto & Mobility, QN