Author: Ben Selwyn | Posted On: 19 Feb 2024

The Australian automotive market has seen a surge to start off the new year, with 89,782 new vehicles sold in January 2024 (up almost 5,000 units against January 2023). This month’s sales results highlight the popularity of Utes, with the Ford Ranger, Toyota Hilux and Isuzu D-Max again leading the pack. There was also a shift in market share towards hybrid vehicles, while diesel-powered vehicles (mainly utes) continue to gain popularity. In contrast, Tesla’s dropped significantly as it was outsold by EV competitor BYD (although indications are that its decline is due to vehicle supply issues as against a lack of demand).

top takeaways:

- There were nearly 5,000 more vehicles sold in the month than in Jan 2023 (6% increase), with Victoria having the largest increase with 1,403 more new vehicles. Only the Australian Capital Territory and Tasmania recorded YoY declines.

- Sales of Light Commercial vehicles increased 11% YoY, with SUVs also recording a 7% increase.

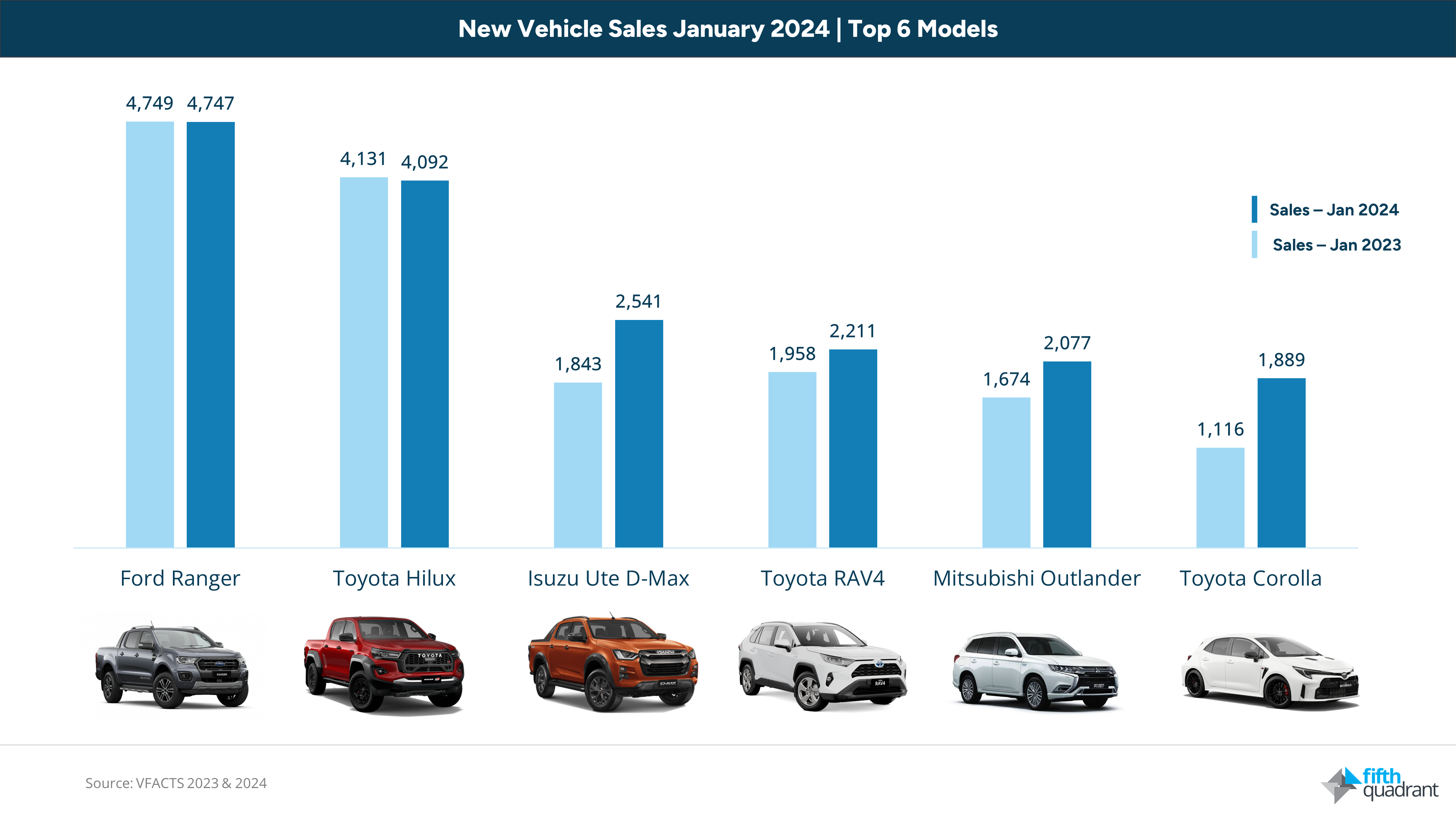

- The Ford Ranger topped the chart with 4,747 new vehicles, while the Toyota HiLux fell behind with 4,092 sales

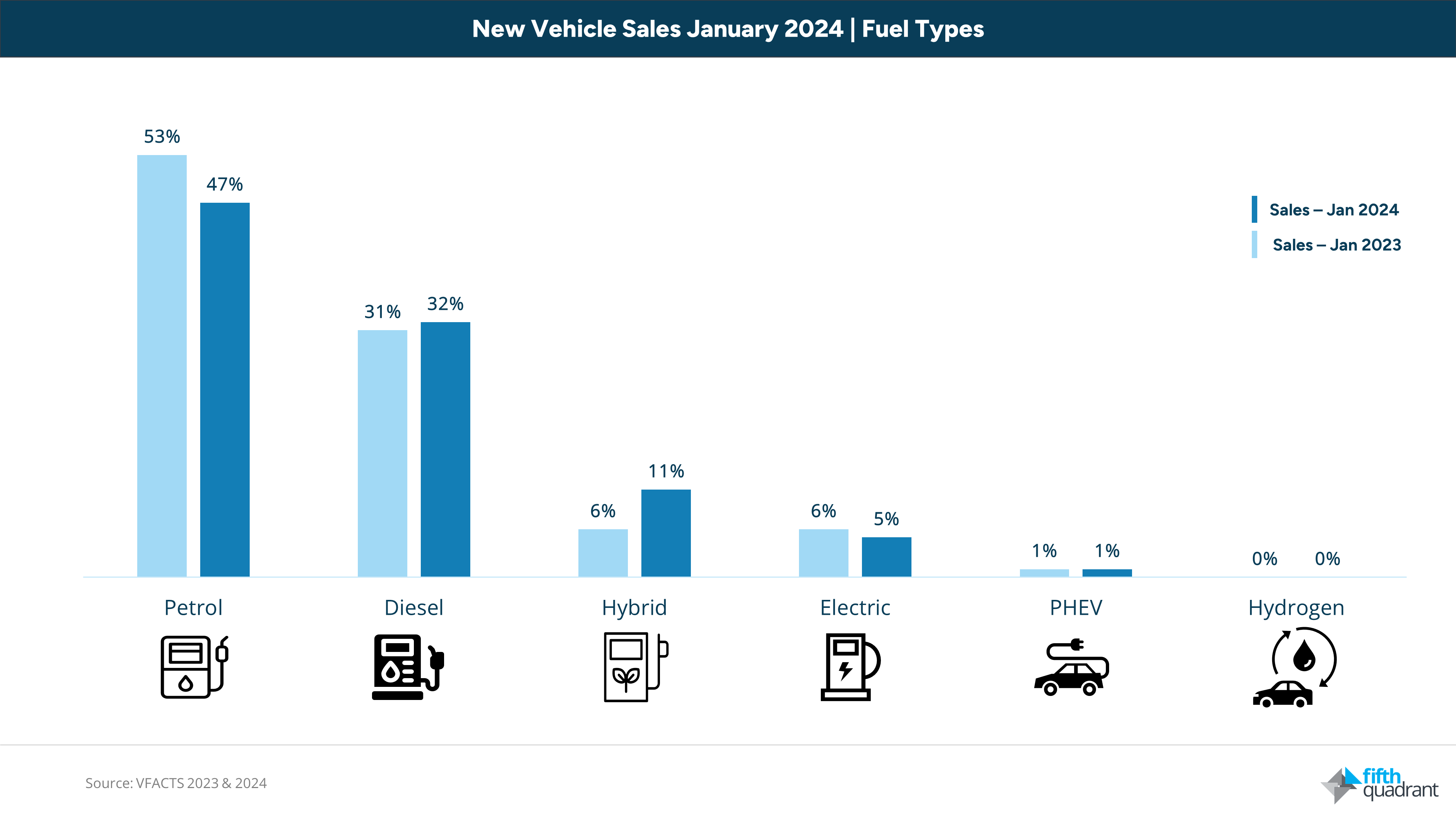

- Petrol sales have dropped 6%, with Hybrids taking up the slack with a 5% increase in market share (compared to January 2023)

- BYD sold 1,310 new vehicles of which 589 were BYD Seals, while Tesla sold just 1,107 new vehicles (their lowest since July 2022)

utes top the charts and toyota’s impressive sales growth:

This month, the focus is on Utes, with the top three models overall coming from this category. The Ford Ranger has maintained its lead over the Toyota Hilux, with similar results to last year. The Isuzu Ute D-Max takes the third spot, with a 38% YoY increase and 698 more new vehicles sold than last year.

At a brand level, Toyota has made a great start to 2024, up 34% on last year as it broke its January record (set in 2008). This is largely driven by improved vehicle supply, with examples like the Toyota Corolla up 69% YoY.

hybrids surge, while 4x4s boost diesel market:

Hybrid vehicles have seen a significant jump in market share, up from 6% to 11% as they take share from ICE competitors. Their growth is distributed across both the Passenger (up 137%) and SUV (up 75%) categories, putting them well ahead of their electric counterparts, which held steady at 5% of market (vs. 6% in Jan ’23).

While diesel vehicles are largely in line with January 2023, we can see a shift in the specific diesel vehicles being sold in Australia. Just 683 diesel passenger vehicles were sold in January 2024 (down by 34% from 2023), whereas sales of Diesel SUVs and Light Commercial vehicles are both up by around 10%.

If we were however to exclude commercial vehicles (that are still predominantly diesel-powered), there were 9,792 hybrid vehicles sold against 10,377 diesel ones. Twelve months ago, this was 5,136 vs. 9,844, which highlights the speed with which the market is shifting. If we include plug-in hybrids in our counts, the Jan ’24 number goes up to 10,772, putting them in clear second behind petrol-powered vehicles.

looking ahead

All indications are that the Australian automotive market will face some challenging times over the next 12 months. Supply chain issues are generally abating, but ongoing global uncertainty is likely to lead to more localised impacts that will flow through into the local market. While there is significant demand from vehicle buyers for lower emission vehicles, the dynamic between hybrid and battery electric appears to be shifting (and will shift further as we progress towards legislation of Vehicle Emission Standards. Ultimately, while the market shows continued growth, it will be important to monitor these trends closely in order to fully understand their impact.

If you’ve enjoyed this piece, keep an eye out for our regular updates on the Australian automotive industry. You can also find our 2023 year in review summary slides here.

Also remember that our b2b and consumer tracking research runs monthly. Click here to find out more, and feel free to get in touch if you’ve got questions that you’d like to answer.

Posted in Auto & Mobility, B2B, QN, TL, Transport & Industrial, Uncategorized