Author: Ben Selwyn | Posted On: 12 Feb 2025

For decades, Mercedes-Benz has been synonymous with luxury and innovation, but its passenger car sales in Australia have nearly halved since peaking in 2017. While significant locally, this trend isn’t unique to Australia – globally, the brand has been shifting away from mass-market luxury to focus on high-end models, exclusive variants, and commercial vehicle growth.

At the same time, Mercedes-Benz’s commercial segment is gaining traction, with steady van sales and increasing investment in electric power trains and fleet solutions. This raises an important question: Is Mercedes-Benz gradually transitioning into a commercial vehicle-first brand?

Three (possibly) surprising insights

- Almost one in four Mercedes-Benz vehicles sold in Australia in 2024 were commercial vehicles (23% of total sales).

- Passenger vehicle sales are down 46% from their peak in 2017.

- The top-selling Mercedes-Benz model in 2024 was a van (Mercedes-Benz Sprinter, 3,983 sales).

Passenger Cars in Decline, Vans on the Rise

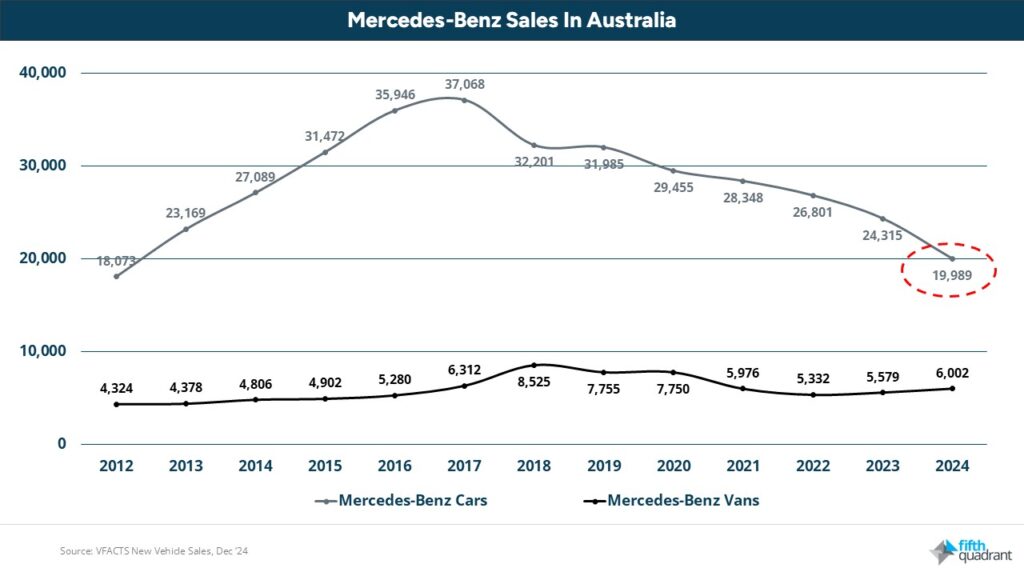

Splitting out brand sales between Mercedes-Benz Cars and Mercedes-Benz Vans, we can see the sharp decline in passenger car sales over the past decade, dropping from a peak of 37,068 in 2017 to 19,989 in 2024.

On the other hand, Mercedes-Benz van sales have remained relatively stable, fluctuating between 5,000 and 8,500 units per year. This segment saw a modest uptick in 2024, reaching 6,002 units and reinforcing the brand’s steady presence in the commercial vehicle market (encompassing both heavy vans and trucks).

The Decline of the C-Class and Shifting Sales Balance at Mercedes-Benz

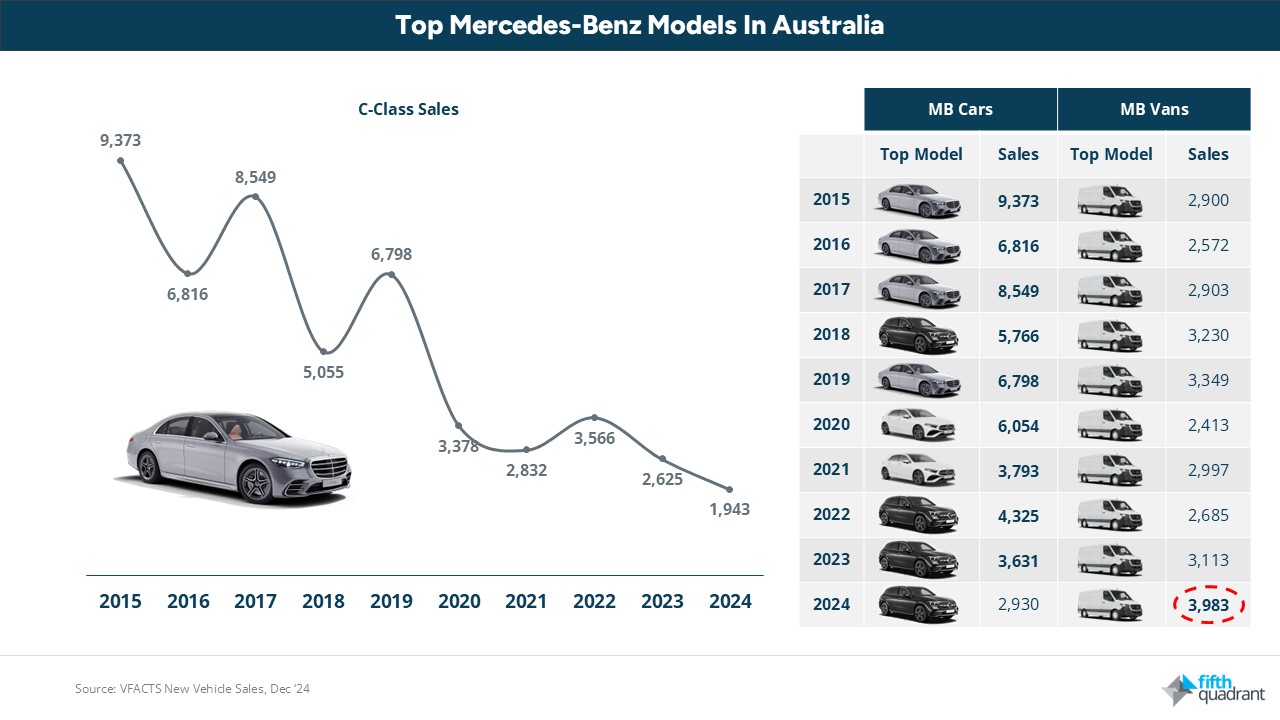

To uncover what’s going on with passenger vehicles though, we need to go deeper into performance across some specific key models. In particular, the C-Class. For years, the Mercedes-Benz C-Class was the brand’s flagship model in Australia. In 2015, it was the top-selling vehicle with 9,373 units sold. Fast forward to 2024, and sales have collapsed to just 1,943 units.

This sharp decline mirrors a global shift in consumer preferences, as SUVs and electric vehicles take precedence over traditional sedans. Buyers are increasingly seeking practicality, technology, and electrification, leaving legacy sedans struggling for relevance. This is visible in the sales data, with the GLC SUV the top selling Mercedes-Benz Cars model for the last three years running. Unfortunately though, it’s doing this on the basis of reducing volumes, dropping from 4,325 in 2022 (and 5,766 when it previously led the brand in 2018) down to just 2,930 sales in 2024.

Meanwhile, Mercedes-Benz vans have quietly taken over. Last year, for the first time ever, a commercial vehicle outsold any passenger model – the Sprinter van led the lineup with 3,983 units sold. This underscores the brand’s growing reliance on commercial success as demand for fleet and logistics solutions expands.

looking ahead

If the current trajectory continues, Mercedes-Benz may no longer be a luxury-first brand, but a commercial-first brand with a premium halo. This shift would have major implications for dealers, fleet operators, and consumers alike.

The key question that we need to consider though is whether this strategy will succeed? Can the brand maintain profitability and exclusivity while reducing its reliance on passenger cars? And if so, which existing or emerging competitor brands will fill the gap in the luxury market it leaves behind?

Want more of this content? Sign up for our newsletter here to ensure you stay up to date with our monthly updates.

Also remember that our b2b and consumer tracking research runs monthly. Click here if you have questions you’d like to ask.

Posted in Uncategorized