Author: Matthew Beatty | Posted On: 13 Feb 2024

The Australian automotive industry has recorded healthy new vehicle sales over the last decade, with an average of 1.1 million new vehicles entering the car parc each year (and a record of 1.2 million set in 2023). From this, the Australian car parc has been growing at a steady rate of 2% every year, with our estimates predicting it will go from the 19 million passenger and light commercial vehicles currently registered to more than 22 million by 2028.

This macro performance also underpins a significant parts and accessory ecosystem, which has similarly been growing strongly in recent years. In this article, we unpack that further, drilling into trends across a range of service parts, workshop consumables and upgrade parts.

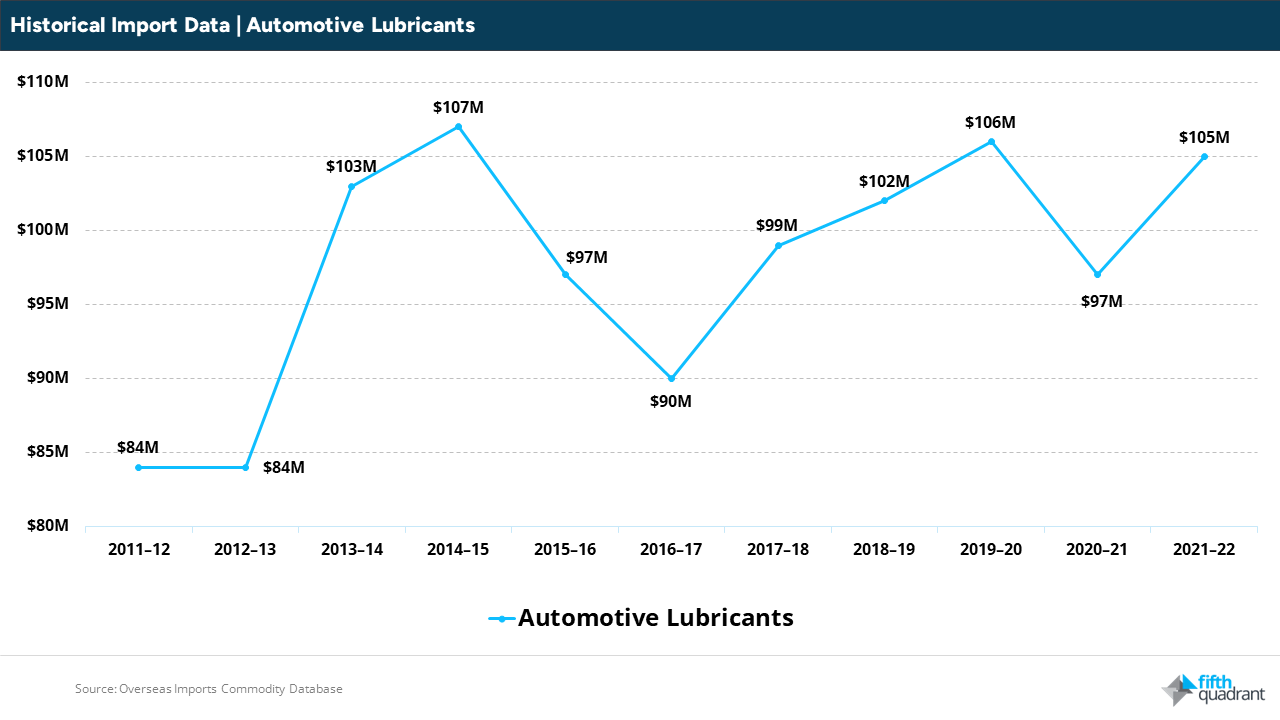

automotive lubricants

Starting with automotive lubricants, the historical import data reveals a frequently fluctuating trajectory, with annual volumes ranging between $84m and $107m over the past decade. Despite a 20% increase over this period, the more recent numbers remain marginally behind the peak recorded in 2014-15. While the sharp upward trend in 2022 was a positive shift, the nation’s progress towards electrification (and associated impact on servicing requirements) suggests the longer-term forecast is likely to be less positive.

Household essentials such as fuel and electricity saw significant price rises in 2023, as the Consumer Price Index (CPI) increased by 5.4% in the 12 months preceding Q3 2023. As a result, many are now saving less, with the household saving ratio falling to 1.10 percent in Q3 2023, the lowest level since December 2007.

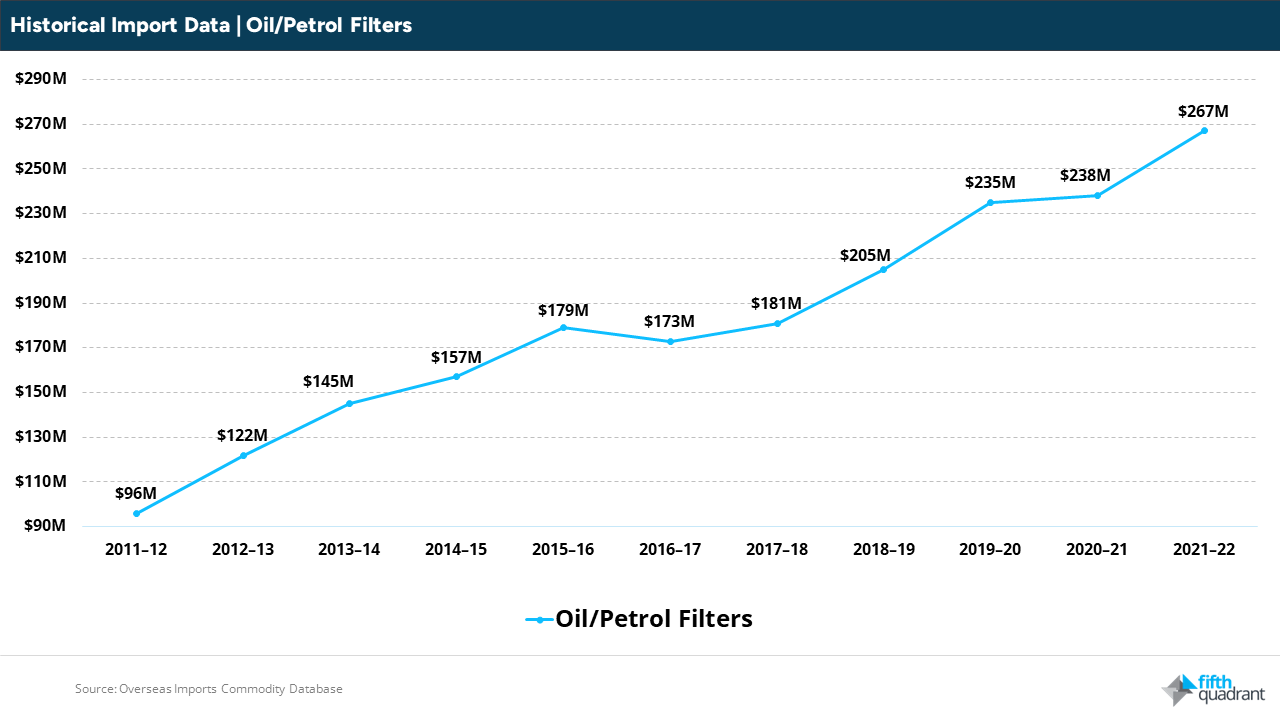

automotive service parts

Redirecting our focus to service parts, we can see healthy and consistent growth in the demand for oil and petrol filters. Unlike engine oils, this trend also continued through the COVID-impacted years. Looking over the decade, this translates to an impressive 178% increase, highlighting the importance of these products when it comes to sustaining the health and efficiency of automotive engines.

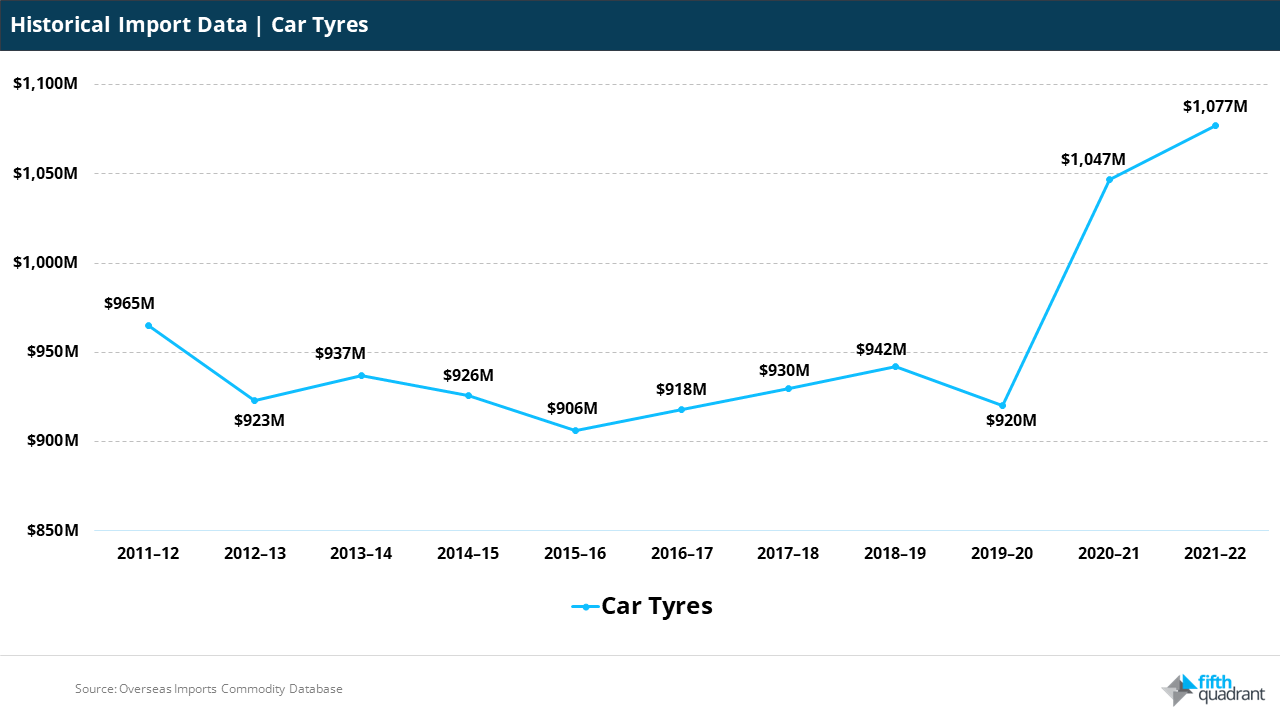

tyres

Shifting attention to tyres, we can see a significantly different trend over the past decade. This market remained largely static between 2011 and 2020, before rapidly growing more than $100m in 2020-21. While we can’t specifically link this change to one factor, Australians have definitely taken more trips (and increased the wear and tear on their tyres) off the back of COVID-19, with staycations and local travel becoming more popular. Shifting vehicle preferences will also have played a role, with the growing popularity of heavier vehicles such as utes and SUVs increasing wear and tear, but also contributing to the demand for specialised tyres.

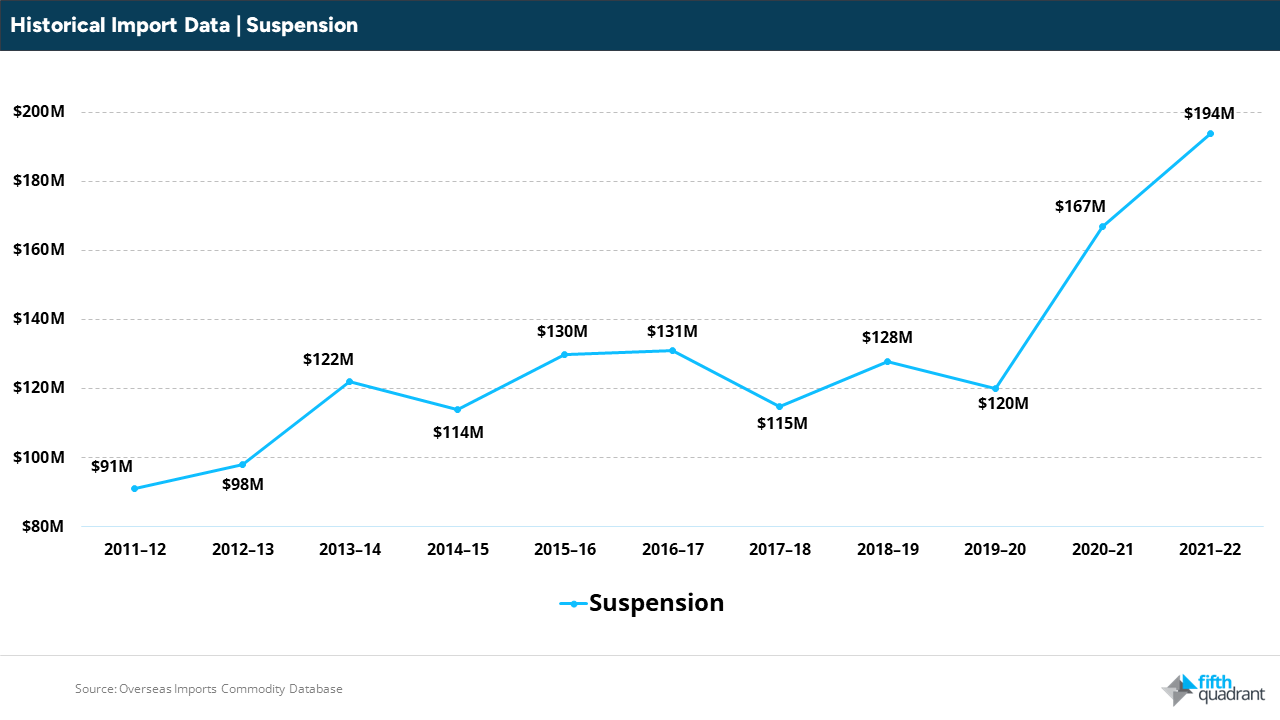

suspension

Looking further into the sector, we can see a similar trend in upgrade parts like suspension as to the tyre market. Between 2011 and 2020, the market experienced steady growth, with average YoY increase of 4% aligning with growth in the national car parc. As with tyres, the suspension market then recorded an incredible 62% increase between 2020 and 2022, likely also driven by COVID-19 behaviour change. This rapid rise could be attributed to Australia’s growing interest in 4×4 driving and accessories, with newfound enthusiasts spending their money on upgrades such as shock-absorbers or lift kits.

summary

This analysis of historic import data spanning the last decade for lubricants, oil/petrol filters, car tyres, and suspension has revealed intriguing patterns. There is clearly substantial (and in many cases growing) value in aftermarket manufacturing and sales. Despite the escalating popularity of electric vehicles in Australia, reaching 7% of sales in 2023, it is crucial that we not overlook the importance of internal combustion vehicles to this industry. While the noticeable shift in Australians’ behaviour may not persist over the longer term, the aftermarket appears well positioned to play a significant role in the Australian automotive industry for the foreseeable future.

If you’ve enjoyed this piece, keep an eye out for our regular updates on the Australian automotive industry.

Also remember that our consumer and SME tracking programs run monthly. Click here to find out more, and feel free to get in touch if you’ve got questions that you’d like to answer.

Posted in Auto & Mobility, QN, TL, Transport & Industrial