Author: James Organ | Posted On: 08 Aug 2024

Updates to this research are published monthly. View previous wave

The latest edition of Fifth Quadrant’s SME Sentiment Tracker shows ongoing downward pressure on revenues, with 40% of businesses reporting lower revenues than 12 months earlier. This is a significant increase from the 29% reported in February. The most significant declines are observed in the distribution, retail, production, and construction sectors, highlighting the widespread impact on sectors foundational to overall economic stability. Additionally, loan stress is steadily increasing, with 13% of SMEs expecting difficulties making debt repayments over the next three months, up from 9% in April.

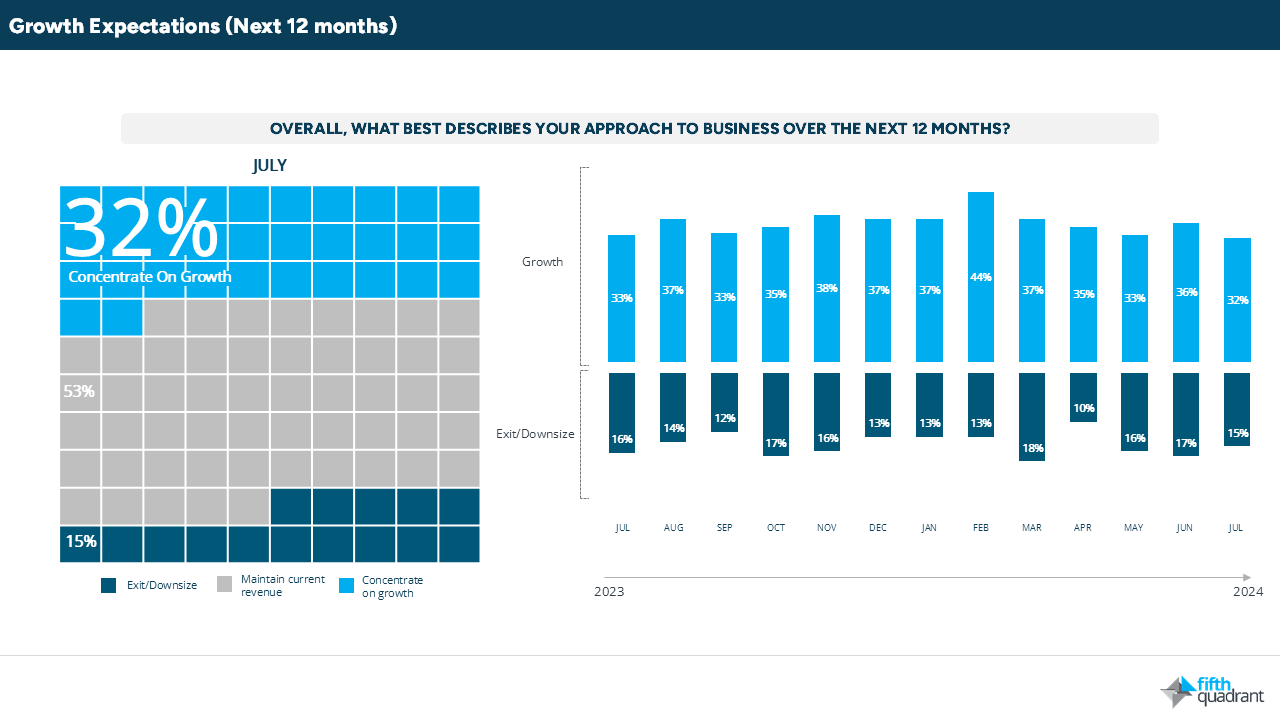

growth expectations

Given the heightened economic uncertainty and the emphasis on cost management, it’s no surprise that growth ambitions are being deprioritised by many businesses as they focus on sustaining operations rather than expanding. Currently, only 32% of SMEs are focused on growth, compared to 44% in February.

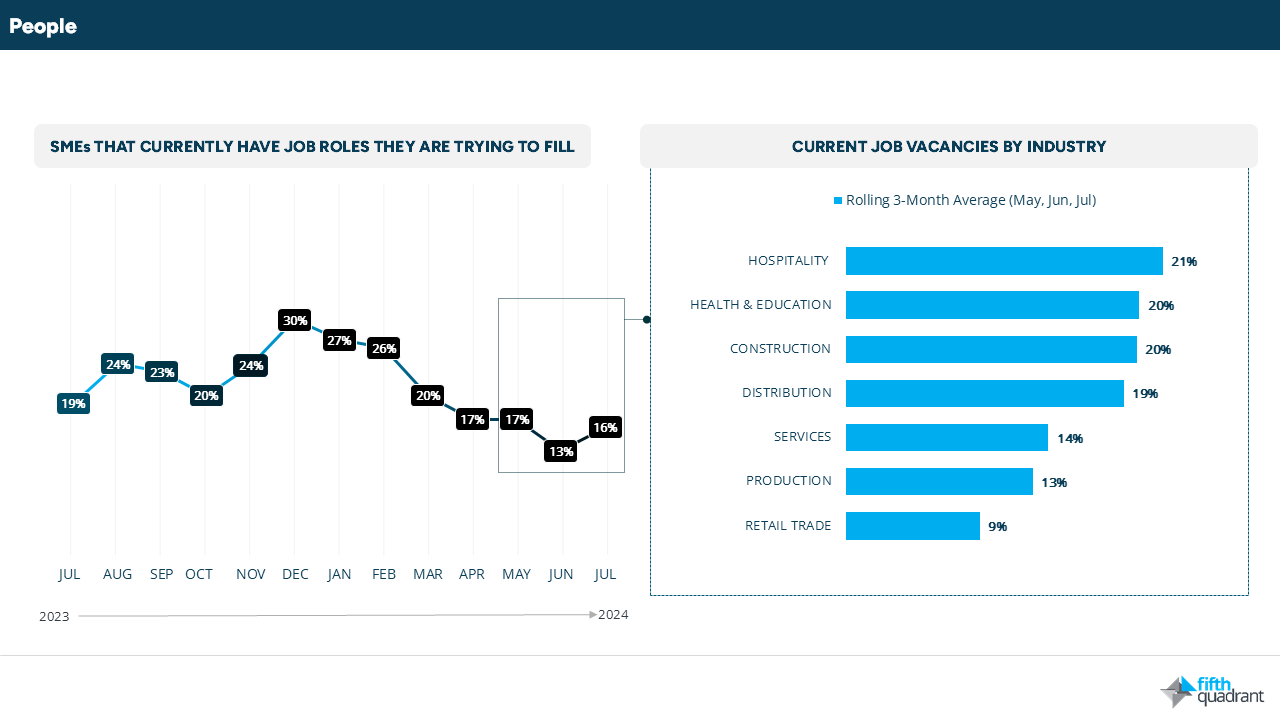

people

Furthermore, the labour market is reflecting these economic pressures. All employee indicators are trending downward, suggesting a tough time for job hunters in the short term. Consequently, recruitment activity remains well below the norm, currently at 16%, compared to 26% six months earlier.

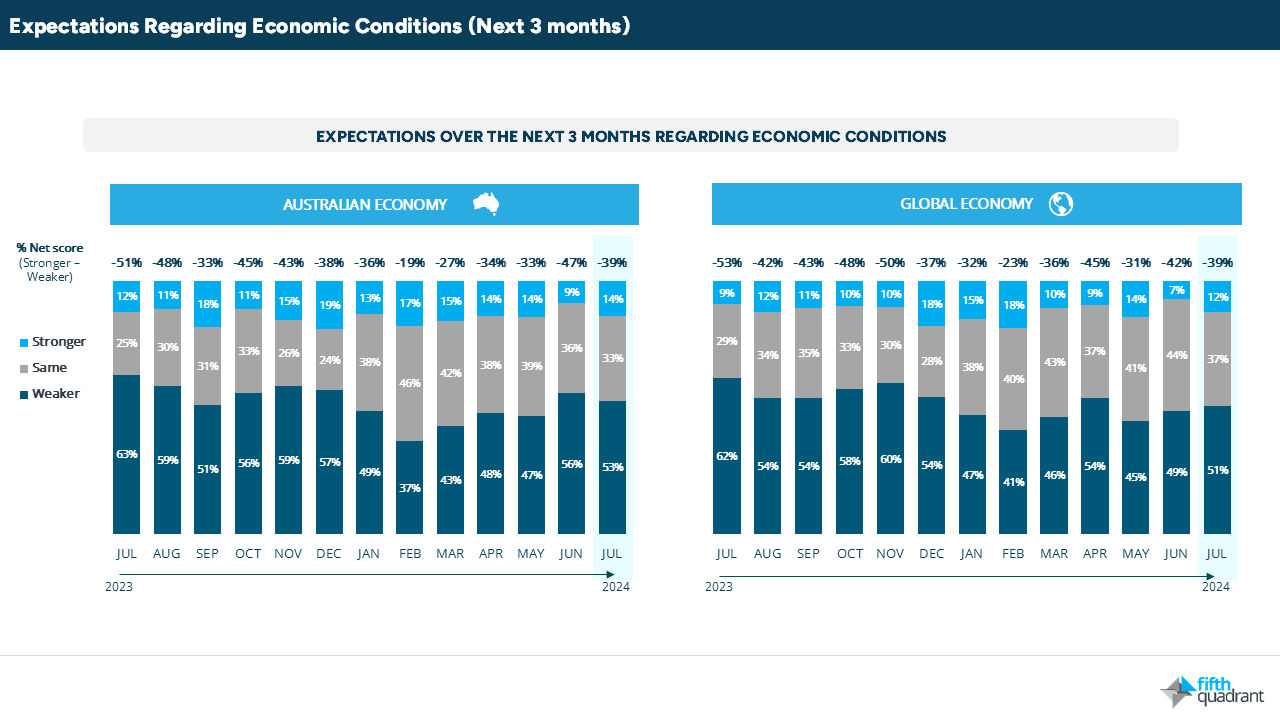

economic conditions

Confidence in both the Australian and global economies has seen a slight improvement since the spike last month. However, with increasing discussions about potential recessions globally, any hopes of recovery might be short-lived.

In summary, revenue and sentiment continue the ongoing decline that began in early 2024. Consequently, growth aspirations are on hold, with cost management and efficiency becoming key priorities, especially as interest rates are unlikely to be lowered anytime soon. Recruitment activity remains low, and we expect unemployment to keep rising in 2024.

Please click on this link to access the full report including subgroup analysis by industry sector, size of business and State. Fifth Quadrant and Ovation Research publish monthly updates of this research here. For any questions or inquiries, feel free to contact us here.

Posted in Financial Services, B2B, QN, TL