Author: Ben Selwyn | Posted On: 09 May 2024

In the Australian automotive landscape, the real showdown isn’t Ford versus Ferrari at Le Mans, but rather Ford versus Toyota—a rivalry that impacts the daily lives of consumers much more than any high-speed race. This contest isn’t about sleek racing stripes; it’s about dependable workhorses like the Ford Ranger and Toyota Hilux, vehicles that are essential for everything from the urban commute to rugged off-road adventures.

Over the early 2010s, Toyota dominated the market, but subsequent strategic shifts by Ford have dramatically reshaped their lineup to directly challenge this dominance. Both brands have adapted to evolving consumer needs, underscoring the importance of this competition not just for the economy, but for everyday Australians who depend on these vehicles for reliability and versatility.

In this analysis we’ll explore the strategies that have driven their success to date, and how these automotive giants are gearing up for the future.

the journey so far

2013-2016: Toyota Leads

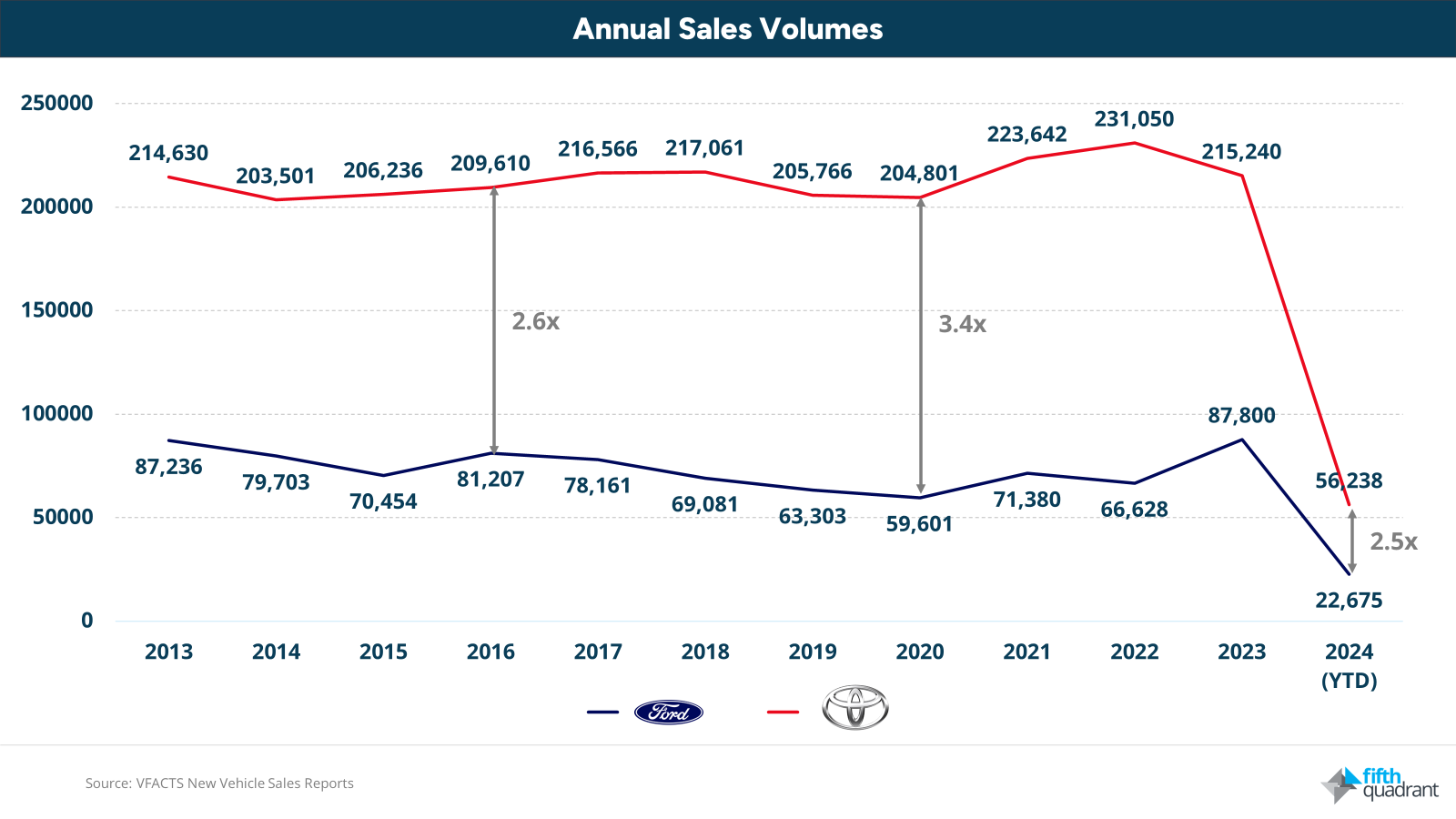

In the early 2010s, Toyota firmly held the upper hand in the Australian market. In 2013, while Ford sold 87,236 units, Toyota significantly outperformed it with 214,630 vehicles sold. During this period, Toyota consistently outsold Ford by about 2.5:1, a reflection of its strong brand presence and diverse vehicle lineup that resonated well with Australian consumers.

2017-2019: End of Local Ford Manufacturing

The landscape began to shift as Ford transitioned to an import-only model in Australia, resulting in a substantial drop in sales. By 2019, Toyota’s sales ratio climbed to 3.25 vehicles for every Ford vehicle sold (205,766 to 63,303), highlighting the challenges Ford faced in maintaining market share during this transition.

2020-2023: Pandemic Impact and Market Shifts

The automotive industry was not immune to the disruptions caused by the COVID-19 pandemic, with both brands experiencing significant sales declines, particularly in 2020. However, the launch of the new Ford Ranger in 2022 marked a turning point for Ford. This strategic move not only revitalized Ford’s sales, climbing to 87,800 units in 2023, but also brought the sales ratio against Toyota back to 2.45:1.

shifting vehicle preferences

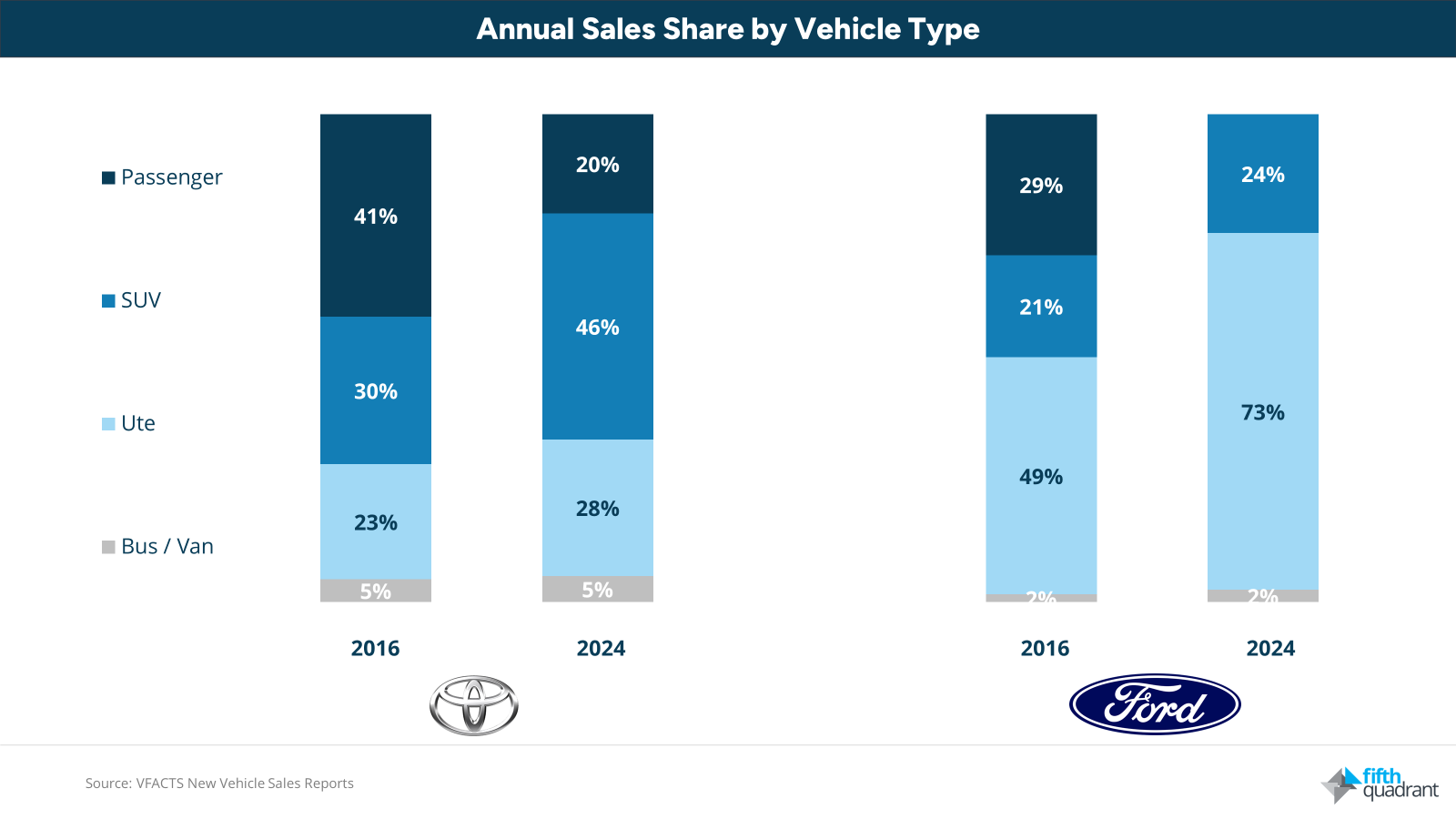

As we delve deeper into the competition between Toyota and Ford, significantly different approaches to shifting consumer vehicle preferences become clear.

Toyota’s Transition:

In 2016, Toyota offered a balanced portfolio with passenger vehicles leading at 41%, followed by SUVs at 30%, and Utes at 23%. By 2024, SUVs had surged to 46% of Toyota’s sales, while the share of passenger vehicles halved to 20%. This shift aligns with global trends towards more versatile vehicles that cater to both urban and adventure-driven lifestyles.

Ford’s Strategic Shift:

Ford underwent a more pronounced transformation. From a fairly diversified portfolio in 2016, where Utes constituted 49% of sales, by 2024 this was up to 73%. This underscores Ford’s bet on the growing popularity of Utes as both work and lifestyle vehicles in Australia, but its reduced focus on passenger vehicles and SUVs risks a loss of brand relevance.

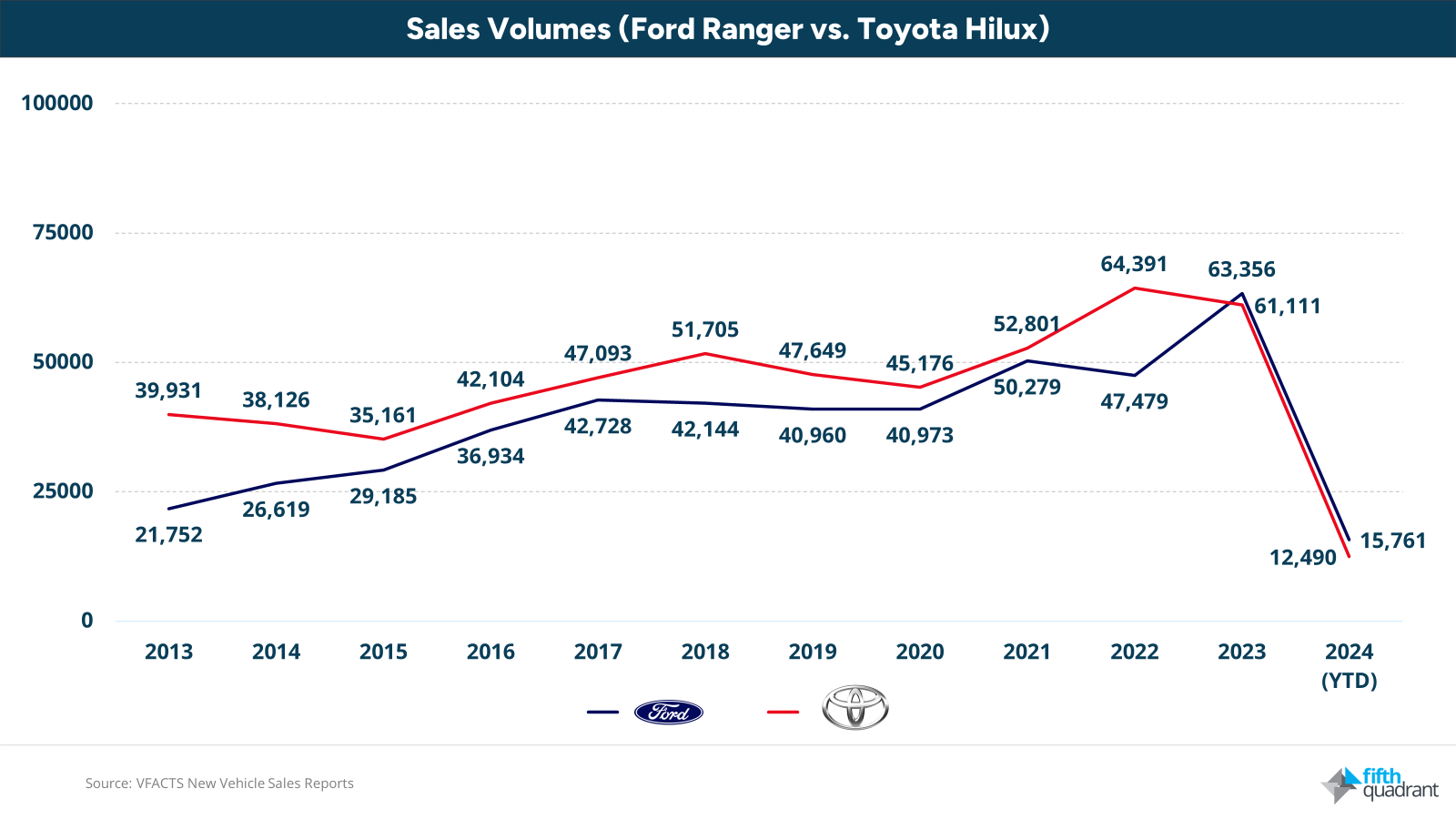

Ranger vs. Hilux

Given Ford’s strategic emphasis on utes, the Ranger has become its flagship model. Comparing its performance to Toyota’s Hilux offers a compelling case study of market dynamics within the segment. Both models have been frontrunners, not only as utes but across the entire market, reflecting their broad adaptability and appeal.

Over the past decade, as utes transitioned from being predominantly trade tools to versatile family vehicles—equally adept at ferrying sports equipment as they are in transporting construction gear—sales soared. For many years, the Hilux led this segment, often being the best-selling vehicle in Australia.

However, in 2023, the dynamics shifted dramatically. Following the release of its new model, the Ford Ranger not only closed the gap but surpassed the Hilux with a total sales figure of 63,356 units, over 2,000 more than its competitor. This raises questions about the future trajectory of this rivalry. With Ford now leading, the pressure is on Toyota to innovate and reclaim its position. As we move forward, the strategies deployed by both companies will be critical in determining who will dominate the utility vehicle market in the years to come.

where to from here

The evolution of Australia’s automotive market over the past decade, underscored by the intense competition between Ford and Toyota, highlights a dynamic industry that adeptly adapts to consumer preferences and economic fluctuations. Ford’s strategic pivot towards utility vehicles and Toyota’s balanced approach to maintaining strength across various segments illustrate their diverse responses to changing market demands.

These strategic adjustments not only reflect shifts in consumer lifestyles but also underscore a tactical adaptation essential for staying relevant and competitive in a rapidly evolving market. Understanding this dynamic offers insights into how both automotive giants are positioning themselves for future challenges and opportunities.

As global trends towards greener technologies and smarter vehicles accelerate, the role of consumer feedback in shaping these innovations becomes ever more crucial. For enthusiasts and consumers alike, the journey ahead promises more choices, better vehicles, and exciting developments. Stay connected and join the conversation as we explore the future of driving in the ever-evolving world of cars.

If you’ve enjoyed this piece, subscribe to our newsletter to stay up to date with our latest content. You can also find our 2023 year in review summary slides here.

Also remember that our b2b and consumer tracking research runs monthly. Click here to find out more, and feel free to get in touch if you’ve got questions that you’d like to answer.

Posted in Auto & Mobility, B2B, QN, TL, Transport & Industrial, Uncategorized