Author: Brad Ripps | Posted On: 18 Jul 2024

As the first half of the year ends, it’s a good time to reflect on the changes we’re seeing in the automotive market, and how these might play out through the rest of 2024 and beyond. Each of these are also important considerations and inputs as we produce the 5th Edition of the Fifth Quadrant New Vehicle Sales & Car Parc Forecasts.

Whilst we incorporate a range of factors in the model, here are three macro trends that we believe will significantly impact the Australian market in the years ahead.

NVeS launched, EVs and Hybrids to follow

The New Vehicle Efficiency Standard (NVES) is now legislated and will launch on 1 January 2025. This will have a profound impact on manufacturer ranging decisions and ideal sales volumes, bringing lower emitting vehicles into the Australian car parc, and helping electric vehicles step beyond early adopters and into the mainstream.

This shift may not happen as quickly as first thought though, with the time lag on the scheme starting and introduction of penalties giving manufacturers a window to clear stock of their existing (higher emitting) vehicles, while they plan for future range updates.

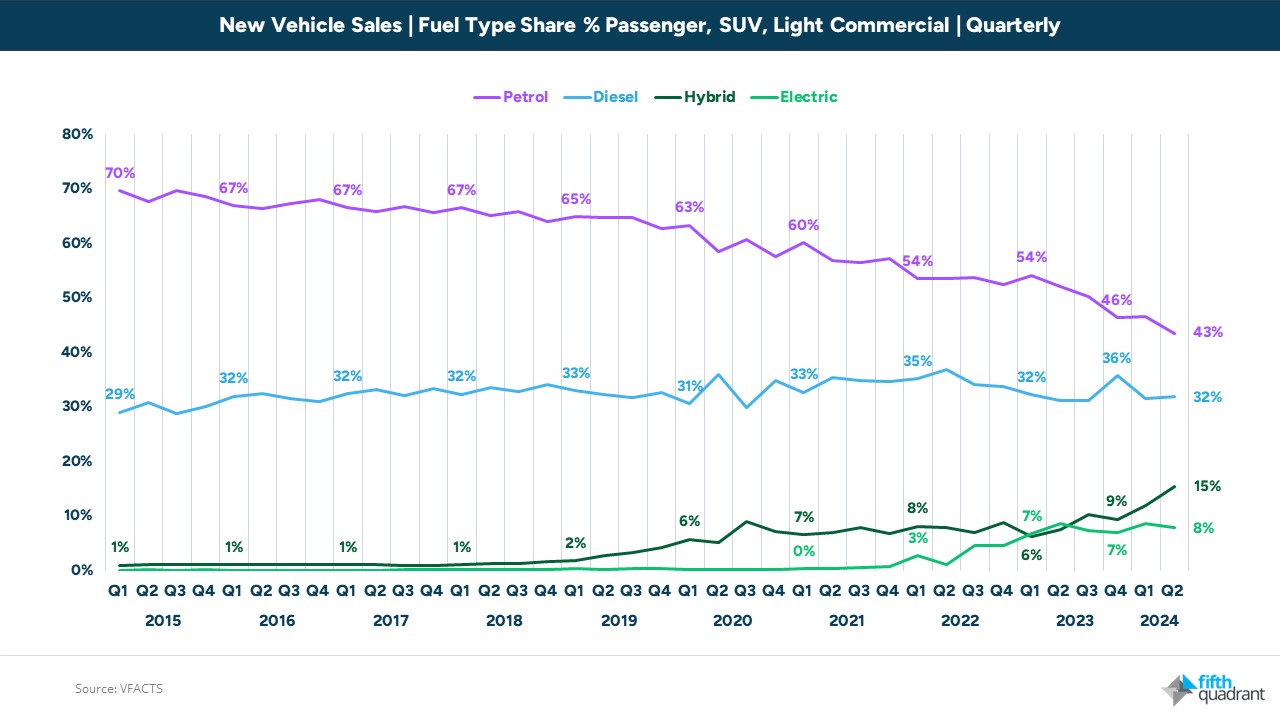

Looking beyond this though, while we have already seen hybrid and electric vehicles eroding share from petrol, manufacturers will need to introduce lower emission alternatives to some of the diesel workhorses currently present on Australian roads. Given many Australians remain wary of transitioning to fully electric vehicles, we expect Hybrids and Plug-In Hybrids to remain compelling options here through the rest of this decade.

subsegment shift

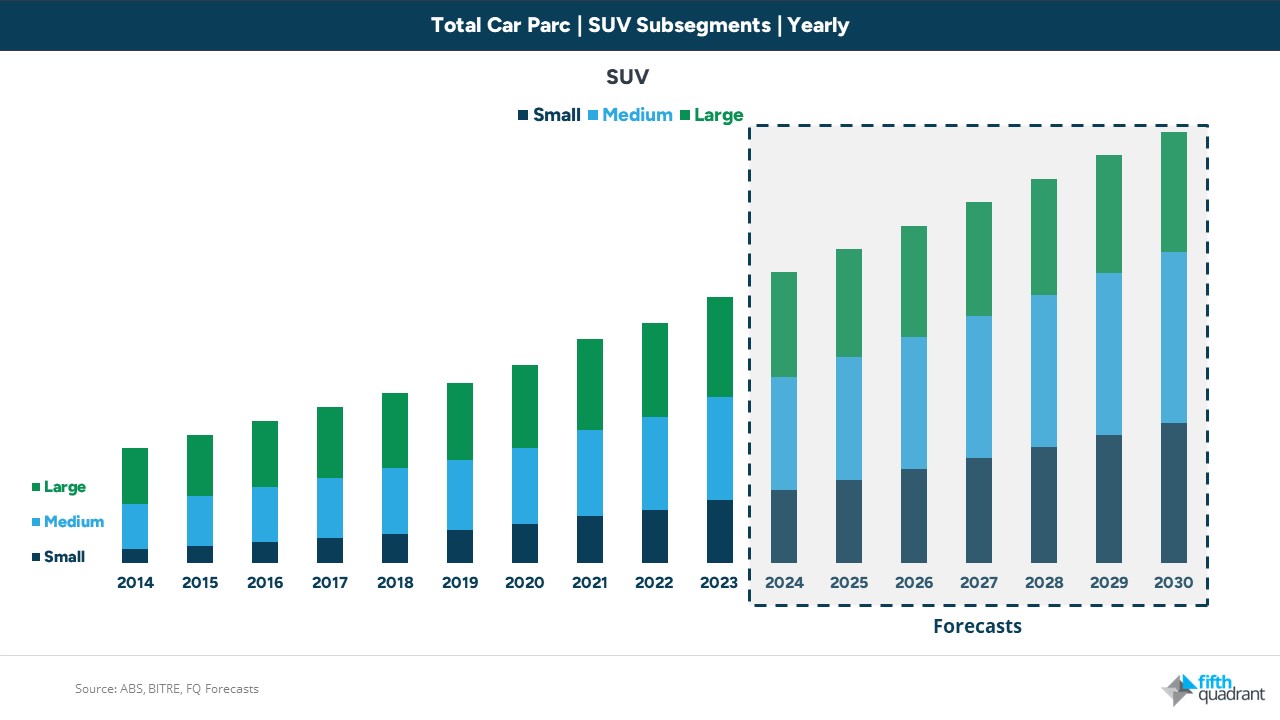

Australians might love their Utes, but SUVs have the spotlight. This segment has more than doubled over the last 10 years, with more than 5 million on road today. This trend will be challenged by the NVES, as the emissions on many current-generation medium and large SUVs will exceed what’s workable within the new framework. Manufacturers will likely either be forced to raise prices or drop models (if an electric or Hybrid option is not available). We are also however expecting to see the drive for efficiency underpin a continued shift towards Small SUVs – while this subsegment barely existed in 2014, we see it overtaking Large SUVs by 2030.

is 1.2m the new normal?

COVID placed a significant strain on the industry’s ability to get new vehicles into the country, creating a significant backlog for many OEMs and dealerships. This led to the average wait time for a new vehicle peaking at 159 days in August 2022 (Source: pricemycar.com.au). Increased import volumes and clearing back orders played a significant role in the market cracking 1.2m new vehicle sales in 2023, but average wait times are now down to 65 days, and economic conditions continue to weaken.

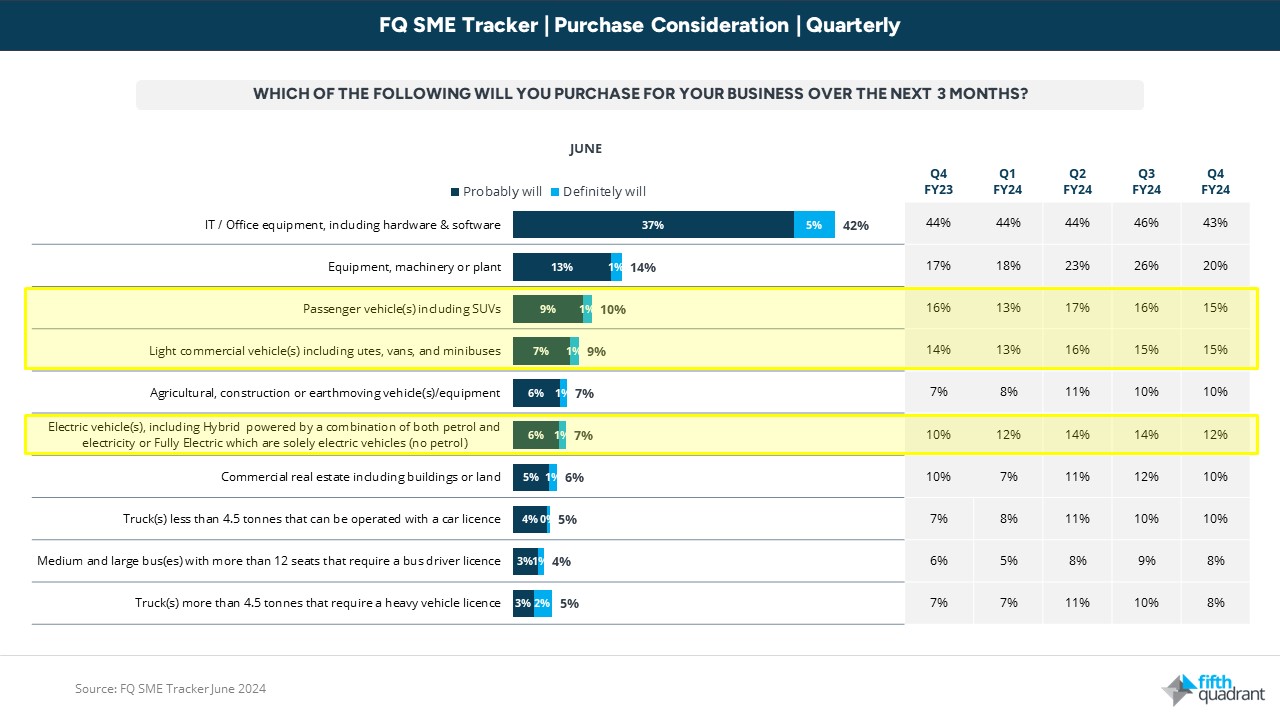

The market has historically been able to rely on fleet buyers to help make up for weaker consumer confidence, but the latest edition of the Fifth Quadrant SME Tracker shows a significant reduction in vehicle purchase intentions (with businesses instead focused on cost reduction). In the short term, sales are likely to remain solid (at the expense of margin as OEMs and dealerships use incentives to move existing vehicle stock), but this is likely to have an impact going forward. Therefore, while we forecast the 2024 market to again exceed 1.2m, we then see a slight downturn in 2025 as import volumes are reduced.

wrap up

Forecasting is a challenging task; in developing our model, we consider a wide range of data sources to as best possible reflect the changing nature of the Australian marketplace, and likely future trends in consumer and business purchasing behaviours.

Click here to find out more about the forecasts, or purchase the latest edition. Otherwise, get in touch with one of our team directly to talk them through in more detail.

Posted in Auto & Mobility, B2B, QN, Transport & Industrial, Uncategorized