Author: Amelia McVeigh | Posted On: 13 Mar 2024

February witnessed another strong month in the Australian automotive market, with 105,023 new vehicles sold (up 21% vs. Feb 2023). Highlights this month include an increase in medium passenger vehicles (with Tesla Model 3 and Toyota Camry responsible for the majority of the uplift), while fleet buyers have also been busy so far this year, increasing YTD purchase volumes by just under 10k.

top takeaways:

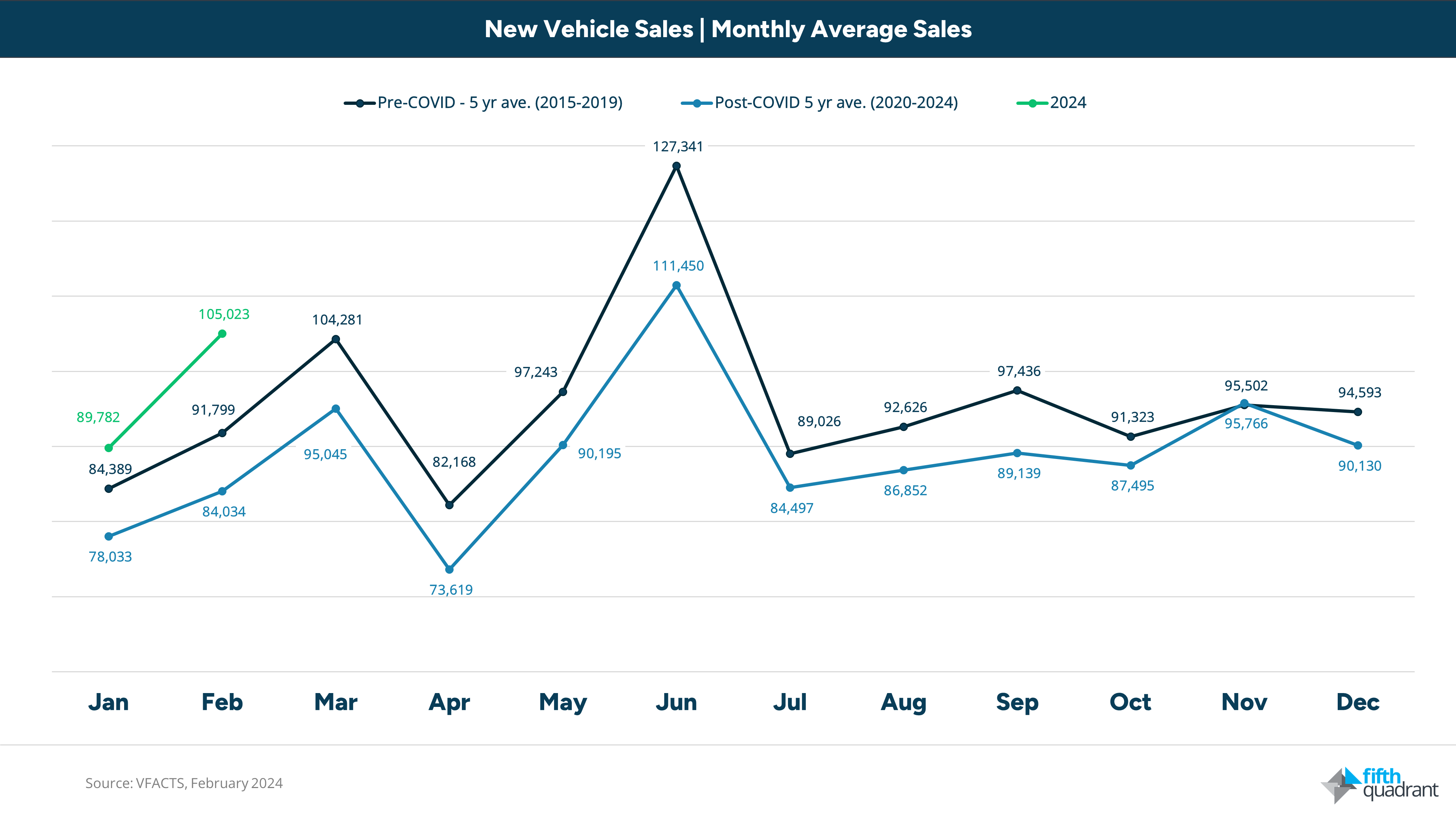

- February saw record New Vehicle Sales with 105,023 sold, significantly higher than the 10-year average of 90k

- Medium passenger vehicle sales nearly doubled from January: 7,003 sold compared to 3,763 in January 2024, with Tesla Model 3 responsible for 41% (2,870) of the MoM increase

- Toyota’s had a good start to the year, with the Corolla and Camry seeing YTD increases of 88% and 259% respectively

- Ford Ranger continues to dominate, topping both 4×2 and 4×4 in Feb with 5,535 total sales (vs. 4,403 for Toyota Hilux)

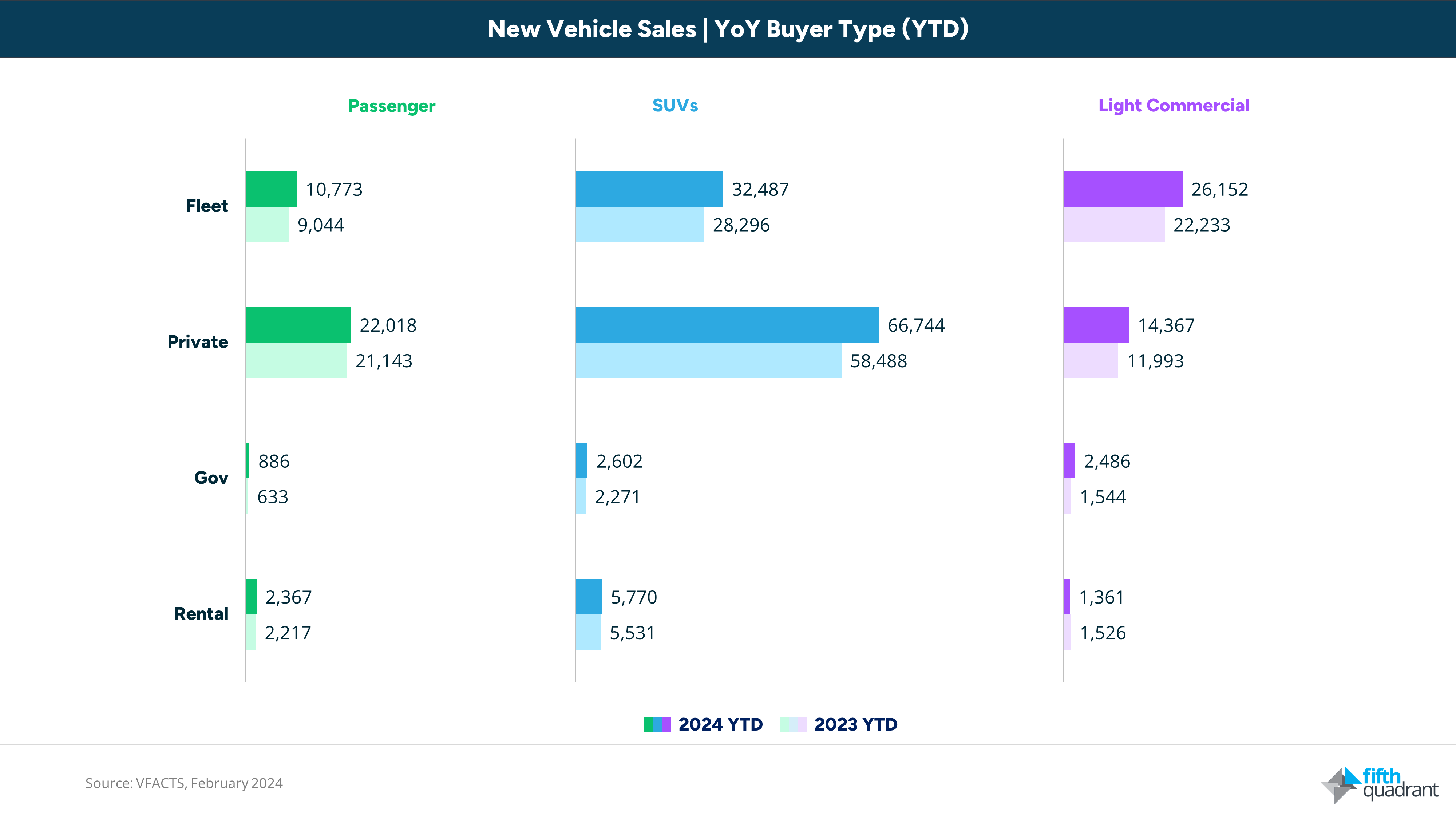

- Fleet buyers are partly responsible for the February surge, up 17% overall YTD compared to last year (69,412 vs 59,573)

strong start to the year suggests market on track to repeat 1.2m

The first two months of the year are well out in front of recent history (both the last 5 years, and the pre-COVID period). While the market is likely to cool as the remaining pre-orders are fulfilled, this suggests a strong year ahead. Our forecast suggest that we’re again on track to be close to (if not slightly above) 1.2m vehicles sold for the year.

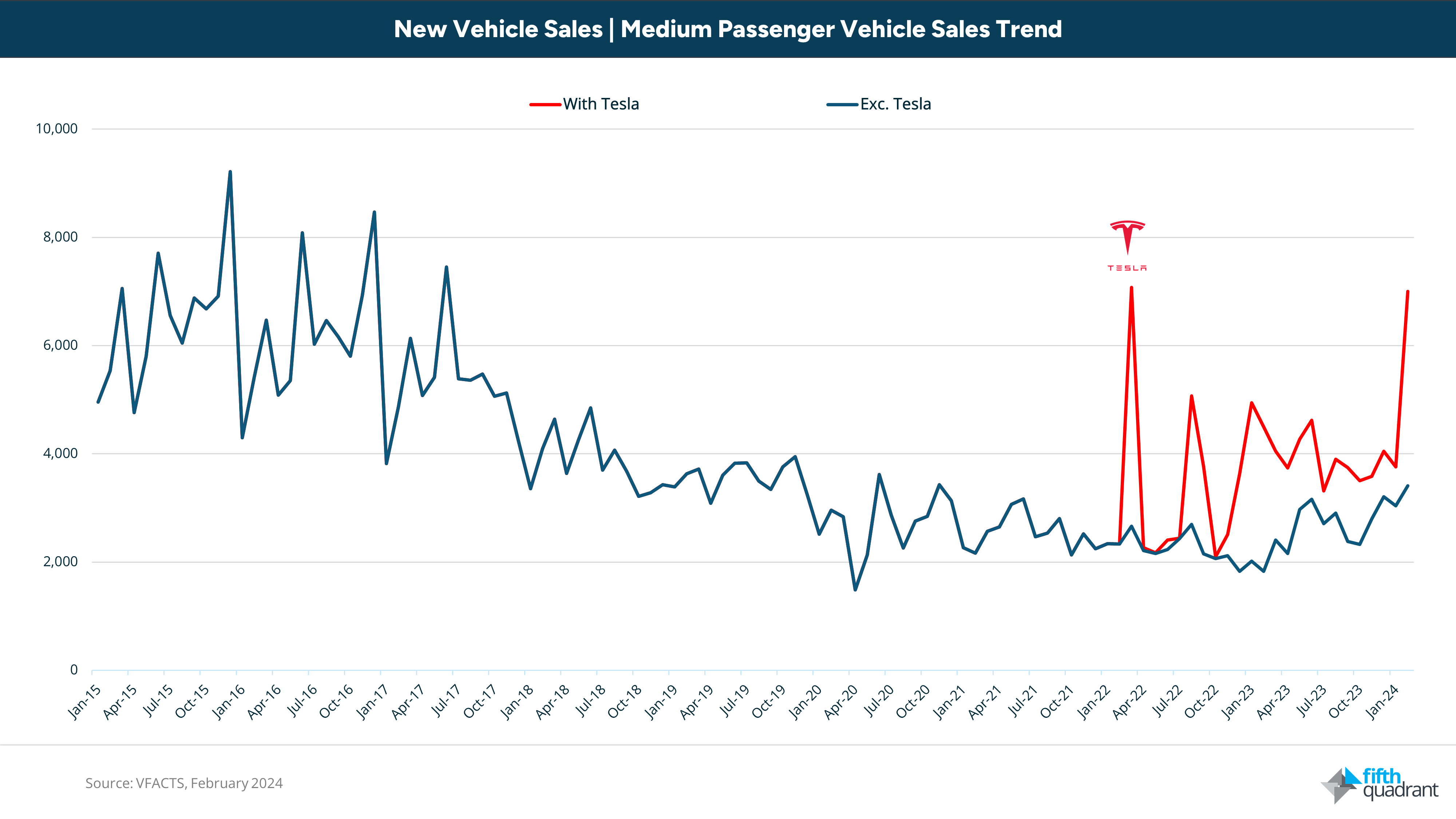

everything that’s old is new again: is Tesla the reason medium passenger vehicles are back?

Medium passenger has been a category in decline for the past decade, dropping from around 6,000 units per month in the mid 2010’s to around 2,500 per month through 2021. It’s back on the radar in 2024 though, with February recording the highest single month result since June 2017 (Mar ’22*).

Digging deeper however, Tesla’s Model 3 is the driving force for this uplift. Without it, medium passenger vehicles remain at a monthly average of 2.5k. The Model 3 is responsible for more than one in three (35%) medium passenger sales since tracking started, and in February 2024 broke the record for monthly sales (3,593 vehicles). On a smaller scale, the once loved Toyota Camry is also making a comeback, reporting the second largest sales since the start of 2020 (1,552).

*Tesla Model 3 figures from March 2022 represented Q1. From April 2022, numbers were reported Monthly

the rise of the fleet ute

This year is off to a strong start for fleet buyers with just under 70k vehicles sold, a 17% increase from the previous year. While SUVs are always a popular option, Light Commercial make up more than a third of fleet purchases (38% vs 14% of private sales), and are a key factor in sales growth. We see this trend in Government fleets too; they’re up 34% YTD (+1,526 vehicles), with light commercial driving the bulk of that increase (+942 vehicles YTD).

looking ahead

The Australian new vehicle market is running hot, but this is still to an extent due to a backlog of pre-existing orders. Longer wait times are gradually declining for most brands (except Toyota), suggesting we’re getting down to the end of the lists. Given this, it is likely that many dealerships will soon start to have stock on hand ready to sell and drive right out the door. Allied with increasing new vehicle prices that see just one vehicle currently on the market under $20k, there will be a tipping point where cost-of-living pressure starts driving down sales.

We’ll be carefully monitoring used vehicle activity through this year, assessing whether prospective new vehicle buyers facing financial pressure are shifting to dealer pre-owned vehicles, or making the jump to the private market.

If you’ve enjoyed this piece, keep an eye out for our regular updates on the Australian automotive industry. You can also find our 2023 year in review summary slides here.

Also remember that our b2b and consumer tracking research runs monthly. Click here to find out more, and feel free to get in touch if you’ve got questions that you’d like to answer.

Posted in Auto & Mobility, B2B, QN, TL, Transport & Industrial, Uncategorized