Author: accounts fifthquadrant | Posted On: 27 Mar 2025

At first glance, February 2025 new vehicle sales appear disappointing, down 8% on 2024 for a total of 96,710 units. However, looking at the VFACTS and EV Council data in more detail highlights some potentially surprising insights. This was the second-highest February sales result since 2012, suggesting that despite facing significant challenges, demand in the Australian automotive sector remains stronger than one might think.

Top 5 Takeaways

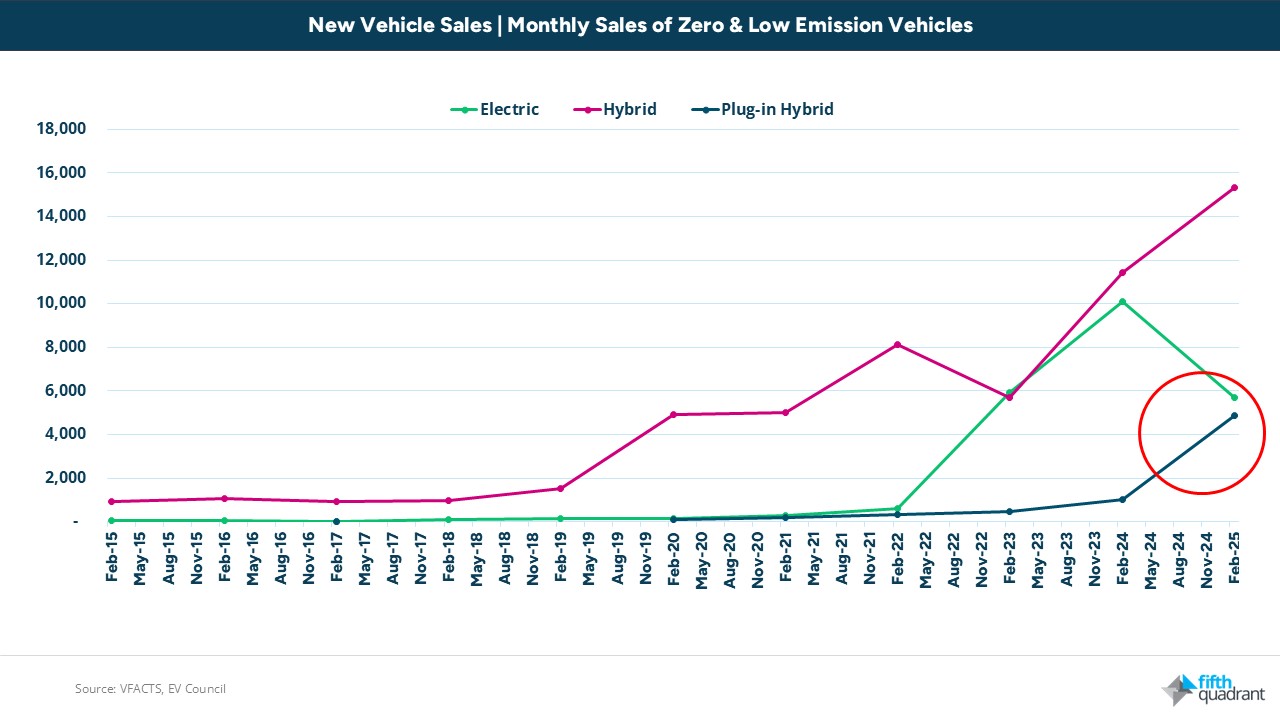

- PHEVs Lead Market Growth: Plug-in hybrid vehicles (PHEVs) reached 4,871 units, marking their strongest month ever in Australia. Can they maintain this though beyond the end of the FBT exemptions?

- BYD Shark 6 secures a strong hold in the LCV market: BYD’s new PHEV offering, the Shark 6 made an impressive entrance into the Australian market, selling 2,026 units. While 450 of these were technically delivered in January, it still marks a strong debut for an important addition to the BYD range.

- Toyota RAV4 Retains Top Spot: The Toyota RAV4 remained Australia’s best-selling vehicle, with 4,405 units sold, a 55% YoY increase.

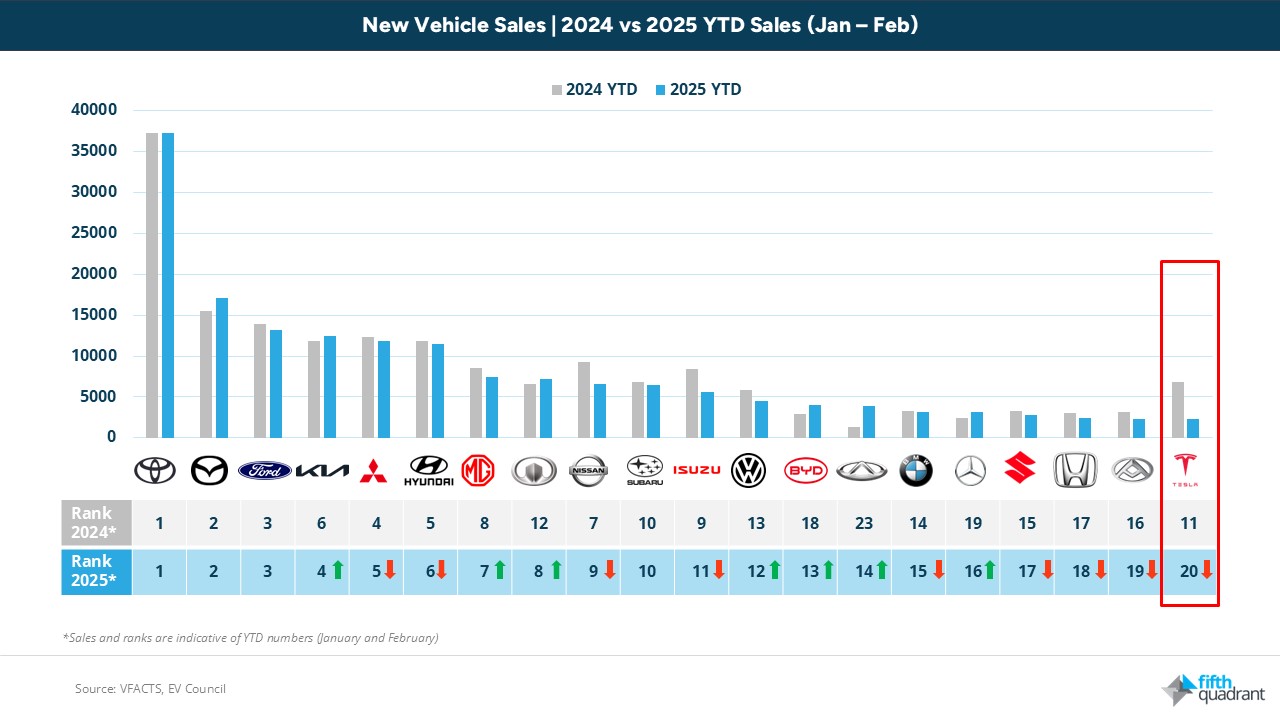

- Tesla Sales Plummet: Tesla recorded 1,592 units in February, a rebound from 739 in January, but still 72% lower than February 2024’s 5,665 units. More thoughts here further down.

- Mazda’s Resilient Return: Mazda remained in second place for the February rankings, however it was the only top five brand to see a YoY increase, up 20% to 8,787 units. It also posted a 10% YTD increase, driven by strong performances from the CX-60 (+99%), Mazda3 (+56%), and CX-3 (+22%).

PHEV sales surge

A key trend this month is the continuing rise of PHEVs, which have surged from just 1% of the market in February 2024 to 5% in February 2025. To put this into perspective, PHEV sales in February alone already account for 21% of last year’s total of 22,900 units.

Driving this change is the growing adoption of PHEV SUVs. Compared to February 2024, PHEVs have increased their market share from 2% (976 units) to 5% (2,781 units), now sitting just behind electric SUVs, which currently hold a 7% share but have seen little movement over the past 12 months.

More notably, LCVs—traditionally one of the slowest adopters of alternative fuel technologies—have also played a significant role in this month’s PHEV growth. While ICE vehicles still account for 90% of sales in this category, the introduction of models like the BYD Shark 6 has sparked increased interest in electrified options.

While new models are clearly having an impact, we do need to recognise that this surge in PHEV sales will partly be driven by buyers rushing to take advantage of the Fringe Benefits Tax (FBT) exemption which ends on 31st March 2025.

Given all of this, it is hard to say whether this momentum can continue in the long-term or if the growth represents a temporary sales spike. Regardless, it highlights consumer responsiveness to incentives and growing interest in alternate fuel types.

The Fall of Tesla

Once a dominant force in the Australian EV market, Tesla is now facing a significant downturn. Tesla has fallen to 20th place in the YTD rankings, trailing luxury brands such as Mercedes-Benz, BMW, and Lexus that it had consistently outperformed since entering the Australian market. This marks a sharp decline from 2024, when the brand ranked 11th in YTD sales. This shift is particularly evident across Tesla’s core lineup. The Model 3 has not reached 1,000 sales this year yet, when it has already recorded 4,316 units by the same time last year. Meanwhile, only 1,389 Model Y’s have been sold since the start of the year, a notable 43% decrease from last year. Therefore, it is no surprise that Tesla’s market share has also suffered, plummeting from 56% of the EV segment in early 2024 to just 28% in 2025.

This highlights the challenges Tesla faces as an EV-exclusive brand in a rapidly evolving market. The shift in Australian consumer preferences towards hybrids and plug-in hybrid electric vehicles has opened the door for both legacy automakers and new entrants offering more affordable alternative-fuel solutions.

Looking ahead

As 2025 unfolds, the Australian automotive market is navigating a shift in powertrain preferences and brand competition. PHEVs are gaining ground, EV sales are slowing, and light commercial vehicles are showing early signs of electrification. At the same time, traditional powerhouses like Mazda have come out strongly, recording solid growth across multiple models.

Given all of this, it’s important to remember that despite overall sales figures being relatively sluggish compared to 2024, February is still early in the year. There is no doubt many twists and turns still to come as we work our way through the rest of 2025.

Looking for more auto insights? Click here to view of our automotive market research reports. Fifth Quadrant publish monthly new vehicle sales updates here. For any questions or inquiries, feel free to contact us here.

Posted in Uncategorized