Author: Nick Rassool | Posted On: 16 Apr 2025

Ten years is a long time. It’s long enough to build robust businesses, long enough to face unprecedented disruption, and long enough to adapt to a rapidly evolving global economy. At Fifth Quadrant, our team has been fortunate to have a front-row seat, conducting the Pacific Islands Export Survey in partnership with Pacific Trade Invest (PTI) since 2014. A decade of data has not only given us insights, but it’s also shaped our perspective on what truly drives economic resilience in the Blue Pacific.

Earlier this year, PTI partnered with Griffith University to explore the longitudinal trends seen in the Export Survey; this article summarises the key findings and explores the potential impact of President Trump’s recent tariff policies and freeze on aid and development.

celebrating hard-won gains

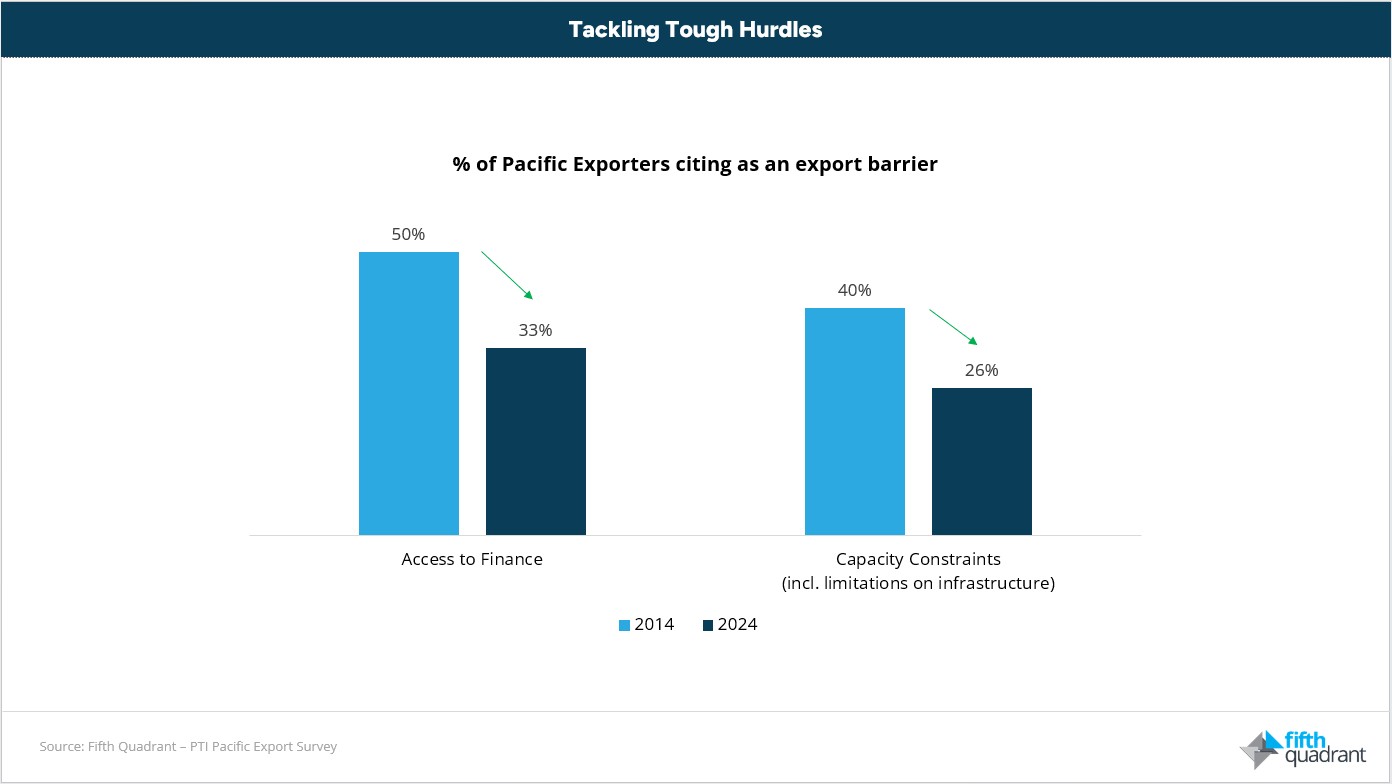

Pacific exporters have steadily tackled tough hurdles. Access to finance, once reported as a barrier by 50% of respondents in 2014, fell to 33% by 2024, with support from governments and evolving financial tools.

Infrastructure and capacity-building have improved too; the proportion of exporters citing this as a barrier dropped from 40% to 26% between 2014 and 2024, helping businesses scale and engage with global markets.

These positive shifts aren’t accidental, they’re evidence of concerted efforts by PTI and supportive governments committed to lifting regional trade capabilities.

the stubborn challenges

Despite these wins, certain issues stubbornly persist. Supply chains remain one of the most significant barriers, consistently cited by more than 50% of exporters throughout the survey period. Geographic isolation, high freight costs, and weak transport routes continue to weigh heavily on exporters.

Digital connectivity and ecommerce capabilities, essential in today’s global economy, continue to lag behind expectations. Despite impressive growth in online adoption, many businesses remain constrained by poor digital infrastructure and the complexity of international payment systems. Additionally, market access barriers still loom large, restricting growth potential despite considerable export readiness.

rising storms on the horizon

Adding complexity are emerging and intensifying issues. Extreme weather events, driven by climate change, have become a significant and growing challenge for Pacific businesses, particularly those in agriculture and tourism. The escalating severity and frequency of cyclones, droughts, and floods have resulted in direct losses to infrastructure, crops, and supply chains.

Political uncertainty also creeps into the narrative, with recent instability in regions such as Papua New Guinea and the Solomon Islands contributing to an environment of unpredictability, further unsettling business confidence.

the Trump factor and potential impact on the Pacific

Earlier this month, President Trump announced sweeping “Liberation Day” tariffs that placed steep duties on many Pacific nations; 32% for Fiji, 30% for Nauru, and 22% for Vanuatu. These measures sparked widespread concern in the region, with Fijian Finance Minister Biman Prasad labelling them “disproportionate and unfair.”

Days later, the U.S. reversed course, pausing most of the tariffs except those aimed at China. While the retreat brings short-term relief, it underscores a deeper issue: unpredictability.

For small, export-dependent Pacific nations, abrupt policy swings create uncertainty for investors, disrupt market access, and strain trade relationships built over decades. The rapid imposition, and rollback, of tariffs shows how quickly external decisions can ripple through fragile economies.

Equally concerning is the freeze on U.S. aid and development funding. This threatens the future of programs supporting infrastructure, business growth, and climate resilience in the region. For nations already under pressure, these changes could undo much of the hard-won progress of the past decade.

the vital role of data

This is precisely why data-driven insights matter. The Pacific Islands Export Survey doesn’t just capture statistics; it provides businesses and policymakers with actionable insights, early warnings, and clear indicators of where intervention is needed most urgently. The depth and breadth of this decade-long dataset empower informed, strategic decisions to navigate uncertain futures effectively.

Behind every data point is a real business with real challenges. At Fifth Quadrant, we see our role as amplifying those voices to help shape effective, timely responses.

strengthening resilience together

Looking ahead, data clearly points to priorities: continued investment in robust infrastructure, targeted support for digital transformation, addressing critical labour shortages through sustainable workforce solutions, and enhancing climate adaptation strategies.

Given the recent uncertainty sparked by shifting U.S. trade and aid policy, reinforcing resilience is more critical than ever. Strong partnerships, clear strategy, and regional cooperation will be key to navigating what lies ahead.

A decade of surveying has shown us this: resilience isn’t fixed. It evolves. And the Pacific’s ability to thrive depends on its capacity to adapt, with the right support, at the right time.

Fifth Quadrant specialises in B2B market research, see our work case studies here. Keep up to date with the latest Insights from Fifth Quadrant here. For any questions or inquiries, feel free to contact us here.

Posted in B2B, Built Environment, Social & Government, TL