Author: Amelia McVeigh | Posted On: 16 May 2024

In our ongoing series on body image and weight issues in Australia, we delve deeper into the use of pharmaceutical interventions like Ozempic and Mounjaro. The GLP1 agonist class of drugs were initially developed for diabetes management (thanks to their ability to mimic a natural hormone to help regulate blood sugar levels), but are increasingly being used to control appetite and weight. Building on our previous discussion, this article explores the controversial rise in the use of weight management drugs among various demographics.

Key insights so far (click here for the first article)

- Rising Rates of Overweight and Obesity: From 1995 to 2018, the proportion of Australian adults who are overweight or obese increased from 57% to 67%, with obesity rates rising from 20% to nearly one-third of the population.

- Generational Weight Management Trends: Younger Australians, particularly Gen Z and Millennials, are more actively engaged in weight management activities.

- Challenges in Sustainable Weight Loss: Sustainable weight management requires holistic lifestyle changes, yet educational and support initiatives remain underutilised in the broader community.

the ‘quick fix’ dilemma

As highlighted in our first piece, Australia is facing an obesity epidemic, with data from the AIHW in 2018 rating more than two in three Australian adults as either overweight or obese.

The challenge here is that while most clinicians suggest a multifaceted approach to weight loss that combines lifestyle changes with potential pharmaceutical aids, just one in four Australians (25%) feel that quick-fix diets and extreme weight management measures are unhealthy. While this partly recognises that no single approach to weight loss will consistently prove effective, it also emphasises the frequent lack of buy-in to longer-term lifestyle changes, particularly among younger members of the community.

generational approaches to weight management

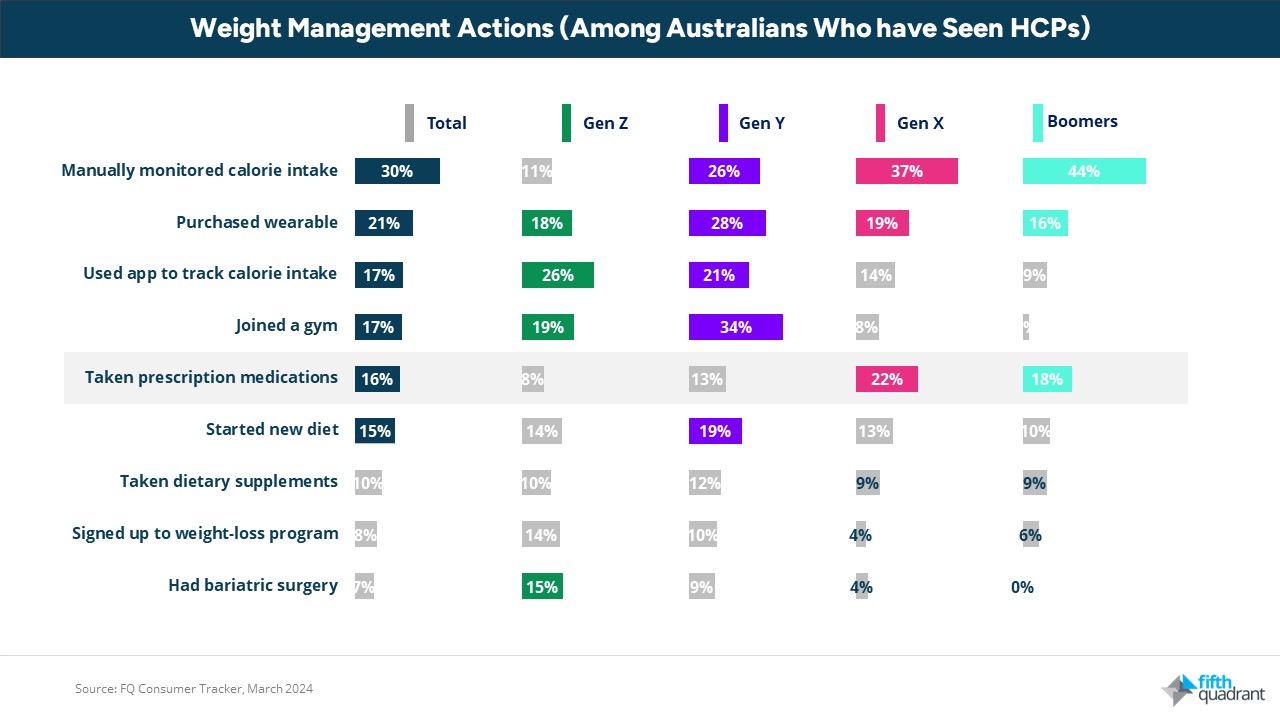

Despite the data above, older consumers are more likely to have taken prescription medications following an interaction with a health care professional. As shown below, almost one in four Gen X, and almost one in five Boomers (who have seen healthcare professionals) have used prescription medications in the past 12 months, making this the most common weight loss strategy (beyond manual calorie counting) for consumers in each group.

In contrast, both Gen Z and Gen Y are more likely to have increased their level of physical activity and/or taken action to moderate food consumption habits.

economic factors in drug accessibility

The cost of pharmaceutical interventions like GLP1 agonists also plays a crucial role in their accessibility. Affluent Australians are twice as likely to use these drugs, (especially when prescribed off-label, which is considerably more expensive), highlighting how economic factors intertwine with health priorities and social influences across different community segments.

The economic barriers clearly skew access to pharmaceutical interventions, but must be considered in the broader context of the evolving landscape of obesity treatment.

looking ahead: the future of obesity treatment

Novo Nordisk has previously applied to the Pharmaceutical Benefits Advisory Committee (PBAC) to have Semaglutide listed on the PBS for the treatment of severe obesity (specifically its Wegovy brand), but this has now been rejected on multiple occasions. This differs to the situation in the US, where Wegovy is FDA-approved for chronic weight management in overweight or obese individuals.

Given this, off-label prescription of GLP1 agonists like Ozempic and Mounjaro is likely to continue in the short to medium term, although supply shortages that are forecast to last through much of 2024 will limit consumers’ ability to access the drugs, and potentially drive consideration and usage of more expensive overseas alternatives. The likely outcome of this is that these drugs are increasingly restricted to those able to afford them, disenfranchising consumers from lower socio-economic households.

If you want to find out more about this, or have other research needed, please get in touch with our team of experts. You can also check out some of our other work in the healthcare space, including how we helped a private health insurer enhance its service offering and customer experience.

The Fifth Quadrant team is highly experienced in conducting healthcare and technology market research. To learn more about our capabilities or if you have a brief to share, please get in touch.

Want to be first to access our latest research findings? Sign up to our monthly newsletter below.

Posted in Healthcare, CJM, QN, Uncategorized