Author: Ben Selwyn | Posted On: 17 Apr 2024

Another month, another record set in terms of new vehicle sales. While we are seeing some brands moving into a surplus situation, that isn’t yet impacting sales volumes with Australia cracking 300,000 units in the first quarter for the first time. Data from the Fifth Quadrant consumer tracking survey does however let us unpack the current state of the market in more detail, exploring trends that are likely to impact consumer behaviours in the months ahead.

younger consumers driving market activity

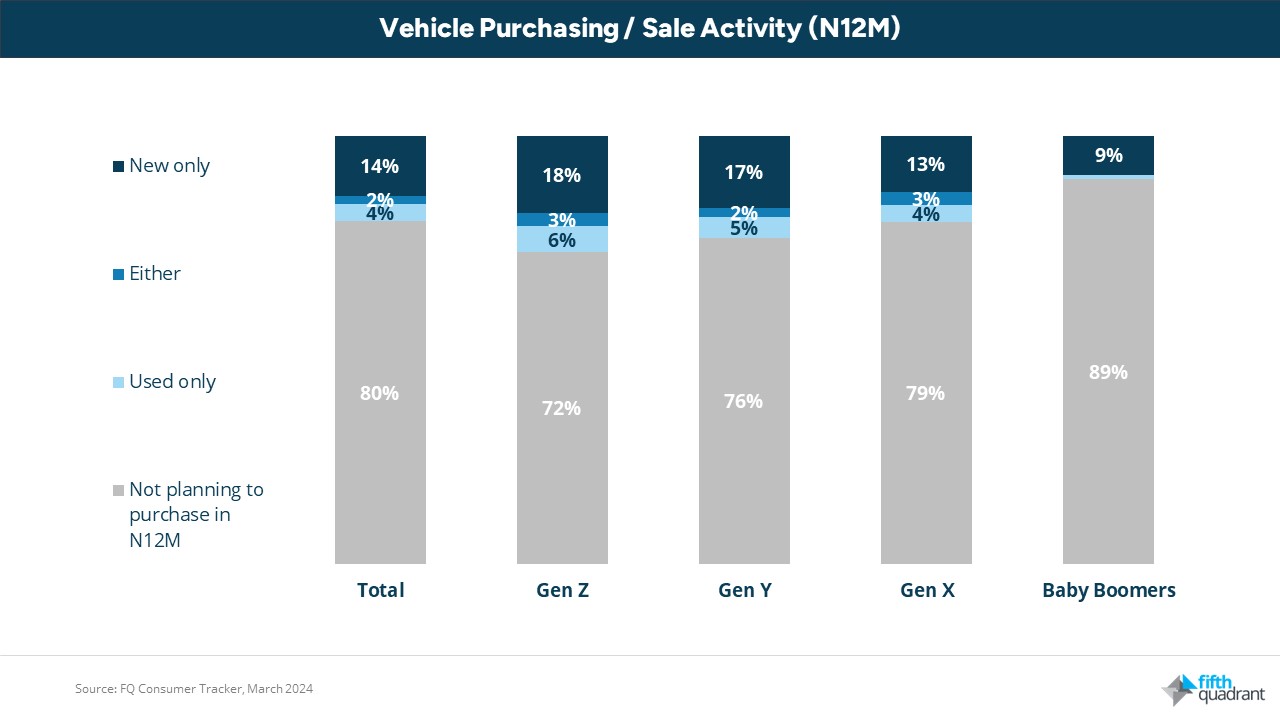

The data reveals generational divides in vehicle purchasing intentions. Overall, around one in five consumers are considering purchasing a vehicle in the next 12 months, but digging deeper, this rises to almost three in ten Gen Z. Gen Y is just behind, with around one in four looking to purchase a vehicle in the next 12 months, while around one in five Gen X expect to be in the market over this period. In stark contrast, Baby Boomers are the least likely to opt into the market, suggesting a more settled situation with their current vehicles.

Once they do enter the market though, Baby Boomers are also the least likely to consider used vehicles, almost exclusively looking at new or demonstrator options. Consideration of used vehicles increases among our younger cohorts, with almost one in ten Gen Z open to this, possibly due to budget constraints or a lesser focus on new car prestige. While Gen Y and Gen X are less likely to look at used options, there is a cohort within each group who are open to them, potentially reflecting a level of practicality and desire for value.

evolving nature of brand loyalty

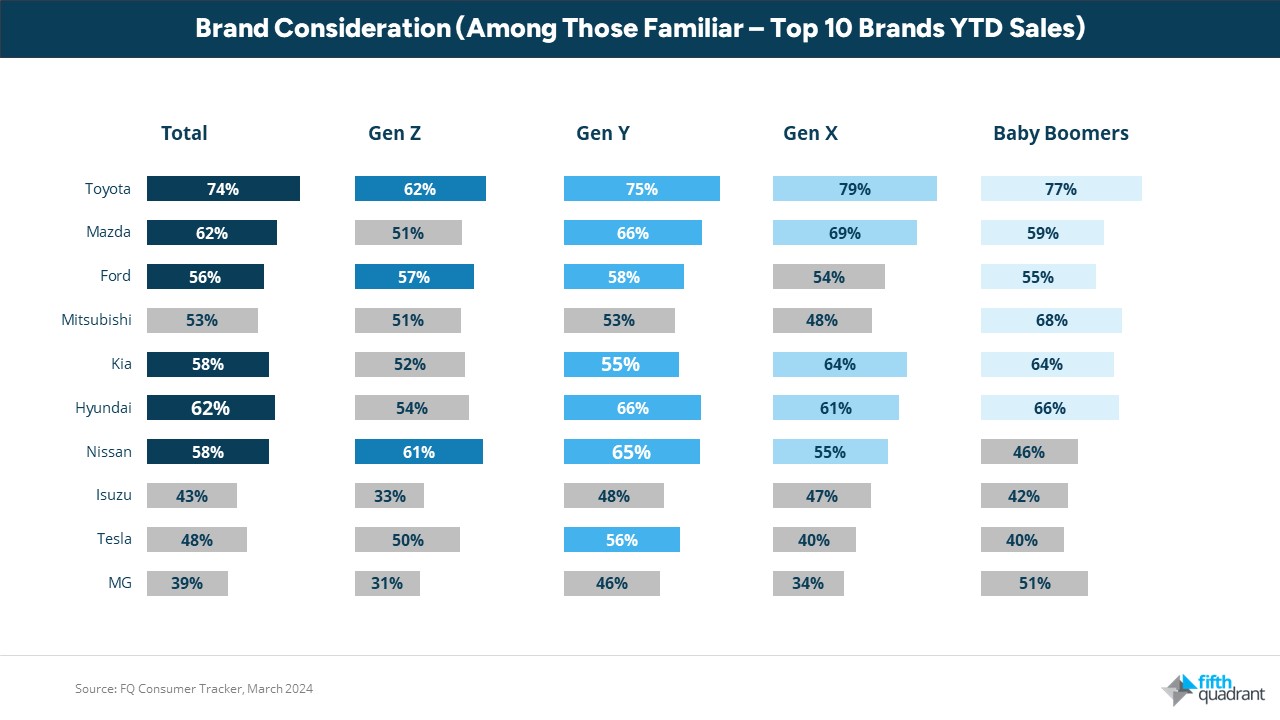

When it comes to brand selection, it’s no surprise that Toyota leads the market, with consistently high levels of consideration. Similarly, our volume brands typically perform well across all segments, showing that they are effectively delivering a compelling range into the Australian market.

With that said, we can see that Gen Y’s preferences are spread more evenly, with a notable openness to Tesla, which may reflect this generation’s environmental conscience and interest in technology. This group’s desire to balance traditional automotive qualities with innovation could shape future market strategies as brands aim to capture their attention.

Interestingly, Gen Z shows the least brand loyalty, especially towards traditional market leaders. While Baby Boomers are generally more loyal, the emerging popularity of MG could indicate a shift towards more cost-effective options or a resonance with MG’s brand revitalisation. As the automotive landscape evolves, understanding these nuanced preferences will be vital for brands aiming to secure market share.

alternatives to vehicle ownership

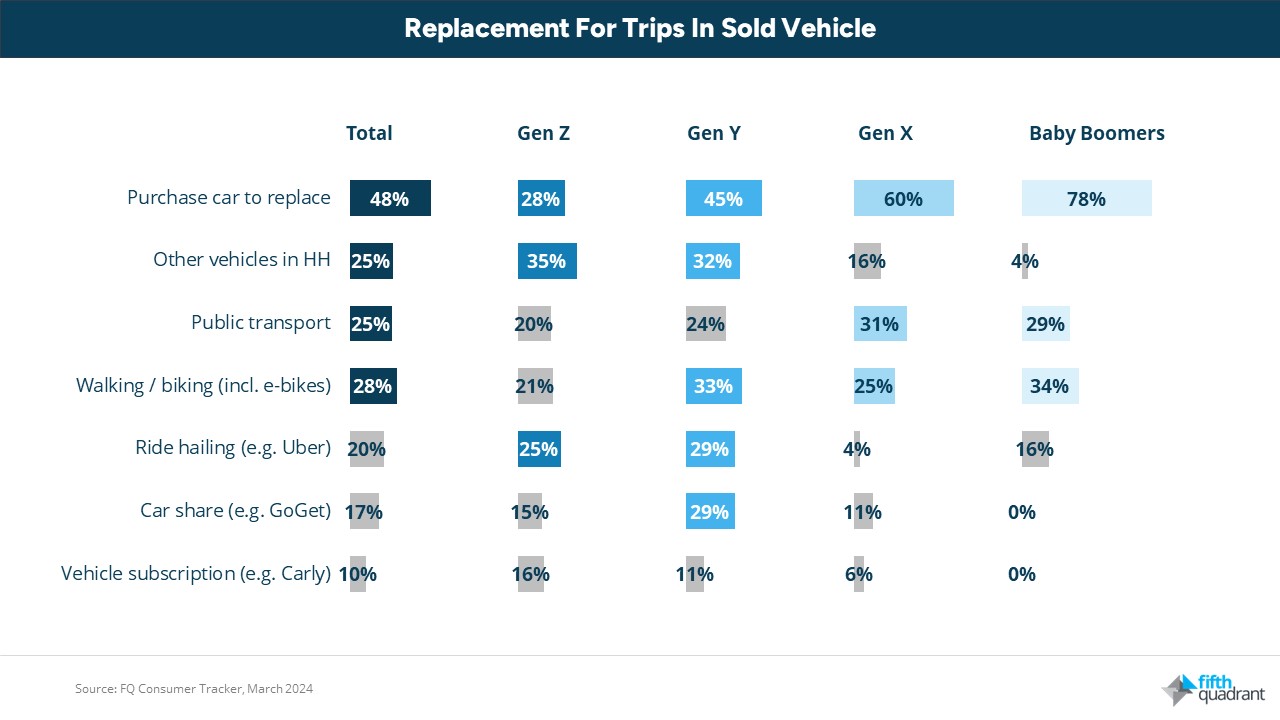

While vehicle purchases often mean trading in another vehicle, consumers can also look to reduce the number of vehicles in their household, as illustrated in the chart below.

Gen Y in particular stands out for the balance between vehicle ownership and alternatives, exhibiting an inclination towards shared mobility options such as car sharing and vehicle subscription services. This reflects a generation that is balancing traditional car ownership with the emerging sharing economy, while also actively incorporating more environmentally friendly travel modes such as walking or biking into their regular habits.

In stark contrast, Gen X and Baby Boomers show a stronger attachment to vehicle ownership, potentially reflecting entrenched habits and a preference for the familiarity and independence that comes with owning a vehicle. With that said, they do still display an openness to public transport, and will consider walking or biking for shorter trips.

where to from here?

The dynamic nature of the automotive market is clearly driven by generational shifts that signal a redefined landscape of mobility. Younger consumers in particular are leaning into varied transport solutions, balancing value, innovation, and eco-conscious choices. For industry stakeholders, staying attuned to these evolving preferences—from the steadfast loyalty to heritage brands among older generations to the rising consideration of alternative mobility options among the young—will be key to navigating the road ahead.

If you’ve enjoyed this piece, subscribe to our newsletter to stay up to date with our latest content. You can also find our 2023 year in review summary slides here.

Also remember that our b2b and consumer tracking research runs monthly. Click here to find out more, and feel free to get in touch if you’ve got questions that you’d like to answer.

Posted in Auto & Mobility, B2B, QN, TL, Transport & Industrial, Uncategorized