Author: Angus McLachlan | Posted On: 12 Dec 2024

When discussing decarbonisation, the spotlight often falls on emissions released during a product’s use. Yet, a substantial share of environmental impact stems from the production phase. Addressing production-phase emissions requires collaboration across the entire value chain, from raw material suppliers to OEMs. Research by BCG reveals valuable insights into consumer willingness to pay a “green premium”—a markup for products manufactured with net zero emissions.

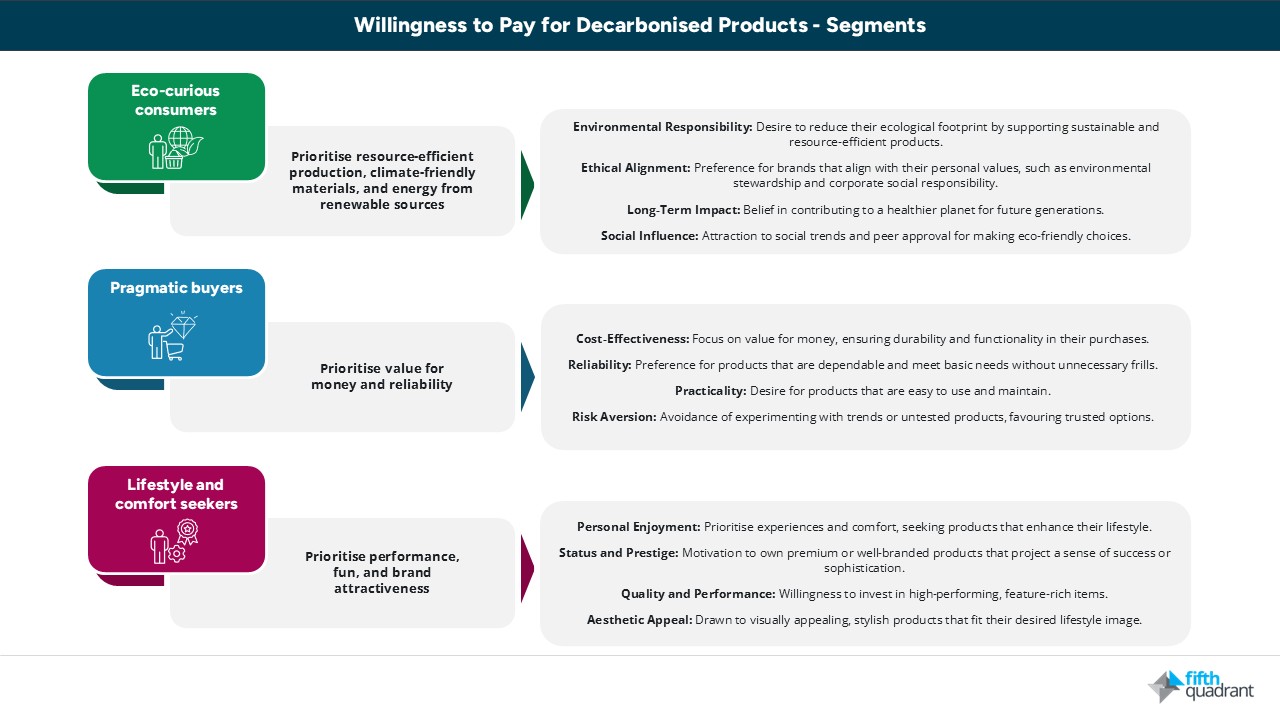

BCG’s global survey explored consumer willingness to pay for products made using net zero production practices. The findings highlight three critical consumer segments with varying levels of willingness to pay:

- Eco-curious consumers: Value sustainability and resource-efficient production.

- Pragmatic buyers: Prioritise reliability and value for money.

- Lifestyle and comfort seekers: Focus on performance and brand appeal.

China: leading the change

In China, respondents showed the highest willingness to pay for green premiums, with 9% for cars and 12% for washing machines. This is substantially higher than levels observed in the US and Western Europe, with green premiums in these regions capped at 3% for cars, and 6% for washing machines. This aligns with other research, as eco-consciousness tends to be higher in areas that have already experienced the negative effects of climate change – like China. Chinese consumers have felt the effects of smog, pollution, and environmental degradation more acutely than many areas in the US and western Europe. Thus, the benefits of a green premium are more tangible for consumers in this market.

circular economy: willingness to pay

As we found in CommBank’s Consumer Insights, 1 in 3 consumers are willing to pay more to support businesses that adopt circular economy principles.

Younger generations are leading the shift towards the circular economy, with Gen Z showing the highest level of engagement—47% actively adopting circular economy practices and 53% willing to pay more to support businesses involved in this movement. In contrast, only 1 in 4 pre-boomers participate in such initiatives.

challenges in translating willingness to action

Despite positive indications, translating stated willingness to pay into actual purchases presents hurdles. Common barriers include:

- Cost-of-living: Decreased disposable incomes amidst inflationary pressures limit adoption.

- Greenwashing Fears: Doubts about the authenticity of net zero claims.

- Performance Concerns: Perception that sustainability compromises quality.

balancing value along the supply chain

For green premiums to drive meaningful change, benefits must be distributed equitably across the value chain. Currently, upstream players, such as material suppliers, bear the brunt of decarbonisation costs while receiving limited compensation. Key actions include:

- Increase Transparency: Share detailed carbon footprint data to foster trust and equitable value allocation.

- Collaborate Across the Ecosystem: Form partnerships to secure sustainable material supplies and invest in infrastructure to support decarbonisation efforts.

- Enhance Visibility: Use marketing and design to highlight green production practices, such as certifications, labels, and co-branding opportunities.

a call to action for industry players

These findings underline the growing consumer appetite for sustainable products. While willingness to pay may not fully cover decarbonisation costs, it is a critical component of financing the green transformation. The path to decarbonisation is complex but navigable. By addressing barriers, leveraging consumer interest, and fostering collaboration across value chains, companies can unlock opportunities for sustainable growth.

Read more about our meta-analysis of decarbonisation in global steel production here. If you’d like to discuss customised research solutions to answer your questions, get in contact with us here.

Posted in Energy Transition