Author: Charlie Ellis | Posted On: 09 Oct 2023

The Australian financial landscape is set for a significant transformation as we increasingly shift away from cash to digital alternatives.

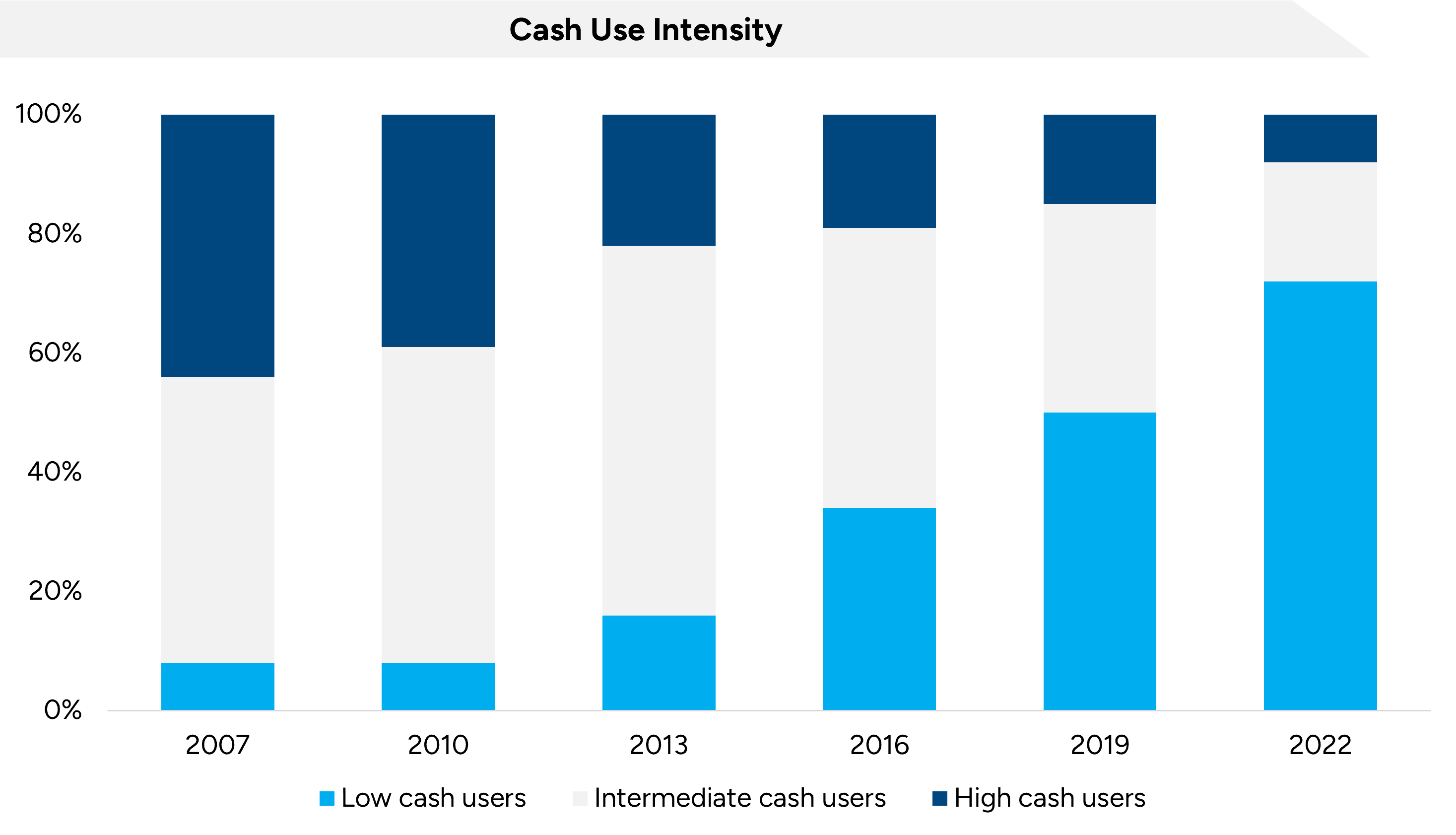

According to the Reserve Bank of Australia (RBA) earlier this year, over a billion dollars in physical currency has vanished from circulation over FY23, with almost three in four (72%) Australians now ‘low cash users,’ (i.e. they use cash for 20% or less of in-person transactions) – a substantial increase from 50% in 2019. (RBA June’23)

We are still seeing some sectors holding out, with more than 25% of Leisure activities and bills still paid with cash, but change is coming. The recent announcement of some NSW KFC outlets going cashless has seen a highly polarised response, but feels like it could be a pivotal moment on the journey.

COVID-19 accelerated the shift to cashless

How though did we arrive at this point?

COVID-19 was a major catalyst for reduced usage of cash, with commerce increasingly shifting online, and consumers steering clear of handling money given concerns about hygiene.

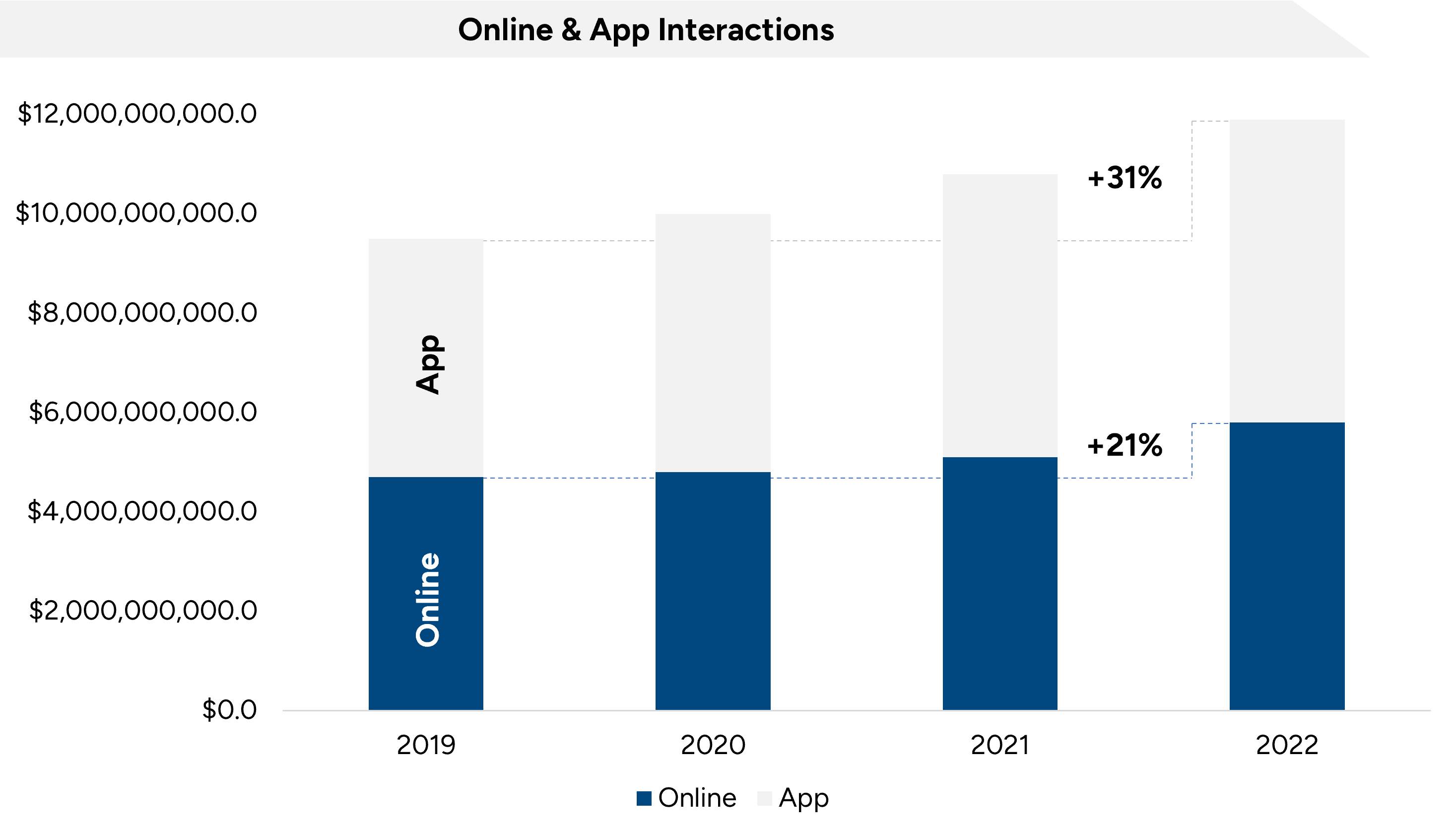

This shift is evident in the Australian Banking Association’s consumer banking trends 2023 report, with branch interactions down by 46% since COVID-19, whilst online/app interactions have risen by 26%.

Addressing Consumer Concerns

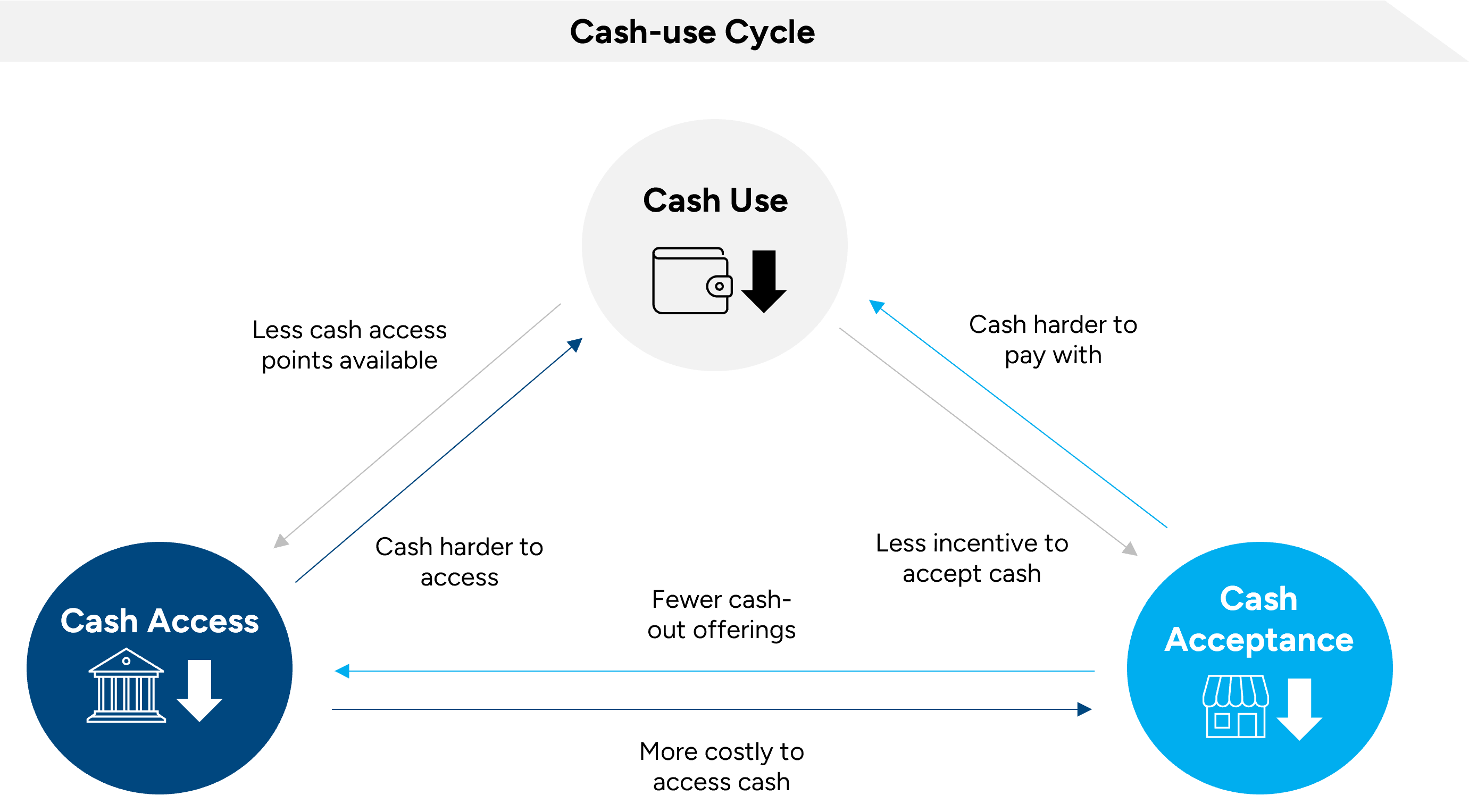

The RBA’s Cash-use Cycle Model (March’23) highlights the impact of the trend, with cash payments becoming increasingly less available for consumers as the cycle accelerates. While consumers initiated this shift, it’s only as businesses have stopped accepting cash that we are seeing concerns expressed more vocally.

Many of these concerns are fundamentally grounded in privacy and data security. Campaigns like Boycott Cashless Business Australia take this perspective, worrying about their digital trail, and raising concerns about data security, fraud, and identity theft.

These risks have become increasingly tangible over the past few years as we’ve experienced a number of highly publicised data breaches. While the expectation is that businesses should be responsible with sensitive personal and financial information, that trust has to be earned not given, and once lost can be hard to regain.

Hence, consumers are left wondering if they should be trusting businesses to hold this information, and whether a shift back to cash is a viable option to protect themselves from future data breaches.

Skimming the skim

This isn’t however only a consumer trend, so let’s dive into why businesses are cashing out.

Handling cash incurs a range of direct and indirect costs – physical security when transporting, sorting and counting time, float and cash reserve storage and handling errors can all be removed with the shift to cashless.

The challenge is that while these savings can be substantial, many small businesses aren’t fully considering them. From their perspective, every card transaction comes at a cost. These fees add up and impact the bottom line more visibly than the wages they’re paying team members (or the time they spend away from their family).

The counter here is that in an increasingly challenging economic environment, businesses are looking for efficiencies that can help them drive down costs and regain lost margin. Given that, this feels like an area of opportunity that could drive change in their mindsets over the short to medium term.

What next?

Ultimately, consumers paved the way for a cashless society. It’s convenient, safe and accessible for most, but there is a cohort who worry about the power it bestows upon large corporations. This human element is a key part of the equation, and one we’ll be exploring further in the months ahead.

Fifth Quadrant surveys 1,000 Australians every month as part of our ongoing Consumer Insights Study.

Contact us if you are interested in finding out more, or have questions you’d like answered.

Posted in Consumer & Retail, Financial Services, QN, TL