Author: Charlie Ellis | Posted On: 27 Mar 2024

In this third post in the series, we continue our exploration of Australia’s transition towards a cashless society. Following on from our previous posts looking at the overall shift to cashless, and consumer sentiment around the change, this piece uses data from the Fifth Quadrant SME tracker to explore SME attitudes, revealing their expectations for the future, and the concerns they have about the potential impact on their business.

The Australian eCommerce landscape is evolving, and small and medium-sized enterprises (SMEs) are finding themselves at the forefront of a shift towards cashless transactions. While many are ready to go, welcoming the opportunity to transition to a cashless model, they also acknowledge that it presents new challenges such as access to funds in the case of technological outages and increased cybersecurity threats. Given this, how prepared are SMEs to deliver to consumers changing payment demands?

sme’S PERSPECTIVE ON CASHLESS TRANSACTIONS

The U.N Social Commission has coined Australia as a global innovator for digital payments and finance in the Asia Pacific. This is no surprise, given Australian SMEs are currently experiencing a major shift to cashless transactions. Half of these businesses (50%) already report that less than 10% of their revenue is from cash payments. This trend is expected to continue, rising to nearly three in five businesses (58%) over the next three years.

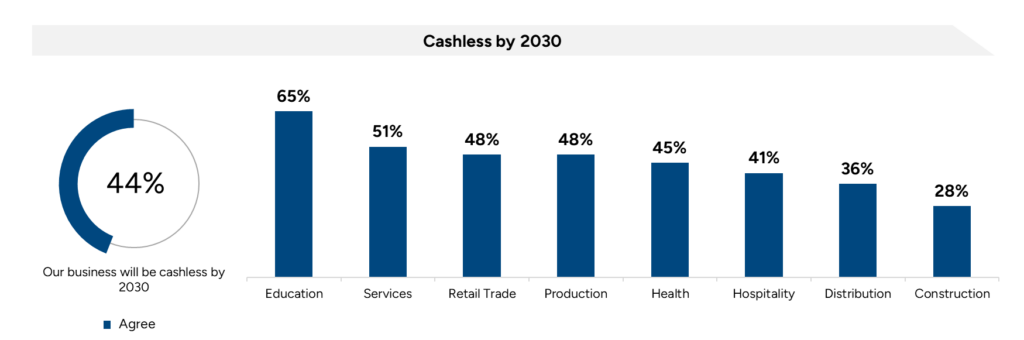

While they do recognise the potential risks involved, almost two in three businesses (63%) feel the transition will be an easy one, while just under half (44%) are confident they will be cashless by 2030. This sentiment is not however consistent across the economy. Merchant take-up is largely reflective of consumer sentiment, so the adoption of cashless payment methods varies by industry. The Education sector has the most businesses intending to be cashless by 2030 (65%), but this falls to less than two in five Distribution (36%) or Construction (28%) businesses.

CASHLESS CONCERNS AND CONSIDERATIONS

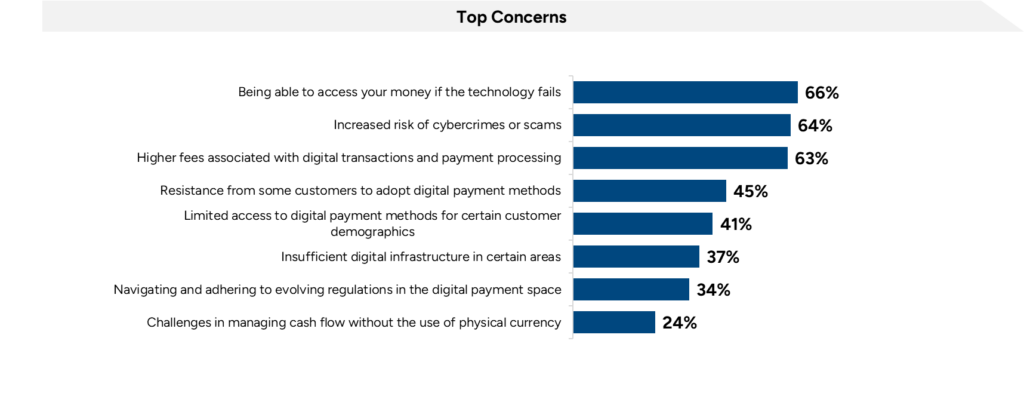

Despite being generally optimistic about the journey to cashless, SMEs do harbor some apprehensions regarding the transition. Their concerns primarily focus on issues such as accessing cash in the case of technological issues, the escalating threat of cybercrime, and the potential for fee increases related to digital transactions.

CASHLESS CONCERNS: TECH OUTAGES

Chief among their concerns are the risks associated with infrastructure failures, and what this would mean for the cashless system. Two-thirds of SMEs (66%) fear the risk of restricted access to funds, highlighting the importance of maintaining liquidity for unforeseen circumstances. This is particularly true within the Distribution Industry and Services sector (80% and 71% respectively).

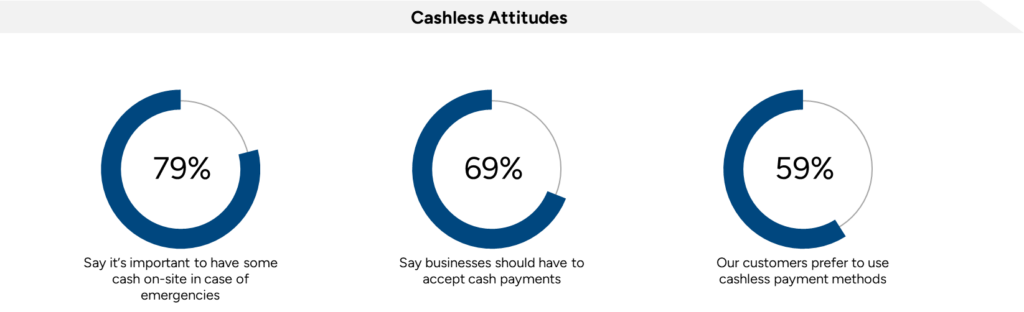

SMEs do however see steps they can take to proactively address this risk, with more than three quarters feeling that it’s important to have cash on-site in case of emergencies, and over half having a contingency plan ready in case of EFTPOS system failures.

CASHLESS CONCERNS: CYBERCRIME

Cybersecurity continues to be a priority area across all industries, with 64% of SMEs expressing their concerns about digital security threats. In addition, over one-third (37%) are concerned that their business has insufficient access to the necessary digital infrastructure to safely and securely deliver cashless transactions to their customers. These fears are no doubt elevated by recent high-profile data breaches (e.g. Optus, Medibank).

CASHLESS CONCERNS: FEES

In the current economic environment, SME’s concerns are further compounded by the potential financial implications of solely taking digital payments, with almost two in three worried about the higher fees associated with cashless payments (63%). Some do however feel that they can mitigate this issue by raising prices, with almost half already passing on additional fees to customers.

MOVING FORWARD: CONFIDENCE & PREPAREDNESS

Looking ahead, SMEs exhibit a mix of confidence and pragmatism regarding the transition to a cashless model. They recognise the shifting nature of consumer preferences, with over half believing that their customers already prefer cashless payment methods. Furthermore, a substantial portion are confident in their ability to adapt to a cashless model. They do however remain pragmatic about this transition (and the need for regulatory safeguards), with around two-thirds of SMEs asserting the importance of legally mandated acceptance of cash payments when required.

While SMEs anticipate an increase in cashless transactions, they remain divided on the impact it will have. Given consumer expectations are clearly shifting in this direction though, the real question is how SMEs can best deliver to these, and what a realistic timeframe for adoption might look like. At this point, there are clearly some significant concerns to overcome, particularly in terms of the underlying digital infrastructure and security mechanisms. Financial service providers will need to work hard to address these in order to drive broader adoption across their business customer base. This will not however be a consistent process, with some industries such as education and services, transitioning more swiftly, while others that remain heavily reliant on cash will find it more challenging.

If you’ve enjoyed this piece, keep an eye out for our regular updates on SME trends. Also remember that our b2b and consumer tracking research runs monthly. Click here to find out more, and feel free to get in touch if you’ve got questions that you’d like to answer.

Want to stay up to date with our latest content? Sign up to our newsletter below.

Posted in B2B, Consumer & Retail, Financial Services, QN, Technology & Telco, TL