Author: Ben Selwyn | Posted On: 31 May 2023

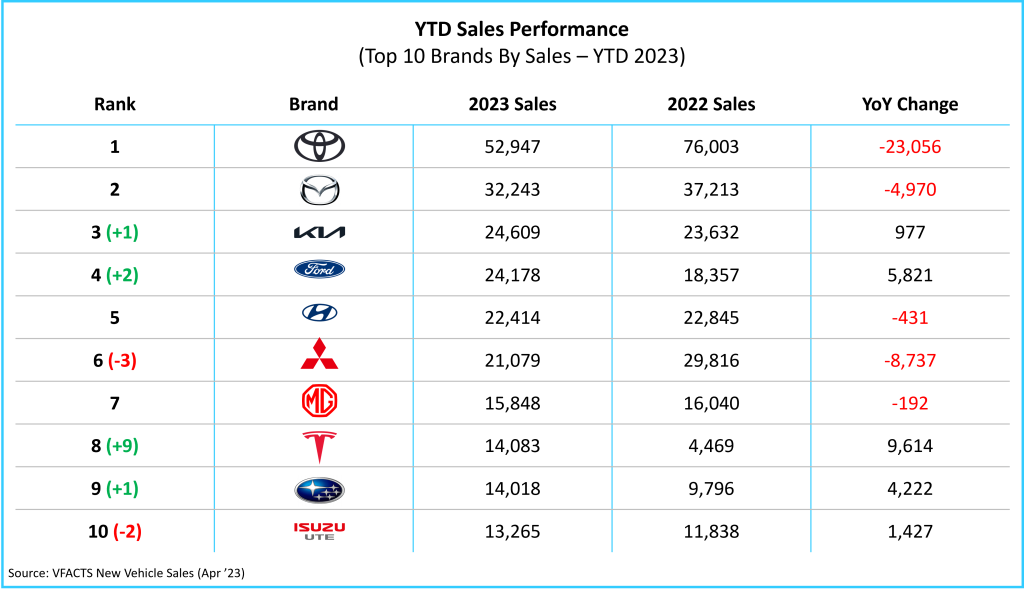

The automotive landscape is changing quickly, with existing brands struggling to maintain supply, and new brands entering the Australian market. This can be seen in the sales data, with significant change in the top 10 brands over the past year. In some cases, the market has also shifted despite the rankings not changing. Toyota is still top of the list in 2023, but it’s sold about 23,000 less vehicles than it did in the first four months of 2022.

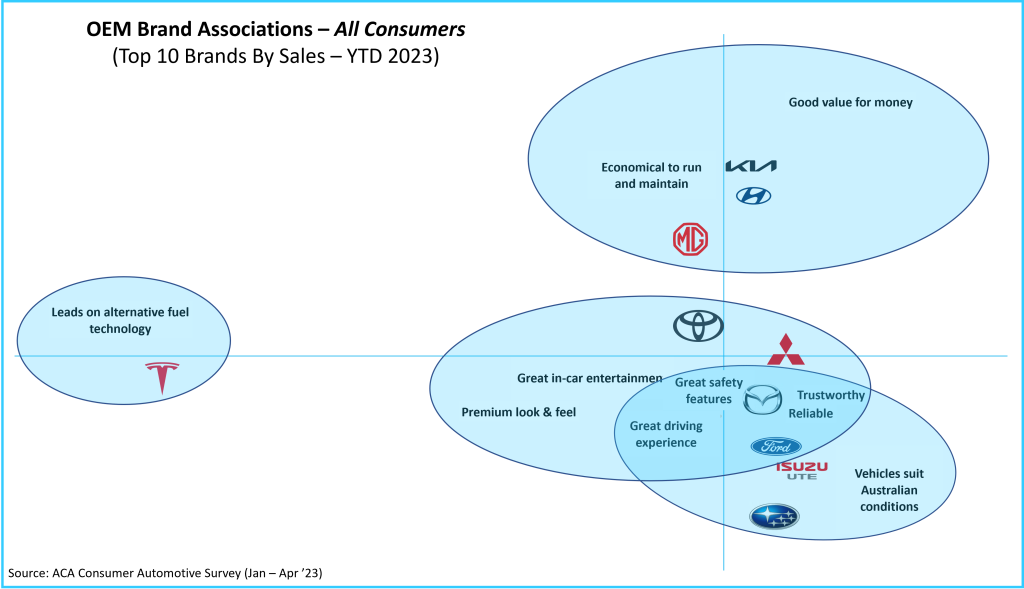

Despite the speed of change we see in the sales data, it takes significantly longer for consumer brand perceptions to shift. Attitudes towards brands (in this case vehicle manufacturers) are built up over a period of years, based on personal experiences and interactions. This means that brands that have significantly shifted their brand positioning in recent years may still be judged based on their history, as against what they stand for today.

We can clearly see this reflected on the brand map below, with a core group of (mostly Japanese) brands clustered around attributes relating to trust, reliability, and the driving experience. Despite a significant investment in both product and brand, the two Korean brands (Hyundai and Kia) as well as MG are still seen to be more strongly associated with value-based attributes over performance-based ones.

NOTE: For those not familiar with brand maps, the closer a brand is to a specific attribute, the more strongly associated it is with it. Multiple brands can be associated with each attribute, with the map indicating the strength of this relationship.

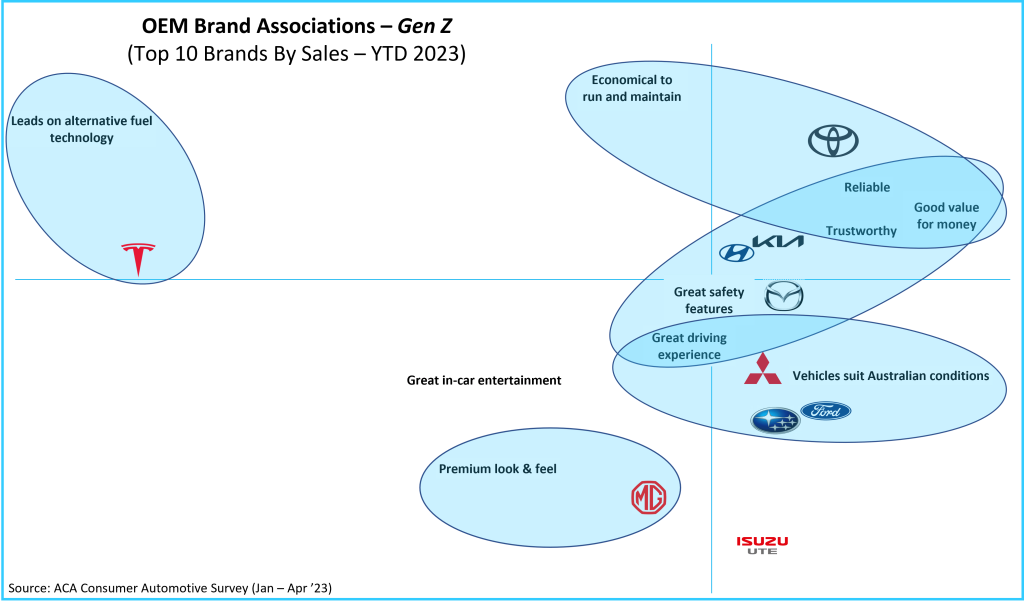

As mentioned above, these perceptions are based on attitudes that have been built up over many years or even decades. To get a different perspective, we can look at how this falls out for Gen Z, who by their very nature have been engaged with automotive brands for a shorter period of time.

Looking at the map below, this then tells a very different story. Kia, Hyundai and Mazda are now the strongest brands (based on a combination of trust, value, and usage experience), while Toyota pushes out to a more value-based positioning. In an impressive shift, MG also leverages the work done in recent years to stand apart as the brand most associated with a ‘Premium look & feel’.

The obvious caveat here is that looking at brand perceptions over the total market includes a mix of those who own or would consider a brand, those who would not consider it, and those who know very little about it. From a research perspective, this is where you’d run this type of analysis within those different groups, to understand the strength of your brand on a more targeted basis.

Stepping back though, it’s clear that brand perceptions are deeply embedded in the consumer psyche. They take a number of years to build, and even more so to shift.

For more information about our automotive research, you can browse our automotive blog, reach out to our automotive experts, or access our latest automotive research reports.

Photo by Sutthisak – stock.adobe.com

Posted in Auto & Mobility, QN, TL