Author: Ben Selwyn | Posted On: 28 Feb 2024

Vehicle subscription is a growing trend, with providers like Carly recording significant growth as Australians start to shift away from traditional approaches to vehicle ownership. These models bundle up most vehicle costs into a monthly fee, while also offering consumers the opportunity to switch vehicles on a more regular basis in line with their needs.

This trend does however raise the question about which consumers are the most likely to consider vehicle subscription, and the most common use cases. Looking at data from vehicle subscription back-end platform Loopit, we can see that in most cases the average subscription duration ranges from 60-120 days, suggesting vehicles are being used to fill a gap over that 2-4 month window. Hypothetically, this might be to cover an emerging need, to allow someone an extended period to test a vehicle prior to purchasing, or just a realisation that given the choice, people will choose to mix things up, and change up what they’re driving for a bit of fun.

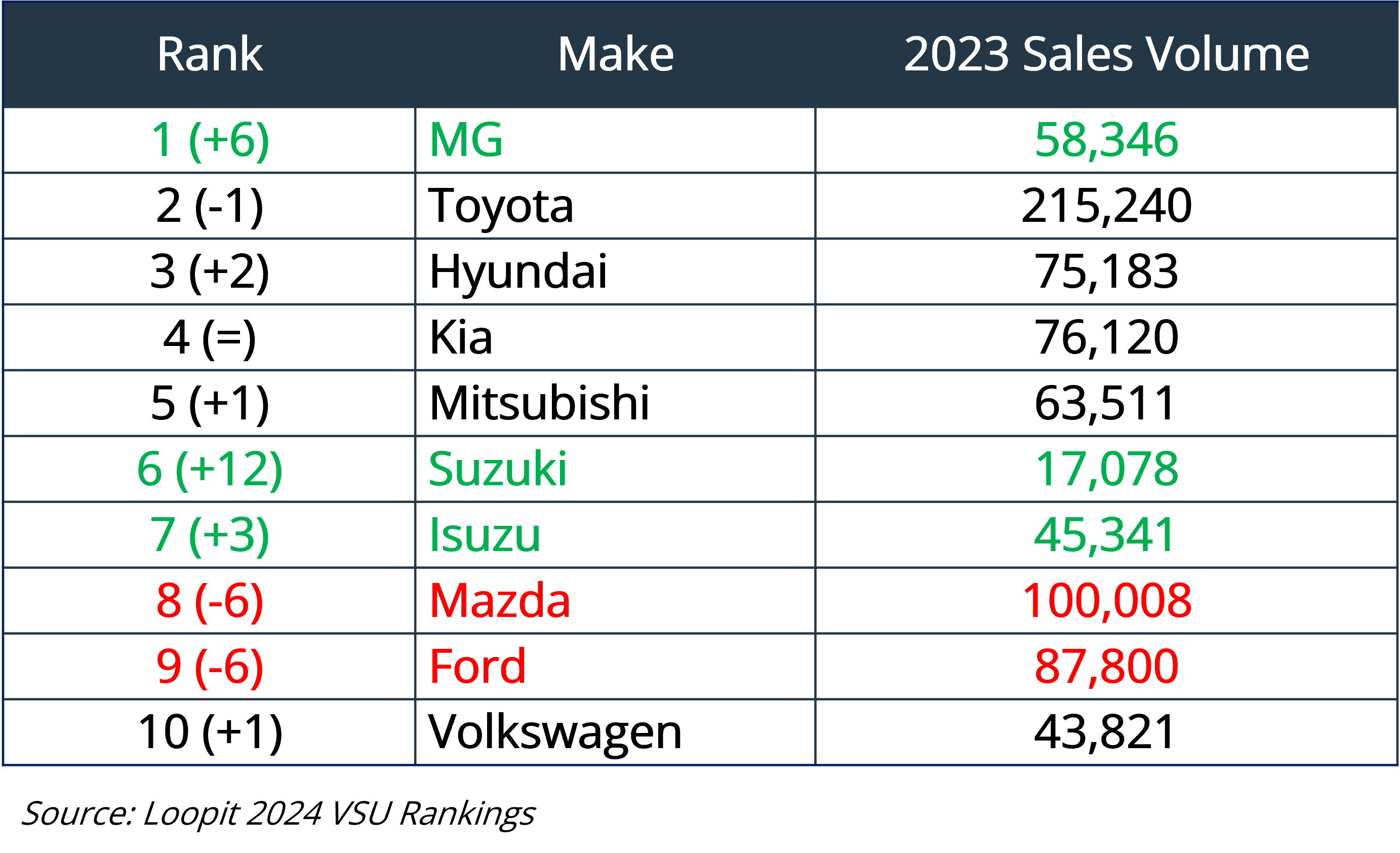

Looking at the specific makes and models being chosen in comparison to the ones performing best in terms of new vehicle sales, we can however uncover some surprising results. At a brand level, while three of the top 5 remain the same, the order is very different, with MG rising to the top of the tree ahead of Toyota, Hyundai and Kia. Similarly, Suzuki ranked 18th for new vehicle sales in 2023, but makes it to 6th on this list. The two biggest ‘losers’ in the top 10 are Mazda and Ford, which both dropped 6 spaces in comparison to their sales performance.

top 10 vehicle subscription makes

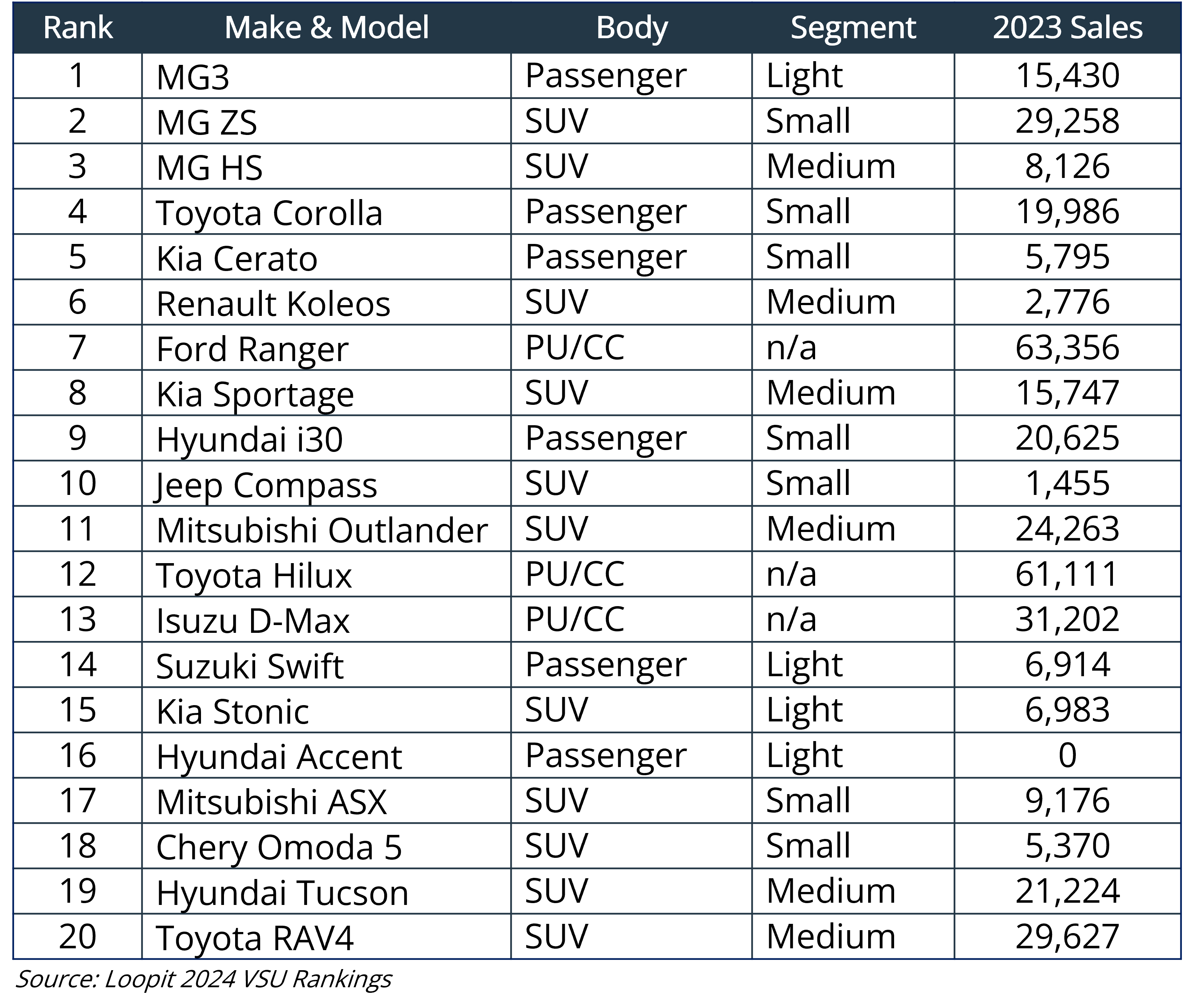

At a model level, the results reflect overall market trends, with 11 of the top 20 vehicles being SUVs. With that said, the results here are arguably more surprising than the brand rankings when it comes to some of the specific models within the top 20. As can be seen in the table below, there’s a huge level of diversity, with the vehicles in the top 20 ranging from 0 sales in 2023 up to the market-leading Ford Ranger.

Importantly, sales volume also isn’t a predictor of subscription length, with the low-selling Renault Koleos holding the longest average at 162 days, almost three times longer than the Toyota Corolla (56 days).

- It’s a clean sweep at the top of the table for MG, with the MG3 the most commonly selected subscription vehicle, ahead of its popular small ZS SUV and mid-sized HS SUV

- Passenger cars are clearly a strong proposition when it comes to subscriptions, with three of the top 5 options in that category

- The three top selling vehicles in Australia last year (Ford Ranger, Toyota Hilux, Isuzu D-Max) are all present as the only light commercial options on the list

- The Hyundai Accent ranks 16th, despite not recording a sale since 2020

top 20 vehicle subscriptions models

looking ahead

Ultimately, the results here do suggest that while some vehicle subscription providers are growing strongly, it is still at this time a more niche proposition in the Australian market. Fundamentally, vehicle ownership still has a strong emotional hook into our psyches, and that sort of mindset takes time to shift. With that said, as more Australians become exposed to subscription as a solution to their short-term needs, they may come to recognise the value that it can also deliver over the longer-term. One to watch in the years ahead!

If you’ve enjoyed this piece, keep an eye out for our regular updates on the Australian automotive industry. You can also find our 2023 year in review summary slides here.

Also remember that our b2b and consumer tracking research runs monthly. Click here to find out more, and feel free to get in touch if you’ve got questions that you’d like to answer.

Posted in Auto & Mobility, B2B, QN, TL, Transport & Industrial, Uncategorized