Author: Madelyn Stafford | Posted On: 20 Dec 2024

Australia’s job market in 2024 has been defined by resilience in a time of economic uncertainty, with employers facing complex structural challenges. Data from Seek reveals that while unemployment remains very low at 4.0%1, job listings have also consistently been lower year-over-year (YoY). This underscores the cautious approach being taken by businesses as they navigate this challenging economic landscape. Despite the subdued hiring activity through much of the year, recent months have shown stabilisation, offering cautious optimism for the future.

national trends: job listings stabilising post-decline

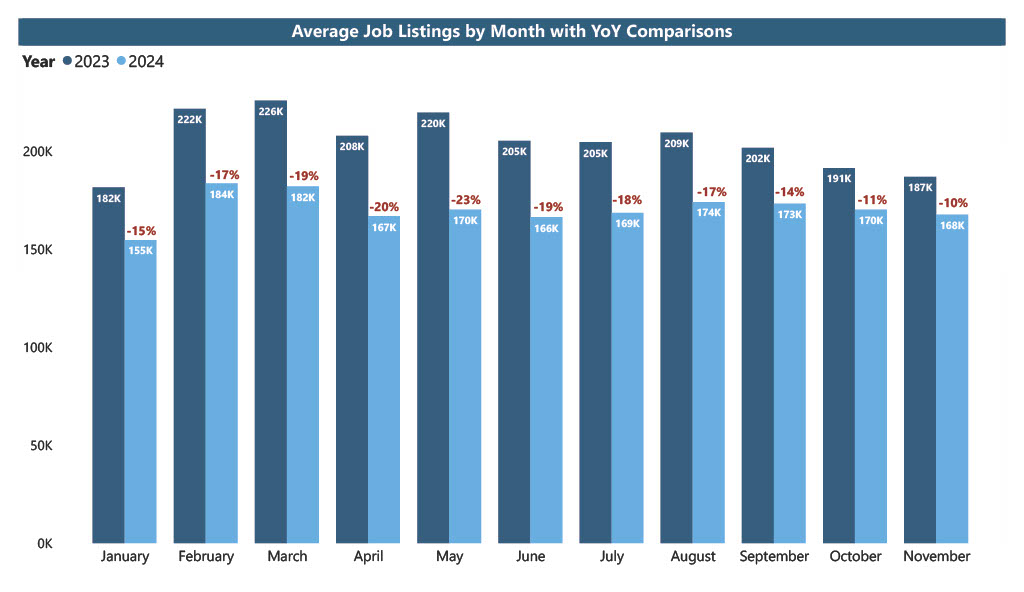

Job listings in 2024 are well down compared to 2023, but the trend here is shaped more by the market changes of 2023 than by new activity this year. Listings started the year down 15% year-over-year (YoY) and remained lower throughout the first half. By November, the YoY decline had narrowed to 10%, but this is due to weaker market conditions in late 2023 rather than a meaningful increase in hiring towards the back end of this year.

In practice, job listings have held largely steady through much of 2024, suggesting that businesses have adjusted their workforce needs rather than expanding them. Any increases in hiring activity from here are likely dependent on stronger business confidence and potential interest rate cuts in early 2025.

State Variations: Australia’s Diverse Job Market Landscape

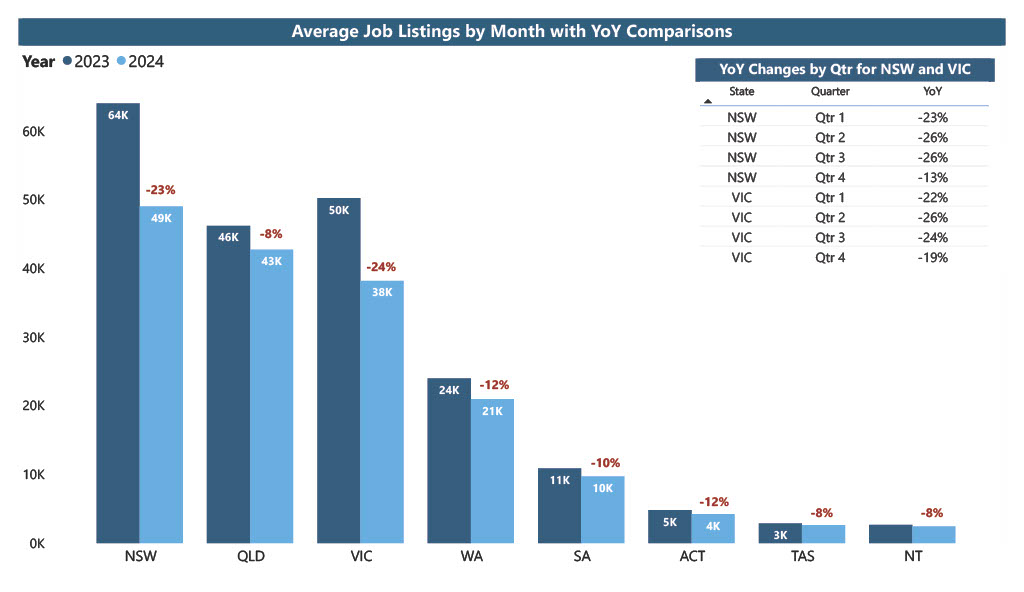

State-level data reveals some key differences in job market performance across Australia, influenced by regional economic conditions and the industries prominent in each area. This becomes particularly evident when we consider the differences between the two largest state economies in NSW and Victoria:

- New South Wales (NSW): Job listings in NSW faced a 23% year-to-date (YTD) decline, highlighting challenges in one of Australia’s most economically significant states. By Q4, this had however ‘improved’ to a 13% decline, indicating a stabilisation in hiring activity. The relatively quicker recovery may reflect a stronger rebound in Sydney’s job market as businesses adjust to economic conditions and find a new balance.

- Victoria: Victoria’s job listings experienced a similar decline, starting the year with a 22% drop. By Q4, however, this hadn’t changed significantly, remaining at a 19% decline. While this shows some progress, the recovery has been slower compared to NSW, suggesting ongoing difficulties in the Southern market.

Sector Performance: Resilience and Challenges

Australia’s job market in 2024 has also recorded a clear divide by sector, with some industries proving more adaptable to economic pressures than others.

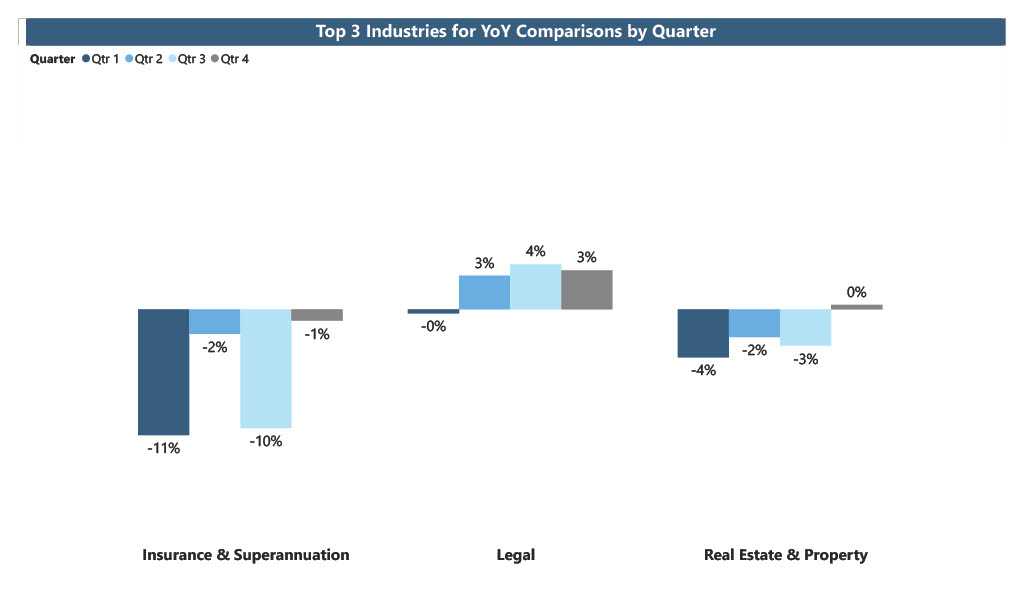

Despite the challenging environment, several sectors have shown remarkable resilience:

- Legal Industry: The legal sector was the standout performer, achieving year-over-year (YoY) growth in job listings. This growth reflects consistent demand for legal services, driven by regulatory changes, corporate activity, and a need for businesses to navigate economic uncertainties.

- Real Estate/Property: This sector has experienced relatively small YoY declines, supported by steady activity in property management and ongoing demand for real estate services despite subdued market conditions.

- Insurance/Superannuation: Job listings in this industry also saw minimal declines, potentially due to its essential role in financial planning and risk management, areas that remain priorities for businesses and individuals alike during economic fluctuations.

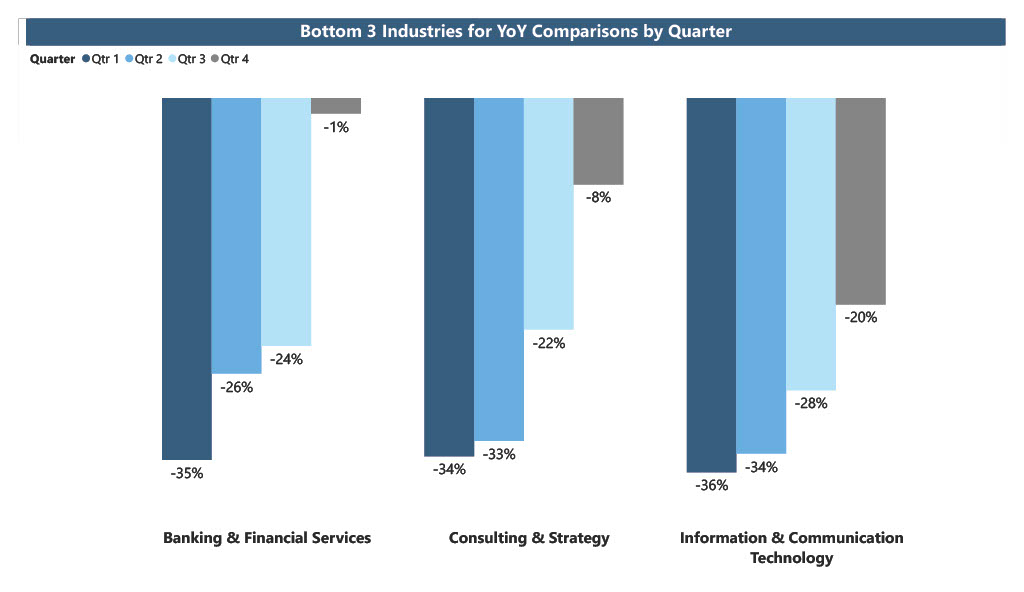

In contrast, some industries faced significant challenges:

- Information and Communication Technology (ICT): ICT experienced one of the largest YoY declines in job listings. This reflects tightened budgets and reduced investment in large-scale digital transformation projects as many businesses focus on cutting costs.

- Consulting and Strategy: This sector also saw steep declines, with reduced demand for advisory services in areas like management consulting and strategic planning.

- Banking and Financial Services: Job listings in this sector dropped significantly, reflecting broader market uncertainty and reduced hiring in non-critical roles as financial institutions navigate ongoing economic pressures.

Interestingly, both the most resilient and the most challenged sectors are predominantly white-collar industries. While the struggling sectors faced steep initial declines, job listings in ICT, consulting, and banking have shown signs of gradual improvement from Q1 to Q4, suggesting cautious optimism for 2025.

Broader Implications for Businesses

The subdued job market in 2024 has created both challenges and opportunities for Australian businesses:

- Talent Acquisition: Lower job listings across sectors make it easier for businesses to attract skilled workers in competitive areas. Companies offering flexibility and career development are better positioned to retain talent.

- Regional Strategies: State-level disparities provide opportunities for businesses to expand into markets like NSW or adopt innovative approaches to succeed in more challenging regions like Victoria.

- Cost Pressures: Rising living costs require businesses, especially SMEs, to focus on efficiency and adaptability. Streamlining operations and exploring flexible workforce models are key to managing expenses.

Despite the challenges, businesses that adapt to these dynamics are well-placed to build resilience and capitalise on recovery opportunities in 2025.

Outlook for 2025 and Beyond

As we move into 2025, the Australian job market shows signs of stabilisation. Businesses must however adapt to varied sector performances and regional differences to navigate the complexities ahead. SMEs, in particular, are well-positioned to leverage opportunities in underserved markets thanks to their agility.

While challenges remain, steady job listing trends in late 2024 provide a foundation for recovery. Improved economic conditions, boosted by potential interest rate cuts and stronger business confidence, could create a more favourable environment for employers and job seekers in 2025.

Keep up to date with the latest market research from Fifth Quadrant here. For any questions or inquiries, feel free to contact us here.

Posted in Social & Government, Uncategorized