Author: Madelyn Stafford | Posted On: 21 Feb 2025

Australia’s EV market in 2024 was anything but predictable. While early projections suggested a continued surge in battery electric vehicle (BEV) adoption, the reality told a more nuanced story. Instead of a straight-line trajectory toward full electrification, Australian consumers leaned heavily toward the more ‘familiar’ hybrid and plug-in hybrid electric vehicles (PHEVs), suggesting we’re currently experience an evolution rather than a revolution.

Despite record-breaking EV sales in 2023, 2024 saw a slowdown in BEV growth, intensified competition in the market, and a sharp rise in hybrid adoption. With more brands entering the space and consumer preferences shifting, the landscape for electrified vehicles is evolving in unexpected ways. So, what really happened in 2024, and what does it mean for the future of EV adoption in Australia?

Top 3 Takeaways from 2024 for EVs

- Hybrids Take The Lead: While BEV sales continued to grow modestly, hybrids saw explosive growth, nearly doubling in some segments. With concerns around charging infrastructure, range, and upfront costs still top of mind, hybrids have become the “safe middle ground”, allowing buyers to reduce emissions in a ‘safer’ fashion.

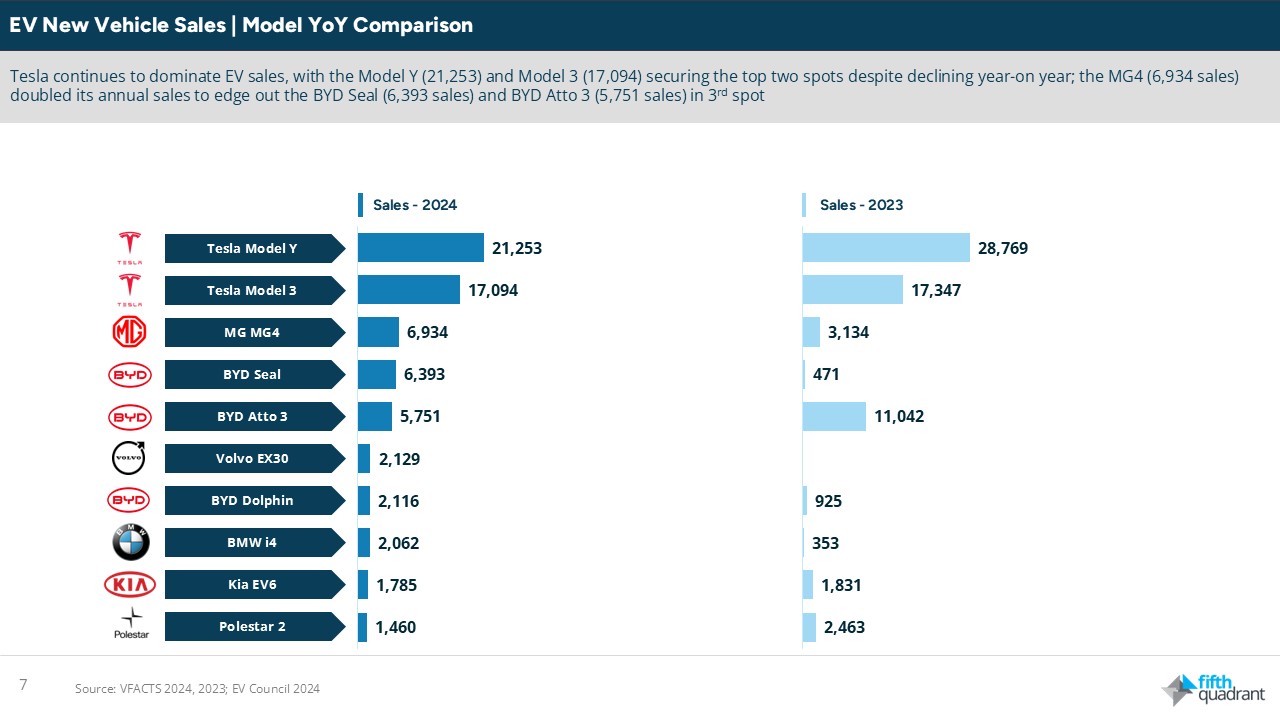

- Tesla Faces Increasing Competition: Tesla remains the market leader, but its dominance is being challenged. MG, BYD, and Volvo made significant gains, with models like the MG4, BYD Seal, and Volvo EX30 carving out market share (and plenty more to come over the next 18-24 months).

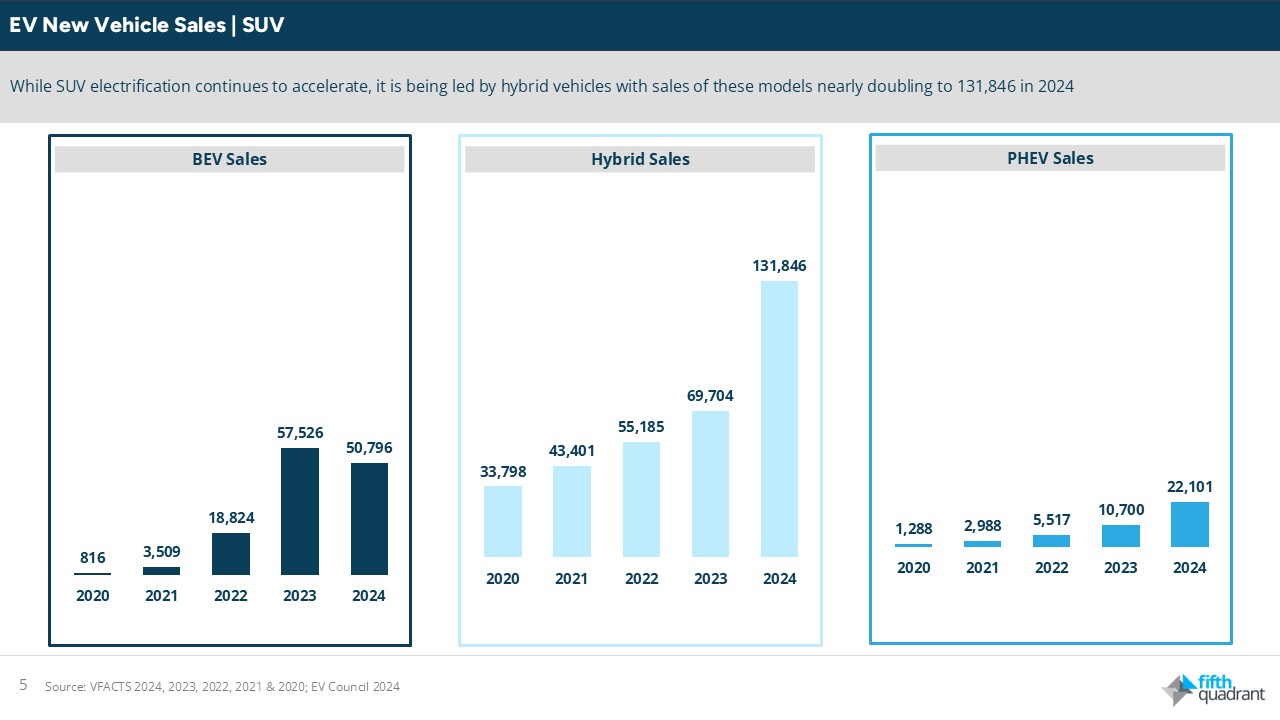

- The SUV Shift Towards Hybrids: Australians love SUVs, and electrification is following suit. However, hybrid SUVs stole the show in 2024, almost doubling in sales, while BEV SUV sales declined. This shift reinforces the idea that consumers still value the familiarity, flexibility, and extended range of hybrid powertrains over fully electric alternatives—at least for now.

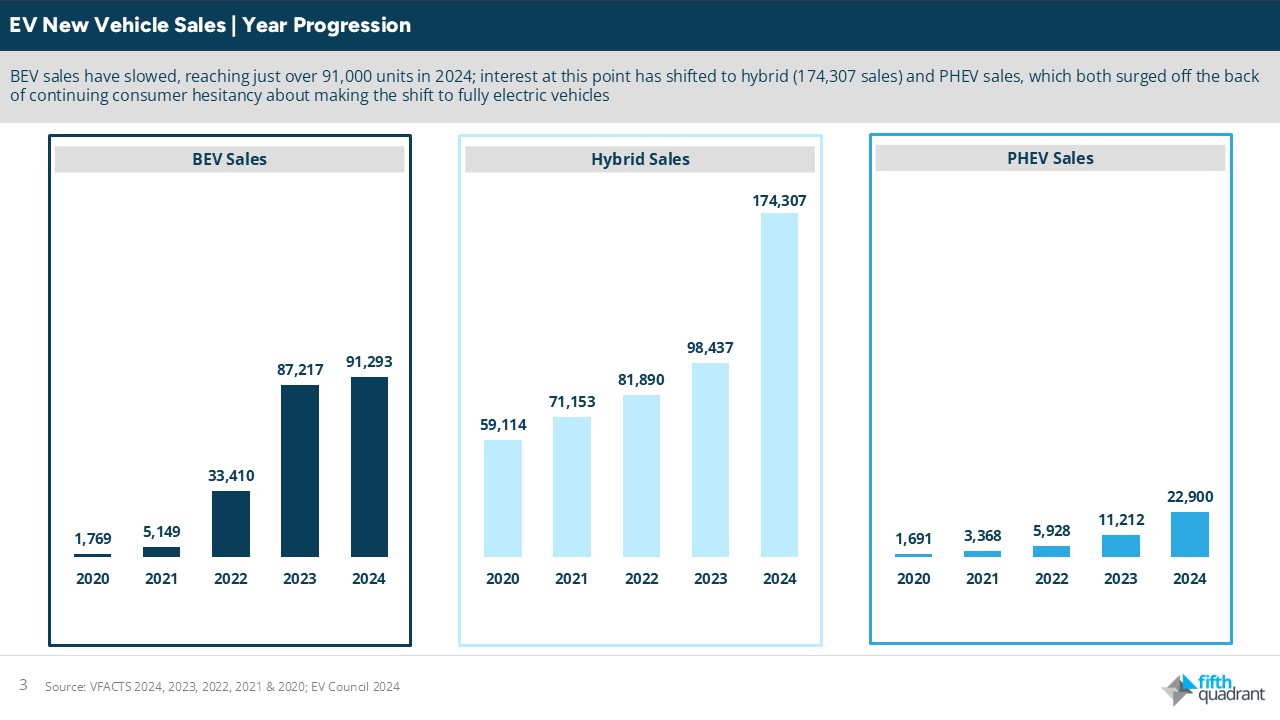

EV Sales: The Overall Picture

Australia’s EV market continued to grow in 2024, but momentum slowed. BEV sales rose to 91,293 units (up just 4.7% from 2023), marking a sharp deceleration from previous years. Consumer concerns over charging infrastructure, range, and pricing likely contributed to the slowdown. In contrast, hybrid sales surged to 174,307 units (+77% YoY), with many buyers opting for electrification without full EV commitment. PHEVs also doubled, reaching 22,900 units, showing rising interest in transitional technologies.

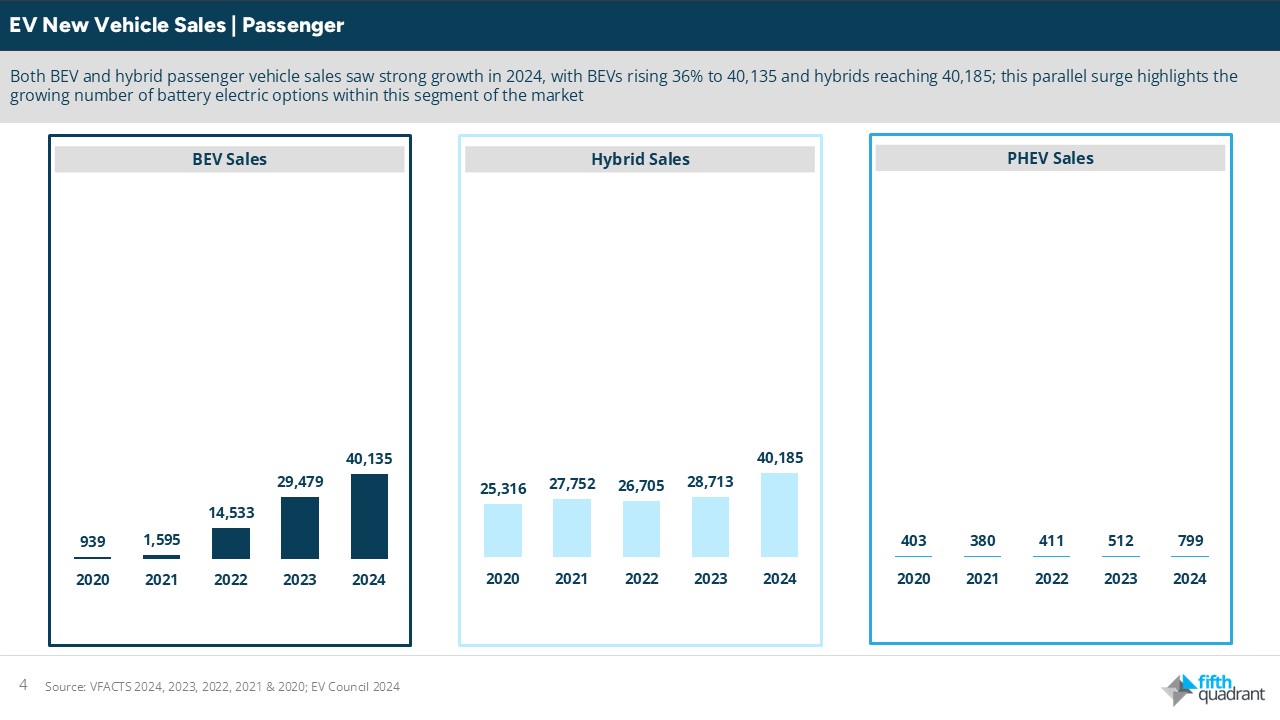

Passenger Vehicles: Parallel Growth for BEVs and Hybrids

The passenger vehicle segment saw strong growth in electrification, but hybrids and BEVs are now running neck and neck. BEV passenger car sales jumped 36% to 40,135 units, showing growing adoption in mainstream segments. However, hybrids again followed the same trajectory, reaching 40,185 units, proving that many buyers still favour a middle-ground solution.

SUV Electrification Accelerates, Led by Hybrids

SUVs continue to dominate Australia’s car market, and electrification is accelerating, but hybrids, not BEVs, are driving the growth. Hybrid SUV sales nearly doubled to 131,846 units, up from 69,704 in 2023, as buyers opted for fuel efficiency without full EV reliance. In contrast, BEV SUV sales declined to 50,796 units, down from 57,526,. PHEVs also saw strong growth in this category off the back of a range of compelling model launches, climbing to 22,101 units (up from 10,700).

Top Brands: Tesla Maintains Lead, But Competition Heats Up

Tesla remains Australia’s top EV brand, but its dominance is slipping as competition heats up. The Tesla Model Y retained its top spot with 21,253 sales, though this marked a decline from 28,769 in 2023. The Model 3 followed with 17,094 units, holding steady from last year. The real momentum came from MG and BYD, with the MG4 more than doubling sales to 6,934 units, while the BYD Seal surged to 6,393 sales. Other key players included the BYD Atto 3 (5,751), Volvo EX30 (2,129), and BMW i4 (2,062). Meanwhile, the Kia EV6 and Polestar 2 saw declines, highlighting an increasingly competitive market with a number of new entrants (and more yet to come).

Conclusion: A Market In Transition

Australia’s EV market in 2024 reflected a shift in consumer behaviour, with hybrids surging ahead while BEV growth slowed, signalling a more gradual transition to full electrification. Tesla still leads, but competition from MG, BYD, and Volvo is intensifying, reshaping the EV landscape. Meanwhile, SUV buyers overwhelmingly favoured hybrids, reinforcing the trend toward practical, transitional electrification rather than an immediate shift to BEVs.

As we move into 2025, the key question is whether charging expansion, technological innovation, and more affordable BEVs can reignite consumer confidence. One thing is clear. Australia’s road to electrification isn’t a sprint. It’s a measured, evolving journey.

Please click here to access our full new vehicle sales report. Click here to view more of our automotive market research reports. Fifth Quadrant publishes monthly new vehicle sales updates here. For any questions or inquiries, feel free to contact us here.

Posted in Auto & Mobility, QN