Author: Angus McLachlan | Posted On: 17 Feb 2025

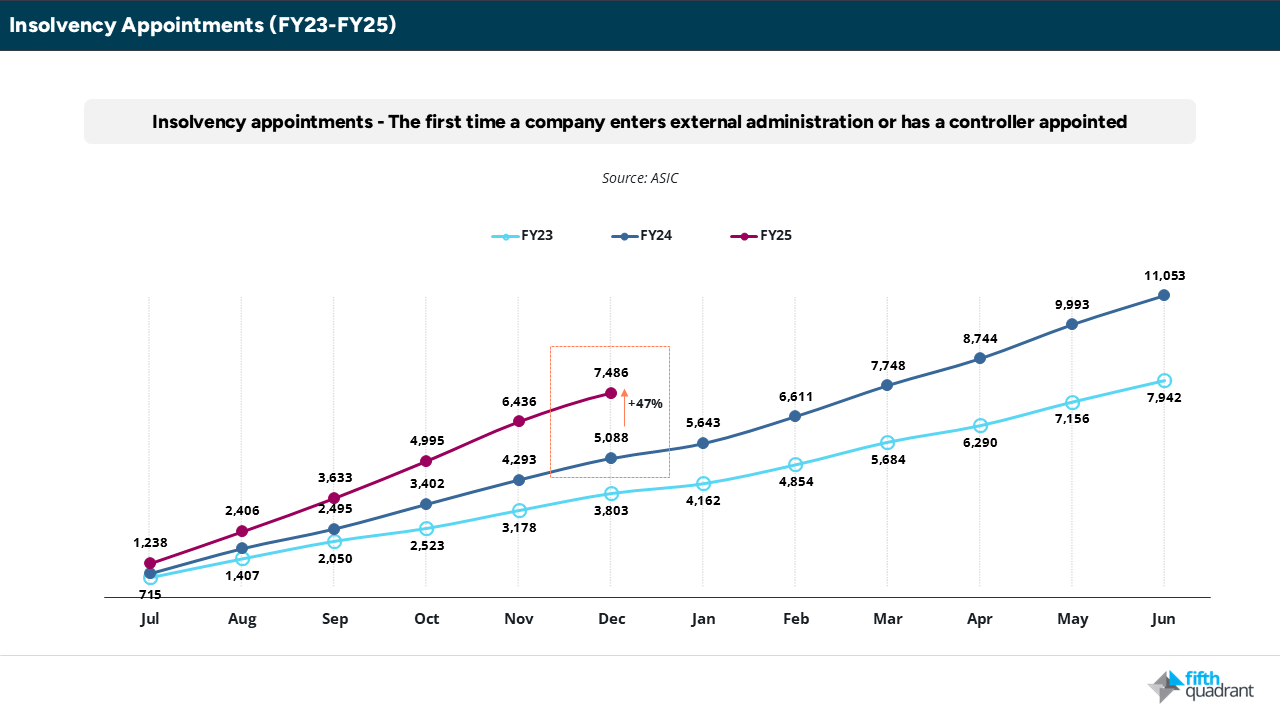

The Australian business landscape is experiencing a notable dichotomy. On one hand, the total number of businesses increased by 2.8% in FY24, driven by a strong 16.8% entry rate. However, this growth is accompanied by a sharp rise in business failures, with Australian insolvencies surging by 39% in FY24 and continuing to climb, up 47% YoY in FY25 so far.

These numbers raise important questions:

- Why are so many businesses being created while an increasing number are failing?

- Is this trend a sign of a dynamic, high-churn economy, or a warning of deeper financial instability?

This article unpacks these findings, exploring the forces driving business creation and failure and assessing what lies ahead for the Australian economy.

A Booming Business Landscape?

At first glance, the 2.8% rise in new business entries in FY24 signal a strong entrepreneurial environment. As we found in the latest wave of the Fifth Quadrant SME Sentiment Tracker, 1 in 4 businesses reported an increase in revenues last month, while 4 in 10 are focussed on growth.

There are several possible reasons behind this growth:

- Post-pandemic economic recovery: Many industries have rebounded after COVID-19 disruptions, leading to new opportunities.

- Technology-driven entrepreneurship: Low barriers to entry for online businesses, e-commerce, and digital services have made it easier for startups to emerge.

- Corporate restructuring: As businesses adjust to new market conditions, some employees have turned to self-employment or started new ventures. Interestingly, in FY24 the count of non-employing businesses grew by 4.9% (78,144).

The Dark Side: A Surge in Business failures

While business creation is high, so too is business failure. The 39% rise in insolvencies in FY24, followed by a 47% increase YoY in the first half of FY25, points to mounting financial distress.

What’s driving the surge in insolvencies?

- Higher interest rates and inflation: Rising borrowing costs have made it harder for businesses to manage debt, while inflation has increased operational expenses.

- Cash flow challenges: A tough economic climate has led to delayed payments from customers and tighter credit conditions, putting pressure on working capital.

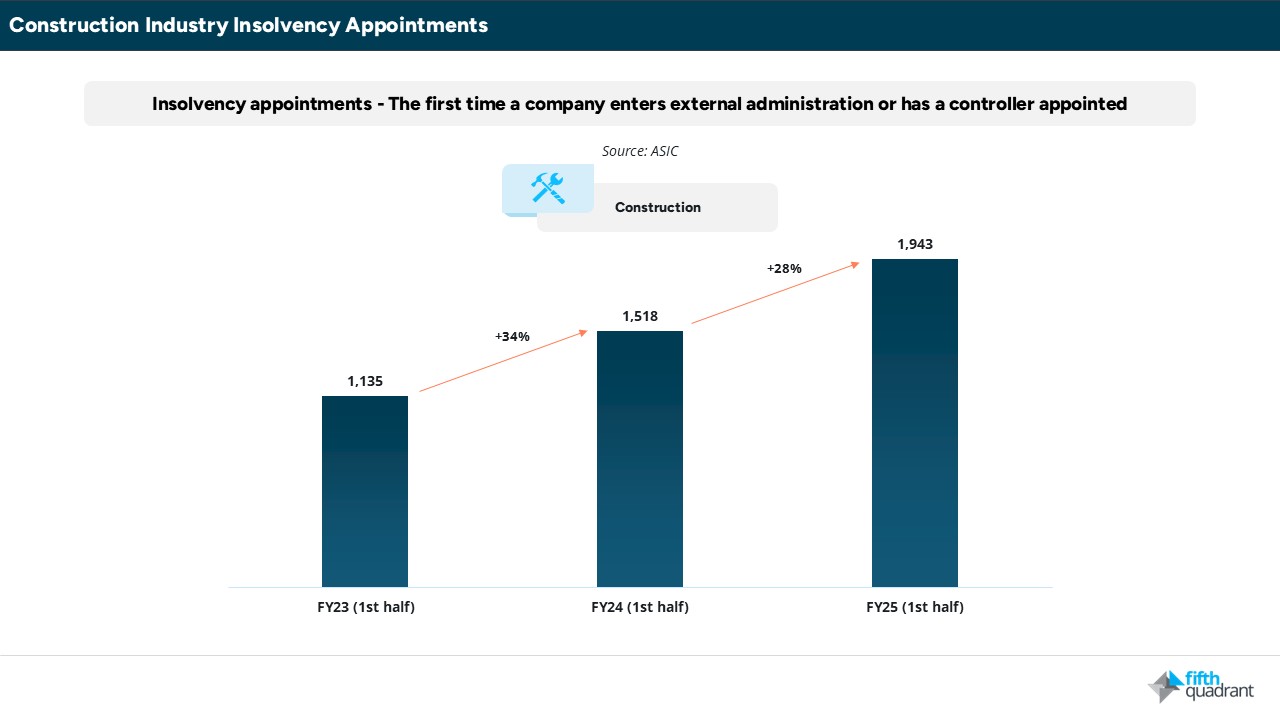

- Industry-specific struggles: Certain sectors—such as retail, construction, and hospitality—have been hit harder by changing consumer behaviour, supply chain disruptions, and rising costs. In particular, the construction industry continues to grapple with steep increases in the costs of essential inputs like materials and labour.

A High-Churn Economy? The Entry-Exit Cycle

The 16.8% entry rate and 14.0% exit rate highlight the high turnover in Australia’s business landscape. While new businesses outnumber closures, the gap between entries and exits is relatively narrow.

What does this churn indicate?

- A dynamic and competitive market: Business turnover can be healthy, ensuring innovation and competition.

- A risky business environment: If too many businesses are failing shortly after launching, it may suggest that many new entrants lack the financial resilience to survive.

- Economic uncertainty: Business owners may be struggling to forecast demand, manage costs, or secure funding, leading to shorter business lifespans.

As the latest wave of the Fifth Quadrant SME Sentiment Tracker revealed, 2 in 3 businesses say weak economic conditions and increased operational and supplier costs have had a substantial impact on their financial health over the last 12 months. If these issues persist, we’ll likely see a high rate of business insolvencies continuing into FY26.

At a Crossroads

The Australian business landscape is currently at a turning point. While the number of businesses is growing, insolvencies are rising at a concerning rate. The coming months will reveal whether we are seeing a temporary adjustment or a deeper economic issue. The challenge for businesses, investors, and policymakers alike is to navigate this period of high volatility—ensuring that while market competition remains strong, financial stability is not compromised.

Keep up to date with the latest B2B market research and SME Insights from Fifth Quadrant here. For any questions or inquiries, feel free to contact us here.

Posted in Uncategorized