Author: Ben Selwyn | Posted On: 07 May 2024

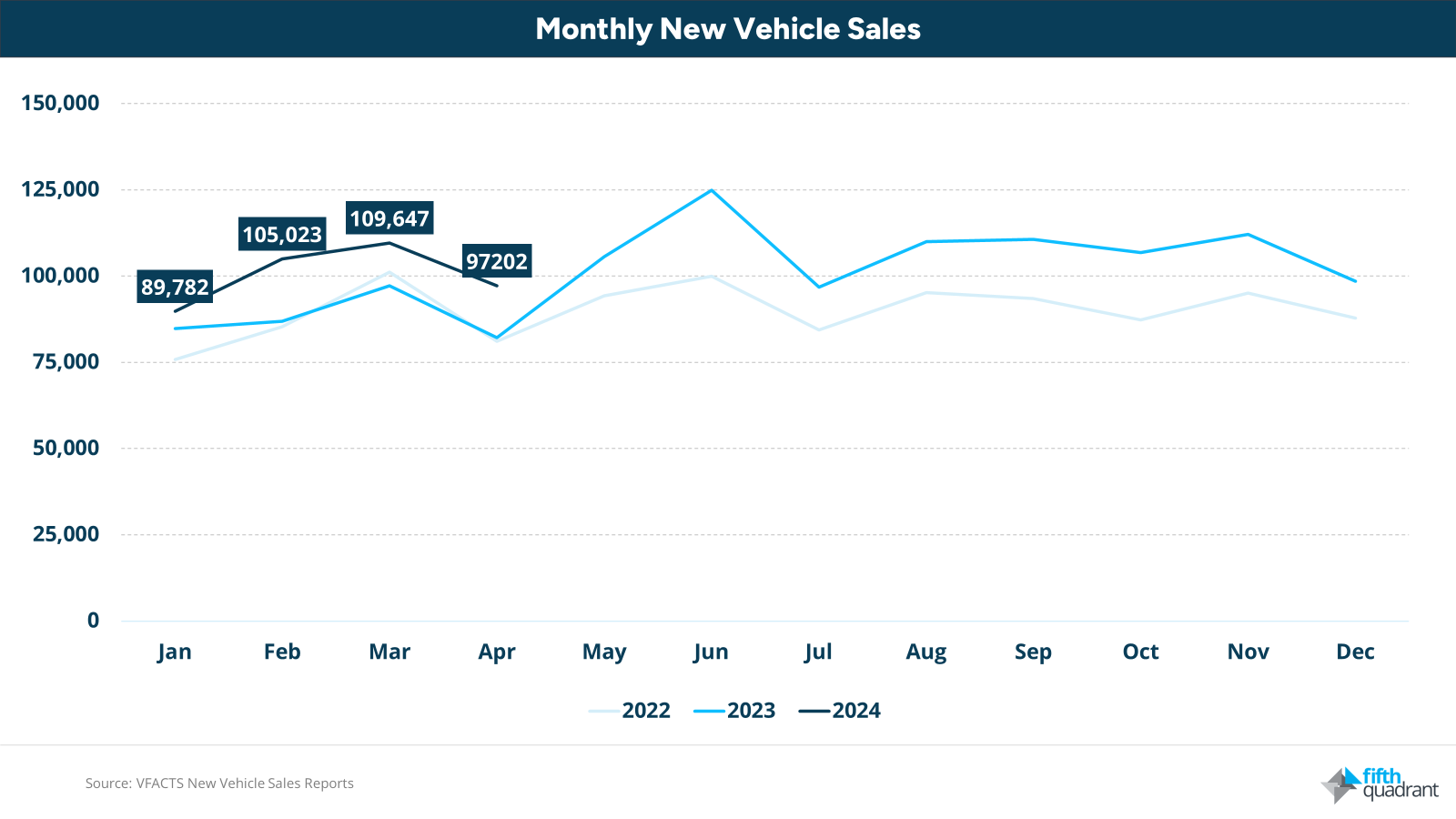

April’s automotive sales have broken the streak, dipping below 100,000 units for the first time this year. Despite this dip, the 97,202 new vehicle sales this month still significantly outpace the record-breaking figures from 2023, with total sales this year already reaching 401,654. The resurgent Toyota (77,009 sales YTD) is our runaway leader, up almost 50% YoY to hold a 19% share of market YTD (21% in April).

top takeaways:

- YTD sales are 50,000 units ahead of last year. The market shows no signs of slowing, maintaining a robust pace despite expectations.

- We’re seeing an increasing divide between ‘traditional’ and disrupted segments; passenger vehicles are increasingly shifting to lower emissions (i.e. EV & hybrid), while diesel remains strong in its light commercial heartland

- Plug-in hybrids gain traction: while this previously felt like the worst of both worlds, newer models appear better suited to the needs of the market as a replacement for traditional workhorse vehicles

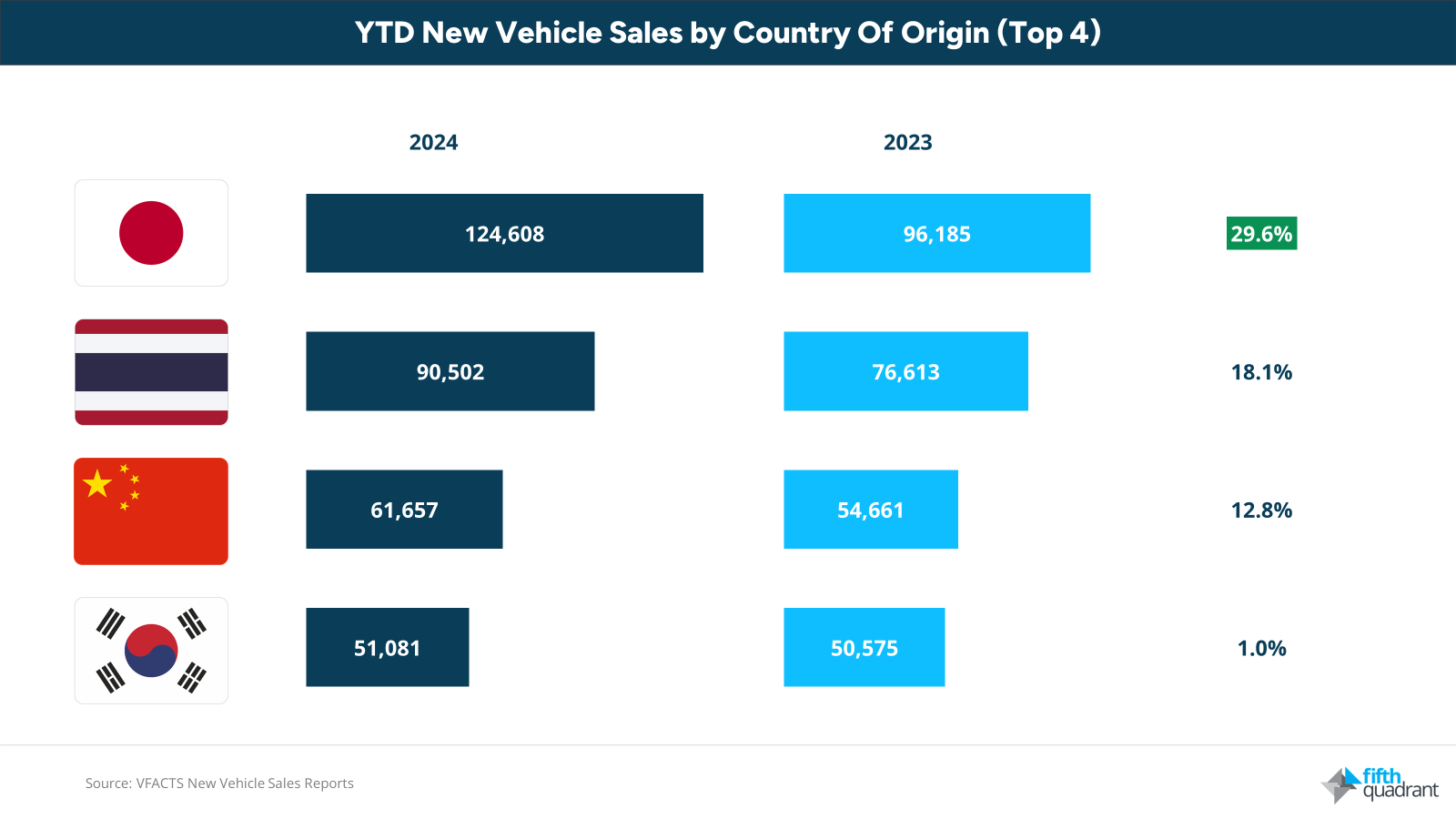

- Chinese takeover on hold? Not really, but the resurgence of Japanese brands (led by Toyota) is holding our focus right now

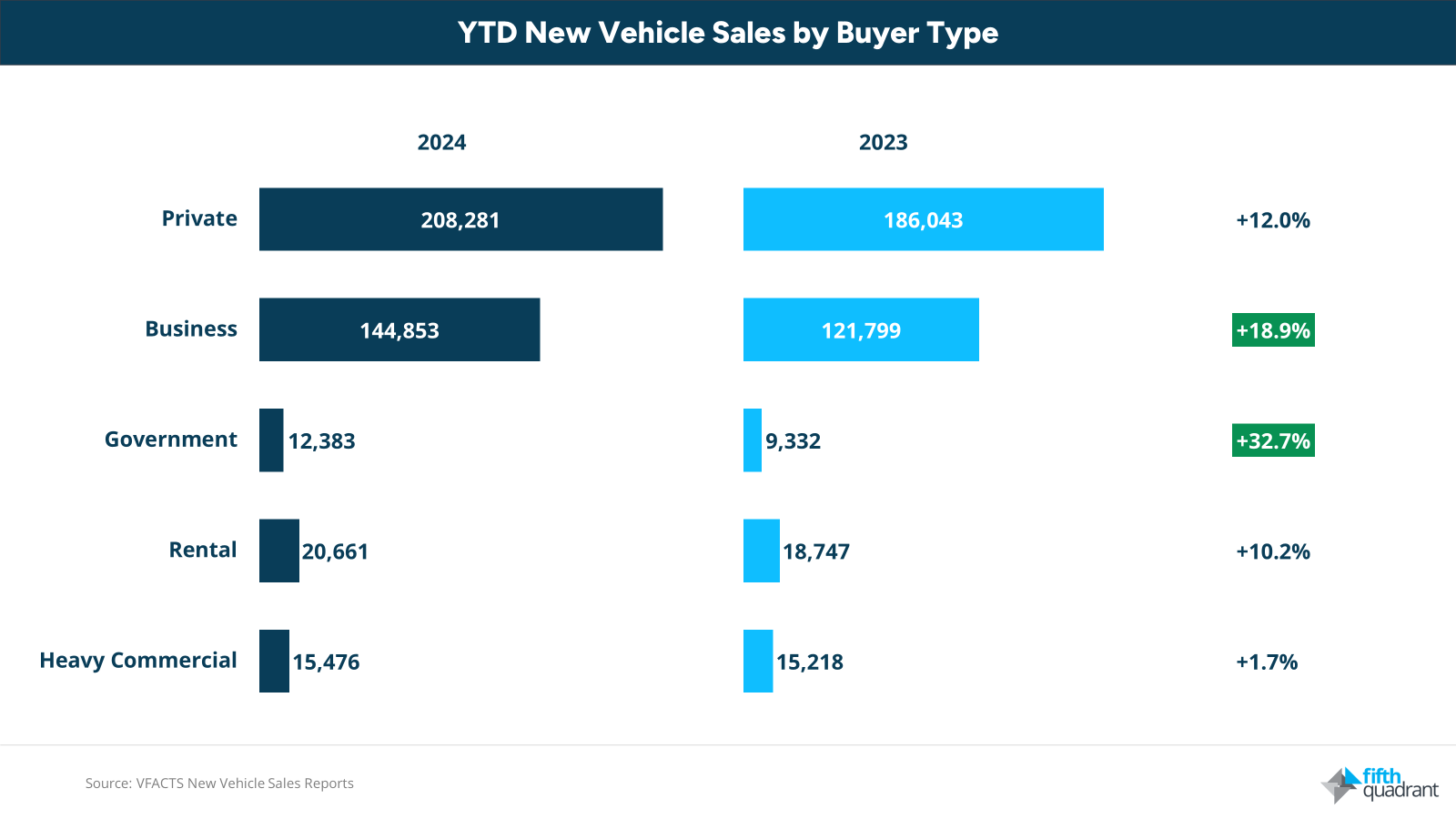

- Q1 fleet orders reaching fulfilment leave non-private sales just 684 units behind retail customers for the month of April

on track for another record-breaking year in auto sales

At this point last year, Australians had purchased just over 350,000 vehicles. Incredibly, the 2024 is 50,000 up on that number, for a 14.4% YoY increase. The hot start to the year also isn’t restricted to any one state or territory, with all except the ACT (6.6%) recording double-digit YoY growth and NSW (up 11.4%), VIC (up 20.1%) and QLD (up 11.7%) all sold more than 20,000 vehicles in April. Our latest forecasts had the full year at approx. 1.2m vehicles, but based on results so far, we might be revising that up.

fleet sales surge, retail remains resilient

Fleet sales soared in April, reaching 48,259 units (49.6%) of monthly sales. This likely represents the fulfillment of orders placed in Q1 and possibly earlier, underscoring the strategic focus on fleet renewal by business buyers. Government fleets (12,383 units) are a key player here, with sales to this group up almost 40% YoY, but private businesses also hit 35,914 units for the month, increasing volumes by more than 25%.

the japanese auto resurgence: a closer look

While Chinese brands are expanding their presence in Australia with new entrants like JAC and Zeekr, Japanese manufacturers are experiencing a significant resurgence. So far this year, sales of Chinese-made vehicles are up 12.8% YoY (vs. 14.4% for total market), while sales from Japanese plants soared by nearly 30% YoY, allowing brands like Nissan, Toyota, Isuzu Ute, and Mitsubishi to meet demand more efficiently, clearing outstanding orders and reducing wait times on popular models.

looking ahead

We keep waiting for the bubble to burst, but need to consider that this could be a new normal. As flagged above, we will be recalibrating our market forecasts for the year based on current record-setting pace. With that said, inflation remains over RBA target bands, with many economists now suggesting that the next rate activity will be upwards as the central bank looks to cool the economy and reduce household spending activity.

We’ll continue monitoring these trends, but for now the Australian auto market shows no signs of slowing down. Stay connected with our monthly updates to keep your finger on the pulse of this dynamic industry.

Also remember that our b2b and consumer tracking research runs monthly. Click here to find out more, and feel free to get in touch if you’ve got questions that you’d like to answer.

Posted in Auto & Mobility, B2B, QN, TL, Transport & Industrial, Uncategorized