Author: Melissa Borg | Posted On: 19 Mar 2025

The Australian Medical Association’s (AMA) latest Public Hospital Report Card paints a less than rosy picture of Australia’s public healthcare system. While some short-term improvements are evident, the broader trend points to three urgent challenges: Declining Performance, Longer Wait Times and Capacity Strains in Australia’s public hospitals. These results coupled with declining bulk billing rates across Australia, suggests there is a need to increase publicly funded healthcare services to meet the rising demand.

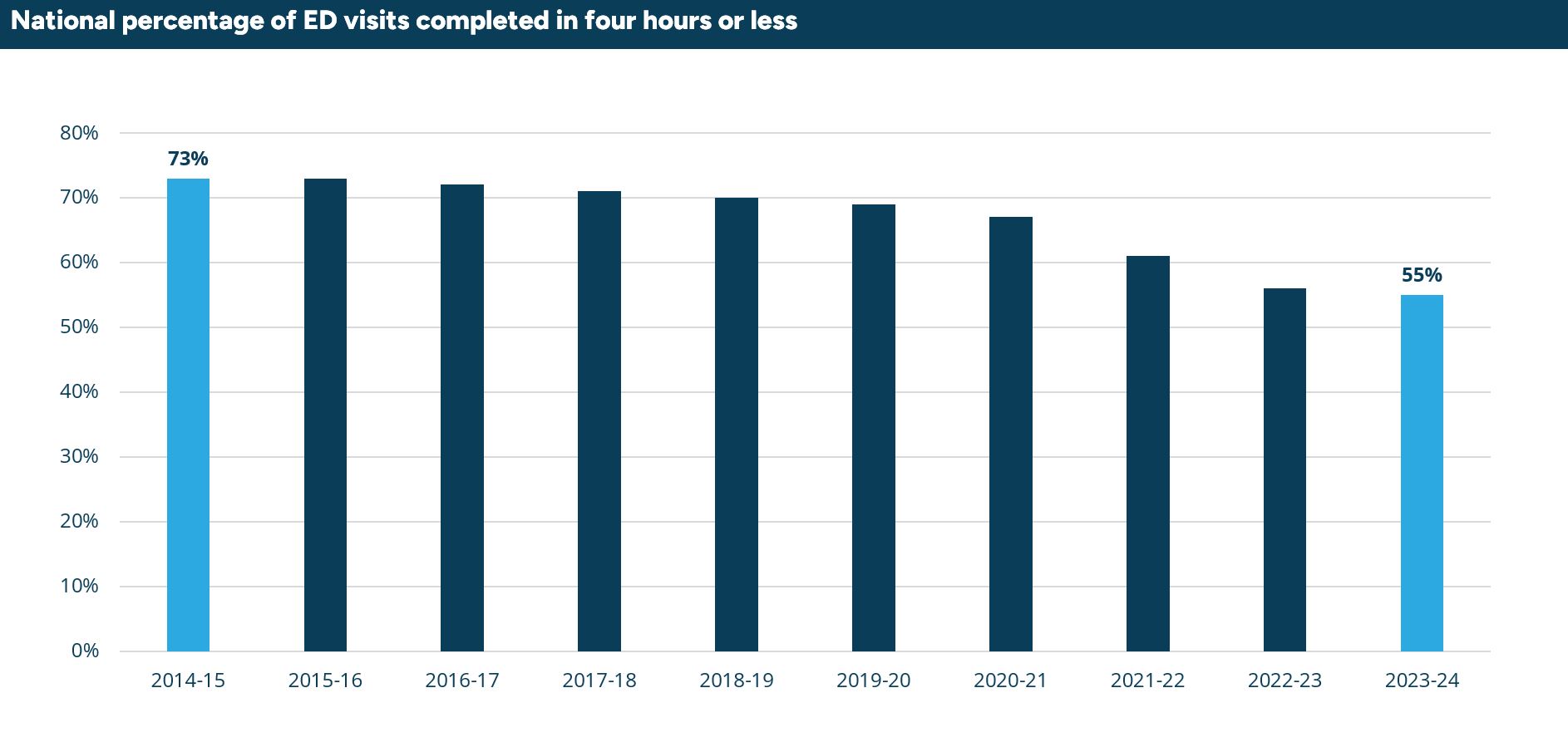

Emergency department (ed) performance

The report indicates a long-term decline in emergency department (ED) performance despite marginal recent improvements. Only 55% of ED patients were seen within the target four-hour window, down from 73% a decade ago. While there has been some recent uptick in ED patients being seen on time in 2024, a third of presentations triaged as a Category 2 (serious emergency cases) were not seen within the recommended timeframe of 10 minutes. This has led to some fatal cases, including the recent death of a 2-year-old child at Northern Beaches hospital.

Surgery wait times are still too long

While median wait times for planned surgeries dropped slightly since a record high in 2023, they are still 58% longer than they were 20 years ago, sitting at 46 days in 2024. Category 2 surgeries (which include heart valve replacements and other essential procedures) are being delayed at alarming rates, leading to unnecessary pain and worsening patient outcomes.

Capacity strains

The number of presentations to Australia’s public hospital EDs have been on the rise over the last ten years for both emergency and urgent presentations, with the decline of GP bulk-billing a contributing factor. Additionally, the number of public hospital beds per 1,000 people has continued to fall over time, with most hospitals operating at near or full capacity limiting efficiency improvements.

The role of Urgent Care Clinics

These factors have contributed to the declining performance of public hospitals in the face of growing demand for public health services. One solution is the introduction of urgent care clinics (UCCs) by the Labor Government in 2022, with a further 50 clinics pledged as an election promise by the Government.

Aiming to alleviate the pressure on hospital emergency departments, amid a decline in bulk-billing GPs, UCCs are designed to treat minor injuries and illnesses. However, doctor’s groups including the AMA and RACGP have been critical of the urgent care clinic approach. Their ability to only treat minor incidents may not ease pressure on hospital EDs, and the cost of the clinics for taxpayers compared to GP services are key concerns. The announcement of further clinics without a full independent evaluation of their performance has also been criticised.

Meeting the Growing Demand

With a clear growing demand for public health services, and the declining performance and capacity strains in public hospitals, the role urgent care clinics play needs to be assessed. While they provide access to bulk-billed GP services, they may not move the needle on the number of presentations to emergency departments and reduce waiting times for those seeking emergency care. This potentially limits their ability to improve public hospital performance in the long term and meet the growing demand for services.

It is evident the healthcare landscape is becoming increasingly complex, requiring data-driven insights to guide decision-making. Fifth Quadrant’s healthcare market research brings expertise in market evaluation, patient experience research, and strategic consulting to help healthcare organisations adapt. View more of about our healthcare market research or reach out to us here to understand how we can help you navigate the healthcare landscape.

Posted in Healthcare, CX, QL, QN, Social & Government