Author: Kat Noyes | Posted On: 12 Mar 2025

Australia’s Heavy Commercial Vehicles (HCV) market remained resilient in 2024, with 51,306 units sold (just 466 fewer than in 2023), highlighting the ongoing demand for freight services in the Australian market. We can however also see the mix of vehicles evolving in line with changes to the market, with light-duty (LD) vans gaining momentum off the back of shifting logistics needs and growing demand for urban delivery solutions.

Top Takeaways

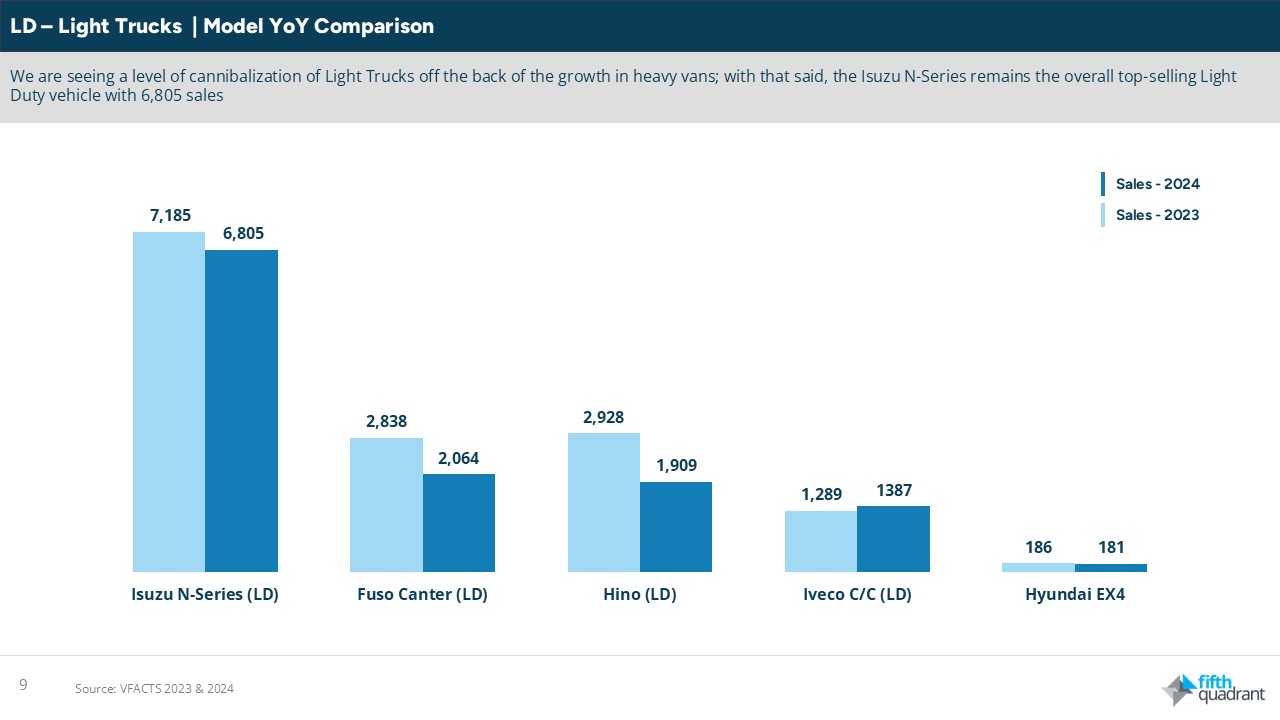

- Isuzu’s continued dominance: Overall, Isuzu remains the market leader, maintaining around a third of the total industry volume in 2024 with 13,402 units sold, and taking top spot in two of the three Heavy Commercial sub-segments.

- In Light Duty (LD), Isuzu’s N-Series captured 6,805 sales (almost 3,000 ahead of its closest competitor).

- We saw a similar story in Medium Duty (MD), where Isuzu (4,116 sales) was almost 2,000 units ahead of Hino in 2nd.

- Despite coming 3rd in Heavy Duty (HD) behind Kenworth and Volvo, Isuzu grew sales marginally year-on-year (2,481, up from 2,393 in 2023)

- Kenworth continues to lead in HD: Kenworth hits new sales records in 2024, with 3,774 units sold. Looking across other HD brands, we see a slight dip in Volvo with 361 less units sold compared to 2023, and marginal improvements for Isuzu (+88 units) and Scania (+76 units).

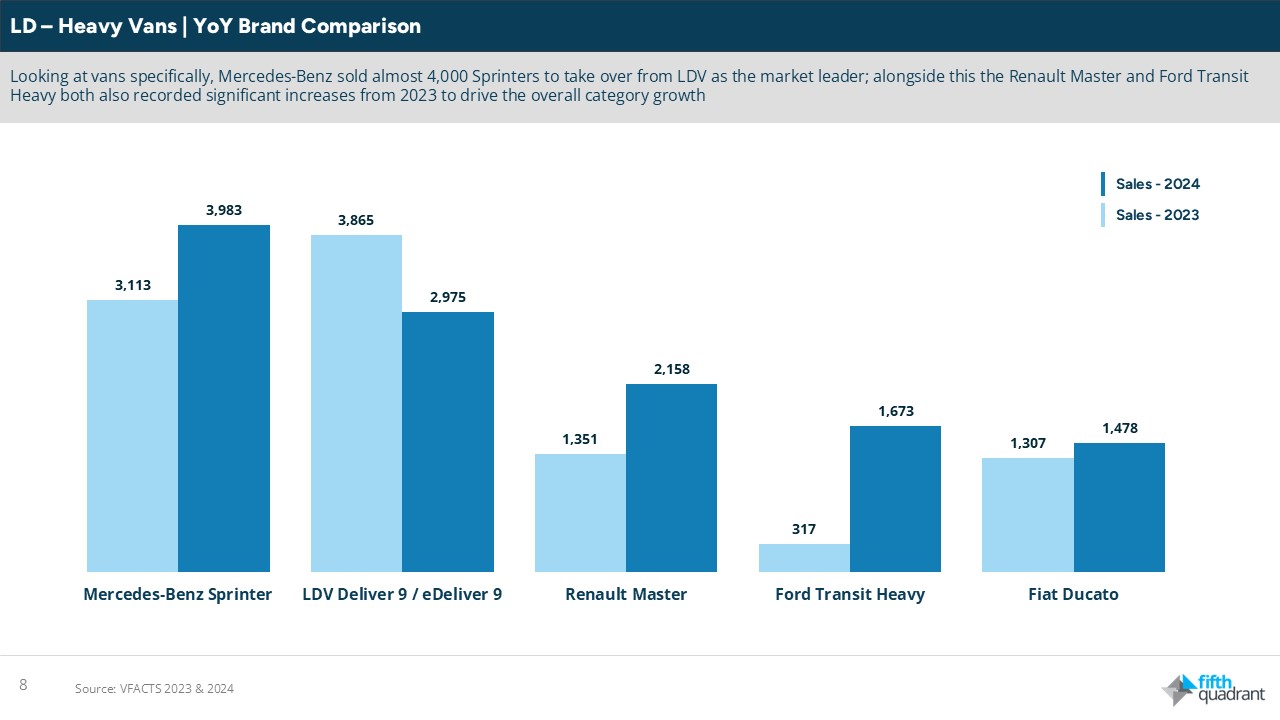

- Van market shake-up: Mercedes-Benz overtook LDV as the van market leader, while Renault and Ford saw strong growth, reflecting a shift in fleet demand towards last-mile, urban transport solutions.

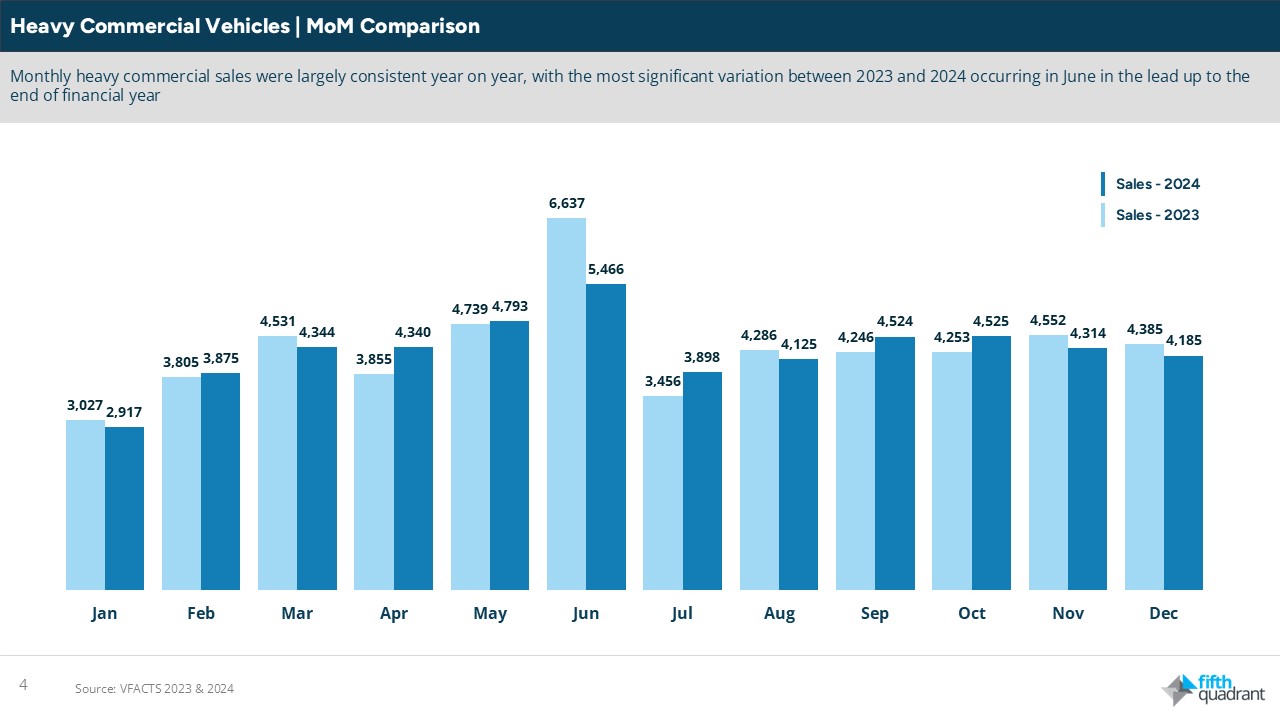

- Economic Indicators and Seasonal Trends: The typical end of financial year sales peak in June was less pronounced in 2024, suggesting a modest cooling of economic activity. Steady overall sales do however confirm the importance of HCVs in supporting Australia’s supply chain infrastructure.

2024 Heavy Vehicle YOY and MOM comparisons

The HCV market recorded consistent performance year-on-year, down just 1% from 2023. Month on month, we can however see that the typical end of financial year sales peak was less pronounced in 2024, with purchases spread more evenly through the year.

What has changed in LD?

The LD category made up 51% of HCV sales in 2024. While light trucks have been highly successful in recent years in line with the growth of last mile delivery, we are now seeing a further evolution within this category, with sales of heavy vans growing as they become more viable options for many tool-of-trade settings. They now make up over half (52%) of the LD category, up from 44% in 2023.

The Mercedes Sprinter stands out here, recording strong year-on-year growth to overtake the LDV Delivery 9, and become the top option within this segment. Notably, it was also the top-selling Mercedes model in Australia in 2024, highlighting its importance to the brand going forward.

Despite this shift, the Isuzu N-Series is still the top selling LD model overall, with 6,805 sales in 2024. Within the light truck sub-segment, it’s closest competitors are the Fuso Canter and Hino, both of which recorded around 2,000 sales for the year.

Looking Ahead

As we move into 2025, the Heavy Commercial Vehicle market remains a critical pillar of Australia’s transport and logistics ecosystem. While overall sales remained stable in 2024, shifting fleet demands, evolving emissions standards, and the rise of urban delivery solutions signal an industry in transition. With market leaders like Isuzu, Kenworth, and Mercedes-Benz adapting to these changes, the year ahead will be defined by innovation, sustainability, and operational efficiency.

For businesses and fleet operators, staying ahead of these trends will be essential to navigating this increasingly dynamic market. Whether it’s investing in next-generation vehicles, optimising fleet strategies, or responding to economic shifts, 2025 will be a year of opportunity for those who are prepared.

To explore 2024 Heavy Commercial New Vehicle Sales in more detail, download our full Year In Review report. Click here to view more of our automotive market research reports. Fifth Quadrant publish monthly updates of this research here. For any questions or inquiries, feel free to contact us here.

Posted in Uncategorized, Auto & Mobility, QN