Author: Jessica Phan | Posted On: 24 Feb 2025

Australia’s automotive market continued to evolve in 2024, driving continued uncertainty about how its future will unroll. While Australia’s car sales rose slightly to 1,185,982 units (up from 1,165,008 in 2023), the results weren’t all positive. SUVs led the way, increasing 3% to 701,996 units, while passenger vehicle sales remained steady at 210,152 (-1% YoY). LCVs, however, saw an 8% decline to 252,528 units, reflecting tight economic conditions. Beyond volume shifts, hybrid and electric models gained traction, internal combustion engine (ICE) sales declined, and the competition among top-selling models intensified. As we look back on 2024, here are the key takeaways shaping Australia’s vehicle market.

Top 5 Takeaways

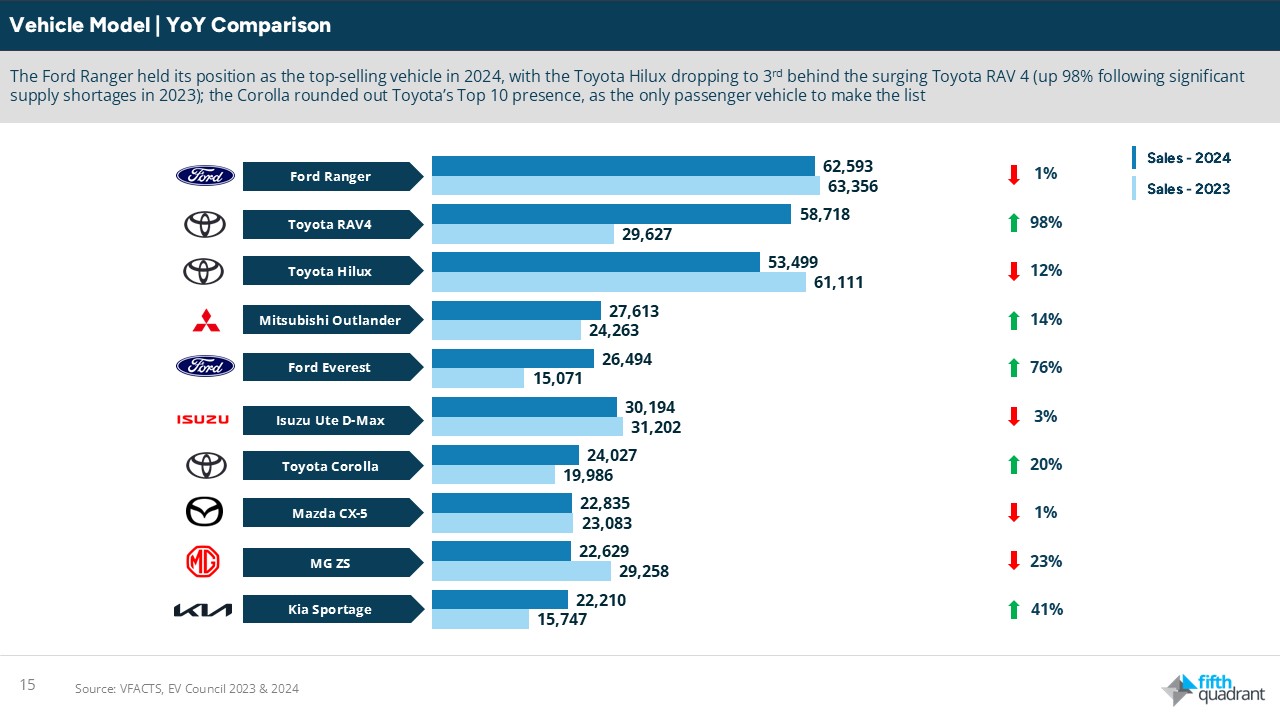

- Ford Ranger Stays on Top: The Ford Ranger was Australia’s best-selling vehicle, with 62,593 sales, outpacing the Toyota RAV4 (58,718) and Hilux (53,499) for the second year in a row.

- SUVs Still Rule: SUVs accounted for nearly 60% of all sales, led by the Toyota RAV4, which doubled the sales of its closest competitor.

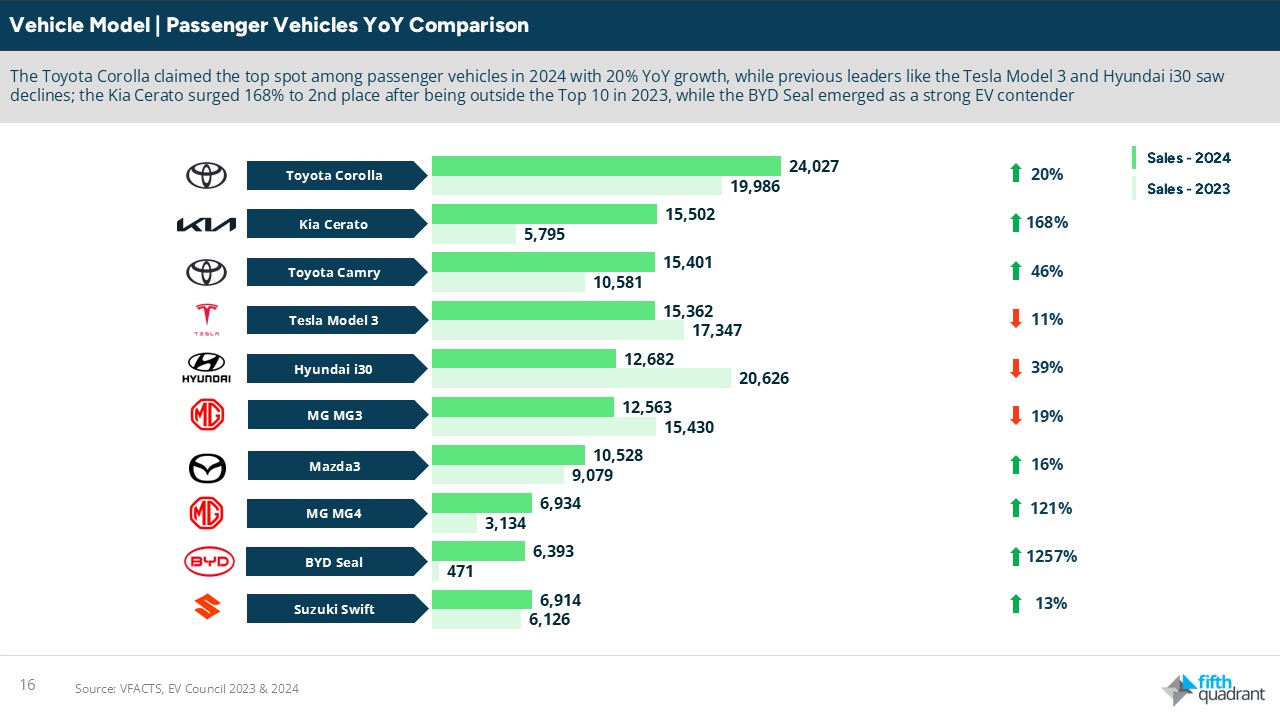

- Passenger Car Sales Hold Steady: Passenger vehicle sales remained stable at 210,152 units. The Toyota Corolla (24,027 sales, +20%) led the segment, followed by strong growth from the Kia Cerato (+168%).

- Hybrids Surge as Petrol and Diesel Decline: Petrol sales fell 11%, and diesel dropped 3%, while hybrids soared 77% (174,307 sales) and PHEVs more than doubled (+104%). EV growth slowed to 5%, as buyers opted for hybrids over full electrification.

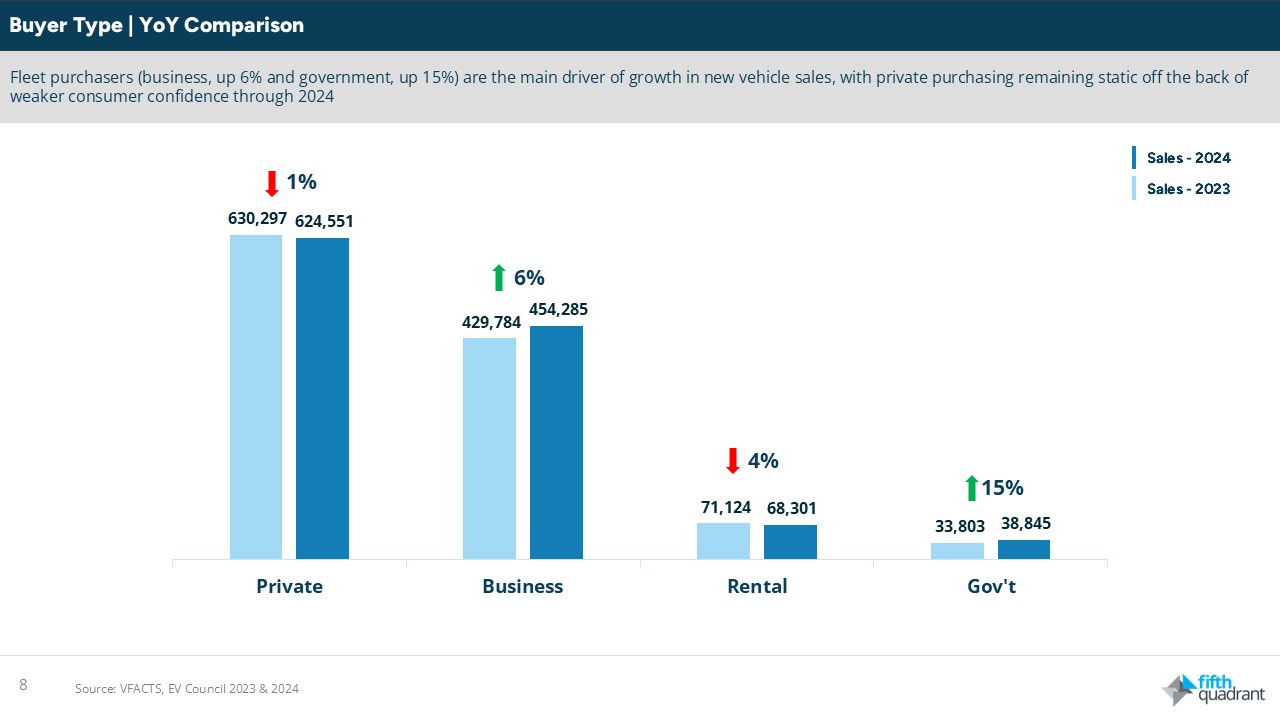

- Fleets Drive Market Growth: Government fleet purchases rose 15%, and business sales increased 6%, while private sales stayed flat and rental fleet purchases declined 4%.

Versatility Wins: SUVs and Utes Remain Top Picks in 2024

Australia’s automotive market was again driven by SUVs and LCVs in 2024, with nine of the top ten best-selling models falling into these segments.

At the top of the sales charts, the Ford Ranger remained Australia’s best-selling vehicle, recording 62,593 sales, down just 1% from 2023. This kept it ahead of the Toyota Hilux, which fell 12% to 53,499 units. Despite the drop, both models remain key players in the LCV market, with the Isuzu D-Max securing third place at 30,194 sales.

Top of the SUV list (and second overall) was the Toyota RAV4, selling 58,718 units, a 98% increase from 2023, more than doubling the Mitsubishi Outlander, which reached 27,613 sales.

Corolla Climbs, Cerato Surges, and the BYD Seal Makes Waves

Passenger vehicle sales remained stable at 210,152 units (-1% YoY), but the segment saw some notable shifts in consumer preferences. Traditional favourites like the Toyota Corolla regained momentum, while newcomers like the BYD Seal made a splash.

The Toyota Corolla led the segment with 24,027 sales, up 20%, reaffirming its position as Australia’s top-selling passenger car. The Kia Cerato surged 168%, climbing to second place and marking a strong comeback after missing the Top 10 in 2023. The Toyota Camry also performed well, growing 46%, highlighting continued demand for mid-size sedans.

Meanwhile, some long-time leaders lost ground. The Hyundai i30 dropped 39%, slipping from its 2023 standing as the top passenger car, while the Tesla Model 3 declined 11%. In contrast, the BYD Seal, launching in late 2023, skyrocketed 1,257% to 6,393 sales, underscoring growing interest in affordable electric sedans.

Fleet Renewals Power 2024 Sales Trends

Australia’s automotive market saw government and business fleets driving much of the market’s growth. Government purchases rose 15%, reaching 38,845 units, reflecting increased investment in fleet renewals and low-emission vehicles. Business purchases also grew by 6% to 454,285 units as companies updated their fleets.

On the other hand, Private vehicle sales remained steady, with a modest 1% increase to 630,297 units, while rental fleet purchases declined by 4%, dropping to 68,301 units.

2025 and the year ahead

Australia’s automotive market in 2024 reflected stability on the surface but significant shifts underneath. SUVs and LCVs remained the top choices, but consumer preferences evolved, with some models gaining momentum while others lost ground. The Ford Ranger and Toyota RAV4 led their segments, while hybrids surged ahead, showing a clear shift toward electrification. At the same time, buyer behaviour changed, with government and business fleets driving growth as private buyers took a more measured approach.

Looking ahead, SUVs and LCVs will likely remain dominant, but electrification and fleet investment will shape the next phase of growth. As the industry adapts to new technologies, evolving buyer trends, and sustainability pressures, 2025 is set to bring another chapter of transformation for Australia’s automotive landscape.

Please click here to access our full VFACTs report. Click here to view more of our automotive market research reports. Fifth Quadrant publish monthly updates of this research here. For any questions or inquiries, feel free to contact us here.

Posted in Auto & Mobility, QN